Losing a parent is, without a doubt, one of life's most profound challenges. The weight of grief can feel crushing, making even the simplest tasks seem insurmountable. Yet, amidst the sorrow, there's often a daunting list of practical responsibilities that need attention, and knowing where to start can feel impossible. I remember the dizzying overwhelm when my own parent passed away, wishing someone had simply handed me a clear, step-by-step guide – a printable checklist after death of a parent – to help me navigate the unexpected administrative maze.

You’re not alone in feeling this way. This article is designed to be that compassionate hand, offering a clear, actionable guide to help you manage the necessary affairs while giving yourself space to grieve. We’ll break down the often-complex process into manageable steps, ensuring you feel supported and informed every step of the way.

The Immediate Aftermath: First Steps in a Time of Grief

In the immediate hours and days following a parent's passing, your priority is often the emotional processing of your loss. However, a few critical steps require prompt attention. Taking these on early can prevent future headaches and provide a sense of control amidst chaos.

- Confirm the Passing & Get a Pronouncement: If your parent passed away at home, this is crucial. Contact their physician, hospice nurse, or 911 (for unexpected deaths) to have a medical professional officially pronounce their death.

- Notify Close Family & Friends: Share the news with immediate family members and close friends. You can designate someone to help spread the word to a wider circle.

- Arrange Transportation of the Deceased: If death occurred at home, you’ll need to contact a funeral home or cremation service. They will typically handle the transportation of the body.

- Locate Important Documents (If Possible): This isn't always feasible in the immediate moments, but if you know where the will, trust documents, or burial instructions are, it helps. Even a quick search for a "red folder" or "important papers" could be beneficial.

- Begin Gathering Information for the Death Certificate: The funeral home will need details like your parent’s full name, date of birth, Social Security number, place of birth, parents' names, and veteran status.

- Consider Initial Funeral Home Arrangements: You don’t need to make all decisions immediately, but reaching out to a funeral home or cremation service can help you understand options and timelines.

- Prioritize Self-Care: This is paramount. Eat, drink water, rest, and allow yourself to feel. Delegate tasks when possible. I remember feeling immense guilt for needing to rest, but it was essential for staying grounded through the following weeks.

Navigating Legal & Official Documentation

This phase often involves obtaining the official proof of death and understanding its implications. This foundational step is essential for almost every subsequent task. Handling these correctly early on will streamline the entire "after death of parent checklist" process.

- Obtain Multiple Certified Copies of the Death Certificate: You will need many copies (10-15 is a good starting point) for banks, insurance companies, government agencies, etc. The funeral home can order these for you.

- Locate the Will or Trust Documents: If a will or trust exists, this document outlines your parent's wishes for their assets and designates an executor or trustee. If you're unsure how to find these, reach out to their estate attorney if they had one.

- Identify the Executor/Personal Representative: The will names the executor, the person legally responsible for settling the estate. If there's no will, the court will appoint an administrator.

- Understand Probate (If Applicable): Probate is the legal process of validating the will, paying debts, and distributing assets. Not all estates go through probate, especially if there's a well-funded trust or joint ownership of assets.

- Consult with an Estate Attorney: Even if the estate seems simple, a brief consultation can clarify your obligations and ensure you don’t miss crucial steps. They can help you understand the nuances of the "legal steps after death."

- Notify Social Security Administration (SSA): The funeral home usually does this, but it’s good to confirm. If your parent was receiving benefits, the SSA needs to be informed.

- Notify Veterans Affairs (VA) if Applicable: If your parent was a veteran, the VA might offer burial benefits, headstones, and other support.

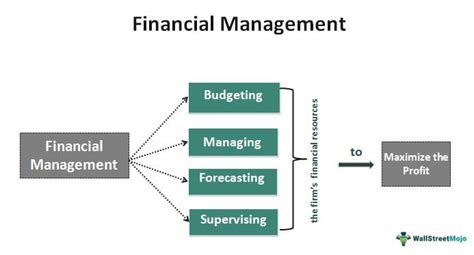

Managing Financial & Estate Matters

This is where the financial complexities come into play, dealing with bank accounts, investments, and any outstanding debts. This part of your printable checklist after death of parent can feel overwhelming, but tackling it systematically helps.

- Gather Financial Statements: Collect bank statements, investment accounts (stocks, bonds, mutual funds), retirement accounts (401k, IRA), and pension statements.

- Contact Banks and Financial Institutions: Inform them of your parent's death. They will typically freeze accounts until an executor or legal representative is established. Understand their specific requirements for access or closure.

- Identify All Assets: This includes real estate, vehicles, personal property (jewelry, art), and any other valuable possessions.

- Review Debts and Liabilities: Look for credit card statements, loan documents (mortgage, car loans), medical bills, and utility bills. Estate funds typically pay these.

- Locate Life Insurance Policies: If your parent had life insurance, contact the company to begin the claim process. This often provides crucial funds for immediate expenses.

- Assess Estate Value: Get a general idea of the total assets vs. liabilities. This will help determine if the estate is solvent and if taxes might be owed.

- File Final Income Tax Returns: You or the executor will need to file final federal and state income tax returns for your parent for the year of their death.

- Consider Professional Financial Advice: A financial advisor specializing in estates can offer invaluable guidance, especially for larger or more complex estates.

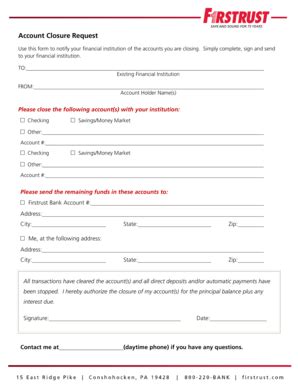

Notifying Institutions & Closing Accounts

Once the core legal and financial foundations are laid, you'll need to systematically inform various organizations and cancel services to prevent ongoing charges or identity theft.

- Notify Employers/Former Employers: Inform any current or former employers, especially if there are outstanding wages, benefits, or pension plans.

- Cancel Subscriptions and Memberships: Think broadly: Netflix, gym memberships, newspapers, magazines, professional organizations, clubs. This can prevent unnecessary billing.

- Forward Mail: Set up mail forwarding with the postal service to the executor's address to catch any lingering bills or important notices.

- Close or Transfer Utility Accounts: Electricity, gas, water, internet, phone, cable, etc. Ensure these are either closed or transferred to a new account holder if someone still lives in the home.

- Update Vehicle Registrations and Titles: If your parent owned vehicles, you'll need to transfer titles or sell them according to the will or state law.

- Cancel Social Media Accounts and Online Profiles: This is a sensitive but important step to protect their digital legacy and prevent identity misuse. Many platforms have a process for this upon proof of death.

- Notify Doctors and Healthcare Providers: Inform their primary care physician, specialists, and any hospitals or clinics to close their medical records.

Caring for Your Well-being & Shared Memories

Amidst all the administrative tasks, it’s critical to remember your own emotional and mental health. This part of the checklist focuses on personal well-being and preserving the memory of your parent.

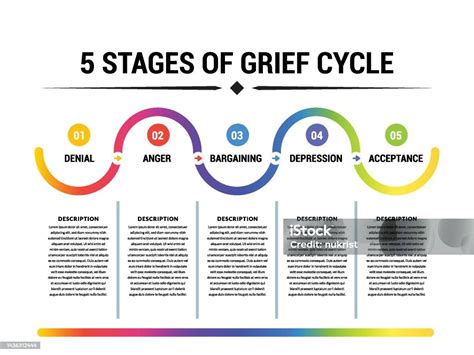

- Allow Yourself to Grieve: There's no right or wrong way to grieve. Give yourself permission to feel all emotions without judgment. I personally found that setting aside specific "grief time" helped, rather than letting it overwhelm all my waking hours.

- Seek Grief Support: Consider attending a grief support group, talking to a counselor, or seeking therapy. Many hospices offer free grief counseling.

- Plan a Memorial or Celebration of Life: Whether a formal funeral or a quiet gathering, creating a space to honor your parent can be incredibly healing. Don't feel pressured to rush this; do it when it feels right.

- Organize Personal Belongings: This can be a gradual process. Decide what to keep, donate, sell, or discard. It’s okay to take your time with sentimental items.

- Create a Memory Box or Scrapbook: Gather photos, letters, and small trinkets to create a tangible collection of memories. This subjective process can be deeply therapeutic.

- Lean on Your Support System: Friends, family, and community can offer immense comfort and practical help. Don’t hesitate to ask for what you need.

- Practice Self-Compassion: Be patient and kind to yourself. You are navigating an incredibly difficult period, and every step, no matter how small, is progress.

Long-Term Loose Ends & Legacy

Some tasks aren't urgent but are important for the long-term management of the estate or legacy. This section looks beyond the immediate post-loss period.

- Monitor Credit Reports: Keep an eye on your parent's credit report for several months to a year after their death to guard against identity theft.

- Distribute Assets as Per the Will: Once all debts are paid and taxes filed, the executor will distribute the remaining assets to the beneficiaries.

- Close the Estate: Once all assets are distributed and all final tax obligations are met, the executor can formally close the estate with the probate court (if applicable).

- Preserve Family History: Consider documenting stories, creating a family tree, or digitizing old photos to ensure your parent's story lives on.

- Review Your Own Estate Plan: Your parent's passing can be a strong reminder to review or create your own will, powers of attorney, and healthcare directives.

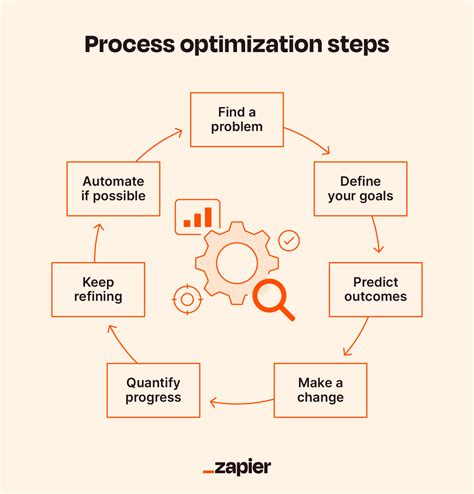

Tips for Personalizing Your Approach to Post-Loss Tasks

Every loss is unique, and so is the path through it. Here are some tips to help you tailor this process to your specific needs and emotional state:

- Break It Down: Don't look at the entire checklist at once. Focus on one category, or even one task, at a time. Checking off even small items can provide a sense of accomplishment.

- Delegate When Possible: You don't have to do everything yourself. Ask trusted family members or friends for help with specific tasks. My favorite approach, and what I found worked best for my family, was assigning tasks based on individual strengths – one person handled legal, another finances, another personal effects.

- Create a Dedicated "Death Admin" Folder: Keep all documents (death certificates, bills, correspondence) in one organized place. This will save you countless hours of searching.

- Set Realistic Expectations: This process takes time, often months or even a year or more, especially for complex estates. Don't pressure yourself to finish everything quickly.

- Don't Be Afraid to Ask Questions: Whether it's to an attorney, a funeral director, a bank representative, or a family member, clarify anything you don't understand.

Common Pitfalls: What to AVOID When Managing Affairs After a Parent's Passing

Navigating the administrative side of loss can be tricky. Being aware of potential missteps can save you stress, time, and money.

- Rushing Decisions: Avoid making major financial or emotional decisions in the immediate aftermath of the death. Grief can cloud judgment.

- Ignoring Legal Advice: Even if you think the estate is simple, a brief consultation with an estate attorney is almost always a good idea. Trying to navigate complex legalities alone can lead to costly errors.

- Neglecting Your Own Well-being: It’s easy to get caught up in the tasks, but burnout is real. Prioritize rest, nourishment, and emotional processing. Don’t be like me and try to power through without breaks; you'll hit a wall.

- Sharing Information Publicly Too Soon: Be careful about sharing sensitive financial details or funeral arrangements on social media before all necessary precautions are taken.

- Assuming All Assets Are Inherited Equally: The will or trust dictates asset distribution, not necessarily equal division among all heirs.

- Missing Deadlines: Some tasks, like filing tax returns or challenging a will, have strict deadlines. Be aware of these to avoid penalties or loss of rights.

- Paying Debts Before Understanding the Estate: The executor should not pay debts out of their own pocket without a clear understanding of the estate's assets and liabilities. The estate itself is responsible for debts.

A Compassionate Path Forward

Navigating the responsibilities after a parent’s death is a marathon, not a sprint. Remember that this printable checklist after death of a parent is a guide, not a rigid set of rules. Allow yourself grace, seek support, and take things one step at a time. You are doing important work, both for your parent's legacy and for your own healing. Now, take a deep breath, and know that you've got this.