Let's be honest: the idea of saving money often feels like climbing Mount Everest in flip-flops. It sounds great in theory, but the execution? That's where most of us stumble. I’ve been there, staring at my bank account, wondering how I was ever going to afford that dream vacation or even just build a comfortable emergency fund. The good news is, you don’t need a finance degree or a secret trust fund to make real progress. What you *do* need is a plan, a little consistency, and a fantastic tool to keep you on track. Trust me, this is where the 52-week savings challenge printable comes in as your secret weapon.

This isn't just about stashing away cash; it's about building a sustainable habit, celebrating small wins, and seeing tangible progress week after week. Whether you're a complete beginner who gets overwhelmed by budgeting apps or a seasoned saver looking for a fun, motivating twist, this challenge is incredibly versatile. I once used a similar system to save for a hefty car repair bill that blindsided me, and seeing those numbers tick up each week was the only thing that kept my panic at bay! Ready to transform your financial future, one small step at a time? Let's dive in.

The Classic & Consistent 52-Week Challenge Printable: The Beginner's Best Friend

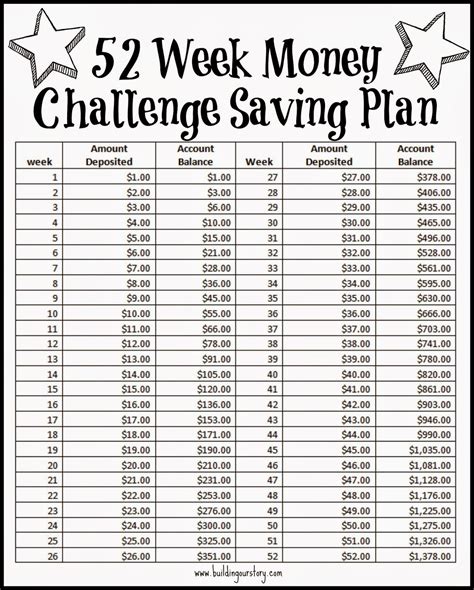

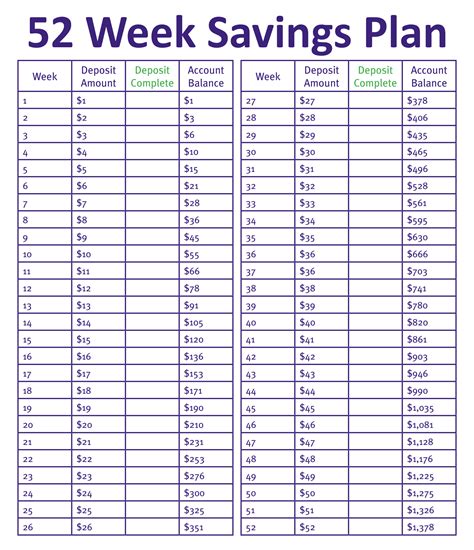

This is the original, straightforward version, perfect for anyone just dipping their toes into the savings waters. The premise is simple: you save $1 in Week 1, $2 in Week 2, and so on, until you save $52 in Week 52. By the end of the year, you'll have saved a tidy sum of $1,378! It's an excellent way to ease into saving without feeling overwhelmed.

- Week-by-Week Accumulation: Start small, build momentum. In Week 1, save $1. In Week 2, save $2. Mark it off on your 52-week savings challenge printable.

- Consistent Growth: Each week, your contribution increases by just $1. This incremental approach makes it surprisingly manageable.

- Visual Progress: Using a printable tracker lets you color in each week as you go, providing a powerful visual reminder of your dedication. I used this strategy when trying to pay off student loans; seeing the weeks marked off truly helped me stay focused on the bigger picture.

- Great for Fixed Incomes: If your income is steady, this predictable structure is easy to integrate into your budget.

- Builds Discipline: It teaches you the power of small, consistent actions over time.

- Simple & Straightforward: No complex calculations or financial jargon. Just follow the numbers.

- Clear End Goal: The $1,378 sum is a powerful motivator for that emergency fund or holiday splurge.

The Flexible & Forgiving Challenge: Your Irregular Income Savior

Life isn't always linear, and neither are our incomes. If you have fluctuating paychecks or simply prefer more control over when and how much you save, the "flexible" approach to your 52-week savings challenge printable is your answer. This method involves saving the *amounts*, but not necessarily in the *order* of the weeks.

- Pick Your Pace: Look at your 52-week savings challenge printable and decide which weekly amount you want to save each week. Maybe you save $52 on a big payday, then $10 on a leaner week.

- Cross Off as You Go: As you save an amount, cross it off your printable list. This ensures you hit all the numbers by year-end without strict weekly adherence.

- Avoid the End-of-Year Crunch: This strategy helps distribute the larger amounts ($40s and $50s) throughout the year, rather than having them all hit in the final quarter. I learned this the hard way when I tried the traditional method, and those last few weeks felt like a real squeeze!

- Leverage Windfalls: Use bonuses, tax refunds, or unexpected gifts to knock out some of the larger savings weeks early.

- Reduces Stress: No more guilt if a particular week's target feels too high. You have the freedom to adjust.

- Maintain Momentum: Even if you can only afford a small amount, you can still mark off a week and feel accomplished.

- Ideal for Freelancers: Perfectly suited for those with project-based or commission-based incomes.

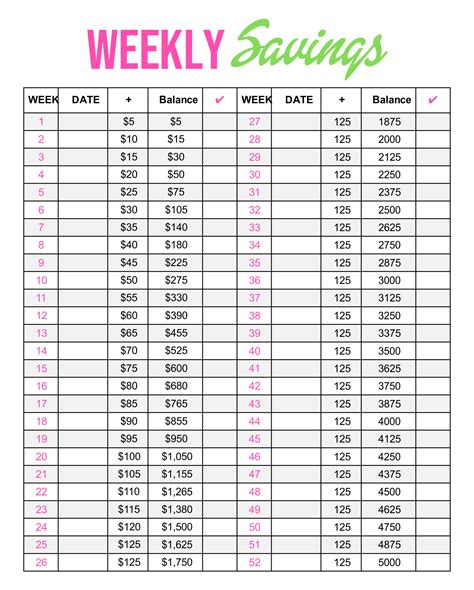

The Accelerated & Ambitious Challenge: Reach Your Goals Faster

Got a big goal and want to hit it sooner? Or maybe you just love a good challenge! The accelerated version of the 52-week savings challenge printable allows you to front-load your savings or double up on weeks when you're feeling flush. This is for the go-getters.

- Reverse Order Power-Up: Start with the largest amount ($52) in Week 1, then $51 in Week 2, and so on. This gets the biggest contributions out of the way when motivation is highest and often finances feel less strained at the start of the year. I found this super motivating when saving for a down payment!

- Double Up Weeks: When you have extra cash, save for two weeks at once. For example, save $1 and $2 in Week 1, marking both off your printable.

- Early Finish Line: Finish the challenge in less than 52 weeks by consistently contributing more than the weekly minimum.

- Great for "Now" Goals: Perfect if you're saving for something in the near future, like a car down payment or a big vacation.

- Ignite Your Momentum: Seeing your savings grow rapidly at the start can be incredibly energizing.

- Challenge Yourself: For those who thrive on pushing their limits and seeing quick results.

- Discipline on Demand: Forces you to find ways to increase your contributions from the get-go.

The Reverse & Rewarding Challenge: A Twist on Tradition

Why always save more as the year goes on? The reverse 52-week savings challenge printable flips the script: you save the largest amount ($52) in Week 1, then $51 in Week 2, and so on, until you save $1 in Week 52.

- Largest Contributions First: Get the biggest sums out of the way when your motivation is highest and the holiday season isn't draining your wallet. This is my favorite strategy because it saved me countless times from financial stress later in the year.

- Easier Ending: The end of the year becomes incredibly easy with tiny contributions of just a few dollars. This is a huge relief around busy times like the holidays!

- Build Early Momentum: Seeing larger numbers stack up quickly can be very satisfying.

- Less Financial Strain Later: As the year progresses and other expenses (holidays, birthdays) might pop up, your required savings decrease significantly.

- Psychological Advantage: It feels good to know the hardest part is behind you.

- Smart for Holiday Savers: Ensures you have more disposable income during the peak spending season.

- Unique Approach: Offers a refreshing alternative to the traditional ascending challenge.

Tips for Personalizing Your 52-Week Challenge

Your 52-week savings challenge printable is a tool, not a rigid rulebook. Make it work for *you*!

- Set a Clear Goal: What are you saving for? An emergency fund? A vacation? Debt payoff? Write it on your printable! Visualizing your goal makes saving real. I find this approach works best for small, tangible goals like a new gadget or a weekend getaway.

- Choose Your Starting Point: Don't feel tied to January 1st. Start today! Any week is a good week to begin your journey.

- Automate When Possible: If your bank allows, set up automatic transfers for a few of the smaller amounts, or even a fixed amount each week, and then manually adjust.

- Involve Your Family/Friends: Make it a friendly competition or a shared goal. If you're saving for a family trip, get everyone excited about contributing.

- Reward Yourself (Sensibly): When you hit milestones (e.g., halfway point, $500 saved), give yourself a small, non-monetary treat like a movie night or a new book.

- Use the Right Printable: Find a 52-week savings challenge printable that resonates with you – one that's visually appealing and easy to track. There are tons of free options online!

- Review & Adjust: Life happens. If you miss a week, don't give up! Just pick up where you left off or double up on another week. It’s about consistency, not perfection.

Common Pitfalls: What to AVOID When Tackling the 52-Week Savings Challenge

While the 52-week savings challenge printable is fantastic, there are a few traps to watch out for. Don't be like me and make these mistakes early on!

- Don't Give Up if You Miss a Week: This is the biggest pitfall. Life gets in the way. Instead of abandoning the challenge, just pick up where you left off or adjust your plan. One missed week doesn't ruin the whole year.

- Avoid Overspending After Saving: It's tempting to think "I saved my $15, now I can splurge!" The goal is to build good habits, not just move money around. Stick to your budget for other expenses.

- Don't Forget Your "Why": Without a clear goal, motivation can wane. Keep your "why" front and center (literally, write it on your printable!).

- Resist the Urge to Withdraw Early: This challenge is about building a lump sum. Unless it's a true emergency, let that money grow.

- Don't Compare Your Progress: Everyone's financial situation is different. Focus on *your* journey and *your* goals, not what others are doing.

- Don't Underestimate the Last Quarter (for classic method): The last few weeks (Week 40-52) require the largest contributions. Plan ahead for these, especially around the holidays! This is where the reverse method really shines.

- Don't Just Let It Sit There (After Challenge): Once you hit your goal, decide what's next. Move the money to a high-yield savings account, invest it, or use it for your planned goal.

Ready to Make It Happen?

You've got the knowledge, you've got the tools (or at least you know where to find your perfect 52-week savings challenge printable!). This isn't just about saving money; it's about gaining confidence, building discipline, and proving to yourself that you can achieve your financial goals. So grab a colorful pen, print out your tracker, and start coloring in those boxes. Your future self will thank you. Now go make that money grow!