Let's face it: the idea of saving money often feels less like an exciting adventure and more like climbing Mount Everest in flip-flops. It can be daunting, overwhelming, and frankly, a bit boring sometimes. But what if I told you there’s a secret weapon that turns that financial mountain into a series of fun, achievable steps? Enter the saving challenge printable. I remember years ago, feeling stuck in a cycle of paycheck-to-paycheck living, until a friend introduced me to a simple printable challenge. It literally changed how I viewed saving, transforming it from a chore into a game I actually wanted to win!

This isn't just about stashing away cash; it's about building consistent habits, celebrating small victories, and finally taking control of your financial future. Whether you dream of a lavish vacation, a down payment on a house, or just building a solid emergency fund, a well-designed saving challenge printable can be your most powerful ally. In this guide, we'll dive deep into different types of challenges, arm you with practical tips, and help you find the perfect printable to kickstart your savings journey. Get ready to make saving fun, tangible, and totally achievable.

Discover Your Perfect Saving Challenge Printable: Categories to Get You Started

Not all saving challenges are created equal, and that's a good thing! Different goals and personalities call for different approaches. Here are some of the most popular and effective categories of saving challenge printables designed to help you reach your financial milestones, no matter your starting point.

### 1. The Classic & Consistent: Weekly & Bi-Weekly Challenges

These are the bread and butter of saving challenges, perfect for establishing a steady rhythm. They typically involve saving a fixed or incrementally increasing amount each week or bi-week.

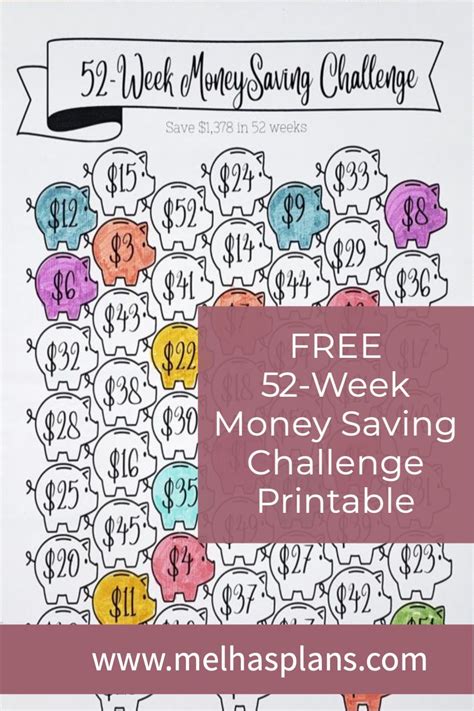

- The 52-Week Challenge: Save $1 in week 1, $2 in week 2, all the way up to $52 in week 52. By the end of the year, you’ll have saved a tidy sum! This is often the first saving challenge printable many people try.

- Reverse 52-Week Challenge: For those who find it easier to save more at the beginning of the year, start with $52 in week 1 and go down to $1. I used this version once when I got a bonus early in the year, and it felt so much easier to front-load the big savings!

- The Bi-Weekly Challenge: Similar to the weekly but with larger sums every two weeks, great if you get paid bi-weekly.

- Fixed Weekly Amount: Choose a comfortable amount, say $25, and save it every single week. Simple, consistent, effective.

- The "Pay Yourself First" Printable: A tracker for automatically transferring a set amount to savings each payday. It’s a classic for a reason.

### 2. Goal-Specific & Big Dreams: Target Savings Challenges

When you have a clear financial target in mind – a new car, a vacation, a down payment – these challenges provide a visual roadmap to get there.

- Vacation Fund Printable: A visual tracker with suitcases, planes, or landmarks, where you color in a section for every $50 or $100 saved towards your trip.

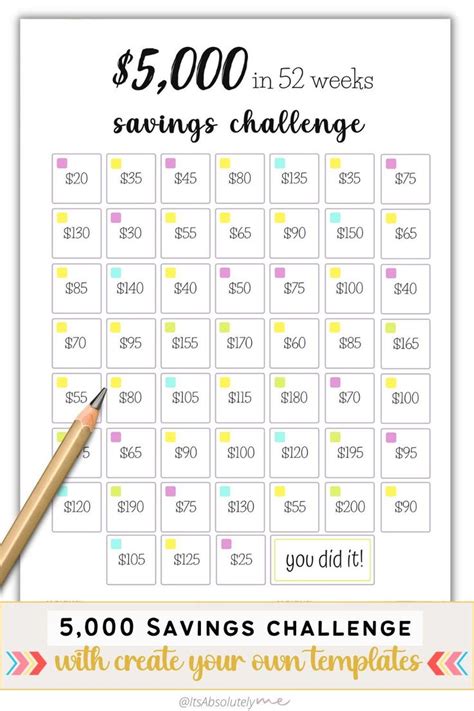

- Emergency Fund Builder: A printable specifically designed to help you save your first $1,000 or $5,000 for unexpected expenses. Each square might represent a $50 deposit.

- Down Payment Dynamo: For bigger goals like a house or a significant investment, break it down into smaller, manageable chunks on a printable. I've seen friends use these to save for everything from a new motorcycle to a significant home renovation!

- Holiday Savings Challenge: Start saving early for gifts, decorations, and festive meals to avoid end-of-year stress. A printable with ornaments or gift boxes works wonders.

- New Gadget Fund: Save up for that new phone, console, or computer by tracking small, consistent contributions.

### 3. Flexible & Fun: Creative & Low-Pressure Challenges

Sometimes, you need a challenge that adapts to your life, not the other way around. These are perfect for those who like a bit of spontaneity or struggle with rigid budgets.

- No-Spend Month Tracker: A printable to track days you don't spend money on non-essentials. Every "no-spend" day could unlock a small transfer to savings.

- The Penny Challenge: Save one penny on day one, two on day two, and so on. It sounds tiny, but it adds up surprisingly fast! This is my favorite for introducing kids to saving.

- Change Jar Challenge: A printable to track how much you're collecting from loose change. Simple, yet satisfying.

- Weather-Based Savings: Save an amount based on the temperature (e.g., $1 for every degree above 70°F) or weather conditions (e.g., $5 on a rainy day). It keeps things interesting!

- The "Found Money" Tracker: Every time you find money (in a pocket, on the street), get an unexpected refund, or sell something, track it on this printable and immediately transfer it to savings.

### 4. High-Impact & Accelerated: Advanced Saving Strategies

For the financially ambitious or those needing to save a larger sum in a shorter timeframe, these challenges push you to save more aggressively.

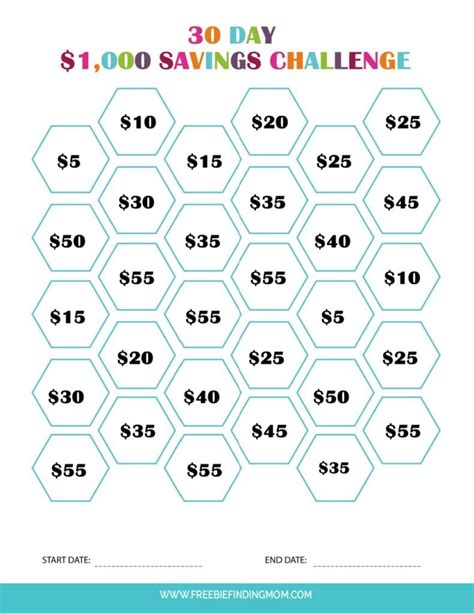

- The $X in 30 Days Challenge: A printable with 30 squares, each representing a varying amount (e.g., from $5 to $100) to save each day. Sums vary to keep it engaging.

- Income Percentage Challenge: A printable to track saving a certain percentage of every paycheck (e.g., 10%, 20%). Veterans can use this strategy to maximize results quickly.

- Debt Snowball/Avalanche Tracker: While not strictly "saving," these printables help visualize debt repayment, freeing up more money for true savings once debts are clear. It's a critical step towards financial freedom.

- The Bill Buster Challenge: Identify one recurring bill you can reduce or eliminate (e.g., unused subscriptions), then track and save the freed-up money on a printable.

- The "Side Hustle" Savings Tracker: If you pick up extra work, use a printable to ensure every penny from that side income goes straight into a dedicated savings goal.

### 5. Shared Goals & Teamwork: Couple & Family Saving Challenges

Saving can be a powerful bonding experience. These printables are designed to get everyone on board and working towards a common financial objective.

- Couple's Dream Fund: A joint printable where both partners track their contributions towards a shared goal, like a dream honeymoon or a new home.

- Family Activity Jar Challenge: Kids contribute their allowance or chore money, and parents match it, all tracked on a printable, for a family outing or vacation. I once used a similar system with my family, and it taught my kids valuable lessons about contributing and delayed gratification.

- "No Eating Out" Challenge for Two: A printable to track meals cooked at home, with the money saved from not dining out going into a shared fund.

- Household Expense Reduction Tracker: A printable where family members track efforts to reduce utility bills or grocery spending, with the savings redirected to a shared goal.

- Debt Payoff Together: If a couple has shared debt, a printable can visualize their joint progress in eliminating it, freeing up more for future savings.

Tips for Personalizing Your Saving Challenge Printable

A generic printable can work, but a personalized one? That's where the magic happens. Making it your own significantly boosts motivation and adherence.

- Identify Your "Why": Before you even download a saving challenge printable, get crystal clear on *why* you're saving. Is it for a trip? Debt freedom? A new gadget? Write it clearly on your printable.

- Break Down Big Goals: If you're saving for something massive, break it into smaller, more manageable chunks. Instead of "Save $10,000," think "$1,000 for flight, $2,000 for accommodation," etc.

- Choose a Visually Appealing Printable: Pick a design that resonates with you. If you're saving for a vacation, find one with palm trees. If it's a house, one with a cozy home illustration. Visual cues are powerful motivators.

- Set Realistic Amounts: Don't start with a challenge that asks you to save more than you can comfortably afford. It's better to start small and consistent than to aim too high and get discouraged. I find this approach works best for those just starting out.

- Incorporate Rewards (Non-Monetary): Plan small, non-monetary rewards for hitting milestones. A movie night, a long bath, or an hour of guilt-free reading. Celebrate your progress!

- Display It Prominently: Don't hide your saving challenge printable! Put it on your fridge, your desk, or your bedroom wall. Seeing it daily keeps your goal top of mind.

- Track Your Progress: This is the core of the printable. Color in, cross off, or add stickers every time you make a deposit. Seeing your progress visually is incredibly satisfying.

Common Pitfalls: What to AVOID When Starting a Saving Challenge

Even with the best intentions and the perfect saving challenge printable, roadblocks can appear. Steering clear of these common mistakes will help you stay on track and reach your goals.

- Being Overly Ambitious (and Burning Out): Don't commit to saving an amount that stretches your budget to the breaking point from day one. This leads to frustration and quitting. Start small, build momentum, and then scale up. Don't be like me and think you can save 50% of your income overnight – it usually ends in pizza and regret!

- Forgetting Your "Why": Life gets busy, and it's easy to lose sight of *why* you started saving. Regularly remind yourself of your end goal and the benefits it will bring.

- Not Automating Your Savings: Relying purely on willpower is a recipe for disaster. Set up automatic transfers to your savings account on payday. This "set it and forget it" method is a game-changer.

- Skipping Weeks (Without a Plan): It's okay if you miss a week or can't contribute the full amount sometimes. The pitfall is letting that derail your entire challenge. Have a plan for catching up or adjusting. Acknowledge it, adjust, and move on.

- Not Celebrating Small Wins: Only focusing on the big, distant goal can be demotivating. Celebrate every time you fill a square, hit a small milestone, or reach a quarter of your goal.

- Comparing Your Progress to Others: Everyone's financial situation is different. Your journey is unique. Focus on your own progress and celebrate your own victories, without comparing your pace to someone else's.

- Ignoring Unexpected Expenses: Life happens. Instead of getting discouraged by an unexpected car repair or medical bill, view your emergency fund as a safeguard, not a setback. Just get back on track with your printable once the immediate crisis is handled.

Ready, Set, Save!

There you have it – your comprehensive guide to unlocking the power of the saving challenge printable. It’s more than just a piece of paper; it’s a tangible representation of your commitment to financial well-being, a visual tracker of your progress, and a constant source of motivation. Whether you're a beginner taking your first step or a seasoned saver looking for a fresh spark, there's a printable challenge out there waiting for you.

So, pick your challenge, find that perfect printable, and start coloring in those squares. You'll be amazed at how quickly those small, consistent actions add up to incredible results. Now go forth and conquer your cash goals – you've got this!