Ever found yourself with a check in hand, a pressing need to deposit it, and not a single deposit slip in sight? The bank's closed, your branch is miles away, and panic starts to set in. Trust me, I've been there! I once had a client check I needed to deposit immediately, but my usual stack of slips had vanished. That’s when I discovered the magic of printable deposit slips – a true game-changer that saved my financial bacon that day and countless times since. It's not just about convenience; it's about empowerment, control, and making your banking life a whole lot smoother.

Whether you're a seasoned small business owner juggling multiple transactions or just someone who occasionally receives a paper check, knowing how to access and properly use printable deposit slips is an invaluable skill. This isn't just a simple print-and-go; it's about understanding the nuances, ensuring accuracy, and maintaining security. Let's dive deep and demystify this essential banking tool, so you're always prepared, no matter what.

The Unexpected Lifesaver: Why Printable Deposit Slips Matter

In an increasingly digital world, paper checks and the need for in-person deposits haven't completely disappeared. This is where printable deposit slips step in as your reliable backup. They bridge the gap between old-school banking and modern convenience, offering a safety net when your usual supplies run low or when you're simply on the go.

- Instant Accessibility: No more waiting for new slips to arrive by mail or making a special trip to the bank just to pick some up. Need one now? Print it!

- Emergency Preparedness: Picture this: a crucial payment arrives, and you need to deposit it quickly. If your regular slips are depleted, a printable option means you're never stuck. I once used this feature during a weekend when the bank was closed, allowing me to prep everything for Monday morning.

- Cost-Effective: While banks provide slips, having a digital template means you're not reliant on their supply chain, which can be useful for small businesses looking to minimize minor expenses.

- Organization & Record-Keeping: Printing your own can sometimes make it easier to maintain a digital backup of the slip details before you even head to the bank.

- Flexibility for Home Businesses: For many sole proprietors and freelancers, banking from a home office means needing solutions that fit your workflow, and printing slips on demand fits perfectly.

Your Digital Treasury Map: Where to Find Reliable Printable Deposit Slips

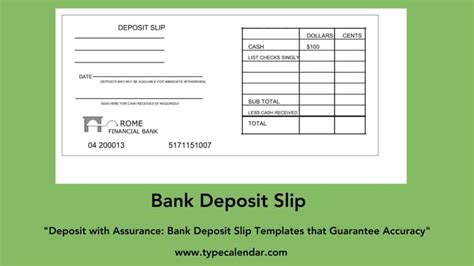

Finding a reliable source for your printable deposit slips is crucial. You want templates that are accurate, readable by bank machines, and free from errors. This isn't the time for random internet searches; stick to trusted sources.

- Your Bank's Official Website: This is almost always the best first stop. Many major banks (like Chase, Bank of America, Wells Fargo, etc.) offer downloadable PDF templates for deposit slips right on their forms or banking services section. Look for terms like "forms," "deposit slips," or "account services."

- *Personal Scenario:* When I first needed one in a hurry, I navigated to my bank’s "Forms" section, and there it was – a crisp, official template. It felt instantly trustworthy.

- Reputable Third-Party Financial Software: Accounting software like QuickBooks or personal finance tools often have built-in features to generate or print deposit slips pre-filled with your account information.

- Printable Forms Websites (with caution): There are general websites that offer printable forms. If you go this route, *always* cross-reference the layout and required information with an official slip from your bank to ensure accuracy. Double-check for your bank's specific format requirements.

- Template Generators: Some online tools claim to generate custom deposit slips. While convenient, verify they include all necessary fields (bank name, your name, account number, routing number, check boxes for cash/checks, total, etc.).

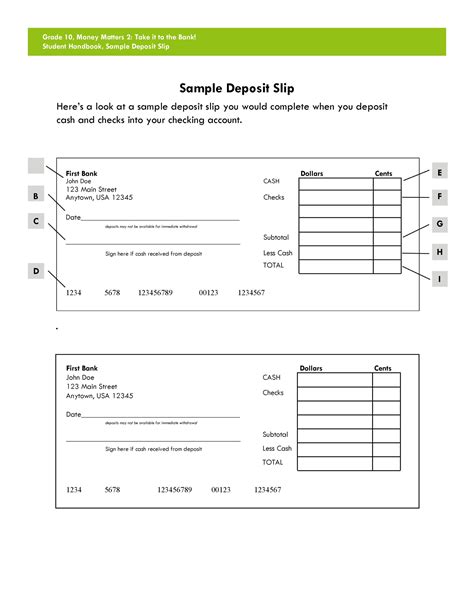

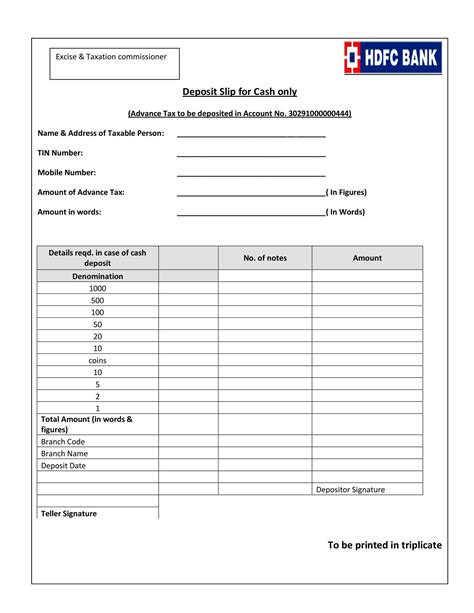

Decoding the Slip: A Step-by-Step Guide to Filling Yours Out

Even a printable deposit slip needs to be filled out correctly. Precision here prevents delays and headaches. If you’re new to this, here’s why this is important: banks process thousands of these daily, and an error can send your deposit into limbo.

1. Date: Enter the current date. Simple, but easily overlooked.

2. Your Name & Address: This is usually pre-printed if you order slips, but you’ll need to write it clearly on a printable one.

3. Account Number: This is your specific checking or savings account number. Do not confuse it with your debit card number. It's typically found on your checks or online banking portal.

4. Bank Routing Number: This nine-digit number identifies your bank and is usually at the bottom left of your checks. Many printable templates will already have this pre-filled if they are bank-specific.

5. Cash Breakdown: If you're depositing cash, list the denominations (e.g., "Two $20s," "Five $1s") or simply the total cash amount.

6. Checks: This is crucial. List each check individually. For business deposits, you might list the check number. For personal deposits, writing "Check" followed by the amount is usually sufficient.

7. Subtotal: Add up all your cash and check amounts.

8. Less Cash Received (Optional): If you're depositing a large sum but want to take some cash back, specify that amount here. The bank will deduct it from your total deposit.

9. Net Deposit/Total: This is your final deposit amount after any cash received. This is the amount that will be credited to your account.

10. Signature: Sign the slip if you're getting cash back, or if your bank requires it for all deposits.

Beyond the Basics: Advanced Tips & Niche Uses

Veterans can use this strategy to maximize results and avoid common snags. Printable deposit slips offer more versatility than you might initially think.

- Pre-Filling Templates: If you regularly use printable slips, save a blank template with your name, address, account number, and routing number pre-filled. This saves time and reduces potential errors. I find this approach works best for small teams or solo operators managing their own banking.

- Batch Printing: If you know you'll need several slips over a period, print a small stack at once to keep handy.

- Remote Deposit Backups: While mobile deposit is convenient, sometimes it fails, or you hit a daily limit. Having a printable slip ready means you can quickly pivot to a physical deposit if needed.

- Business Account Specifics: For businesses, ensure your printable slips align with your business checking account details, not a personal one. Some businesses require specific memo lines or endorsements.

- Documenting Large Deposits: For significant sums, consider making a photocopy of the filled-out deposit slip (and perhaps the checks) for your records before heading to the bank.

Guard Your Gold: Security & Best Practices for Printable Slips

Just because it's convenient doesn't mean you should overlook security. Your printable deposit slip contains sensitive financial information.

- Secure Printing: Use a private printer, not a public one (like at a library or internet cafe) when printing slips with your account information.

- Shred, Don't Trash: Once a deposit slip is used, or if you make a mistake and print a new one, always shred the old one. Do not just toss it in the bin – it contains your bank account details!

- Double-Check Everything: Before you head to the bank, meticulously review all the numbers: account number, routing number, and the total deposit amount. A tiny error here can cause major headaches. Don't be like me and rush through this step, leading to a frantic call to the bank later!

- Keep Blanks Safe: Treat blank pre-filled templates like you would a checkbook – keep them in a secure, private location.

- Verify Bank Acceptance: While generally accepted, it’s wise to confirm with your specific bank if they have any unusual policies regarding self-printed deposit slips, especially if it's for a business account.

Know Before You Go: When Printable Slips Are Your Best Friend (and When They're Not)

Understanding the optimal use cases for printable deposit slips is key to efficient banking. They're fantastic for certain situations but not a universal replacement for all banking methods.

- Best For:

- In-Person Deposits at the Teller: The most common and effective use. Hand it directly to a bank teller.

- ATM Deposits: Many ATMs accept envelopes with slips and checks/cash. Ensure the ATM explicitly states it accepts deposits.

- Mail-In Deposits: If you're sending checks via mail, a completed printable slip is essential.

- Less Ideal For (Consider Alternatives):

- Mobile Check Deposit: If your bank offers it, this is often faster and requires no printing.

- Cash Deposits without a Slip: While some ATMs allow cash deposits without a slip (simply entering the account number), having a slip provides a clear paper trail for reconciliation.

- Depositing Multiple, Complex Items: If you have a highly complex deposit with many checks and specific instructions, an official bank slip might have more space or specific fields.

The Future is Now: Integrating Printable Slips with Digital Banking

Even in the age of apps and online portals, printable deposit slips aren't obsolete; they're evolving. They represent a tangible link in an increasingly digital financial ecosystem. For example, some accounting software can generate a PDF slip that you can then print, merging your digital records with the physical requirement of a deposit. This seamless integration ensures that whether you prefer the tactile experience of a paper slip or the speed of a digital transaction, your financial operations remain smooth and efficient. It’s all about having options and choosing the method that best suits your needs in the moment.

Tips for Personalizing Your Printable Deposit Slip Experience

Making the most of printable deposit slips isn't just about functionality; it's about optimizing your personal banking workflow.

- Create a "Banking Kit": Have a folder or designated spot for your printed slips, a pen, and any checks you need to deposit. This makes quick deposits stress-free.

- Bookmark Your Bank's Form Page: Save the direct link to your bank's printable deposit slip page in your browser for immediate access.

- Use a Dedicated Folder on Your Computer: Keep a "Bank Forms" folder on your desktop with your pre-filled templates, ready to print at a moment's notice.

- Subjective Tip: I personally prefer using a specific, darker ink pen when filling out my slips; I've found it makes them clearer for bank scanners, reducing any potential read errors.

- Review Your Bank's Specific Requirements: Some smaller banks might have unique layouts or requirements. A quick call or visit to their website can save you a headache.

Common Pitfalls: What to AVOID When Using Printable Deposit Slips

Navigating the world of printable deposit slips has its quirks. Here's what I learned the hard way (so you don't have to!).

- Don't Use Outdated Templates: Bank information can change. Always use the most current version from your bank's website. Using an old one is like trying to use a map from 1990 to navigate a new city – you’re going to get lost!

- Avoid Poor Print Quality: Faint ink, streaky lines, or blurry numbers can make the slip unreadable by bank machines or tellers. Ensure your printer has enough ink/toner.

- Never Handwrite Account Numbers If Possible: While some slips might allow it, it's safer and more accurate if your account and routing numbers are pre-printed or typed onto the template. My advice: use a template that allows you to type this information in before printing.

- Don't Forget Endorsements: Remember to endorse any checks you're depositing on the back before you go to the bank. A common slip-up (pun intended!).

- Avoid Generic Templates for High-Value Deposits: For very large sums, always err on the side of caution and use an official bank-provided slip if possible, or double-check a printable one with extreme diligence.

- Don't Ignore "Less Cash Received": If you want cash back, fill out that line clearly. Otherwise, your entire deposit goes into your account.

Now you’re armed with the knowledge and the tools to handle your deposits like a pro. From finding the right template to filling it out flawlessly and keeping your information secure, you're ready for anything. Go forth and conquer your banking tasks with confidence – and never get caught without a deposit slip again!