Ever felt that knot in your stomach when you think about your finances? Or perhaps you're dreaming of a big purchase, a debt-free life, or a robust emergency fund, but the sheer scale of it feels overwhelming? Trust me, you're not alone. I remember staring at my bank account, feeling completely stuck and unsure how to even begin. It wasn't until a friend introduced me to the simple, yet powerful, concept of a savings challenge with a printable tracker that things started to click. Seeing that progress visually, week after week, was a game-changer.

That's the beauty of a savings challenge printable PDF free download: it breaks down a daunting goal into manageable, bite-sized steps. It transforms an abstract number into a tangible journey, allowing you to track your progress, celebrate small wins, and stay motivated. Forget complicated spreadsheets or expensive apps; sometimes, all you need is a pen, a printer, and a clear path forward. Whether you're a seasoned saver looking for a new twist or a complete beginner just dipping your toes into the world of personal finance, these free resources are your secret weapon for building wealth, paying down debt, and achieving your financial dreams.

---

For the Absolute Beginner: Gentle & Achievable Savings Challenges

Starting your savings journey can feel intimidating, but these challenges are designed to be low-stress and highly effective, building momentum with small, consistent steps. They're perfect for anyone who's new to saving or has struggled to stick with it in the past.

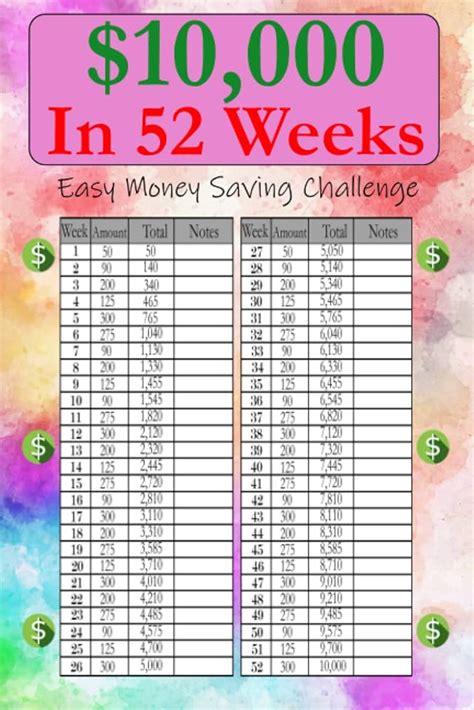

- The Classic 52-Week Savings Challenge: This popular challenge starts small and gradually increases. You save $1 in week one, $2 in week two, and so on, until you save $52 in the final week. By the end of the year, you'll have saved $1,378! It's fantastic for seeing consistent growth.

- *Hypothetical Scenario:* "I used the 52-week challenge to save for my first good camera. It felt like playing a long-term game where every week I just had to hit my 'level up' contribution."

- The $1 a Day Challenge: Simple as it sounds, commit to saving just $1 every single day. At the end of the year, you'll have $365. It's an easy habit to build and incredibly impactful over time.

- The Spare Change Challenge: Empty your pockets or wallet of all loose change at the end of each day and drop it into a jar. It’s surprisingly effective, especially if you deal with a lot of cash transactions.

- The "No-Spend Day" Starter: Pick one day a week where you commit to spending absolutely no money. This forces you to be mindful of your habits and can free up funds for saving.

- The "Found Money" Stash: Any unexpected money (a rebate, a small bonus, a gift, or even finding a few dollars on the street) goes straight into savings. Don't spend it – save it!

- The "Coffee Break" Challenge: Cut out one regular small expense, like your daily fancy coffee, and transfer that exact amount into your savings account. You won't miss the money, but your savings account will certainly feel the love.

- The "Weekly Round-Up": At the end of each week, round up your checking account balance to the nearest $10 or $100 and transfer the difference to savings. If you have $473, round up to $480 and transfer $7.

Target-Driven Savers: Challenges for Specific Goals

Once you've got the hang of the basics, or if you have a clear financial objective in mind, these challenges help you focus your efforts on achieving specific, meaningful goals.

- The Emergency Fund Challenge: Aim for a specific amount, like $1,000 or one month's expenses, and break it down into smaller weekly or bi-weekly contributions. A dedicated printable helps you track every dollar towards your peace of mind.

- *Hypothetical Scenario:* "This Emergency Fund challenge was a lifesaver when my car decided to stage a dramatic breakdown. Knowing I had that dedicated fund meant panic didn't set in!"

- The Vacation Fund Challenge: Dream of a tropical getaway or a mountain adventure? Set a target amount for your trip and use a themed printable to color in milestones as you save for flights, accommodation, and fun.

- The Debt Snowball Savings Challenge: If you're tackling debt, commit to saving a specific amount that you'll then use to pay down your smallest debt, creating a powerful snowball effect. The printable can track the savings *and* the debt paid off.

- The Down Payment Savings Challenge: For bigger goals like a house or a car, this challenge breaks down a large sum into manageable chunks. You might save a specific percentage of your income or a fixed amount each month.

- The "Big Purchase" Accumulator: Whether it's a new laptop, a fancy gadget, or a home appliance, set your sights on a specific item and track your progress towards its cost.

- The "Holiday Debt-Free" Challenge: Start saving for the holidays early in the year, contributing a small amount each week or month to avoid dreaded post-holiday debt.

- The "Education Fund" Challenge: If you're saving for tuition or a child's college fund, use a challenge to regularly contribute to this long-term goal. Seeing the fund grow is incredibly motivating.

Flexibility is Key: Low-Pressure & Adaptable Challenges

Life happens, and sometimes rigid savings plans can be hard to stick to. These challenges offer more flexibility, allowing you to save at your own pace and adapt to your financial situation.

- The No-Spend Month/Week Challenge: Commit to a period where you only spend on essentials (rent, groceries, bills). This requires careful planning but reveals just how much "extra" spending we incur.

- *Hypothetical Scenario:* "My 'No-Spend Week' during a particularly tight month felt like a financial detox. It was tough, but I found so many surprising ways to save, and the printable helped me avoid sneaky impulse buys."

- The Round-Up Savings Challenge (Manual): Every time you make a purchase, manually round up the transaction to the next dollar or five dollars and transfer that difference to savings. If you spend $12.35, transfer $0.65.

- The Envelope System Challenge: A classic for a reason! Allocate cash into different envelopes for categories like groceries, entertainment, and personal spending. Once an envelope is empty, you're done for that period. Any leftover cash in an envelope at the end of the month goes into savings.

- The "Unexpected Win" Savings: Whenever you get an unexpected bonus, cashback, or even a gift, immediately transfer a portion or all of it into a dedicated savings account.

- The "Meal Prep & Save" Challenge: Plan your meals for the week and stick to a grocery list. Calculate how much you saved by avoiding impulse buys or eating out, and transfer that amount to savings.

- The "Subscription Purge" Challenge: Go through your monthly subscriptions and cancel any you don't actively use. Transfer the freed-up cash into savings. Repeat monthly!

- The "Smallest Bill" Challenge: Each time you receive a $5 bill (or any specific small denomination), put it directly into your savings. This is a fun, almost gamified way to accumulate cash.

Gamify Your Finances: Fun & Visual Savings Challenges

Who says saving can't be fun? These challenges incorporate elements of games and visual tracking to make the process more engaging and satisfying.

- Savings Bingo: Create a bingo card with different savings amounts ($5, $10, $20, etc.) or small financial tasks (e.g., "packed lunch," "no impulse buy"). Each time you hit one, cross it off. The goal is to get bingo and save the corresponding amounts.

- *Hypothetical Scenario:* "My personal favorite is Savings Bingo. It turned saving for a new gaming console into an actual quest! Hitting a 'no takeout' square felt like earning XP."

- The Dice Roll Savings Challenge: Roll a die each week or day. The number you roll is the amount you save (or multiply it by 5 or 10 for bigger savings). It adds an element of chance and excitement.

- The 100 Envelope Challenge: Number 100 envelopes from 1 to 100. Each week, pull two envelopes, save the corresponding amounts, and seal them away. By the end, you’ll have saved $5,050! This is an excellent savings challenge printable PDF free download candidate as it requires clear tracking.

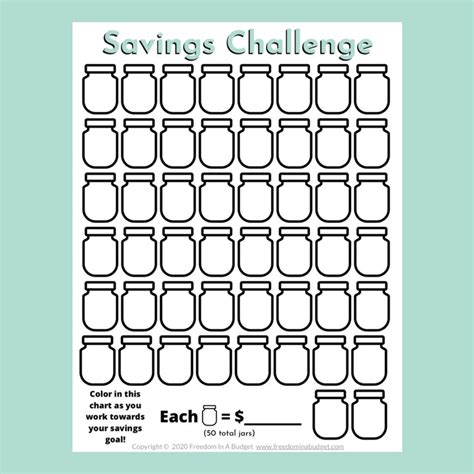

- The "Color in Your Progress" Tracker: These printables often feature a picture (like a piggy bank, a house, or a mountain) divided into small sections. Each time you save a certain amount, you color in a section. Seeing the image fill up is incredibly motivating.

- The "Savings Jar" Challenge: Decorate a clear jar and make it your visual savings goal. Every time you contribute, you see the money accumulate, making your progress tangible.

- The "Matching Game" Challenge: Set up categories or goals, and save equal amounts for each (e.g., save $5 for vacation, and $5 for emergency fund). This helps balance your financial goals.

- The "Progress Bar" Savings: Similar to a download bar, you track your savings progress towards a goal. Fill in the bar incrementally for every dollar saved, visually showing how close you are to your target.

Family-Friendly Finances: Teaching Kids to Save

Involving the whole family in savings challenges can be a fantastic way to teach financial literacy from a young age and work towards shared goals.

- The Chore Chart Savings Match: Create a chore chart where completed tasks earn a set amount of money. Then, set up a savings goal (e.g., a new toy, a family outing) and match a portion of what your child saves.

- The "Kid's Vacation Fund" Challenge: If you're saving for a family trip, involve the kids by giving them a smaller, proportional savings goal they can contribute to. A dedicated "adventure map" printable where they color in destinations as they save can be very engaging.

- The "Penny Jar" Challenge: A classic! Encourage kids (and adults!) to put every penny they find or receive into a designated jar. It adds up remarkably fast and teaches the value of small amounts.

- The "Family Goal Thermometer": Print a large thermometer and mark it with a family savings goal (e.g., new board games, a camping trip). Everyone contributes, and the thermometer fills up as you get closer.

- *Hypothetical Scenario:* "We used the Family Goal Thermometer to save for a new trampoline. The kids were so invested, they'd even put their allowance in, cheering as the 'mercury' rose!"

- The "No-Waste Meal" Challenge: As a family, commit to eating leftovers or cooking with what you have to reduce food waste. The money saved from not eating out or buying extra groceries can go into a family savings jar.

- The "Screen Time for Savings" Swap: Offer kids a small incentive to reduce screen time. For every hour they swap for reading or outdoor play, a small amount goes into their savings.

- The "Toy Purge to Save" Challenge: Encourage kids to declutter old toys. For every item they donate or sell, a small portion of the proceeds (or a matching amount from parents) goes into their savings.

Advanced & Accelerated: Supercharging Your Savings

Ready to take your savings game to the next level? These challenges are for those who are comfortable with budgeting and want to find ways to save more, faster.

- The "Paycheck-to-Paycheck Upgrade" Challenge: If you typically live paycheck to paycheck, commit to getting one week ahead, then two, and so on. This builds a financial buffer and reduces stress.

- The "High-Value Item" Savings: Identify an expensive recurring cost (e.g., premium cable, daily take-out) and commit to cutting it out for a set period, directing the full amount saved to a specific goal.

- The "Bi-Weekly Savings Accelerator": Instead of saving a fixed amount each week, challenge yourself to save 10-20% of your bi-weekly paycheck, or increase your savings contribution by a small percentage each payday.

- *Subjective Insight:* "This is my favorite strategy because it really forces me to optimize my budget and saved me countless times from overspending. I found that linking these aggressive savings to a vivid, emotional goal (like that trip to Japan!) makes sticking with it so much easier."

- The "Income Boost" Challenge: Actively look for ways to earn extra income (side hustle, selling unused items) and commit to saving 100% of that new income.

- The "Financial Fast" Challenge: For a month, cut out all non-essential spending. This requires discipline but can reveal significant hidden savings potential.

- The "Automatic Transfer Turbo": If you already have automatic transfers set up, challenge yourself to increase the amount by a small percentage (e.g., 2-5%) every quarter.

- The "Debt Avalanche Savings": Similar to the snowball, but you save to pay off the debt with the highest interest rate first, potentially saving you more money in the long run.

---

Tips for Personalizing Your Savings Challenge

A savings challenge printable PDF free download is a fantastic starting point, but making it truly yours is where the magic happens.

1. Set Clear, Exciting Goals: Don't just save to save. What are you saving *for*? A dream vacation? A down payment? Financial freedom? The clearer and more emotionally resonant your goal, the stronger your motivation.

2. Make it Visual: Print your chosen challenge and put it somewhere you’ll see it every day – the fridge, your office desk, your planner. Seeing your progress visually is incredibly powerful. Color in those boxes, cross off those numbers!

3. Track Your Progress Diligently: This is crucial. Every time you make a contribution, mark it down. The act of tracking reinforces the habit and celebrates your small wins.

4. Reward Yourself (Sensibly!): When you hit a major milestone (e.g., halfway point, $500 saved), give yourself a small, non-financial reward. A special treat, a relaxing evening, or a new book – something that doesn't derail your savings.

5. Get an Accountability Buddy: Share your challenge with a friend or family member. Checking in with each other can provide motivation and encouragement.

6. Adjust as Needed: Life is unpredictable. If a challenge becomes too difficult, it’s okay to adjust your weekly contribution or pause for a bit. The goal is to keep going, not to be perfect.

- *Subjective Tip:* I find that linking my savings to a vivid, emotional goal (like that trip to Japan!) makes sticking with it so much easier. That "why" is your strongest motivation.

---

Common Pitfalls: What to AVOID When Starting a Savings Challenge

Even with the best intentions and the perfect savings challenge printable PDF free download, it's easy to stumble. Here's what to watch out for:

- Don't Overcommit Too Soon: Starting with an overly ambitious challenge can lead to burnout and discouragement. Begin with a gentle challenge and build up your confidence and capacity. Don't be like me and try to do the 100 envelope challenge and the 52-week challenge *at the same time* on your first go – that's a recipe for overwhelm!

- Don't Forget Your "Why": Without a clear purpose, saving can feel like a chore. Regularly remind yourself of the goal you're working towards. Put a picture of your dream vacation on your printable!

- Don't Get Discouraged by Setbacks: Missed a week? Had an unexpected expense? It happens! Don't throw in the towel. Just pick up where you left off or adjust your plan. Consistency over perfection is key.

- Don't Keep Your Progress a Secret (Unless You Prefer To!): While some prefer to keep their finances private, sharing your goals with a trusted friend or family member can provide invaluable support and accountability.

- Don't Use "Found Money" as an Excuse to Spend: That bonus or tax refund? It's a prime opportunity to supercharge your savings, not to splurge on something you don't truly need.

- Don't Forget to Actually *Download* the Printable: After all this excitement and planning, don't be like me and forget to actually get your savings challenge printable PDF free download! That's a true 'fail' right there – all motivation, no action!

---

Embarking on a savings challenge is more than just accumulating money; it's about building discipline, developing healthy financial habits, and gaining a sense of control over your future. These free printable resources are powerful tools that can transform your financial outlook, one small step at a time. The real treasure isn't just the money you save, but the confidence and peace of mind you gain along the way.

So, what are you waiting for? Grab your favorite savings challenge printable PDF free download, pick a challenge that resonates with you, and start today. Your future self will thank you for it! Now go make your financial dreams a reality – you absolutely got this!