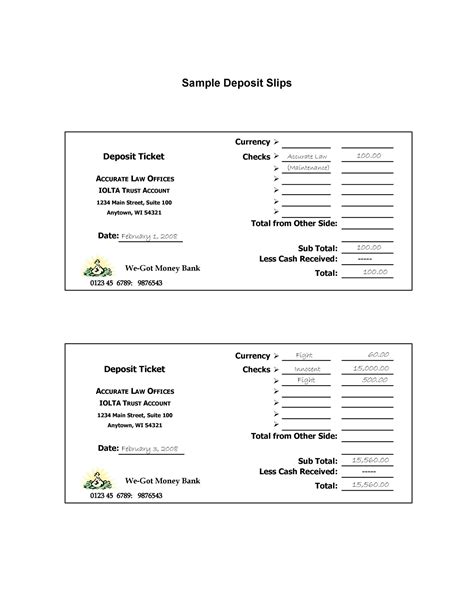

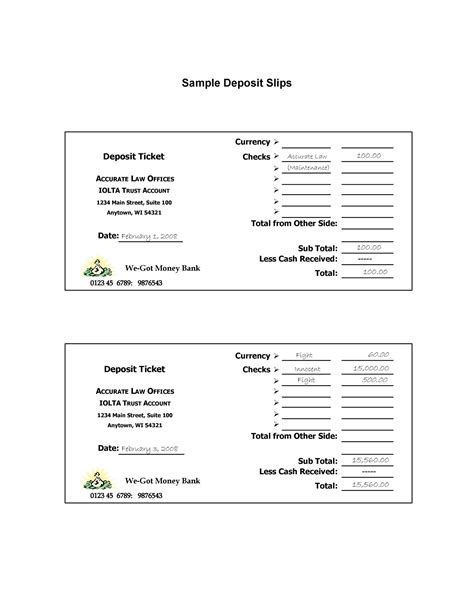

Ever found yourself at the bank, checks in hand, ready to deposit, only to realize you’ve run out of deposit slips? Or maybe you're handling finances for a small business and need a quick, reliable way to make deposits without waiting for a new book of slips. Trust me, I’ve been there – standing sheepishly at the counter, hoping the teller has a spare blank one. It's a tiny moment of panic, but easily avoidable once you master the power of the printable deposit slip.

This isn't just about saving a trip to the bank for new slips; it's about empowerment, efficiency, and ensuring your financial transactions are smooth and stress-free. Whether you're a seasoned account holder or just starting your financial journey, understanding how to properly use and even create your own deposit slips can be a game-changer. I learned the hard way that a little preparation saves a lot of hassle, especially when you're in a hurry!

---

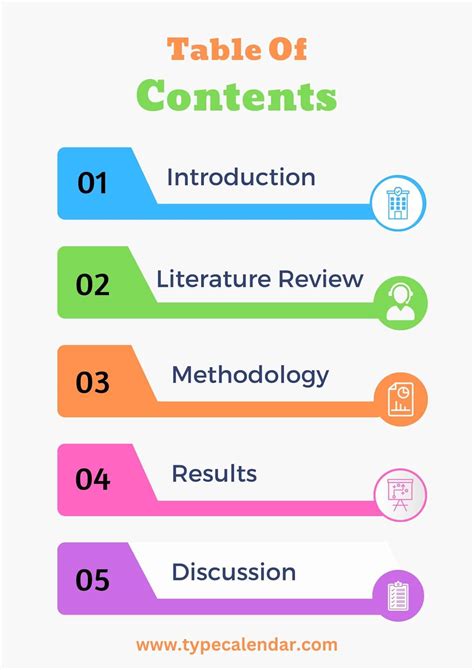

Table of Contents

- The Lifesaver: When You're Out of Bank Slips

- Your Business, Your Way: Generic Slips for Professionals

- The Digital Vault: Keeping a Template Handy

- Deciphering the Details: Essential Information for Every Slip

- Beyond the Basics: Advanced Tips for Smooth Deposits

- Common Roadblocks & How to Swerve Them

- Tips for Personalizing Your Printable Deposit Slip for Success

- Common Pitfalls: What to AVOID When Using a Printable Deposit Slip

---

The Lifesaver: When You're Out of Bank Slips

We've all been there: that sudden realization that your last bank-issued deposit slip has been used. Panic not! A printable deposit slip can be your immediate rescue. This category focuses on how to quickly get a generic slip and ensure it works for your personal banking needs when time is of the essence.

- Scenario 1: The Urgent Deposit. You need to deposit a check right now, but your slip book is empty. Find a reliable generic template online, print it, and fill in your bank name, account number, and routing number. *I once had a crucial bill payment due, and I’d used my last slip the day before! A generic printable saved my bacon.*

- Scenario 2: The ATM Deposit. Many ATMs accept deposits without a physical slip, but if you prefer the added security of documenting your deposit yourself, a self-filled printable deposit slip can be a great backup to include in the envelope.

- Scenario 3: The "Borrowed" Slip. You’re at a friend’s house, and they have an old generic slip from another bank. While you can't use *their* bank's pre-printed info, you *can* use it as a guide to hand-write your own details on a plain piece of paper, ensuring you capture all the necessary fields from a proper slip.

- Scenario 4: Limited Bank Access. You're traveling or your bank branch is closed. Knowing how to generate a printable deposit slip means you can still make a deposit at a shared ATM or a friendly, accommodating branch of another bank (though this is less common and often requires a bank-specific form).

- Scenario 5: Preparing for Emergencies. Keep a blank, filled-out template on your computer. When you run out of physical slips, just print it. This is pure convenience.

Your Business, Your Way: Generic Slips for Professionals

For small business owners, freelancers, or anyone managing funds for an organization, relying solely on bank-issued slips can be inefficient. A generic printable deposit slip template offers flexibility and control, especially if you deal with multiple accounts or high volumes of transactions.

- Scenario 1: Managing Multiple Accounts. If your business has a checking and a savings account, or even separate accounts for different projects, having a versatile printable deposit slip template allows you to easily switch between them by simply changing the account numbers.

- Scenario 2: Streamlining Office Supplies. Why order and store bulky bank deposit slip books when a simple digital template you can print on demand is so much more efficient? This is especially true for remote teams.

- Scenario 3: Handling Client Payments. When receiving checks from clients, having a pre-filled printable deposit slip ready for your business account ensures quick and accurate processing.

- Scenario 4: Charitable Organizations. Treasurers of non-profits, clubs, or school organizations often deal with varied incoming funds. A standardized printable deposit slip helps maintain consistent records.

- Scenario 5: Audit Readiness. Using consistent printable deposit slip templates, even if generic, can help create a uniform paper trail that's easier to track for accounting and auditing purposes.

The Digital Vault: Keeping a Template Handy

The best offense is a good defense! Proactively storing a printable deposit slip template digitally can save you time and stress down the line. This section focuses on methods for digital organization and quick access.

- Scenario 1: Cloud Storage for Access Anywhere. Save a generic deposit slip template (perhaps one you've customized with your bank info) in Google Drive, Dropbox, or OneDrive. *I learned this trick after a mad dash to print a slip from a public library computer before the bank closed. Now, it's always available.*

- Scenario 2: Desktop Shortcut. Create a folder on your computer's desktop specifically for banking essentials, and keep your printable deposit slip template there. It's quick access when you need it.

- Scenario 3: Email Yourself a Backup. Send a copy of your blank printable deposit slip template to your own email address. This creates another accessible backup, even if your usual cloud service is down.

- Scenario 4: Mobile Access. Convert your template into a PDF and store it on your smartphone or tablet. While you can't fill it out easily on mobile, you can quickly share it with someone who *can* print, or find a print shop.

- Scenario 5: Password-Protected File. For added security, store your printable deposit slip template (especially if pre-filled with sensitive info) in a password-protected document or a secure notes app.

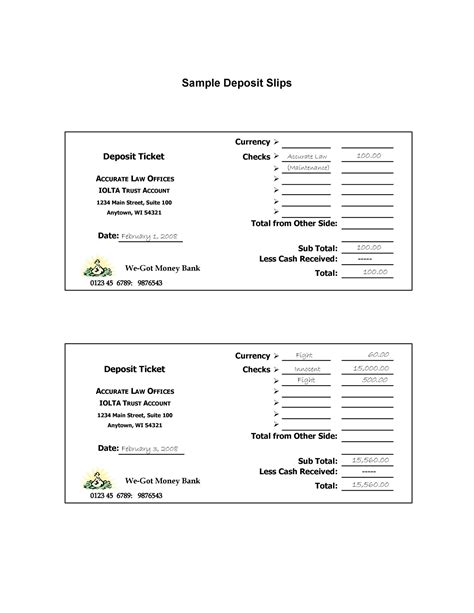

Deciphering the Details: Essential Information for Every Slip

A printable deposit slip is only as good as the information you put on it. Accuracy is paramount here! This category breaks down the critical pieces of information you need to include to ensure your deposit goes through without a hitch.

- Scenario 1: Your Name & Address. Even on a generic slip, write your full name and address clearly. This helps the bank identify you if there's any confusion.

- Scenario 2: Bank Name & Branch (if applicable). While generic slips don't pre-fill this, write your bank's full name. If you use a specific branch often, include that too.

- Scenario 3: Account Number & Routing Number. These are the non-negotiable details. Your account number identifies *your* specific account, and the routing number identifies *your bank*. Double-check these numbers from your checks or online banking portal. *I once mixed up two numbers, causing a significant delay in funds availability – trust me, you don't want to mess this up!*

- Scenario 4: Date of Deposit. Always include the current date. This is crucial for record-keeping and processing timelines.

- Scenario 5: Cash, Checks, and Total. List each item separately. For cash, specify the denominations. For checks, write the check number (if applicable) or the payer's name/bank and the amount. Sum everything up accurately for the total deposit.

- Scenario 6: Signature (for cash back). If you're requesting cash back from a check deposit, you *must* sign the slip. Otherwise, a signature isn't usually required for a simple deposit.

Beyond the Basics: Advanced Tips for Smooth Deposits

Once you're comfortable with the basics, there are a few extra tips that can make using a printable deposit slip even more efficient, especially in less common scenarios.

- Scenario 1: Large Deposits. For very large cash or check deposits, consider visiting a teller directly even with your printable deposit slip. They can verify counts immediately and provide an official receipt, reducing potential discrepancies.

- Scenario 2: Foreign Checks. If you're depositing a check from a foreign bank, always consult your bank's specific policy. A generic printable deposit slip might not be sufficient, and special forms or processing times may apply.

- Scenario 3: Business Deposits with Endorsements. For business deposits involving multiple checks, ensure each check is properly endorsed with "For Deposit Only" and your business account number, regardless of your printable deposit slip.

- Scenario 4: Documenting Your Deposit. Before heading to the bank, take a photo of your filled-out printable deposit slip and the checks/cash you're depositing. This serves as an excellent personal record. *This is my favorite strategy because it saved me countless times when I needed to verify a deposit later!*

- Scenario 5: Printing on Demand vs. Batch Printing. If you make frequent deposits, consider printing a small batch of your preferred printable deposit slip template instead of just one at a time. Store them in an accessible place.

Common Roadblocks & How to Swerve Them

Even with the best intentions, using a printable deposit slip can sometimes hit a snag. Knowing common issues and how to avoid them will ensure your transactions are always smooth.

- Roadblock 1: Illegible Handwriting. If the bank can't read your account number or the deposit amount, your deposit will be delayed or returned. *Don't be like me and try to write it quickly in the car! Take your time, write clearly.*

- Roadblock 2: Incorrect Account/Routing Numbers. This is the biggest culprit for deposit rejections. Double-check, triple-check, and then ask a friend to check them for you. Always cross-reference with your online banking or a voided check.

- Roadblock 3: Missing Information. Forgetting to fill in the date, your name, or the total amount can cause a hiccup. Banks prefer complete information.

- Roadblock 4: Using the Wrong Bank's Slip (if not generic). If you try to use a slip pre-printed with another bank's name and routing number for your bank, it won't work. Stick to truly generic templates or fill in *all* details manually on a blank paper.

- Roadblock 5: ATMs Not Recognizing Generic Slips. While most modern ATMs are quite smart, very old ones might have issues. If depositing via ATM, ensure your printable deposit slip is neat and fits standard dimensions. If unsure, use a teller.

- Roadblock 6: Security Concerns. Be mindful where you print your printable deposit slip if it has sensitive information. Public printers might retain a copy in their memory. Always print at home or from a secure connection.

---

Tips for Personalizing Your Printable Deposit Slip for Success

While a printable deposit slip is a functional tool, you can "personalize" it to make your banking experience smoother and more organized. This isn't about pretty fonts, but about practical efficiency.

- Pre-fill Common Info: If you consistently use the same bank and account, pre-fill your bank name, account number, and routing number into your digital template. This saves time and reduces errors for every print.

- Add a Memo Line for Business: For business users, adding a small "Memo" or "Reference" line at the bottom of your template can be incredibly helpful for tracking specific deposits (e.g., "Jan Sales," "Client XYZ Payment").

- Consider Numbering: If you want to track deposits sequentially, add a small space for a deposit number that you can fill in manually before heading to the bank.

- Include Your Phone Number (Optional): While not typically required, adding a small space for your phone number can be useful in case the bank needs to contact you regarding the deposit. I find this approach works best for small teams or if I'm depositing for someone else.

- Print on Sturdy Paper: While not strictly necessary, printing your printable deposit slip on slightly heavier paper (like 24lb bond) can make it feel more substantial and less likely to wrinkle or tear, especially if you're putting it in an envelope.

Common Pitfalls: What to AVOID When Using a Printable Deposit Slip

Using a printable deposit slip is straightforward, but there are a few common mistakes that can turn a simple transaction into a headache. Steer clear of these pitfalls!

- Avoid Outdated Information: Don't use an old template that might have an outdated routing or account number. Always ensure your digital template is current.

- Don't Rush the Fill-Out: It's tempting to quickly scribble everything, especially if you're in a hurry. Take a breath and write clearly and accurately. A deposit rejected for illegible numbers is incredibly frustrating.

- Never Leave Blanks You Should Fill: While some parts might not apply (like cash back if you're not getting any), ensure all relevant fields (date, name, account numbers, amounts, total) are filled in completely.

- Don't Over-Rely on Memory: Even if you've done it a hundred times, always double-check your account and routing numbers against an official source like your online banking portal or a check. Don't be like me and make this mistake in a clutch moment, thinking you remember the numbers perfectly!

- Avoid Using Flimsy Paper: While you *can* print on regular copier paper, very thin paper might tear or get crumpled, especially if going into an ATM. A standard printer paper is usually fine, but avoid anything overly delicate.

---

Depositing funds shouldn't be a source of stress. By understanding the power of a printable deposit slip – how to create one, what to include, and how to use it effectively – you're taking control of your financial convenience. Keep a template handy, fill it out meticulously, and you'll always be prepared for your next deposit. Now go make those deposits with confidence!