Have you ever stared at your bank statement, a knot forming in your stomach, wondering where all your money went? Or maybe you’ve had that heart-stopping moment at the checkout, card declined, even though you *swore* you had enough? Trust me, I’ve been there. For years, I bounced between banking apps and spreadsheets, always feeling like I was one step behind, one transaction away from a financial mystery. It felt chaotic, overwhelming, and frankly, a little scary. Then, almost by accident, I stumbled upon the humble printable check register PDF. It seemed almost too simple, a relic from a bygone era, yet it completely transformed my relationship with my money. It wasn't about ditching digital; it was about adding a layer of tangible control, a physical anchor in the stormy seas of modern finance.

In a world obsessed with digital solutions, the idea of a physical check register might seem quaint, even unnecessary. But what if I told you that this simple, printable document holds the key to unparalleled financial clarity, reduced stress, and a deeper understanding of your spending habits? This isn't just about tracking checks anymore; it's about tracking *all* your transactions – debits, credits, online payments, subscriptions – in a way that truly resonates and empowers you. It’s about creating a tangible record that acts as your personal financial compass, giving you peace of mind and genuine control.

This comprehensive guide is your blueprint to mastering the printable check register PDF. We’re going to dive deep into why it's more relevant than ever, explore the myriad of options available, walk through exactly how to use it, and even look at how it can seamlessly integrate with your digital life. Whether you’re a financial novice feeling overwhelmed, a seasoned budgeter looking for a new edge, or someone simply craving a more mindful approach to your money, you're in the right place. Get ready to transform your financial tracking from a chore into an empowering daily practice.

---

Table of Contents

- [The Unsung Hero: Why a Printable Check Register PDF is Still Essential in a Digital Age](#the-unsung-hero-why-a-printable-check-register-pdf-is-still-essential-in-a-digital-age)

- [Finding Your Perfect Match: A Guide to Different Printable Check Register PDF Styles](#finding-your-perfect-match-a-guide-to-different-printable-check-register-pdf-styles)

- [The Gold Mine: Where to Discover High-Quality, Free, and Premium Printable Check Register PDFs](#the-gold-mine-where-to-discover-high-quality-free-and-premium-printable-check-register-pdfs)

- [Mastering the Art: A Step-by-Step Guide to Filling Out Your Printable Check Register PDF Like a Pro](#mastering-the-art-a-step-by-step-guide-to-filling-out-your-printable-check-register-pdf-like-a-pro)

- [Beyond the Basics: Customizing Your Printable Check Register PDF for Ultimate Financial Clarity](#beyond-the-basics-customizing-your-printable-check-register-pdf-for-ultimate-financial-clarity)

- [The Hybrid Harmony: Blending Your Printable Check Register PDF with Digital Banking for Seamless Tracking](#the-hybrid-harmony-blending-your-printable-check-register-pdf-with-digital-banking-for-seamless-tracking)

- [Dodging Disasters: Common Pitfalls and Troubleshooting Tips for Your Printable Check Register PDF](#dodging-disasters-common-pitfalls-and-troubleshooting-tips-for-your-printable-check-register-pdf)

- [The Emotional Connection: How a Physical Check Register PDF Boosts Your Financial Well-being](#the-emotional-connection-how-a-physical-check-register-pdf-boosts-your-financial-well-being)

- [Specialized Solutions: Using Printable Check Register PDFs for Unique Financial Scenarios (Small Business, Family Budgets & More)](#specialized-solutions-using-printable-check-register-pdfs-for-unique-financial-scenarios-small-business-family-budgets--more)

- [The Future is Organized: Archiving, Security, and Long-Term Strategies for Your Printable Check Register PDF](#the-future-is-organized-archiving-security-and-long-term-strategies-for-your-printable-check-register-pdf)

- [How to Choose the Best Printable Check Register PDF for Your Needs](#how-to-choose-the-best-printable-check-register-pdf-for-your-needs)

- [Common Pitfalls to Avoid in Your Financial Tracking Journey](#common-pitfalls-to-avoid-in-your-financial-tracking-journey)

- [Advanced Tips for Experts: Elevating Your Printable Check Register PDF Game](#advanced-tips-for-experts-elevating-your-printable-check-register-pdf-game)

- [Conclusion: Your Journey to Financial Freedom Starts Here](#conclusion-your-journey-to-financial-freedom-starts-here)

---

The Unsung Hero: Why a Printable Check Register PDF is Still Essential in a Digital Age

In an era where banking apps flash real-time balances and every transaction is supposedly recorded digitally, why would anyone bother with a physical printable check register PDF? This is a question I hear often, and it's a valid one. But as someone who's navigated the complexities of both digital and analog financial tracking, I can tell you that the tangible act of writing down your transactions offers a unique set of benefits that no app can fully replicate. It's not about being anti-technology; it's about harnessing a powerful, often overlooked tool for clarity and control.

Here’s why your trusty printable check register is more essential than ever:

1. Instant Reconciliation, No Lag: When you swipe your card or write a check, the funds aren't always immediately reflected in your online banking. There's a lag. Writing it down in your register *immediately* updates your personal balance, giving you the most accurate, real-time picture of your available funds. *I once avoided an overdraft fee simply because I'd meticulously logged a large bill payment in my register the moment I sent it, even though it took two days to clear the bank.*

2. A Tangible Record You Control: Your bank's app can go down, your internet can fail, or servers can crash. A physical register is always accessible, always there, providing an undeniable record of your transactions. It's your ultimate backup.

3. Enhanced Awareness and Mindfulness: The act of physically writing down each transaction forces you to acknowledge where your money is going. This isn't a passive glance at a screen; it's an active engagement. This heightened awareness is a cornerstone of effective budgeting.

4. Error Detection and Fraud Prevention: Discrepancies between your register and your bank statement become immediately apparent during reconciliation. This quick identification can be crucial for spotting bank errors or, more critically, fraudulent activity. *A friend of mine caught a mysterious small charge by a streaming service she didn't subscribe to because her check register showed a clear imbalance.*

5. Simplicity and Accessibility: No complex software, no login issues, no battery life concerns. All you need is a pen and your printed register. This makes it incredibly accessible for anyone, regardless of tech proficiency.

6. Budgeting at a Glance: Many printable check register PDF templates can be adapted to include budget categories or notes, allowing you to see not just what you spent, but *where* you spent it, aiding your budgeting efforts naturally.

7. Historical Record Keeping: A physical register provides a clear, chronological history of your financial activity. This can be invaluable for tax purposes, disputing charges, or simply reviewing past spending patterns.

8. Reduced Financial Anxiety: Knowing your exact balance, seeing your transactions laid out clearly, and having a system you trust can significantly reduce the anxiety often associated with managing money. It gives you a sense of control.

9. Teaches Financial Discipline: For beginners, especially younger individuals, a check register teaches fundamental financial principles: tracking, balancing, and understanding debits vs. credits. It’s a hands-on financial literacy tool.

10. A Companion to Digital Tools: It's not an either/or situation. Your register can complement your online banking and budgeting apps, acting as the immediate, personal record while apps provide deeper analysis or bill pay features.

11. No Data Privacy Concerns: Unlike cloud-based apps or online services, your physical register keeps your sensitive financial data entirely offline and in your possession.

12. Perfect for Irregular Income or Expenses: If your income is variable, or you have large, infrequent expenses, a register helps you track the ebb and flow more intuitively than waiting for digital updates.

In essence, a printable check register PDF serves as your personal financial diary, a place where you maintain complete control and gain invaluable insights. It’s a testament to the power of simplicity and the enduring value of a tangible record in an increasingly virtual world.

---

Finding Your Perfect Match: A Guide to Different Printable Check Register PDF Styles

Just like there's no one-size-fits-all budget, there's no single perfect printable check register PDF for everyone. The beauty lies in the variety! Depending on your needs, your financial complexity, and even your personal aesthetic preferences, you can find a register that feels just right. Let's explore the common styles and what makes each one unique.

Here are the different types of printable check register PDFs you'll encounter:

1. The Classic/Basic Register:

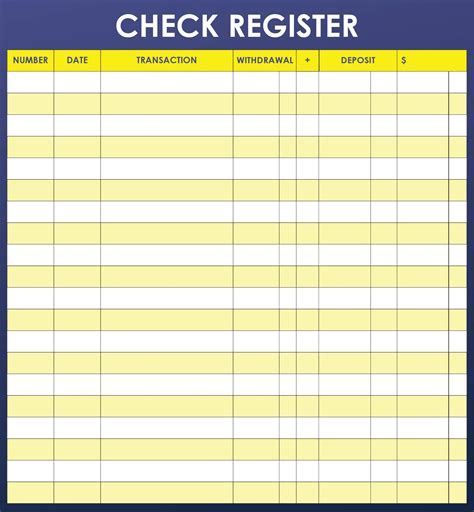

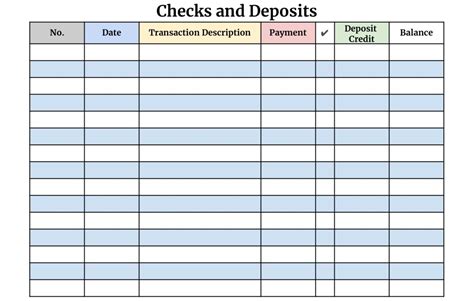

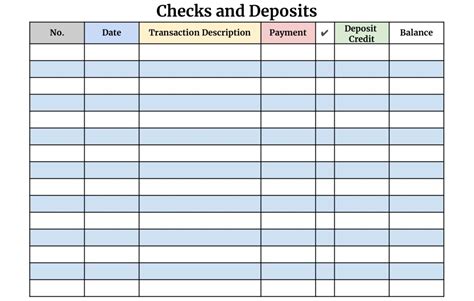

- Description: This is what most people picture. It typically includes columns for Date, Transaction/Description, Check Number (or Debit/Credit type), Payment/Debit, Deposit/Credit, and Balance. Simple, straightforward, and gets the job done.

- Best For: Beginners, those with simple finances, people who only want to track core transactions without extra frills.

- Hypothetical Scenario: *My mom, who isn't tech-savvy, found a basic printable check register PDF to be a game-changer. She prints a few pages each month, keeps them in a binder, and finally feels confident about her balance after years of relying solely on bank statements.*

2. Detailed/Expanded Register:

- Description: Builds on the classic but adds more columns for specific information like Category (e.g., Groceries, Utilities, Entertainment), Payee, or even a column for reconciling (e.g., a checkmark when it clears the bank).

- Best For: Individuals who want more granular tracking, those who are actively budgeting and need to categorize expenses, or small businesses.

- Hypothetical Scenario: *When I started freelancing, my basic register wasn't cutting it. I found a detailed printable check register PDF that allowed me to add a 'Client' column and a 'Project ID' column, which became invaluable for tax season and tracking project profitability.*

3. Budgeting-Integrated Register:

- Description: These registers go beyond mere transaction tracking and incorporate elements of a budget. They might have dedicated sections for monthly income, fixed expenses, variable expenses, or even a running budget balance.

- Best For: Anyone serious about budgeting who wants their transaction log to directly inform their budget, or those using a zero-based budgeting approach.

- My Personal Preference: I prefer a slightly more detailed register that has a small "category" column. This is my go-to because it's a game-changer for understanding where my money actually goes, not just *that* it went somewhere.

4. Transaction Type Focused Register:

- Description: Some registers might have specific columns for "Debit Card," "ATM Withdrawal," "Online Payment," etc., instead of just a generic "Check No." or "Type."

- Best For: People who use a variety of payment methods and want to easily distinguish between them for analysis.

5. Small Business/Freelancer Register:

- Description: Often includes columns for Invoice Number, Client Name, Business Expense Category, and potentially separate columns for business income and expenses. These are designed with tax reporting in mind.

- Best For: Self-employed individuals, sole proprietors, or anyone managing business finances alongside personal ones.

6. Compact/Travel-Friendly Register:

- Description: Designed to be smaller, sometimes half-page or designed to fit into a wallet or small notebook. They often sacrifice some detail for portability.

- Best For: Those who need to track transactions on the go, or prefer a minimalist approach.

7. Large Print/Accessibility Register:

- Description: Features larger fonts, wider spacing, and clearer lines to make it easier to read and write for individuals with visual impairments or fine motor skill challenges.

- Best For: Anyone who benefits from increased readability and ease of writing.

8. Themed/Aesthetic Registers:

- Description: While functionally similar to basic or detailed registers, these incorporate design elements, colors, or themes (e.g., minimalist, floral, geometric) to make the tracking process more visually appealing.

- Best For: Individuals who are motivated by aesthetics and want their financial tools to reflect their personal style.

- Hypothetical Scenario: *After struggling to stick with a plain register, my sister found a beautifully designed, themed printable check register PDF online. The act of using something visually pleasing actually made her more consistent with her tracking!*

9. Project-Based or Goal-Oriented Registers:

- Description: Less common, but some templates allow for tracking transactions related to a specific savings goal (e.g., "Vacation Fund") or project, with a running balance for that specific goal.

- Best For: People saving for multiple distinct goals, or managing funds for specific events.

10. Annual/Monthly Summary Registers:

- Description: These often combine a daily transaction log with monthly summary sections, allowing you to see totals for income, expenses, and net balance at the end of each month or year, without needing a separate spreadsheet.

- Best For: Those who want a comprehensive overview built directly into their transaction tracker.

11. Customizable/Fillable PDF Registers:

- Description: These aren't just for printing; they allow you to type directly into the PDF fields on your computer before printing, or even keep them entirely digital (though for this article, we're focusing on the *printable* aspect).

- Best For: Users who want the flexibility of typing but still prefer a physical record, or those who frequently update their register.

12. Debt Payoff Specific Registers:

- Description: Some registers are designed with an extra column or section to track principal and interest payments for loans, helping users visualize their debt reduction progress.

- Best For: Individuals actively working on paying down debt who want a clear, physical record of their progress.

Choosing the right printable check register PDF is a personal journey. Consider your current financial habits, your goals, and what level of detail will genuinely help you feel more in control, not overwhelmed.

---

The Gold Mine: Where to Discover High-Quality, Free, and Premium Printable Check Register PDFs

So, you're convinced a printable check register PDF is for you. Fantastic! Now, where do you find one that fits your needs? The internet is a treasure trove, but knowing where to look can save you hours of searching. From completely free options to beautifully designed premium templates, there's a world of resources waiting to be discovered.

Here's where to unearth your perfect printable check register:

1. Personal Finance Blogs & Websites (Free & Freemium):

- Description: Many personal finance gurus, bloggers, and financial planning websites offer free resources, including various printable check register PDF templates, often as lead magnets for their newsletters or courses. They're usually well-designed and practical.

- Examples: The Budget Mom, Dave Ramsey's website (sometimes offers freebies), various minimalist budgeting blogs.

- Hypothetical Scenario: *I found my first really useful template on a personal finance blog. It was a simple, clean design, and it came with a mini-guide on how to start tracking. It kickstarted my journey and felt like a warm welcome into the world of budgeting.*

2. Etsy & Creative Market (Premium/Paid):

- Description: These platforms are fantastic for unique, aesthetically pleasing, and highly functional printable check register PDF designs created by independent designers. You'll find everything from minimalist to elaborate, often bundled with other budgeting printables. Prices are usually very affordable (a few dollars).

- Pros: High quality, unique designs, often part of larger budgeting kits.

- Cons: Not free, but the investment is usually minimal for a lifetime resource.

- My Experience: I've bought a few from Etsy over the years, and the sheer variety and quality make it worth the small price. Plus, you're supporting independent artists!

3. Pinterest (Inspiration & Links to Freebies):

- Description: While not a direct source of files, Pinterest is an incredible visual search engine. Type in "free printable check register PDF" or "budget printables," and you'll find hundreds of pins linking to various blogs, websites, and even some direct downloads.

- Tip: Always click through to the original source to ensure you're downloading from a reputable site.

4. Template Websites (Free & Paid Subscriptions):

- Description: Sites like Template.net, Vertex42, or even Microsoft Office templates offer a wide array of ready-to-use templates for various purposes, including financial tracking. Some are free, others require a subscription.

- Pros: Professional-looking, often very functional.

- Cons: Can sometimes be a bit generic.

5. Your Own Bank's Website (Sometimes Free):

- Description: Believe it or not, some banks, especially smaller credit unions, might offer basic printable check register PDF templates as a courtesy to their customers. It's worth checking their "forms" or "resources" section.

- Pros: Directly from a financial institution.

- Cons: Often very basic, not always available.

6. Online Forums & Communities (Free & User-Shared):

- Description: Personal finance subreddits (like r/personalfinance, r/budgeting) or forums often have users sharing their self-made or favorite printable check register PDF templates. You might find some very niche or highly customized options here.

- Caution: Always exercise caution when downloading from unknown sources; ensure files are scanned for viruses.

7. Canva (Design Your Own or Use Templates):

- Description: If you're feeling a bit creative, Canva (the free version is sufficient) offers a vast library of templates and design tools. You can search for "ledger," "check register," or "budget tracker" templates and customize them to your heart's content, then download as a PDF.

- Pros: Ultimate customization, fun creative process.

- Cons: Requires a bit of design effort.

8. Google Search – The Obvious Starting Point:

- Description: A direct search for "free printable check register PDF" or "blank check register template" will yield countless results. Be specific with your search terms (e.g., "printable check register pdf with categories," "large print check register pdf").

- Tip: Look for results from reputable sites, and check the date of the post to ensure it's still relevant.

- Hypothetical Scenario: *I remember trying to find a printable check register PDF for my small business, and after a few frustrating generic results, I narrowed my search to "business check register pdf." That's when I found exactly what I needed on a site specializing in small business forms.*

9. Library Websites & Public Domain Resources:

- Description: Some public library websites offer links to free financial literacy resources, which might include printable templates. Occasionally, you might find very basic templates in the public domain.

10. Financial Software Companies (Marketing Freebies):

- Description: Companies like Quicken or YNAB, while primarily offering digital software, might occasionally release free printables as part of their marketing efforts to introduce people to financial tracking. Keep an eye on their "resources" or "blog" sections.

11. Book/Workbook Companions:

- Description: If you've purchased a personal finance book or workbook, check if it comes with companion printables, as a printable check register PDF is a common inclusion.

12. Your Printer Manufacturer's Website:

- Description: Believe it or not, some printer manufacturers (like HP or Canon) offer free printables on their websites to encourage printer usage. You might find basic financial templates there.

When downloading, always check the source's reputation, read reviews if available, and ensure the file type is indeed a PDF to avoid compatibility issues. Happy hunting!

---

Mastering the Art: A Step-by-Step Guide to Filling Out Your Printable Check Register PDF Like a Pro

Alright, you've found your perfect printable check register PDF. Now what? This is where the rubber meets the road! Filling out your register properly is key to its effectiveness. It’s not just about jotting down numbers; it’s about creating a clear, accurate, and actionable financial record. Think of it as your personal financial ledger, and with a little practice, you'll be a pro.

Here’s a step-by-step guide to mastering your printable check register:

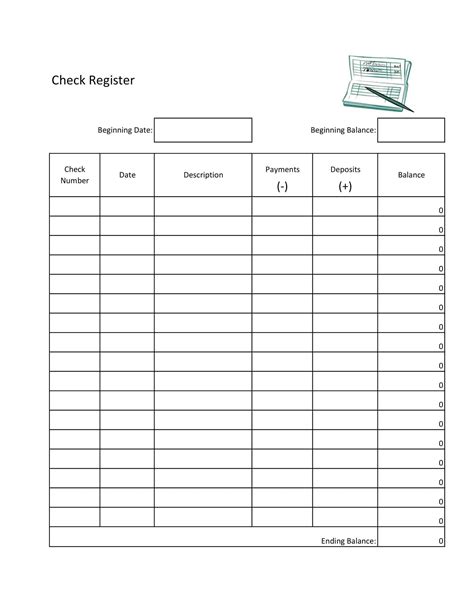

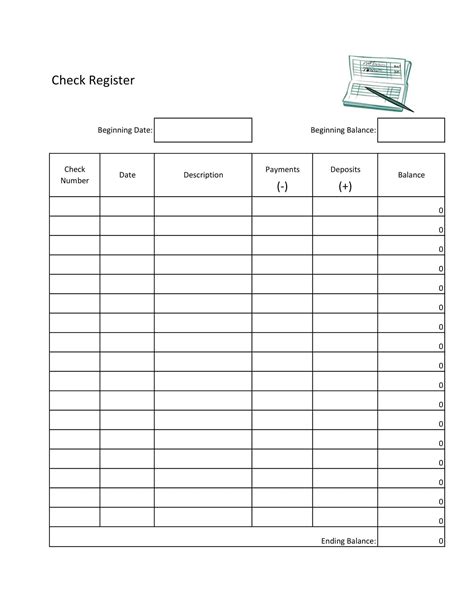

1. Set Up Your Starting Balance:

- Action: Before you record any new transactions, enter your current, verified checking account balance at the top of your register. This is your foundation.

- Pro Tip: Don't just pull this from memory. Log into your online banking or check your last statement to get the precise figure. *I once started with an estimate and spent an hour trying to figure out why my balance was off. Never again!*

- Where to Write: Usually, there's a dedicated "Starting Balance" line, or you can write it in the "Balance" column on the first line with "Initial Balance" in the description.

2. Date:

- Action: For every transaction, immediately record the date it occurred. This is crucial for reconciliation.

- Format: MM/DD or MM/DD/YYYY. Consistency is key.

3. Transaction/Description:

- Action: Write a clear, concise description of the transaction. This helps you identify it later.

- Examples: "Grocery Store - Safeway," "Electric Bill - PGE," "Paycheck - Employer Name," "ATM Withdrawal," "Online Order - Amazon," "Subscription - Netflix."

- Pro Tip: Be specific enough to jog your memory. "Coffee" isn't as helpful as "Starbucks - Morning Brew."

4. Check Number/Type of Transaction:

- Action: If it's a check, write the check number. If it's another type of transaction, indicate that.

- Examples: "Check 101," "Debit," "ATM," "Online," "Deposit," "Transfer," "Credit."

- Why it Matters: This helps you quickly identify how the money moved. For instance, if you're missing a check, you know exactly which one it is.

5. Payment/Debit (Money Out):

- Action: For any money leaving your account (expenses, withdrawals, transfers out), enter the exact amount in this column.

- Crucial: Don't round! Every cent matters.

6. Deposit/Credit (Money In):

- Action: For any money coming into your account (paychecks, refunds, transfers in), enter the exact amount in this column.

7. Balance:

- Action: This is the heart of your register. After each transaction, calculate your new balance.

- Calculation:

- If it's a payment/debit, subtract it from your previous balance.

- If it's a deposit/credit, add it to your previous balance.

- Example:

- Starting Balance: $1,000.00

- Grocery Store Debit: $150.00 → New Balance: $850.00

- Paycheck Deposit: $500.00 → New Balance: $1,350.00

- Hypothetical Scenario: *I once had a nagging feeling my bank balance was wrong. I sat down with my printable check register PDF and systematically re-calculated every single line item. Turns out, I'd accidentally transposed two numbers on an earlier entry. Catching that small error saved me from potential overdrafts later!*

8. Reconciliation Column (Optional, but Recommended):

- Action: Many registers have a small column (often labeled "R" or with a blank box) where you can place a checkmark or an "R" when the transaction clears your bank.

- When to Use: When you reconcile your register with your bank statement (ideally weekly or bi-weekly).

- Benefits: This is how you confirm that your register balance matches your bank's balance, and it helps you spot missing transactions or errors. *This single column saved me from a major headache when my bank double-charged me for a utility bill. The missing "R" for one of the charges was a red flag.*

9. Notes/Category Column (Optional):

- Action: Use this column for extra details, such as the budgeting category (e.g., "Food," "Utilities," "Entertainment") or any other relevant notes.

- Benefits: Helps with budgeting and analyzing spending patterns without needing a separate budgeting sheet.

General Best Practices:

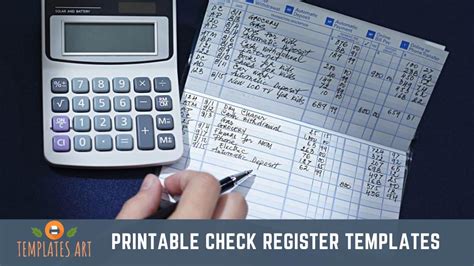

- Record Immediately: The golden rule! As soon as a transaction occurs, write it down. Don't rely on memory. This is especially true for debit card purchases.

- Use a Pen: Avoid pencils unless you truly need to make temporary notes. A pen provides a permanent, clear record.

- Be Neat and Legible: You need to be able to read your own handwriting later.

- Reconcile Regularly: At least once a week, compare your register to your online banking or statement. This is crucial for accuracy and catching issues early.

- Don't Forget Small Transactions: That $3 coffee or $1.50 vending machine purchase adds up. Every transaction, no matter how small, affects your balance.

- Carry it With You: If you're frequently making purchases, keep your printable check register PDF in your wallet, purse, or a dedicated budgeting notebook so it's always handy.

- Hypothetical Scenario: *My partner was initially skeptical about using a physical register, but after a week of diligently recording every coffee, every gas station stop, and every online purchase, he exclaimed, "Wow, I actually know exactly how much money I have right now!" That immediate, tangible understanding was a powerful motivator for him to stick with it.*

Mastering your printable check register PDF is a skill that pays dividends in financial peace of mind. It's a simple habit, but its impact on your financial awareness and control is profound.

---

Beyond the Basics: Customizing Your Printable Check Register PDF for Ultimate Financial Clarity

The beauty of a printable check register PDF isn't just its simplicity; it