Let’s face it: money management can feel overwhelming. In a world buzzing with apps and digital solutions, sometimes the most empowering tool is a simple, tangible one. We’re talking about the humble check register – that little booklet that once lived in every checkbook. But what if you don't use checks anymore? Or what if you just need a straightforward way to track every dollar in and out, without the fancy tech? Trust me, there's immense power in a pen and paper, especially when it comes to understanding your financial flow. I once thought I could just "wing it" with my bank's online statements, only to find myself scratching my head at month-end, wondering where a chunk of cash disappeared to. That's when I rediscovered the magic of meticulous tracking, and that's exactly why free printable check registers are about to become your new best friend.

Whether you're a budgeting pro or just dipping your toes into financial tracking, a printable check register offers clarity, control, and a surprising sense of calm. It's a reliable, no-fuss way to stay on top of your transactions, reconcile your accounts, and avoid those "where did my money go?" moments. In this guide, we'll explore the best types of free printable check registers, how to use them effectively, and tips to truly make them work for *your* financial life.

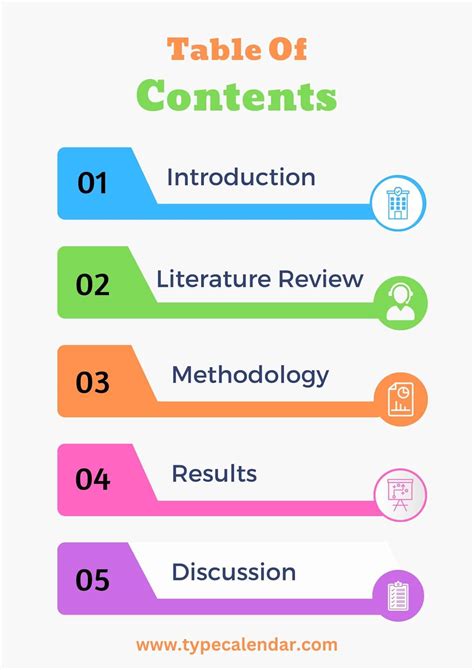

Table of Contents

- The Essential Classic: Your Go-To Basic Check Register

- Dive Deep: Comprehensive Transaction Log for Power Users

- Budgeting Bliss: Check Registers Designed for Financial Goals

- The Modern Minimalist: Streamlined Registers for Clarity

- Student & Beginner Friendly: Simple Tracking for Newbies

- Tips for Personalizing Your Check Register Experience

- Common Pitfalls: What to AVOID When Using Printable Check Registers

---

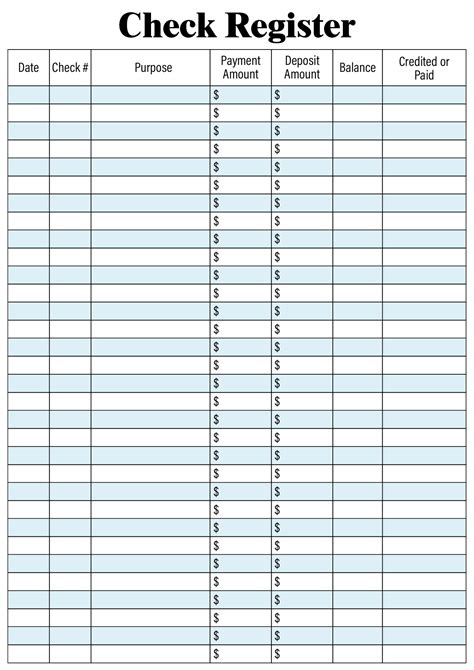

The Essential Classic: Your Go-To Basic Check Register

Sometimes, simple is best. The classic free printable check register template is designed for straightforward tracking of deposits, withdrawals, and current balances. It's the bread and butter of financial organization, perfect for anyone who needs a reliable record without overwhelming details.

- Key Features: Columns for date, transaction description, check number (if applicable), withdrawal/debit, deposit/credit, and current balance.

- Why it's a winner: Offers a clear, chronological record. Helps you catch bank errors instantly. Prevents overdrafts by showing your *true* available balance.

- Example Use Case: I still keep one of these for my main checking account. Every time I use my debit card, pay a bill online, or deposit a check, it goes straight into this register. It's my daily "financial pulse check."

- Best for: Everyday bank account management, basic expense tracking, ensuring you always know your balance before a big purchase.

- Variations to look for: Larger spacing for easier writing, extra lines for notes, larger font sizes for readability.

- Download Tip: Look for "basic check register template free download" or "standard printable check register PDF."

- Personal Insight: This is my absolute favorite type for daily use because its simplicity means I'm far more likely to stick with it consistently.

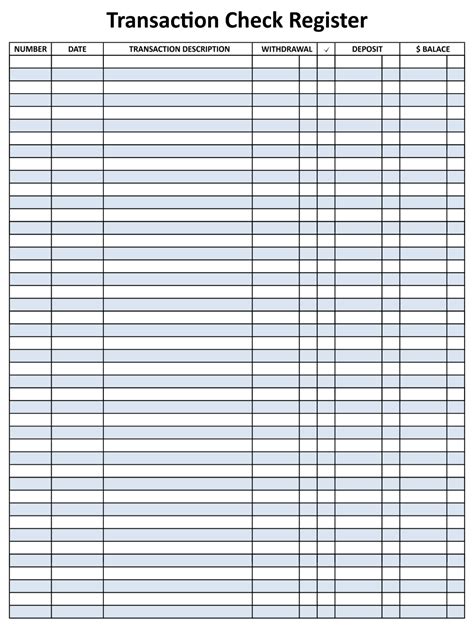

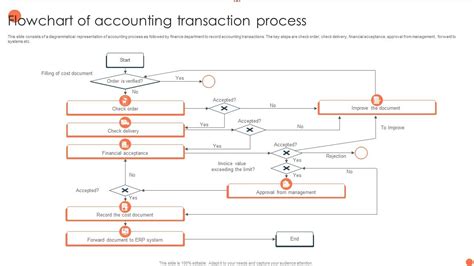

Dive Deep: Comprehensive Transaction Log for Power Users

For those who want to track more than just ins and outs, a comprehensive transaction log takes the basic check register and adds layers of detail. Think categories, reconciliation columns, and even budget allocations. This is for the person who wants to see where every penny goes.

- Key Features: All classic features, plus columns for categories (e.g., "Groceries," "Utilities," "Entertainment"), cleared/reconciled indicators, and perhaps a running total for specific budget categories.

- Why it's a winner: Provides powerful insights into spending habits. Simplifies month-end reconciliation with your bank statement. Great for small businesses or side hustles.

- Example Use Case: When I was tracking expenses for a freelance project, I used a comprehensive register to tag every expense (software, travel, supplies) to a specific project category. It made tax time a breeze!

- Best for: Detailed budgeters, small business owners, freelancers, or anyone trying to understand specific spending patterns.

- Variations to look for: Pre-defined categories, customizable category sections, columns for multiple accounts, or space for mileage tracking if applicable.

- Search Terms: "detailed printable check register," "comprehensive expense tracker PDF," "business transaction log printable."

- Advanced Tip: Use different colored highlighters for different spending categories to quickly visualize where your money is going.

Budgeting Bliss: Check Registers Designed for Financial Goals

These free printable check registers aren't just about tracking; they're about *planning* and *achieving*. They often incorporate elements of a budget, allowing you to not only log transactions but also see their impact on specific financial goals like saving for a down payment or paying off debt.

- Key Features: Dedicated columns for budget categories, running totals for each category, space to note budget limits, and perhaps sections for income goals vs. actual income.

- Why it's a winner: Turns tracking into an active budgeting tool. Helps you visualize progress towards financial goals. Makes overspending immediately obvious.

- Example Use Case: When my partner and I were saving for our first big trip, we used a register that let us earmark every deposit and withdrawal against our "Travel Fund" goal. Seeing that number grow (or shrink, if we splurged!) kept us motivated.

- Best for: Goal-oriented savers, debt-reducers, families managing household budgets, or anyone practicing envelope budgeting digitally.

- Variations to look for: Integrated budget sections, debt snowball trackers, savings goal progress bars, or templates inspired by specific budgeting methods (e.g., "zero-based budget check register").

- Relevant Keywords: "budget printable check register," "financial goal tracker PDF," "debt snowball check register template free."

The Modern Minimalist: Streamlined Registers for Clarity

For those who appreciate clean lines, ample white space, and only the absolute essentials, minimalist free printable check registers are a godsend. They cut out the clutter, focusing solely on the core information needed to track your balance effectively.

- Key Features: Often just date, description, debit, credit, and balance. No unnecessary lines, ornate fonts, or extra columns. Emphasis on clean design.

- Why it's a winner: Reduces visual noise, making tracking feel less daunting. Ideal for people who get overwhelmed by too much detail. Highly customizable if you want to add your own notes.

- Example Use Case: My friend, who despises clutter in all forms, absolutely loves these. She only tracks what's essential and finds the simplicity makes her more consistent. She adds little dots next to transactions she's reconciled.

- Best for: Minimalists, visual learners, those seeking a less intimidating tracking method, or anyone wanting a blank canvas to adapt.

- Variations to look for: Landscape or portrait orientation, various sizes (A4, A5, half-letter), dot grid or blank backgrounds for notes.

- Search Queries: "minimalist check register printable," "simple transaction log PDF," "clean design check register template."

Student & Beginner Friendly: Simple Tracking for Newbies

Starting out with money management can be intimidating. These free printable check registers are designed with the beginner in mind, featuring clear instructions, large print, and simplified layouts to ease new users into the habit of tracking finances.

- Key Features: User-friendly instructions printed on the template, extra large columns, simplified terms (e.g., "money in" instead of "deposit"), and often a "how-to" guide included with the download.

- Why it's a winner: Removes the jargon and complexity, making financial tracking accessible. Builds confidence in managing money independently.

- Example Use Case: I started my nephew on one of these when he got his first bank account. We practiced together, and the large spaces made it easy for him to write neatly and focus on one transaction at a time. It helped him avoid a classic mistake: thinking his ATM balance was his *actual* balance!

- Best for: Students, young adults, anyone new to banking, or those who prefer a highly guided approach.

- Variations to look for: Illustrated examples, short financial tips, "why track?" explanations, or templates with fun designs to encourage engagement.

- Keywords: "easy printable check register for beginners," "student bank account tracker free," "how to use a check register printable."

---

Tips for Personalizing Your Check Register Experience

A printable check register is a powerful tool, but it's even more effective when you make it your own.

1. Choose the Right Fit, Not Just Any Fit: Don't just pick the first template you see. Consider your daily habits, how much detail you *actually* want to track, and your comfort level with numbers. If you only use debit cards, you probably don't need a "check number" column.

2. Consistency is King: The best register in the world won't help if you don't use it. Make it a habit: log every transaction as soon as it happens, or set aside 5 minutes at the end of each day. Trust me, finding a missing transaction from two weeks ago is a headache you don't need.

3. Color-Code for Clarity: Use different colored pens or highlighters for deposits vs. withdrawals, or for different spending categories. It makes visual reconciliation much faster.

4. Reconcile Regularly: Compare your register to your bank statement at least once a week, if not daily. This helps catch errors, spot fraud, and ensure your numbers are always accurate.

5. Don't Be Afraid to Get Creative: Add a small column for emotional notes (e.g., "needed this treat!"). Or, if you're tracking towards a specific goal, draw a little progress bar at the bottom of each page.

6. My Personal Preference: I find that printing a few pages and keeping them in a small binder with my pen makes me far more likely to grab it and log a transaction immediately. Out of sight, out of mind for me!

Common Pitfalls: What to AVOID When Using Printable Check Registers

Even with a simple tool, there are traps to avoid. Don't be like me and make these mistakes:

- Forgetting to Log Immediately: The biggest culprit! You make a purchase, tell yourself you'll write it down later, and then *poof* – it's gone from memory. This leads to discrepancies and frustration. Just log it, even if it's a quick note in your phone to transfer later.

- Ignoring Small Transactions: "$2 for coffee won't hurt," you think. But a dozen $2 coffees add up! Every single transaction, no matter how small, needs to be recorded for an accurate balance. This is how the "where did my money go?" mystery usually starts.

- Not Reconciling with Your Bank: Your register is your record, but your bank's record is the official one. If they don't match, you're flying blind. Don't fall into the trap of thinking your balance is correct just because *you* wrote it down.

- Using Outdated Templates: Ensure the template you download is current and relevant to your needs. If you start writing checks, you'll want a "check number" column. If you only use debit, you might prefer a template without it.

- Getting Overwhelmed by Detail: While a comprehensive register is great for some, if you find yourself bogged down by too many columns or categories, switch to a simpler version. The goal is clarity, not complexity.

---

Take Control, One Transaction at a Time

There's a unique satisfaction in seeing your financial picture laid out clearly, right there on paper. Free printable check registers aren't just relics of the past; they're timeless tools for financial empowerment, offering a tangible connection to your money that digital apps sometimes can't replicate. Whether you're tracking daily spending, working towards a big savings goal, or just want to ensure you're never surprised by your bank balance, there's a perfect printable template out there for you. So, download your favorite, grab a pen, and take control of your cash flow. You've got this!