Remember that gut-wrenching feeling when you check your bank balance and it's… lower than expected? Or worse, the dreaded overdraft fee lurking in your statement? Trust me, I’ve been there. For years, I stumbled through my finances, relying on memory (a truly terrible idea!) until I discovered the humble, yet mighty, free printable check register. It was like finding a secret weapon in my financial arsenal, bringing order and peace of mind to what felt like a chaotic mess.

Whether you're new to managing a checking account or you're a seasoned pro looking for a simple, reliable backup, a printable check register is an incredibly powerful tool. It’s a tangible way to track every dollar in and out, helping you avoid surprises, meet your budget goals, and truly understand where your money goes. Forget complicated software or expensive apps – sometimes, the simplest solutions are the most effective.

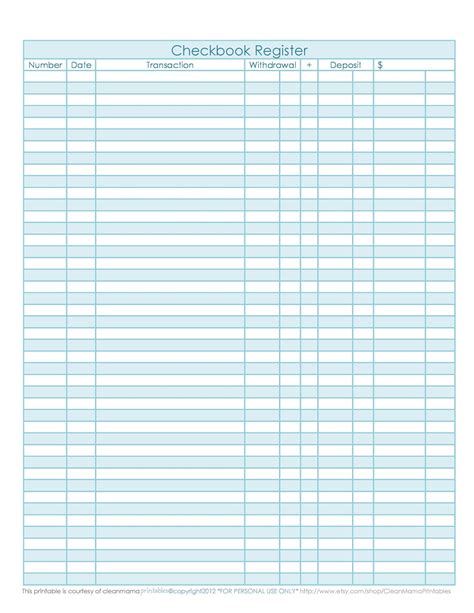

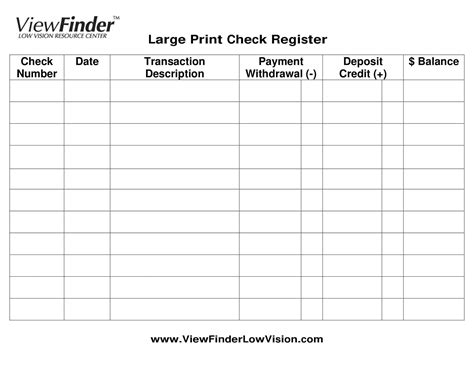

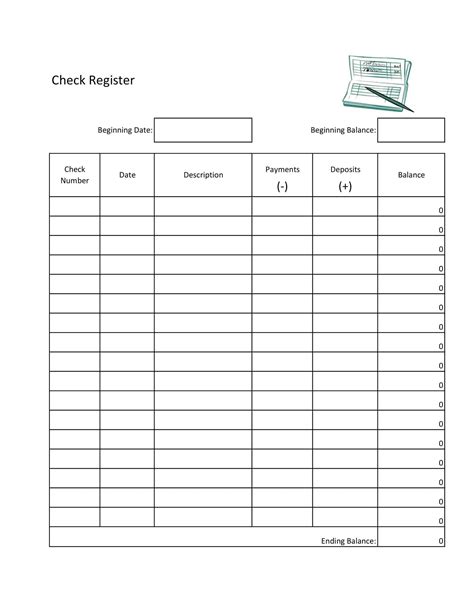

The Classic & Concise Register: Your No-Frills Financial Backbone

This is your go-to if you just need the basics: a place to record transactions and keep a running balance. It’s perfect for beginners or anyone who appreciates minimalist design and straightforward functionality.

- What it offers: Columns for date, check number/transaction type, description, payment/withdrawal, deposit, and balance.

- Why it's essential: It mirrors the traditional paper register that comes with your checkbook, making the transition seamless.

- Ideal for: People who primarily use checks or debit cards and just want a simple ledger.

- Ease of use: Incredibly intuitive, requiring minimal setup. Just print and start writing!

- My personal scenario: When I first started diligently tracking, I used a classic free printable check register template. It helped me finally see exactly how much I had *before* logging into my bank, saving me from a few near-overdraft heart attacks.

- Key benefit: Builds fundamental financial discipline by requiring manual entry.

- Versatility: Can be adapted for credit card tracking in a pinch, though dedicated templates are better.

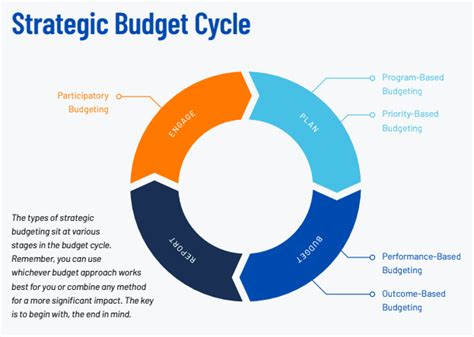

The Budgeting Booster Register: Track Your Pennies, Master Your Plan

Ready to take your financial tracking beyond just balances? This type of register includes extra columns or sections to categorize your spending, helping you align with your budget goals.

- What it offers: All the classic fields, plus additional columns for categories (e.g., "Groceries," "Utilities," "Entertainment").

- Why it's invaluable: Helps you pinpoint where your money is actually going, identifying areas for adjustment.

- Ideal for: Budget-conscious individuals or families committed to understanding their spending habits.

- Practical application: Use a different colored pen for each category, or tally up categories weekly.

- Empowerment: Knowing your spending patterns is the first step to financial freedom.

- Advanced tip: Some versions might include a "budgeted amount" column to compare planned vs. actual spending.

- My experience: I started using a version of this when I realized my "coffee fund" was actually a "small fortune fund." It was humbling, but necessary for real change!

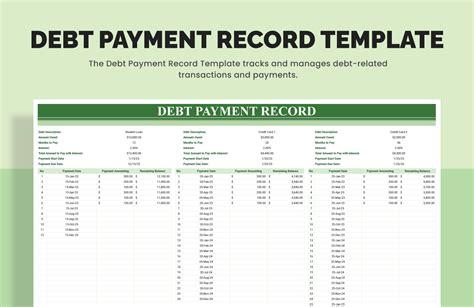

The Debt-Payment Power Register: Conquer Your Debts, One Payment at a Time

If you're focused on chipping away at loans, credit card balances, or other debts, a specialized register can keep you motivated and on track.

- What it offers: Fields for loan name, original balance, payment made, interest paid, principal paid, and remaining balance.

- Why it's a game-changer: Provides a clear, visual representation of your progress, which is incredibly motivating.

- Ideal for: Anyone on a debt-reduction journey, like paying off student loans or credit card debt.

- Focus: Shifts the emphasis from just "spending" to "reducing liability."

- Accountability: Seeing your principal balance decrease can be a huge psychological boost.

- Scenario: My friend used a template like this to track her car loan payments, and she swore it helped her mentally "see the finish line" and stay committed to extra payments.

- Motivation: Turns abstract debt into concrete, manageable chunks.

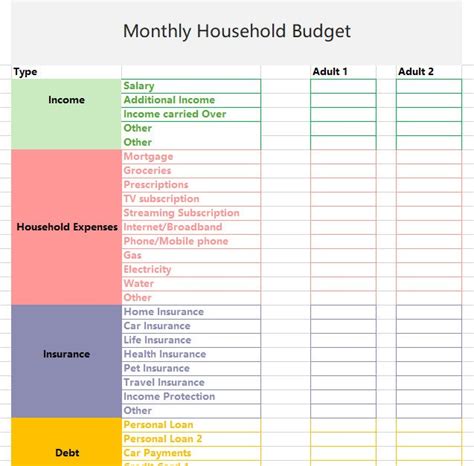

The Family Finance Flow Register: Harmony in Household Spending

Managing money as a couple or family can be tricky. A printable register designed for shared finances can bring much-needed transparency and reduce arguments.

- What it offers: Columns similar to the classic, but with added fields for "Who Paid" or "Account Used" (if multiple accounts are linked).

- Why it's a blessing: Promotes open communication about money and ensures everyone knows the current financial standing.

- Ideal for: Couples, roommates, or families with shared household expenses and a joint checking account.

- Transparency: No more "whose turn is it to pay for groceries?" debates.

- Shared responsibility: Everyone sees the inflows and outflows, fostering a sense of joint stewardship.

- Communication tool: Can spark important conversations about financial goals and habits.

- My tip: Make it a habit to sit down together once a week to review and update the register. It sounds tedious, but it built so much trust in my household!

The Small Business Starter Register: Simple Tracking for Solopreneurs

Even the smallest businesses need to track income and expenses. A simplified printable register can be a lifesaver before you're ready for complex accounting software.

- What it offers: Fields for date, transaction type, description, income, expense, and running business balance.

- Why it's crucial: Helps separate personal and business finances, simplifying tax preparation and understanding profitability.

- Ideal for: Freelancers, solopreneurs, Etsy shop owners, or anyone with a side hustle.

- Tax readiness: Keeps your records organized for tax time, avoiding last-minute scrambling.

- Financial health check: Provides a quick snapshot of your business's cash flow.

- Personal story: When I started my freelance writing, I used a basic business register like this. It gave me a clear picture of my net income and helped me avoid mixing business and personal funds, which trust me, you don’t want to mess up!

- Scalability: Can be a solid foundation before upgrading to more sophisticated accounting tools.

Tips for Personalizing Your Free Printable Check Register

Making your register your own doesn’t just make it visually appealing; it makes it more effective because you’re more likely to use it!

- Use color coding: Assign different colors to categories, types of transactions, or even different family members. I find this approach works best for small teams (or families!) and makes scanning super easy.

- Add personal notes: Use the "description" field, or add a dedicated notes column, for details that help you remember the transaction ("Birthday gift for Aunt Sue," "Emergency tire repair").

- Integrate reminders: Jot down upcoming bill due dates directly in the margins or next to relevant entries.

- Choose the right size: Print it in a size that fits your binder, planner, or wallet – portability is key.

- Laminate or put in a sleeve: If you handle it often, protecting it will ensure it lasts longer.

- My subjective tip: I always add a small section at the bottom for "Upcoming Large Expenses." It's a simple visual reminder that keeps me from overspending on impulse buys.

Common Pitfalls: What to AVOID When Using Your Printable Check Register

Even the simplest tools can be misused. Here’s what I learned the hard way (so you don't have to!).

- Don't skip entries: Every single transaction, no matter how small, must be recorded immediately. That $2 coffee? Write it down. Overdraft fees often start with those "insignificant" purchases.

- Don't rely solely on memory: If you wait until the end of the day or week, you're bound to forget something crucial. Make it a habit to log as you spend.

- Avoid "rounding up": Be precise. A register is only as accurate as the data you put into it. Don't round to the nearest dollar; use exact cents.

- Don't forget ATM withdrawals: This is a big one. It's easy to pull cash and forget to record it, throwing your balance completely off.

- Never mix personal and business funds: If you're using a business register, stick to business transactions. Mixing them leads to a tax nightmare.

- Don't forget recurring payments: Subscriptions, rent, loan payments – jot them down at the beginning of the month so you know they’re coming.

- Light-hearted warning: Don’t be like me and think, "Oh, I'll just check my online banking later!" That "later" often turned into a panicked rush to figure out where my money went. Your printable register is your real-time snapshot!

There you have it. The humble free printable check register isn't just a piece of paper; it's a powerful ally in your quest for financial peace of mind. By choosing the right template for your needs and committing to consistent use, you'll gain an unparalleled understanding of your money, avoid dreaded fees, and build healthy financial habits that will serve you for years to come. Now go print your register, fill it out, and take control of your cash flow!