Do you ever feel a little lost in the digital shuffle of your finances? Bank apps, online statements, automatic payments – they’re undeniably convenient, but sometimes, they can make money feel… ethereal. It’s hard to get a tangible grip on where every penny goes when it’s just numbers on a screen. If you’ve ever wished for a simpler, more hands-on way to track your money, to truly see your financial flow, then you’re in the right place.

I remember a time, not so long ago, when my bank account felt like a black box. Money went in, money went out, and I had a vague idea of my balance, but no real understanding of the ebb and flow. I tried budgeting apps, spreadsheets, everything. But it wasn't until I stumbled upon the humble printable bank ledger that something clicked. The act of physically writing down each transaction, seeing the numbers in my own handwriting, transformed my relationship with money. It wasn't just about tracking; it was about understanding, about taking control. This guide is born from that personal journey, from the relief and clarity I found, and it's here to help you experience that same financial peace.

A printable bank ledger isn't just a relic of the past; it's a powerful tool for the present, perfectly blending simplicity with profound financial insight. It offers a tangible record, a sense of control, and a level of privacy that digital tools sometimes can't match. Whether you're a budgeting novice overwhelmed by financial jargon or a seasoned money manager seeking a robust backup, this comprehensive guide will walk you through everything you need to know. We’ll dive deep into its benefits, explore various types, share practical tips, and even unearth advanced strategies to make your ledger an indispensable part of your financial toolkit. Get ready to transform your financial understanding, one entry at a time.

---

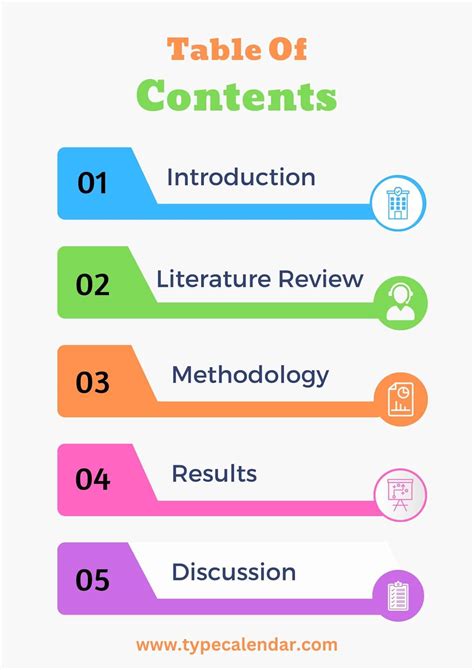

Table of Contents

- [The "Why" Behind the Ledger: Rediscovering Financial Clarity](#the-why-behind-the-ledger-rediscovering-financial-clarity)

- [Anatomy of a Printable Ledger: Understanding the Essentials](#anatomy-of-a-printable-ledger-understanding-the-essentials)

- [Finding Your Perfect Match: Types of Printable Bank Ledgers](#finding-your-perfect-match-types-of-printable-bank-ledgers)

- [Beyond the Basics: Customizing Your Ledger for Personal Zen](#beyond-the-basics-customizing-your-ledger-for-personal-zen)

- [Seamless Integration: Using Your Ledger with Digital Tools](#seamless-integration-using-your-ledger-with-digital-tools)

- [Ledger Wisdom: Common Pitfalls & How to Avoid Them](#ledger-wisdom-common-pitfalls--how-to-avoid-them)

- [The Ledger Lifestyle: Advanced Strategies for Financial Mastery](#the-ledger-lifestyle-advanced-strategies-for-financial-mastery)

- [Security & Privacy: Protecting Your Financial Information (Even on Paper)](#security--privacy-protecting-your-financial-information-even-on-paper)

- [The Future is Tangible: Why Physical Ledgers Endure](#the-future-is-tangible-why-physical-ledgers-endure)

- [Your Toolkit: Where to Find and Print Your Ideal Ledger Template](#your-toolkit-where-to-find-and-print-your-ideal-ledger-template)

- [How to Choose the Best Printable Bank Ledger for Your Needs](#how-to-choose-the-best-printable-bank-ledger-for-your-needs)

- [Common Pitfalls to Avoid When Using Your Printable Bank Ledger](#common-pitfalls-to-avoid-when-using-your-printable-bank-ledger)

- [Advanced Tips for Experts: Elevating Your Printable Bank Ledger Game](#advanced-tips-for-experts-elevating-your-printable-bank-ledger-game)

- [Conclusion](#conclusion)

---

The "Why" Behind the Ledger: Rediscovering Financial Clarity

In a world obsessed with digital solutions, the idea of a printable bank ledger might seem old-fashioned. But trust me, there's a profound "why" behind its enduring relevance. It's not just about tracking numbers; it's about fostering a deeper connection with your money, gaining unparalleled clarity, and truly understanding your financial narrative. Many of us feel a sense of detachment from our money, often because it exists only as abstract figures on a screen. A physical ledger changes that.

1. Tangible Connection and Mindfulness: When you physically write down each transaction, you engage a different part of your brain. It forces you to pause, to acknowledge the exchange, and to be mindful of your spending. This tactile interaction creates a stronger memory imprint than simply swiping a card or glancing at an app. It's a form of financial meditation, if you will.

2. Unbeatable Visual Overview: A ledger provides an immediate, uncluttered visual of your financial activity. You can quickly scan through a page and spot trends, identify recurring expenses, or notice where your money is truly going. It's like having a personalized financial map laid out right in front of you, without distractions from ads or notifications.

3. Enhanced Budgeting Awareness: By tracking every debit and credit, you become intimately aware of your spending habits. This granular insight is invaluable for budgeting. You'll naturally start questioning purchases, not out of deprivation, but out of a clear understanding of their impact on your overall balance. It brings the "aha!" moments that digital reports often miss.

4. Security and Backup: In an age of cyber threats and power outages, a physical ledger offers an unhackable, always-accessible backup of your financial transactions. Imagine your bank's website is down, or your phone dies – your paper ledger remains steadfast, a reliable source of truth. I once lost access to my online banking for a day due to a system error, and having my ledger to reference was a huge relief for peace of mind.

5. Simplicity and Accessibility: No internet connection needed, no battery to charge, no complex software to learn. A pen and a printable bank ledger are all you require. This simplicity makes it incredibly accessible for everyone, regardless of tech savviness, and ensures you can track your finances anywhere, anytime.

6. Empowerment and Control: Taking charge of your financial tracking manually fosters a sense of empowerment. It puts you firmly in the driver's seat, rather than feeling like a passive observer of your bank statements. This active participation builds financial confidence and a feeling of genuine control over your money.

7. Identifying Discrepancies: Reconciling your ledger with your bank statement becomes a straightforward exercise. It’s much easier to spot a missing transaction or an incorrect charge when you have your own meticulous record to compare against. This vigilance can save you money and prevent fraudulent activity from slipping by unnoticed.

8. Historical Record Keeping: A physical ledger creates a beautiful, tangible history of your financial journey. Years down the line, you can look back and see how your spending habits evolved, how you achieved savings goals, or even trace the financial story of significant life events. It's a personal financial archive.

9. Reduced Screen Time: For those of us constantly glued to screens, a printable bank ledger offers a welcome break. It encourages a moment of quiet reflection, away from the blue light and digital distractions, which can be surprisingly refreshing for your mental well-being.

10. Aids in Debt Reduction: When you clearly see your expenses and income laid out, it becomes easier to identify areas where you can cut back to accelerate debt repayment. The ledger doesn't just show you "how much"; it shows you "where," which is critical for making targeted changes.

11. Teaches Financial Discipline: The consistent habit of updating your ledger instills financial discipline. It's a small, regular action that compounds over time, building a robust foundation for good money management habits. It's like a daily financial workout.

12. Perfect for Cash-Based Transactions: While bank statements track card transactions, a ledger is ideal for meticulously tracking cash inflows and outflows, ensuring every penny is accounted for, whether it touches a bank account or not.

Anatomy of a Printable Ledger: Understanding the Essentials

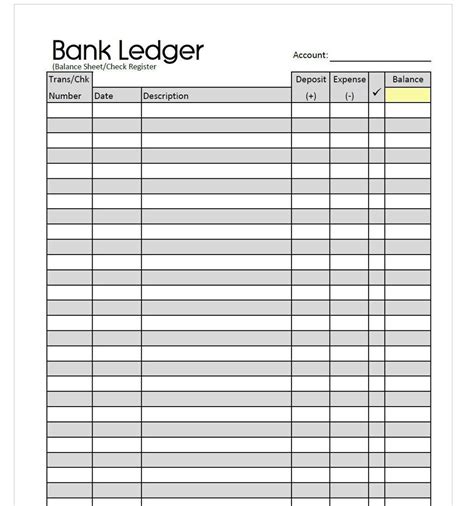

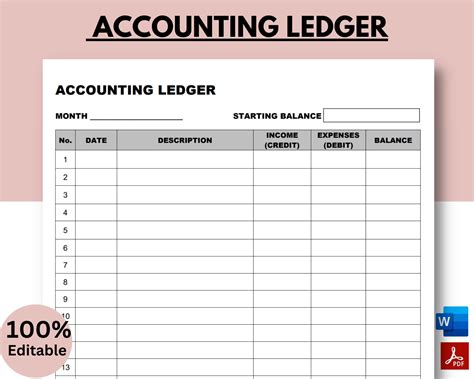

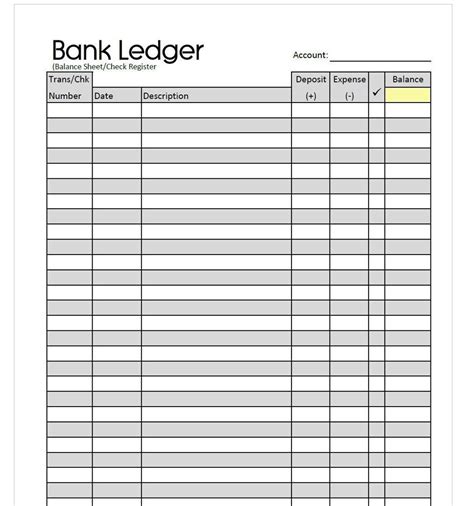

A printable bank ledger, at its core, is a simple yet powerful spreadsheet designed to track your financial transactions. While different templates might offer variations, the foundational elements remain consistent, providing a clear and organized record of your money's journey. Understanding these key components is the first step to mastering your ledger.

1. Date Column: This is perhaps the most critical column. It records the exact date (month, day, year) when a transaction occurred. Precision here is key for accurate reconciliation with your bank statement later.

2. Description/Payee Column: This is where you note what the transaction was for, or who it was with. Was it groceries from "SuperMart"? A bill paid to "Electric Co."? Or a deposit from "Salary"? Clear, concise descriptions are vital for remembering the purpose of each entry. *For instance, I once just wrote "Coffee" and then spent five minutes trying to remember which coffee shop it was from when reconciling! Now, I'm specific: "Starbucks - latte."*

3. Transaction Type/Ref. No. Column: Some ledgers include a column for the type of transaction (e.g., "Deposit," "Withdrawal," "Check," "Debit Card," "Transfer") or a reference number (like a check number or transaction ID). This helps categorize and easily cross-reference entries with your bank statement.

4. Debit/Withdrawal Column: This column is for money leaving your account. Every expense, bill payment, ATM withdrawal, or purchase made with your debit card goes here. It’s where you see your money "going out."

5. Credit/Deposit Column: This column is for money coming into your account. Your paycheck, refunds, interest earned, or any other inflow of funds are recorded here. This is where you see your money "coming in."

6. Balance Column: This is the heart of your ledger. After each transaction, you calculate your running balance. If it's a deposit, you add it to the previous balance; if it's a withdrawal, you subtract it. This column gives you an immediate, real-time snapshot of how much money you have available. *My personal rule: never go to bed without updating the balance. It saved me from an overdraft fee once!*

7. Check Mark/Reconcile Column: Often a small box or column, this is used during reconciliation. Once an entry on your ledger matches an entry on your bank statement, you place a checkmark here. This visually confirms that the transaction has cleared and is accounted for.

8. Memo/Notes Column: A versatile column for any additional information you might want to include. This could be a specific budget category, a reminder, or details about a split payment. It's your space for context.

9. Starting Balance: At the top of your ledger, or on a new page, you'll record your initial balance. This is the amount of money you have in your account before you start tracking new transactions.

10. Column Headings: Clear, concise headings at the top of each column (Date, Description, Debit, Credit, Balance, etc.) are essential for readability and ease of use.

11. Page/Sheet Numbers: For multi-page ledgers, numbering your pages helps keep everything organized and ensures you can easily find specific periods of activity.

12. Instructions/Legend: Some more comprehensive printable bank ledger templates might include a small section for instructions on how to use them or a legend for specific codes or symbols, which is particularly helpful for beginners.

Finding Your Perfect Match: Types of Printable Bank Ledgers

Just like there isn't a one-size-fits-all shoe, there isn't a single "perfect" printable bank ledger for everyone. The beauty lies in the variety, allowing you to choose a template that perfectly aligns with your financial habits, preferences, and goals. From minimalist designs to comprehensive tracking systems, let's explore the diverse world of ledger types.

1. The Basic/Standard Ledger: This is your no-frills, classic ledger. It typically includes columns for Date, Description, Debit, Credit, and Balance. It's incredibly straightforward, easy to understand, and perfect for those who want a simple, uncluttered overview of their transactions without too many details. *This was my starting point, and I still appreciate its simplicity when I'm just looking for a quick check-in.*

2. Detailed Check Register: Designed specifically for those who still write checks regularly, this ledger often includes additional columns for Check Number, Payee, and sometimes even a column for the date the check was cleared. It's essentially a specialized bank ledger focused on check management.

3. Budgeting Ledger with Categories: For users who want to integrate budgeting directly into their tracking, these ledgers include an extra column for "Category." After each expense, you assign it a category (e.g., "Groceries," "Utilities," "Entertainment"). This helps you see at a glance where your money is going in relation to your budget limits.

4. Cash Flow Ledger: While all ledgers track cash flow, some are specifically designed to highlight it. They might separate income and expenses more prominently, or even include columns for "Net Cash Flow" for a given period, making it easier to see if you're spending more than you earn.

5. Multi-Account Ledger: If you manage multiple bank accounts (checking, savings, credit cards), a multi-account ledger allows you to track them all within one system. Each page or section might be dedicated to a different account, or there might be an "Account" column to specify which account each transaction belongs to.

6. Minimalist Ledger: For the aesthetically inclined and those who prefer extreme simplicity, minimalist ledgers reduce clutter to the absolute bare essentials. They often have clean lines, fewer columns, and focus solely on the transaction amount and balance, making them visually appealing and easy to digest.

7. Debt Tracking Ledger: While not a pure bank ledger, some templates combine transaction tracking with debt repayment. They might have additional columns for "Principal Paid," "Interest Paid," and "Remaining Balance" on specific debts, helping you visualize your debt reduction journey alongside your daily spending. *My friend used one of these religiously to pay off her student loans, and swore by the motivation it gave her.*

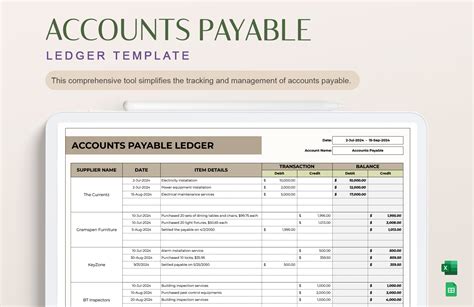

8. Project-Specific/Event Ledger: For those managing finances for a specific project, event (like a wedding or a home renovation), or small business, these ledgers are tailored to track income and expenses related only to that particular endeavor. They might include project codes or client names.

9. Weekly/Monthly Summary Ledger: Some advanced printable bank ledger templates include summary sections at the bottom of each page or at the end of a week/month. These sections allow you to quickly tally up total income, total expenses, and the ending balance for that period, offering quick insights without needing to crunch numbers across multiple pages.

10. Income & Expense Split Ledger: This type is popular for freelancers or small businesses, where income and expenses need to be clearly delineated for tax purposes. It often has separate sections or distinct columns for detailed income sources and expense types.

11. Large Print/Accessibility Ledger: Recognizing that not everyone has perfect eyesight, some printable bank ledger templates are designed with larger fonts and more spacing between lines, making them easier to read and write in for individuals with visual impairments or those who simply prefer more room.

12. DIY Customizable Ledger: While not a pre-designed type, many users prefer to create their own from scratch or heavily modify existing templates. This allows for ultimate personalization, adding exactly the columns and sections they need, and eliminating anything that's irrelevant. *I've seen some truly artistic ones online, turning a financial chore into a creative outlet!*

Beyond the Basics: Customizing Your Ledger for Personal Zen

The real power of a printable bank ledger isn't just in its pre-defined structure; it's in its incredible flexibility. Unlike rigid software, paper allows for limitless personalization. Customizing your ledger transforms it from a generic tracking sheet into a truly intuitive and motivating tool, perfectly aligned with your unique financial personality. Think of it as crafting your personal financial dashboard.

1. Add a "Why" Column: Beyond description, add a small column for "Purpose" or "Why." This could be a simple note like "Treat," "Need," "Bill," or "Savings Goal." It encourages conscious spending and helps you reflect on your motivations. *I started doing this, and it was eye-opening to see how many "Treat" expenses I had versus "Need."*

2. Color-Coding for Quick Insights: Use different colored pens or highlighters for different types of transactions. For example, green for income, red for expenses, blue for transfers. This creates an instant visual map of your money flow and makes patterns jump out.

3. Integrate Mini-Budget Trackers: Dedicate a small section at the bottom or side of each page for mini-budget categories. As you log expenses, you can also jot down how much is left in your "Groceries" or "Fun Money" budget for the week/month.

4. Future Transaction Reminders: Include a small section for "Upcoming Bills" or "Future Deposits." This acts as a forward-looking planner, ensuring you're always aware of what's coming and can plan your spending accordingly.

5. Motivational Quotes/Goals: Reserve a corner of each page for a small motivational quote, a reminder of your financial goals (e.g., "Save for Europe trip!"), or a positive affirmation. It’s a subtle way to keep your "why" front and center.

6. "Net Worth Snapshot" Section: For the more advanced user, add a small area to periodically update a simplified net worth calculation, combining your ledger balance with other assets (e.g., savings, investments) and liabilities (e.g., loans).

7. Custom Symbols/Abbreviations: Develop your own shorthand or symbols for common transactions. For example, "🏠" for rent, "🛒" for groceries, "☕" for coffee. This speeds up data entry and adds a personal touch.

8. Reconciliation Checklist: Create a small checklist at the top or bottom of your page: "Bank Statement Received," "All Entries Checked," "Balance Matches." This ensures you follow your reconciliation process consistently.

9. Debt Progress Tracker: If you're tackling specific debts, add a dedicated line or box to track your principal payment and remaining balance for that debt within the ledger itself. It provides a powerful visual of your progress. *My friend Sarah used this to track her credit card debt, and seeing the number shrink was incredibly motivating for her.*

10. "Wins & Learnings" Section: At the end of each week or month, dedicate a small space to jot down a financial win (e.g., "Stayed under grocery budget!") and a learning (e.g., "Need to cut back on impulse buys"). This fosters a growth mindset.

11. Event/Project Specific Tracking: If you have a one-off event or project (like planning a party or a home repair), create a separate section or use a distinct color to track all related expenses and income, keeping it separate from your daily finances.

12. Creative Layouts: Don't be afraid to experiment with the layout itself. Maybe you prefer a landscape orientation, or perhaps you want more space for descriptions than for amounts. Print blank ledger paper and sketch out your ideal design before committing. My personal preference is for a simple, two-column layout for expenses and income, with a wide description field – it just feels more natural for my brain.

Seamless Integration: Using Your Ledger with Digital Tools

The true magic of a printable bank ledger in the modern age isn't about ditching digital tools entirely; it's about creating a powerful, synergistic hybrid system. Your paper ledger provides the hands-on control and clarity, while digital tools offer convenience, automation, and deeper analytical capabilities. Together, they form an unbeatable financial duo.

1. Ledger as Your Daily Journal, Online as Your Overview: Use your printable bank ledger for daily transaction entry – it’s your immediate, granular record. Then, use your online banking app or budgeting software (like Mint, YNAB, or your bank's own tools) for high-level overviews, automated bill pay, and long-term trend analysis. This gives you both micro and macro perspectives.

2. Digital for Initial Alerts, Ledger for Detailed Logging: Set up digital alerts for large transactions or low balances through your bank. Once an alert comes through, you can then manually record the transaction in your ledger with added detail or notes that a digital notification won't provide.

3. Reconciliation is Key: This is where the paper and digital truly meet. Regularly (weekly or bi-weekly) reconcile your printable bank ledger with your online bank statement. This process is crucial for catching errors, identifying missing transactions, and ensuring both records are perfectly aligned. It's a satisfying ritual that builds trust in your financial data.

4. Leverage Digital for Recurring Bills: Use online banking's automatic bill pay for fixed, recurring expenses like rent, loan payments, or subscriptions. You can then simply note these scheduled payments in your ledger as they occur or just before they're due, saving you manual entry time for predictable outflows.

5. Digital Receipts, Paper Summary: For those who collect digital receipts (email, app-based), use your ledger to summarize these transactions. You don't need to print every receipt, but the ledger provides a consolidated overview, and you can easily refer to your digital files if more detail is needed.

6. Scan and Archive: Once a ledger page or book is complete, consider scanning it to create a digital archive. This provides an additional layer of backup and makes it easy to access old records if your physical ledger is stored away. *I do this at the end of each year; it’s my digital "financial history" folder.*

7. Budgeting App for Planning, Ledger for Execution: Use a budgeting app to set your initial budget categories and limits. Then, use your printable bank ledger to track your actual spending against those limits in real-time. It helps you stay accountable to your budget on a daily basis.

8. Credit Card Tracking: While bank ledgers are for bank accounts, you can use a similar printable ledger for credit card spending. Then, when you pay your credit card bill from your bank account, record that single payment in your bank ledger, noting the credit card it paid off.

9. Cross-Referencing for Disputes: If you ever need to dispute a charge, having both your detailed, self-entered ledger and your bank's digital statement provides a powerful combination of evidence. Your ledger shows when *you* recorded it, and the bank statement shows when *they* processed it.

10. Password Manager Integration: While your ledger is physical, remember that you'll still need digital access for some things. Use a secure password manager to keep all your financial login details organized and safe, complementing your physical ledger's security.

11. "Cash In, Cash Out" with Digital Tracking: If you primarily use your ledger for cash transactions, you can still integrate. When you withdraw cash from your bank (a digital transaction), record the withdrawal in your bank ledger. Then, track the individual cash expenses within a separate section of your ledger, or a dedicated cash ledger.

12. Digital Notifications as Reminders: My phone sends me a notification every Friday to "Update Ledger." It's a simple, digital nudge to ensure my physical record stays current. It prevents the ledger from becoming an overwhelming backlog of entries.

Ledger Wisdom: Common Pitfalls & How to Avoid Them

Even the most straightforward tools can have their quirks, and the printable bank ledger is no exception. While it's incredibly empowering, there are common missteps that can quickly turn your financial clarity into confusion. But don't worry, with a little foresight and the wisdom gleaned from countless entries (and a few personal blunders!), you can navigate these pitfalls with ease.

1. Inconsistent Entry: The biggest pitfall! Forgetting to record transactions regularly leads to a backlog, making the task feel overwhelming and your balance inaccurate.

- Avoid: Make it a daily habit. Before bed, or first thing in the morning, jot down yesterday's transactions. Set a reminder on your phone if needed. Don't be like me and let a week of spending pile up – it's a nightmare to untangle!

2. Inaccurate Balance Calculation: Simple math errors can throw off your entire ledger. A misplaced decimal or a forgotten subtraction can lead to significant discrepancies.

- Avoid: Double-check your math, especially the running balance. Consider using a small calculator. Some people even do a quick mental check: "Okay, I had $100, spent $10, so $90 left. Does that match?"

3. Vague Descriptions: Writing "Misc." or "Store" doesn't help you understand your spending patterns later.

- Avoid: Be specific. "Groceries - SuperMart," "Coffee - Daily Grind," "Online Subscription - Netflix." If it's a gift, note "Gift for Sarah." The more detail, the better for future analysis.

4. Forgetting to Reconcile: Not comparing your ledger to your bank statement means you won't catch bank errors, forgotten transactions, or potential fraud.

- Avoid: Schedule regular reconciliation sessions (e.g., weekly or bi-weekly). It’s a crucial step that validates your hard work. Place a checkmark next to each item on your ledger as it clears your bank.

5. Ignoring Pending Transactions: Your bank app might show a pending transaction, but it hasn't actually cleared yet. Recording it prematurely can cause a temporary mismatch.

- Avoid: You can note pending transactions in a separate "Pending" section or with a light pencil mark, but don't factor them into your main balance until they've officially cleared and posted to your account.

6. Not Accounting for Cash: If you use cash, but don't track it in your ledger, you're missing a significant piece of your financial puzzle.

- Avoid: When you withdraw cash, record it as a debit. Then, track individual cash expenses in a separate section of your ledger or a dedicated cash envelope system that you also note in your ledger.

7. Over-Complicating the System: Adding too many columns or categories can make the ledger feel overwhelming and lead to abandonment.

- Avoid: Start simple. You can always add more detail later if you find you need it. The goal is clarity and consistency, not complexity. My personal motto: "Keep it simple, stupid!"

8. Not Storing Safely: A physical ledger can be lost, damaged, or accessed by unauthorized individuals if not stored securely.

- Avoid: Keep your ledger in a safe, private place. Consider a fireproof box or a secure drawer. Treat it like a valuable document (because it is!).

9. Disregarding Small Transactions: It's easy to think a $2 coffee isn't worth recording, but these small amounts add up quickly and distort your balance.

- Avoid: Record *every single transaction*, no matter how small. Every penny counts when you're aiming for accuracy.

10. Using the Wrong Template: Trying to force a basic ledger to do advanced budgeting, or vice-versa, can lead to frustration.

- Avoid: Take time to choose a template that fits your needs (or customize one!). Refer back to the "Types of Printable Bank Ledgers" section. Don't try to fit a square peg in a round hole.

11. Giving Up Too Soon: There will be days you forget, or feel overwhelmed. The temptation to quit is real.

- Avoid: Don't aim for perfection, aim for consistency. If you miss a few days, just jump back in. Forgive yourself and get back on track. The benefits are worth the occasional hurdle.

12. Not Reviewing Your Progress: A ledger is more than just a record; it's a tool for analysis. Not reviewing your spending patterns misses a huge opportunity.

- Avoid: At the end of each week or month, take 10-15 minutes to review your entries. Where did your money go? What trends do you see? This reflective practice is where the real financial wisdom comes from.

The Ledger Lifestyle: Advanced Strategies for Financial Mastery

Once you've mastered the basics of your printable bank ledger, you'll realize its potential extends far beyond simple transaction tracking. For seasoned users, the ledger can become a powerful instrument for deeper financial analysis, strategic planning, and even psychological reinforcement. This isn't just about recording; it's about leveraging your data for true financial mastery.

1. Zero-Based Budgeting with Your Ledger: For advanced users, integrate a zero-based budgeting approach directly into your ledger. At the start of each month, allocate every dollar of your income to a specific category (even savings or debt repayment). As you spend, track it against these allocations, aiming for a "zero" balance in each category by month-end.

2. Forecasting Future Balances: Use your ledger to project your balance forward. After recording all current transactions, you can pencil in anticipated income (paychecks) and fixed expenses (rent, bills) for the next few weeks to get a clearer picture of your future cash flow. This is incredibly powerful for planning large purchases or managing irregular income.

3. Deep Dive into Spending Categories: Beyond just basic categories, create sub-categories. Instead of just "Groceries," track "Groceries - Staples" vs. "Groceries - Treats." This granular detail helps you pinpoint exactly where you can optimize spending.

4. Tracking Net Worth Components: While your ledger tracks cash, you can use a dedicated section or a separate companion ledger to track other assets (e.g., investment account values, estimated home equity) and liabilities (e.g., loan balances). This provides a comprehensive, at-a-glance net worth snapshot alongside your