Let’s be honest, the words "mileage log" probably don't spark joy. For many, it conjures images of endless receipts, crumpled notes, and that looming dread of tax season. But trust me, as someone who once fumbled through a shoebox full of half-remembered trips every April, a printable mileage log isn't just a boring chore – it's your secret weapon. It’s the difference between stress and peace of mind, between missing out on thousands in deductions and confidently claiming every dollar you deserve. I learned the hard way that a little organization goes a long way, especially when the IRS is involved!

Whether you’re a seasoned road warrior, a side-hustle superstar, or just trying to keep your personal finances tidy, navigating vehicle expenses can feel like a labyrinth. But what if I told you there’s a simple, straightforward tool that cuts through the confusion? That’s exactly what a good printable mileage log offers. It’s accessible, effective, and completely free of subscription fees. Ready to transform your mileage tracking from a headache into a superpower? Let’s dive in.

---

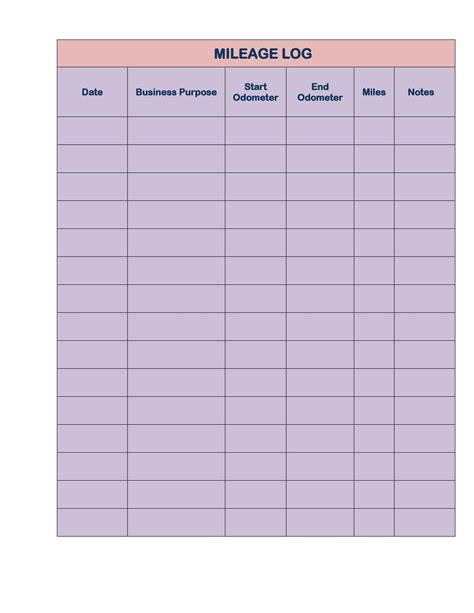

1. The "Just the Basics" Daily Log: Your No-Fuss Foundation

If you’re new to mileage tracking or just need a simple, universal system, this is your starting point. It’s designed for minimal fuss but maximum impact, capturing only the absolutely essential information needed for most purposes. Think of it as your daily diary for your car.

Why it matters: Perfect for beginners, personal expense tracking, or just getting into the habit without feeling overwhelmed. It establishes the fundamental practice of logging.

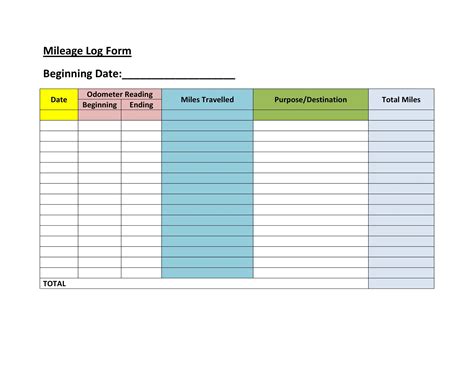

- Example 1: The Daily Commuter Saver: A simple column for date, odometer start, odometer end, and total miles. Perfect for logging miles for a specific commute that might be reimbursable, or simply for personal fuel tracking.

- Example 2: The Errands & Appointments Tracker: A section for "Purpose of Trip" (e.g., "Grocery Shopping," "Doctor's Visit," "School Pickup") in addition to mileage. I used this when I was tracking non-business trips to understand my personal vehicle use better.

- Example 3: The "Quick Log" Dashboard: Designed to be printed and kept directly in your car, with large, clear fields for quick jotting down of start/end mileage and destination. *My favorite method is keeping the log right in my glove compartment, next to a pen – it saved me countless times from forgetting!*

- Example 4: The Monthly Mileage Summary: Includes a dedicated space to total miles at the end of each month, making annual calculations a breeze.

- Example 5: The Fuel Efficiency Monitor: Adds a column for fuel added and price, helping you simultaneously track mileage and gas expenses.

- Example 6: The "One Trip Per Line" Layout: Each row is dedicated to a single trip, making it easy to read and enter data sequentially. This is ideal if you have many short trips throughout the day.

- Example 7: The Annual Overview: A template with enough rows for an entire year, so you only need one sheet for comprehensive tracking.

---

2. The Business & Tax-Savvy Log: Maximizing Your Deductions

For anyone using their vehicle for work, independent contracting, or any activity that qualifies for tax deductions, this category is your best friend. These templates are designed to meet IRS requirements, ensuring every mile counts towards your bottom line. You don’t want to mess this up!

Why it matters: Crucial for claiming eligible deductions on your taxes, avoiding audits, and accurately separating business from personal expenses.

- Example 1: The IRS-Ready Standard: Includes date, start odometer, end odometer, total miles, destination, and *business purpose* (this is key!). Many templates include separate columns for "Personal Miles" vs. "Business Miles."

- Example 2: The Client Visit Tracker: Features additional space to note client names or project codes, linking specific trips to specific income-generating activities. I used this for consulting gigs where I needed to justify every travel expense.

- Example 3: The Multi-Stop Business Route: Designed with extra rows under each "Date" entry to log multiple stops within a single business trip (e.g., visiting three different suppliers in one afternoon).

- Example 4: The "Before & After" Odometer Check: Prompts you to record your odometer reading at the start and end of your workday, even if you don't track every individual trip. This provides an overall daily business mileage.

- Example 5: The Purpose Detailer: A larger box or more lines for the "Purpose" column, allowing for detailed explanations that can stand up to scrutiny during an audit. (e.g., "Meeting with client XYZ regarding Q4 sales strategy at their downtown office.").

- Example 6: The Deduction Estimator: A template that includes space to multiply total miles by the current IRS standard mileage rate, giving you an immediate estimate of your potential deduction.

- Example 7: The Vehicle-Specific Log: If you use multiple vehicles for business, a template that clearly designates which vehicle was used for each trip. This is vital for accurate record-keeping.

---

3. The Gig Economy Go-Getter's Log: For Rideshares & Deliveries

If you’re driving for Uber, Lyft, DoorDash, Instacart, or any other gig economy platform, your mileage is your biggest deduction. These logs are tailored to the unique, often fragmented nature of gig work, helping you track every valuable mile.

Why it matters: Gig workers often rack up tens of thousands of miles. Accurate tracking can save you thousands of dollars in taxes annually.

- Example 1: The "Online Time" vs. "Trip Time" Split: Columns for when you turned on your app, when you accepted your first ride/delivery, and when you signed off, alongside total mileage for the session. *I remember one year, I almost missed a huge deduction because I didn't track my "offline" miles between deliveries! This type of log helps.*

- Example 2: The Per-Trip Detailer: Each line item is for a single ride or delivery, including pickup/drop-off locations, total trip mileage, and even specific client earnings for that trip.

- Example 3: The Multi-App Tracker: A column or section to denote which app (Uber, Lyft, DoorDash, etc.) the miles were associated with, useful if you juggle multiple platforms.

- Example 4: The Home-to-First-Pickup/Last-Dropoff Tracker: Dedicated space to log the "unpaid" miles between your home and your first pickup, and your last drop-off back to home, which are often deductible.

- Example 5: The "Wait Time" Mileage: A log that prompts you to note miles driven while "cruising" for a fare or delivery, even if a specific passenger isn't in the car.

- Example 6: The "Heatmap" Tracker: A simplified version that encourages logging overall daily miles for gig work, perhaps with a quick note about the general area covered. Less granular, but good for high-volume, repetitive driving.

- Example 7: The End-of-Shift Summary: A printable that helps you quickly summarize your total online time, accepted trip count, and total miles for a given shift.

---

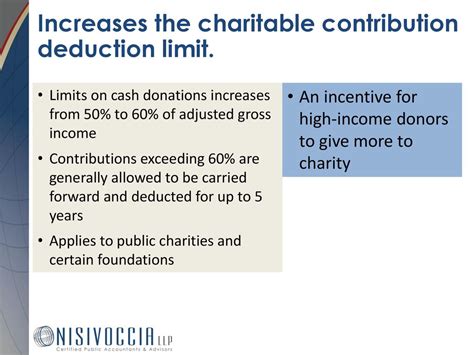

4. The Medical & Charitable Journey Log: Specific Deductions

Did you know you can deduct mileage for medical appointments or volunteer work? These specific printable mileage log templates ensure you capture these often-overlooked deductions, providing the detail necessary for tax purposes.

Why it matters: These deductions are often forgotten but can add up significantly, especially for ongoing medical treatment or dedicated volunteer efforts.

- Example 1: The Medical Appointment Tracker: Includes date, purpose (e.g., "Doctor's visit," "Physical Therapy," "Pharmacy run"), and mileage. Also space for "who" the appointment was for.

- Example 2: The Volunteer Service Log: Columns for the organization name, date, purpose (e.g., "Food bank delivery," "Youth group trip"), and mileage. This is incredibly helpful for documenting your charitable contributions.

- Example 3: The Family Medical Mileage: If you transport family members for their medical appointments, a log that clearly indicates who was transported and the purpose.

- Example 4: The Recurring Trip Template: Ideal for ongoing treatments or weekly volunteer duties, with pre-filled dates or sections for easy repeated logging.

- Example 5: The "Donation Drive" Log: Specifically for documenting miles driven to deliver donations to charities (e.g., dropping off clothes, furniture).

- Example 6: The Event-Specific Volunteer Log: For a large event where you volunteer for several days (e.g., a charity marathon), a log focused on documenting all travel related to that single event.

- Example 7: The Comprehensive Medical Travel: Includes space for other related expenses like parking fees or tolls associated with medical travel, in addition to mileage.

---

5. The Family Fleet Tracker: For Shared Vehicles & Multiple Drivers

Managing mileage for multiple vehicles or drivers within a household can be tricky. These logs are designed for clarity, helping you distinguish between personal, business, and shared use, ensuring everyone’s tracking is in order.

Why it matters: Prevents confusion, ensures accurate individual deductions, and helps manage overall vehicle costs for a household or small team.

- Example 1: The Multi-Car Log: Each sheet has dedicated sections or columns for "Vehicle 1 (Make/Model/VIN)" and "Vehicle 2," allowing for easy tracking of multiple vehicles on one form.

- Example 2: The Driver-Specific Log: Templates with a clear "Driver Name" field, ideal for families where multiple individuals share a car and need to track their own specific mileage.

- Example 3: The "Car Pool" Tracker: If you carpool for work or school, a log that helps differentiate your personal miles from shared miles, particularly if there are reimbursement agreements.

- Example 4: The Personal vs. Business Separator: A log with two distinct sections or columns on each page – one for "Personal Use" and one for "Business/Deductible Use," making categorization instant.

- Example 5: The "Weekend Warrior" Log: Simplified tracking for vehicles primarily used for recreational or weekend trips, to monitor personal mileage and maintenance needs.

- Example 6: The Vehicle Maintenance Linker: Includes small sections to note routine maintenance (oil changes, tire rotations) alongside mileage, helping you track service intervals.

- Example 7: The Yearly Fleet Summary: A larger template designed to summarize the annual mileage for up to 3-5 vehicles, providing an excellent overview of household vehicle usage.

---

6. The Customizable Template Toolkit: Your DIY Dream

Sometimes, off-the-shelf just doesn't cut it. This category is for those who love to tailor things to their exact needs. These aren't complete logs, but rather frameworks or ideas to build your own perfect printable mileage log.

Why it matters: Offers ultimate flexibility for niche needs or complex tracking scenarios not covered by standard templates.

- Example 1: The Blank Grid: A simple grid with pre-labeled "Date," "Odometer Start," "Odometer End," and a large blank column for "Purpose/Notes." You fill in the rest!

- Example 2: The Sectional Template: A printable with pre-defined sections for different types of mileage (e.g., "Business," "Medical," "Charity," "Personal"), but with blank rows and columns within each section for user customization.

- Example 3: The Checklist Log: Rather than just columns, this template incorporates checkboxes for common categories (e.g., "To/From Client," "Supply Run," "Delivery") simplifying entry.

- Example 4: The "Add Your Own Column" Design: A basic log with 2-3 standard columns and several empty, labeled "Custom Field 1," "Custom Field 2" columns for user-defined data.

- Example 5: The Half-Page Quick Log: Designed to be printed two-up on a single sheet of paper, then cut in half, making it compact for glove compartments or small clipboards.

- Example 6: The "Staple & Go" Log: A collection of single-page templates (e.g., a "Daily Log," a "Monthly Summary," a "Client Notes Page") that you can print and staple together to create a custom booklet.

- Example 7: The Visual Tracker: A template that uses simple icons or color-coding suggestions to differentiate trip types at a glance, allowing for quick visual processing of your mileage data.

---

Tips for Personalizing Your Printable Mileage Log

A great log fits *your* life. Here’s how to make that generic printable mileage log truly work for you.

- Add Notes Specific to Your Work/Life: Don’t just put "business." Be specific: "Client meeting - Acme Corp (Q3 review)." This detail is your best friend during an audit.

- Incorporate Reminders: Include a small box at the bottom of each page for "Monthly Total" or "Review by [Date]" to keep you on schedule.

- Tailor the "Purpose" Field: If you know you primarily do deliveries, have a "Delivery # / App" column. If you’re a consultant, "Client Name / Project" is more useful.

- Keep It Accessible: Print it, put it on a clipboard, and keep it in your car. Out of sight, out of mind means missed deductions.

- Consider Color-Coding: While printed, you can still use highlighters to quickly distinguish personal vs. business trips, or different types of business trips.

- My Personal Preference: I find creating a new, fresh log at the start of each month (even if it's just a single page) works best for me. It feels like a clean slate and avoids overwhelming me with a massive annual log.

---

Common Pitfalls: What to AVOID When Tracking Mileage

Even with the perfect printable mileage log, there are traps to sidestep. Don't be like me and learn these the hard way!

- Don't Rely on Memory: This is the biggest mistake. Even if you swear you’ll remember that 20-mile trip, life happens. Log it immediately. Your future self (and your accountant) will thank you.

- Don't Skip the Odometer Readings: The IRS wants start and end odometer readings for each trip. Don't just estimate. It’s a core requirement for substantiating your claims.

- Don't Forget the "Purpose": Simply writing "Work" isn't enough. Be specific: "Meeting with marketing team at Starbucks," "Delivery to customer 123 Elm St." The clearer, the better.

- Don't Mix Personal and Business Records: Keep your business mileage distinct from your personal mileage. This is why having "Personal" and "Business" columns or separate logs is crucial.

- Don't Lose Your Logs! Treat your printable mileage log like cash. Store it securely. Consider scanning pages periodically and backing them up digitally.

- Don't Ignore Small Trips: Those quick runs to the post office for business mail, or a short detour to pick up supplies – they add up! Every mile counts.

- Don't Wait Until Tax Season: This is a recipe for panic and missed deductions. Adopt a "log it as you go" philosophy. A little discipline each day saves massive headaches later. Seriously, don’t let the IRS give you that side-eye because your records are a mess!

---

Ready to Roll? Your Road to Smarter Mileage Tracking Starts Now!

There you have it – your comprehensive guide to mastering the humble yet mighty printable mileage log. From the basics to specialized needs, and from essential tips to common pitfalls, you now have the knowledge to take control of your vehicle expenses.

Remember, this isn't just about avoiding trouble; it's about maximizing your hard-earned money and gaining peace of mind. So, download a template, print it out, grab a pen, and start logging those miles today. Now go make those miles work for you!