Ever stared at your bank account, feeling a knot in your stomach, wishing there was an easier way to get ahead financially? Trust me, I’ve been there. For years, I struggled with inconsistent saving, feeling like I was constantly treading water. It wasn't until I discovered the power of a simple savings challenge free printable that things finally clicked. Suddenly, saving wasn't this massive, overwhelming task; it was a series of small, manageable steps, each celebrated as I colored in a square or marked off a week. This isn't just about money; it’s about transforming your mindset and building lasting habits.

Whether you're new to the world of budgeting or a seasoned financial warrior looking for fresh inspiration, free savings printables are an absolute game-changer. They provide a visual roadmap, turning abstract financial goals into tangible achievements. They’re like having a cheerleading squad, a personal accountability coach, and a progress tracker all rolled into one beautiful, printable sheet. Let's dive into how these amazing tools can revolutionize your money journey.

Your Savings Journey Starts Here: Popular Printable Challenge Categories

One of the best things about the "savings challenge free printable" universe is its incredible variety. There's a challenge for every personality, every income level, and every financial goal. Here are some of my favorite categories that you can easily adapt with a simple printable.

### 1. The Beginner-Friendly Boosters: Kickstarting Your Savings Habit

If you’re new to saving or have struggled with consistency, these challenges are your best friend. They're designed to build momentum and prove to yourself that saving is absolutely achievable. These are all about low commitment and high reward!

- The 30-Day No-Spend Challenge: Commit to a month where you only spend on essentials. A printable helps you track daily successes. I used this when I first started, just to prove to myself I *could* stick to a budget for a month.

- The $1-a-Day Challenge: Save just $1 every day. Sounds tiny, right? But it adds up to $30 in a month and $365 in a year! A simple calendar printable lets you cross off each day you save.

- The "Found Money" Challenge: Every time you find loose change, get a rebate, or receive an unexpected small amount of money (like a friend paying you back), put it into savings. A printable jar graphic works perfectly here.

- The Coffee Shop Cutback: If you're a daily latte buyer, challenge yourself to make coffee at home a few days a week and save the difference. A printable with "coffee cups" to color in for each skipped purchase works wonders.

- The "Change Jar" Tracker: Physically collect all your loose change, then use a printable to track when you deposit it and how much it grows. This is incredibly satisfying.

- The "Small Bill" Stash: Every time you get a $5 or $10 bill in change, put it aside. Mark it off on a specific printable challenge sheet.

- The "Pay Yourself First" Mini-Challenge: For one payday, set up an automatic transfer of just $20-$50 to savings *before* you pay any bills. Track this win on a weekly savings tracker.

### 2. The Goal-Oriented Gladiators: Saving for a Specific Dream

Have a specific savings goal in mind, like a vacation, a new gadget, or a down payment? These challenges help you visualize and track progress towards that big dream, making it feel more attainable.

- The Vacation Fund Visualizer: Break down your vacation cost into smaller chunks (e.g., flights, accommodation, activities) and color in sections of a printable as you save for each. When I saved for my first big trip abroad, a printable tracker for flights and accommodation was a game-changer!

- The "New Gadget" Tracker: Want that new phone or console? Divide its cost by how many weeks or months you plan to save, then track your progress on a dedicated printable.

- The Down Payment Digger: For larger goals, create a printable "thermometer" or "progress bar" to fill in as you hit significant milestones.

- The Emergency Fund Builder: Even if you have a partial emergency fund, a printable can help you track adding "buffer" money regularly until you hit your target.

- The "Big Purchase" Breakdown: For anything from a new appliance to furniture, use a printable to break the total cost into smaller, manageable saving increments.

- The Holiday Gift Fund: Start saving early for gifts by allocating a small amount each week or month and tracking it on a festive printable tracker.

- The Education Savings Boost: If you're saving for school fees or books, a specific printable can help you visualize the growing fund.

### 3. The Irregular Income Innovators: Flexible Saving for Fluctuating Budgets

If your income isn't fixed, traditional budgeting can feel impossible. These savings challenge free printable ideas are perfect because they adapt to your unique financial flow.

- The Percentage Challenge: After each paycheck, save a pre-determined percentage (e.g., 5% or 10%). A printable helps you calculate and track this. As a freelancer, my income varied wildly, so this helped me squirrel away cash from unexpected windfalls without feeling overwhelmed.

- The "No Spend" Week/Weekend: Pick a week or a few days where you consciously avoid *any* non-essential spending. Mark these days on your printable calendar.

- The "Bonus Money" Grab: Any unexpected income (freelance gig, tax refund, birthday money) goes straight into savings. A printable with a "piggy bank" graphic is great for this.

- The "Paycheck Priority" Challenge: On payday, immediately transfer a chosen amount to savings before anything else. Track this critical first step.

- The "Debt Snowball" Tracker (for Debt Payoff): While not strictly *saving*, this printable visually tracks your debt reduction, which frees up future money for saving. Seeing my credit card balance shrink month by month on a debt snowball printable was the motivation I needed to keep going!

- The "Flexible Daily Amount" Challenge: Instead of a fixed amount, your printable lists small amounts ($1, $2, $3, etc.), and you choose which amount to save each day based on your budget.

- The "Side Hustle" Savings: Dedicate all or a portion of income from a side hustle directly to a specific savings goal, tracking it on a printable.

### 4. The Long-Haul Legends: Building Serious Wealth Over Time

These challenges are for those ready to commit to sustained saving, leading to significant financial gains. They require a bit more discipline but the results are incredibly rewarding.

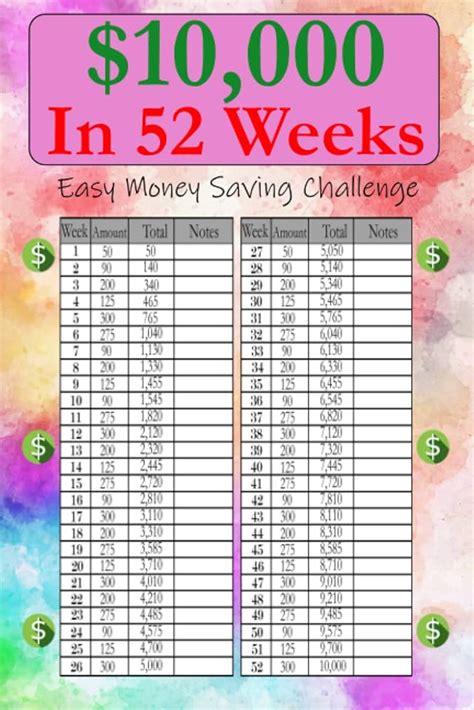

- The 52-Week Money Challenge: Save a progressive amount each week ($1 in week 1, $2 in week 2, up to $52 in week 52). This classic challenge saves you $1,378 in a year! The 52-week challenge felt daunting at first, but marking off each week on my printable was incredibly satisfying.

- The Reverse 52-Week Challenge: Start with $52 in week 1 and go down to $1 in week 52. It's easier at the end of the year when holiday spending hits.

- The "$5,000 in a Year" Challenge: Break down the $5,000 into weekly or bi-weekly amounts (e.g., ~$96/week) and track your progress on a goal-specific printable.

- The Monthly Milestone Tracker: Set monthly savings targets and use a printable to track your progress towards a yearly goal. This is great for bigger goals like a down payment.

- The "Investment Fund Starter": Use a printable to track initial contributions to a new investment account, even if it's small amounts regularly.

- The "Debt Avalanche" Tracker (for Debt Payoff): Similar to the snowball, but prioritizes high-interest debt first. A printable thermometer or progress bar works well.

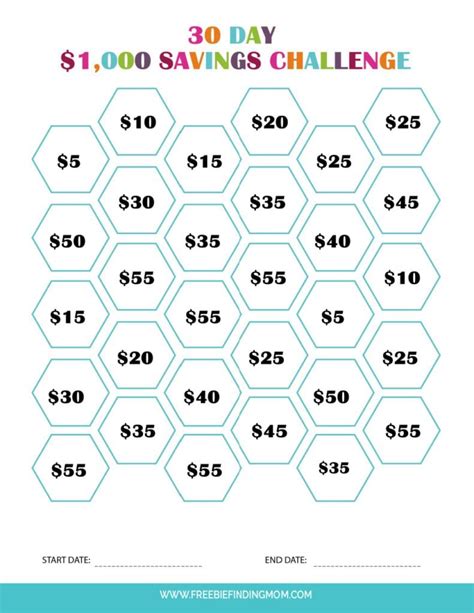

- The "$1000 in 3 Months" Challenge: A more accelerated version of saving, broken down into weekly or daily amounts on a dedicated printable.

### 5. The "Fun & Quirky" Funds: Making Saving Enjoyable

Who says saving has to be boring? These challenges gamify the process, adding an element of fun and surprise to your financial journey.

- The Savings Bingo: Create a bingo card with different amounts ($5, $10, $25, etc.) or savings actions (e.g., "no-spend day," "packed lunch"). When you save that amount or complete an action, cross it off. My favorite was the 'Dice Roll' challenge—it turned saving into a fun little game every payday!

- The Dice Roll Challenge: Roll a die (or two) and save that amount (e.g., roll a 4, save $4). A printable with a track or a jar to fill is perfect.

- The "A-Z" Savings Challenge: Save an amount corresponding to each letter of the alphabet (e.g., A=$1, B=$2, C=$3... or A=$25, B=$50...). A printable with 26 boxes makes this easy.

- The "Weather" Challenge: Save the amount of the daily temperature. On a 70°F day, save $70. A printable calendar is useful for tracking.

- The "Envelope System" Tracker: Label envelopes for different savings categories (e.g., "Vacation," "Emergency," "Treat Yourself") and use a printable to track what goes into each.

- The "Savings Scavenger Hunt": Find areas in your budget to cut back (e.g., unused subscriptions, eating out less) and track the savings on a printable.

- The "Penny Challenge": Start saving 1 cent on day 1, 2 cents on day 2, and so on. A printable calendar makes tracking simple and shows the huge growth.

Tips for Personalizing Your Savings Challenge

A savings challenge free printable is a fantastic starting point, but its true power lies in making it *yours*. Here’s how to tailor any challenge to fit your life.

- Define Your "Why": Before you even print, sit down and identify *why* you're saving. Is it for security, a dream vacation, financial freedom? Write this down on your printable. I personally find that linking my savings goal to a vivid image or reward keeps me motivated more than anything.

- Adjust the Amounts: Don't feel pressured to stick to generic challenge amounts. If $52 a week is too much, try $26. If $1 a day is too little, make it $5. It’s *your* challenge.

- Visualize Your Goal: If you're saving for a specific item, glue a picture of it onto your printable or draw it out. Seeing your goal every day is a huge motivator.

- Set Mini-Milestones: Break down big challenges into smaller, achievable chunks. For a 52-week challenge, celebrate every 10 weeks, or every $100 saved.

- Reward Yourself (Sensibly!): Plan small, non-monetary rewards for hitting milestones – a relaxing bath, an hour of guilt-free reading, a favorite movie.

- Track Consistently: The biggest tip of all! Make it a ritual to mark off your progress on your printable daily or weekly. This visible progress is incredibly motivating.

- Involve a Partner or Friend: If you have an accountability buddy, you're much more likely to stick to it. Share your progress with them.

Common Pitfalls: What to AVOID When Using Savings Challenge Printables

While savings challenge free printable tools are amazing, there are a few traps to watch out for. Learning from these mistakes can save you a lot of frustration!

- Don't Overcommit: This is the biggest one! Don't jump into a challenge that's too aggressive for your current income or budget. Starting too big is a surefire way to get discouraged and give up. I learned this the hard way trying to do an advanced challenge when I was barely making ends meet.

- Forgetting to Track: A printable is only useful if you actually use it. Don't be like me and forget to track your progress – that's a surefire way to lose steam and forget your wins! Make it a habit.

- Treating Savings as Leftovers: Don't wait until the end of the month to see what's "left over" to save. Prioritize your savings as a non-negotiable expense, just like rent or utilities.

- Not Having a "Why": Without a clear purpose, saving feels like deprivation. Your "why" fuels your motivation.

- Being Too Strict with Yourself: Life happens! If you miss a week or can't save the full amount, don't throw in the towel. Adjust, learn, and get back on track. Perfection is the enemy of progress.

- Ignoring Your Budget: A savings challenge is an *addition* to your budget, not a replacement. Understand your income and expenses first.

- Making it a Chore: If it feels like homework, you'll dread it. Find challenges that genuinely excite you and align with your personality. If you're having fun, you're more likely to stick with it!

Ready, Set, Save!

There you have it! The world of savings challenge free printable is vast, welcoming, and incredibly effective. These tools aren't just about accumulating money; they're about building confidence, understanding your financial habits, and ultimately, empowering you to take control of your future. Start small, stay consistent, and celebrate every single step of your journey.

Now go find that perfect printable, grab your favorite pen, and start coloring your way to financial freedom. You've got this!