Ever felt that knot in your stomach when you swipe your card, wondering if you have enough in your account? Or worse, the sudden dread of an unexpected overdraft fee? Trust me, I’ve been there. I remember the gut-wrenching feeling of an unexpected bank fee hitting my account just because I hadn't properly tracked a few small purchases. It was a wake-up call that a little bit of organization goes a long way, and sometimes, the simplest tools are the most powerful. That's where a good old-fashioned checkbook register comes in – a surprisingly effective way to regain control of your money, even in our digital age.

You might think paper tracking is outdated, but for many, it’s the most tangible and reliable way to see where every penny goes. Whether you’re a seasoned budgeter looking for a new template or just starting your financial journey and need a clear, easy-to-use tool, the right free printable checkbook register printable can be a game-changer. We're going to dive deep into different types of registers, why they matter, and how to use them to keep your finances clear, calm, and collected. Let’s make that financial peace a reality!

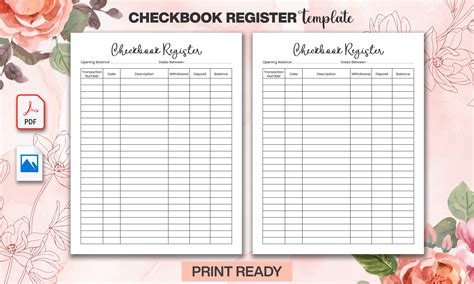

The Essential Classic: Back to Basics Checkbook Registers

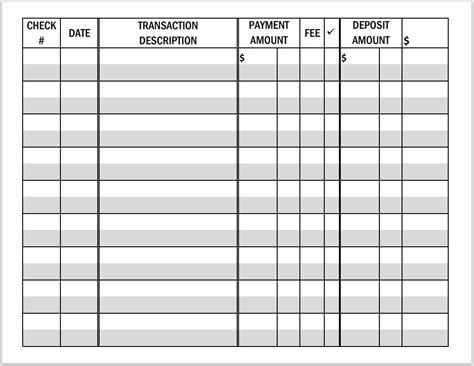

Sometimes, less is truly more. For those who want to stick to the fundamentals of money management without any frills, the classic checkbook register is your best friend. It provides just the essential columns for recording transactions and balancing your account. This is perfect for beginners or anyone who finds too many categories overwhelming.

- Standard Transaction Log: Simple columns for date, transaction number, description, payment/debit, deposit/credit, and balance. No fuss, just facts.

- Clear & Legible Layouts: Designed with ample space for writing, ensuring your entries are always readable, even if your handwriting isn't perfect after that third coffee.

- Balance-Focused Design: Prioritizes the running balance column, making it easy to see your exact available funds at a glance.

- Compact Versions: Many classic designs are made to fit perfectly into a standard checkbook cover, so it feels familiar.

- No-Distraction Format: Ideal for those who want to focus purely on the numbers without added budgeting categories.

- Error-Reduction Layout: The clear, linear flow helps minimize skipped lines or misplaced entries.

- Quick Reference: Great for when you need to quickly jot down a transaction on the go without getting bogged down in detail. I used a bare-bones version of this when I was first learning to manage my college expenses—it taught me discipline!

Budget-Friendly & Categorized: Beyond the Basics for Smarter Spending

Ready to take your financial tracking up a notch? These printable checkbook registers go beyond just balancing your checks. They incorporate extra columns or sections designed to help you categorize spending, track income streams, and even set mini-budgets right within your register. This is ideal for those actively trying to understand where their money goes and make conscious spending decisions.

- Expense Category Columns: Dedicated sections for "Groceries," "Utilities," "Entertainment," etc., allowing you to see spending patterns instantly.

- Income Source Tracking: Specific areas to note where your money is coming from (e.g., "Paycheck," "Side Gig," "Reimbursement").

- Budget Alignment Features: Some templates include small sections for monthly budget goals alongside your transactions.

- Savings & Debt Tracking: Dedicated lines to record contributions to savings goals or payments towards specific debts.

- Project-Specific Tracking: If you have a one-off project or event (like planning a trip), a categorized register can help you keep its finances separate. I personally used a version like this when I was tracking my wedding budget, and it saved me so much stress and helped us stay within our limits!

- Visual Spending Insights: By categorizing, you get a clearer picture of your spending habits without needing extra spreadsheets.

- Flexible Customization: Many of these allow you to hand-write your own categories, making them highly adaptable to your unique financial life.

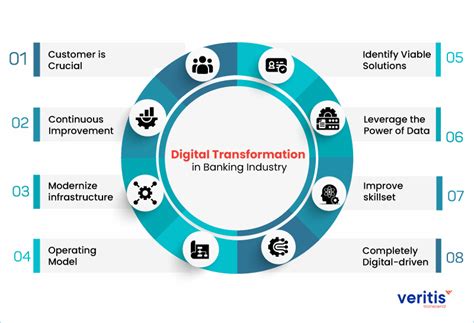

Digital-Sync Companion: The Hybrid Approach for Modern Banking

Even if you do most of your banking online, having a physical backup can provide an invaluable sense of security and clarity. These printable registers are designed to complement your digital banking, offering a tangible record that mirrors your online statements, helping you catch discrepancies or simply understand your financial flow better.

- Reconciliation Focus: Layouts optimized for easily comparing your physical record with your online bank statement at a glance.

- Online Transaction Integration: Space to note transactions made with debit cards, credit cards (when paid from your checking account), and online transfers.

- Clear Check-off Boxes: Small boxes next to each entry to mark when a transaction has cleared your bank account.

- Monthly Reconciliation Sections: Dedicated areas to tally your digital vs. physical balances at the end of each month.

- Error Detection Aid: A paper trail makes it easier to spot unauthorized transactions or bank errors.

- Security Layer: If your online access is ever compromised, you still have your most recent transactions recorded. This is my favorite strategy because it saved me countless times when I briefly lost internet access or experienced online banking glitches – knowing I had my own accurate record was a huge relief!

- Offline Access: Perfect for those moments when technology fails or you simply prefer a break from screens.

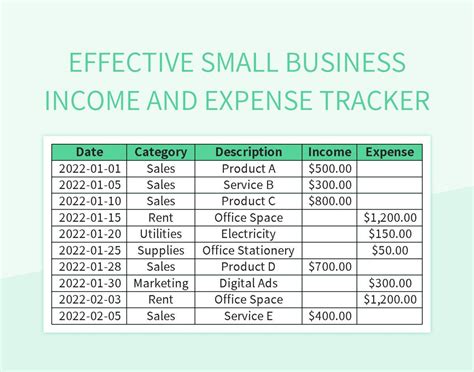

Small Business & Side Hustle Simplified: Your Basic Income & Expense Log

Running a small business or a bustling side hustle means tracking every dollar is paramount for taxes and profitability. These free printable checkbook register printables are tailored to provide a basic, straightforward log of income and expenses, ensuring you have a clear financial snapshot without needing complex accounting software just yet.

- Income/Expense Split: Clear differentiation between money coming in and money going out, often with separate columns.

- Client/Project Reference: Space to note which client or project a transaction relates to, simplifying invoicing and tracking.

- Tax-Ready Data: Designed to help you easily extract the necessary information for tax season, whether for Schedule C or general expense deductions.

- Simple Profit/Loss View: The running balance can effectively show your basic cash flow for your venture.

- Mileage/Notes Section: Some versions include small areas for additional details pertinent to business expenses, like mileage or meeting notes.

- Proof of Transaction: A physical log can serve as a supplementary record should you ever need to verify a payment or expense. I once used a simple version of this when first starting my freelance writing gig, and it was a lifesaver for keeping my small, irregular income and expenses organized for tax time.

- Streamlined for Non-Accountants: Uses straightforward language and layout, making it accessible even if you're not a financial expert.

Minimalist & Modern Designs: Aesthetic Meets Function

Who says financial tools have to be boring? For those who appreciate clean lines, modern aesthetics, and a less cluttered look, these free printable checkbook register printable options combine functionality with visual appeal. They offer the necessary tracking elements in a design that's pleasing to the eye and encourages consistent use.

- Clean Layouts: Plenty of white space, clear fonts, and minimal decorative elements for a crisp look.

- Aesthetic Appeal: Designed to be visually pleasing, making the task of logging transactions feel less like a chore and more like a structured habit.

- Reduced Visual Clutter: Fewer lines and simpler boxes make the data easier to digest quickly.

- Printer-Friendly: Often designed to use less ink, which is a bonus for printables!

- Versatile Use: Their clean design makes them suitable for a wide range of users, from students to professionals.

- Focus on Clarity: The emphasis is on making your financial data immediately understandable without distractions.

- Professional Feel: Great for those who like their organizational tools to reflect a sleek, modern approach.

Tips for Personalizing Your Printable Register Experience

Getting a free printable checkbook register printable is just the first step. Making it truly *yours* and effective involves a few personal touches.

- Choose Your Perfect Fit: Don't just pick the first one you see! Browse different designs. Do you prefer lots of space, or a compact layout? Do you need extra columns for categories, or just the basics?

- Color-Coding Magic: Use different colored pens for debits vs. credits, or assign colors to specific spending categories (e.g., red for bills, green for savings contributions). This creates an instant visual map of your money.

- Laminate for Longevity: If you find yourself needing to erase and update frequently, or if you just want your register to withstand daily use, consider printing it on slightly thicker paper or even laminating it and using a dry-erase marker. I find laminating my frequently used registers helps them last longer, especially if I'm erasing and re-writing.

- Integrate with Your Planner: Punch holes and add your register pages directly into your planner or budget binder for a cohesive financial hub.

- Add Personal Reminders: Jot down upcoming bill due dates, savings goals, or even motivational quotes directly onto your register pages to keep your financial objectives top of mind.

Common Pitfalls: What to AVOID When Using Your Checkbook Register

While a free printable checkbook register printable is a fantastic tool, it's only as good as how you use it. Avoid these common mistakes to ensure your register truly serves its purpose:

- Not Updating Regularly: This is the biggest one! The moment you make a transaction, write it down. Waiting means you’re relying on memory, which is a recipe for disaster. Don’t be like me and forget to record that impulse coffee purchase – it adds up and can throw your whole balance off!

- Ignoring Small Transactions: That $3 coffee, the $1.50 vending machine snack – they seem insignificant, but they accumulate rapidly. Every single penny needs to be recorded to maintain an accurate balance.

- Relying Solely on Digital Alerts: While bank alerts are helpful, they shouldn't replace your active tracking. Sometimes alerts are delayed, or you miss one. Your register is your primary, proactive record.

- Not Reconciling Your Account: Once a week or at least once a month, compare your register with your bank statement. This catches errors (yours or the bank’s!) and ensures you have the most accurate picture of your funds.

- Making Assumptions: Never assume a check has cleared or a payment has gone through. Always verify and record the actual transaction date and amount.

- Not Balancing Your Register: The whole point is to have a running balance. Don't skip this crucial step, or you'll lose the immediate clarity that the register provides.

There you have it – the power of a simple, free printable checkbook register printable is within your grasp! Whether you're aiming for basic organization, detailed budgeting, or a smooth transition into small business finances, there's a template out there waiting to bring you clarity and peace of mind. Stop guessing and start knowing where your money stands. Now go forth and master your money, one careful entry at a time!