Ever felt that knot of anxiety in your stomach when you check your bank balance, not quite sure what’s coming in or going out? Trust me, you’re not alone. We’ve all been there – staring at a transaction history, wondering where that money went or if a payment has cleared. I once almost incurred an overdraft fee because I misplaced a single receipt and forgot to account for a large purchase. It was a stressful wake-up call, and it taught me the invaluable lesson of diligent tracking.

That’s where the humble but mighty checkbook register printable free resource comes in. It’s not just for balancing a physical checkbook anymore; it’s your essential tool for understanding your financial flow, avoiding nasty surprises, and finally gaining that sweet, sweet peace of mind. Forget complicated software or expensive apps if you prefer a tangible, hands-on approach. This guide will walk you through finding the perfect free printable register, using it effectively, and turning your financial anxiety into confidence.

---

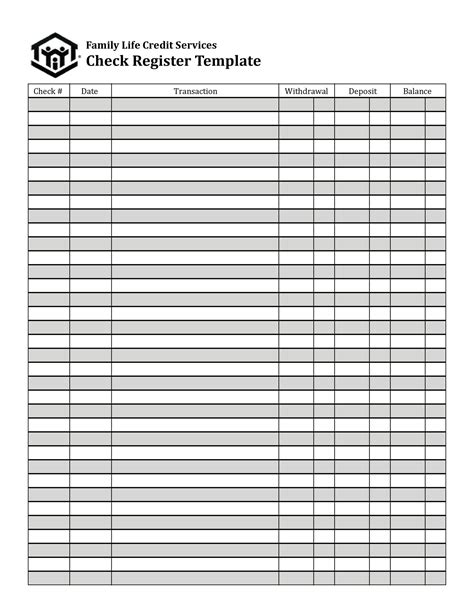

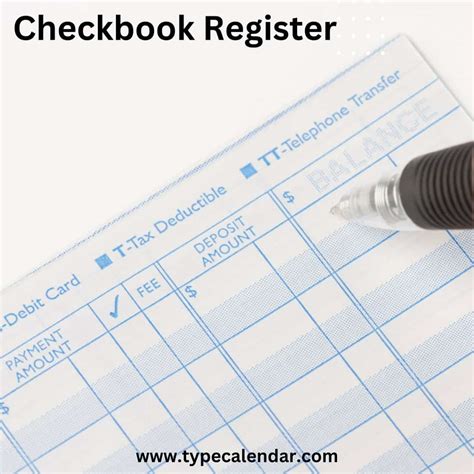

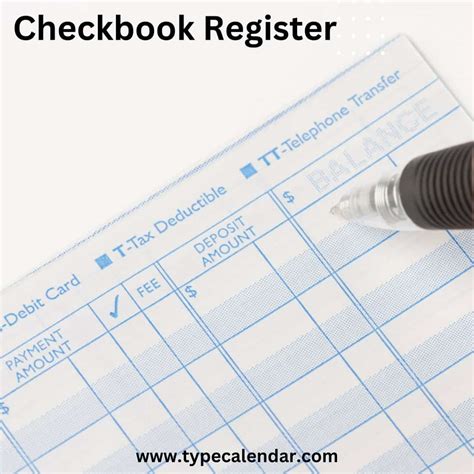

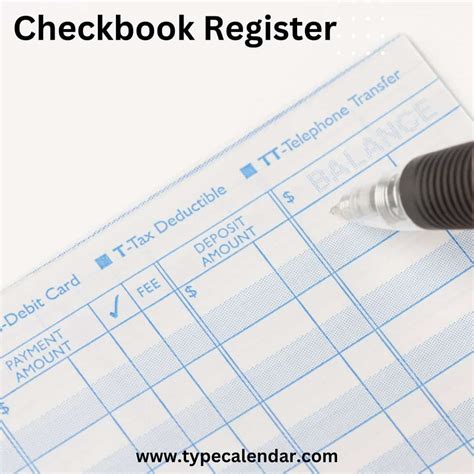

The "Back to Basics" Classic Printable Checkbook Register

Sometimes, simple is simply the best. For those just starting their financial tracking journey, or anyone who appreciates an uncluttered, straightforward approach, a classic checkbook register printable free template is your ideal companion. These designs typically feature just the essentials: Date, Transaction Description, Payment/Debit, Deposit/Credit, and Balance. They are fantastic for getting into the habit without feeling overwhelmed.

- Example 1: A clean, unlined register with clear headings. "Perfect for daily coffee runs and groceries – easy to see your daily spend."

- Example 2: A template with slightly larger rows for those who prefer more writing space. "This is what I started with; it made the initial learning curve so much smoother."

- Example 3: A simple register formatted for two transactions per line to save paper. "Great for minimalists who just need the core data."

- Example 4: A basic register with a dedicated column for check numbers or transaction IDs. "Essential for reconciling bank statements quickly."

- Example 5: One designed with bold lines separating entries, making it easier to read at a glance. "My personal preference for quickly spotting where I am."

- Example 6: A version that includes a small notes section for each entry. "Handy for jotting down details like 'Birthday gift for Mom'."

- Example 7: A standard ledger format, reminiscent of traditional registers. "Tried and true for a reason – it just works."

The Detailed Budget Buddy: Free Printable Check Registers for Deeper Tracking

Ready to go beyond just balancing? These more detailed checkbook register printable free options help you not only track transactions but also categorize your spending, helping you see exactly where your money is going. This type of register is excellent for those who want to stick to a budget, identify spending patterns, and make more informed financial decisions. It often includes additional columns for budget categories or payment methods.

- Example 1: A register with a "Category" column (e.g., Food, Utilities, Entertainment). "This was a game-changer for me when I started trying to cut down on impulse buys."

- Example 2: One that includes a "Budget Allotment" column you can tick off. "Visualize your budget being used up with each entry."

- Example 3: A template with space to denote "Needs" vs. "Wants." "A simple yet powerful reminder of financial priorities."

- Example 4: A register that combines a standard register with a small monthly budget tracker on the same page. "Like a mini financial dashboard at your fingertips."

- Example 5: A version that encourages tracking specific bills due dates alongside transactions. "Great for ensuring you never miss a payment."

- Example 6: One with a running total for different spending categories. "Perfect for seeing your 'eating out' total grow throughout the month."

- Example 7: A detailed register that allows for tracking "Cleared" and "Outstanding" transactions separately. "For those who really want to get granular with their balance."

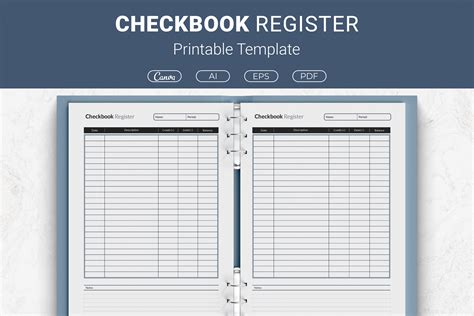

Managing Multiple Accounts: Advanced Printable Checkbook Ledgers

If you juggle several bank accounts, credit cards, or even savings pots, keeping them all straight can be a nightmare. Thankfully, there are checkbook register printable free designs tailored for exactly this scenario. These aren't just single-sheet registers but often come as multi-page or multi-section templates that allow you to track different financial instruments in one cohesive system. This strategy is my favorite because it saved me countless times from misattributing expenses!

- Example 1: A template designed with separate sections for Checking, Savings, and Credit Card accounts. "I found this invaluable when I started managing both my personal and business finances."

- Example 2: A register where each page is dedicated to a specific account, clearly labeled at the top. "Keep things separate but easily accessible."

- Example 3: A comprehensive ledger that allows you to track inter-account transfers. "Essential for seeing how money moves between your own accounts."

- Example 4: A printable that includes a summary page to tally balances from all accounts. "Your holistic financial snapshot in one place."

- Example 5: A register formatted to track multiple credit cards, including columns for minimum payment and due dates. "No more missed credit card payments!"

- Example 6: One with color-coded sections for different accounts, making visual distinction easy. "Super helpful for quick identification."

- Example 7: A system that includes dedicated pages for tracking investments alongside daily spending. "For the financially ambitious."

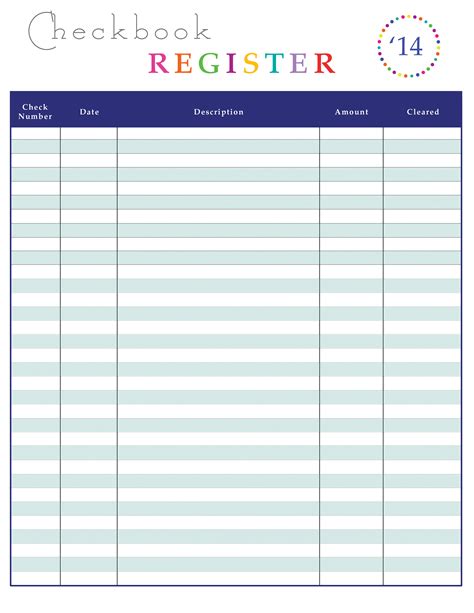

Sleek & Simple: Minimalist Free Printable Checkbook Register Designs

Who says financial tracking can't be aesthetically pleasing? For those who appreciate clean lines, modern design, and an uncluttered look, minimalist checkbook register printable free options are a perfect fit. These registers focus on functionality while maintaining a stylish appearance, proving that good design can make even mundane tasks more enjoyable.

- Example 1: A stark black and white design with sans-serif fonts. "Looks great in any binder or on its own."

- Example 2: A register with subtle gray lines instead of bold ones, creating a softer look. "Easy on the eyes for long tracking sessions."

- Example 3: A template featuring a single pop of color for headings or accents. "A touch of personality without being distracting."

- Example 4: One designed with extra white space for a premium feel. "Makes tracking feel less like a chore."

- Example 5: A register that uses iconography for categories instead of text (e.g., a fork for food). "Visually intuitive and very modern."

- Example 6: A design optimized for printing on colored paper, letting you customize the look. "Personalize it to your heart's content."

- Example 7: A streamlined register that mimics the look of a digital spreadsheet but in print. "Familiar and functional."

For Small Businesses & Side Gigs: Transaction Log Printables

Running a small business or even a robust side gig means meticulous record-keeping. A generic personal checkbook register might not cut it. Thankfully, specific checkbook register printable free templates exist that are geared towards tracking business expenses, income, and even tax-deductible items. These are crucial for tax time and understanding your business's profitability.

- Example 1: A ledger with specific columns for business income and expense categories (e.g., Supplies, Marketing, Client Payments). "Essential for keeping personal and business finances separate."

- Example 2: A transaction log that includes columns for client names or project IDs. "Great for tracking individual project profitability."

- Example 3: One with a dedicated column for tracking mileage or other common deductions. "Makes tax season a breeze, or at least less of a headache!"

- Example 4: A printable with sections for both incoming invoices and outgoing payments. "A complete picture of your business's cash flow."

- Example 5: A simple checkbook register printable free designed specifically for tracking cash transactions, common in small businesses. "Don't let cash slip through the cracks."

- Example 6: A template that integrates a small profit/loss tracker summary at the end of each month. "See your business health at a glance."

- Example 7: A register that includes a notes section for every transaction, crucial for detailed audit trails. "I use this to note *why* an expense was made for future reference."

Quick Check & Go: Emergency Balance Trackers

Life happens fast, and sometimes you just need a super quick way to verify your balance or jot down a few transactions on the fly. These checkbook register printable free options are designed for portability and instant use, perfect for keeping in your wallet, car, or a small bag. They're minimalistic but effective for those moments when you don't have your main ledger handy.

- Example 1: A mini register designed to be cut out and folded into a wallet size. "Perfect for on-the-go tracking after a quick purchase."

- Example 2: A small, single-page register with large print, easy to fill out quickly. "No need for reading glasses when you're in a hurry."

- Example 3: A template specifically for ATM withdrawals and immediate cash expenses. "Crucial for knowing your remaining cash balance."

- Example 4: A checkbook register printable free designed for quick reconciliation after a shopping trip. "Input all those receipts before you forget them!"

- Example 5: One with extra bold lines to ensure entries don't bleed into each other, even with messy handwriting. "Don't be like me and accidentally record the wrong amount because of illegible notes!"

- Example 6: A small sheet that focuses solely on debits, helping you keep track of money going out fast. "For when you just need to ensure you're not overspending."

- Example 7: A tear-off pad style printable, so you can grab a fresh sheet whenever needed. "Always ready for action."

Family Finance Hub: Collaborative Printable Registers

Managing household finances often involves multiple people. A checkbook register printable free designed for family use can be a game-changer for transparency and shared responsibility. These templates often include columns for "Who Paid" or specific household categories, making it easier for everyone to stay on the same page and avoid confusion.

- Example 1: A shared ledger with a "Payer" column for tracking who made which payment. "Helps avoid arguments about who owes what for the utilities!"

- Example 2: A register formatted for tracking joint expenses like groceries or childcare. "Keeps communal spending clear for everyone."

- Example 3: One that includes sections for allowances or kids' spending money. "Teaching financial literacy to the next generation."

- Example 4: A checkbook register printable free designed to be hung on a fridge or shared whiteboard. "Visible to the whole family for easy updates."

- Example 5: A template that allows for tracking shared savings goals alongside regular transactions. "Working together towards that family vacation!"

- Example 6: A register with a section for family meeting notes regarding finances. "Encourages regular money discussions."

- Example 7: One that segregates expenses by family member, for individual accountability within a shared budget. "Great for personal allowance management."

---

Tips for Personalizing Your Checkbook Register Experience

Finding the perfect checkbook register printable free template is just the first step. To truly make it *yours* and maximize its effectiveness, consider these personalization tips:

- Color-Code Everything: Assign a specific color to different types of transactions (e.g., green for income, red for bills, blue for discretionary spending). This makes scanning your register incredibly fast. I find this approach works best for busy people who need quick visual cues.

- Add Notes & Reminders: Don't just list transactions; use the notes section (or add one if your template doesn't have it) to include details like "birthday gift for Aunt Sue," "new tires," or "refund for XYZ." This context is invaluable later.

- Set Up a "Next Step" Column: After reconciling a transaction with your bank statement, mark it off. You could use a simple checkmark, a highlighter, or even a column titled "Reconciled Date."

- Create a "Future Transactions" Section: Dedicate a few lines at the bottom or on a separate page for upcoming bills or known large expenses. This helps you mentally account for money that's "gone" before it even leaves your account.

- Use Unique Identifiers: If your bank statements show transaction IDs, incorporate them into your register. This makes cross-referencing a breeze when things don't quite add up.

- Invest in Good Tools: A comfortable pen, a ruler for clean lines, and a dedicated binder or folder for your registers can significantly improve your experience. Making it a pleasant ritual increases adherence.

Common Pitfalls: What to AVOID When Using Your Printable Checkbook Register

While a checkbook register printable free is a fantastic tool, there are a few common mistakes that can derail your efforts. Don't be like me and make these mistakes – learn from my trials!

- Not Recording Every Transaction: This is the cardinal sin! Even small purchases add up. A $5 latte here, a $10 fast-food lunch there – they can throw your balance off significantly. Record immediately or as soon as humanly possible.

- Forgetting to Update the Balance: Every time you record a transaction, update your running balance. Skipping this step defeats the purpose and leads to inaccurate figures.

- Relying Solely on Memory: Don't tell yourself, "I'll remember to write that down later." You won't. Or you'll forget crucial details like the exact amount or where it went.

- Not Reconciling Regularly: Your register is only accurate if you compare it to your bank statements (or online banking) at least once a week, preferably daily. Overdrafts lurk in the discrepancies!

- Misplacing Your Register: If your register isn't in a consistent, easily accessible place, you'll be less likely to use it. Find a dedicated spot and stick to it.

- Becoming Discouraged by Errors: You *will* make mistakes. It's part of the learning process. Don't throw in the towel because of a calculation error; just correct it and move on. The goal is progress, not perfection.

---

The journey to financial clarity doesn't have to be complicated or expensive. With a trusty checkbook register printable free, a little consistency, and the insights from this guide, you're well on your way to mastering your money. No more financial guesswork, no more "panic nggak tuh" when checking your bank account.

So go ahead, download your favorite template, grab a pen, and take control. You've got this. Now go make your money work for you!