Ever stared at your bank account and felt like you were running on a financial treadmill, getting nowhere fast? Trust me, I’ve been there. For years, I struggled with saving, oscillating between grand intentions and impulsive spending. Then I stumbled upon something that completely transformed my approach to money: the 100 envelope challenge printable. It sounded almost too simple to work, a quirky little game to trick your brain into saving. But let me tell you, this isn't just a gimmick; it's a powerful, tangible method that has helped thousands, myself included, watch their savings grow, sometimes reaching a surprising $5,050!

This challenge is more than just stuffing cash into envelopes; it’s about building a habit, visualizing your progress, and making saving genuinely fun. If you’re tired of vague financial goals and ready for a concrete, rewarding journey, you've come to the right place. We're diving deep into everything you need to know about the 100 envelope challenge, providing actionable strategies, essential tips, and even the pitfalls to avoid, all designed to help you succeed. Let's turn those saving dreams into a delightful reality!

---

The Beginner's Blueprint: Kicking Off Your Savings Journey

If you’re new to this, here’s why the 100 envelope challenge printable is so incredibly effective. It breaks down a big financial goal into manageable, bite-sized steps, making it less intimidating and more achievable. Think of it as a game, not a chore!

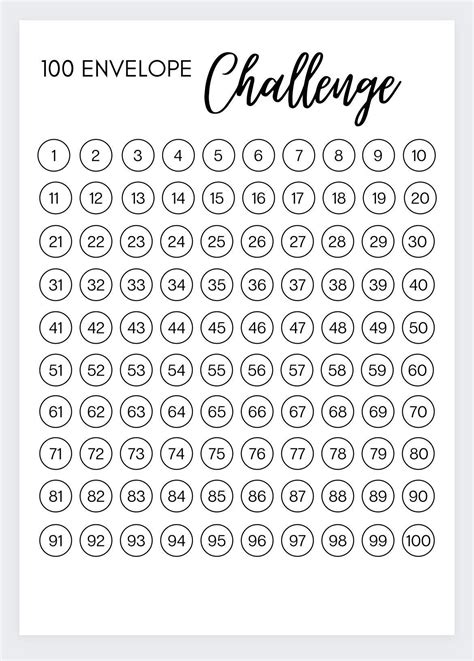

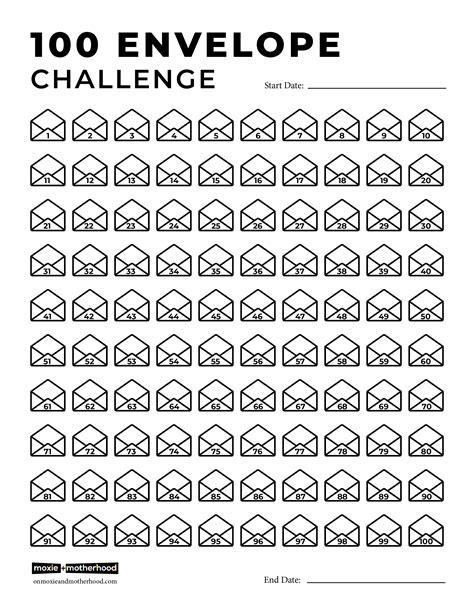

- Understanding the Basics: The challenge involves 100 envelopes, numbered 1 to 100. Each week (or day, or whenever you can), you pick two envelopes at random and put the corresponding dollar amount into each. So if you pick '7' and '50', you put $7 in one and $50 in the other.

- The Power of Randomness: This random element keeps it exciting and prevents "cherry-picking" only the small numbers. You never know what you're going to get, which adds a fun, gamified element to saving.

- Visualizing Progress: Seeing those envelopes fill up, one by one, is incredibly motivating. It's a tangible representation of your growing savings.

- Setting Your Pace: While traditionally weekly, you can adjust the frequency. Some people pick two envelopes every two weeks, or even just one a day. It’s all about finding a rhythm that works for your budget. I started with once a week, and it felt very sustainable.

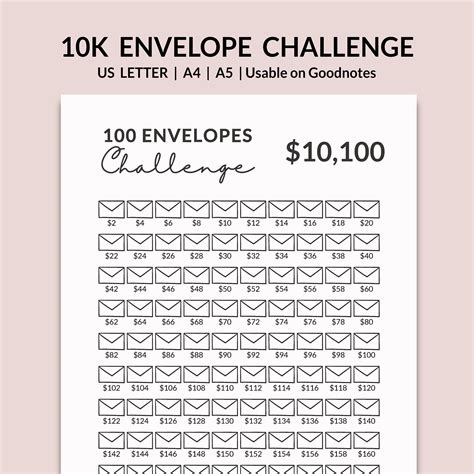

- The Magic Sum: By the end, you'll have saved $5,050! It's an impressive sum that often surprises people who thought they "couldn't save."

- Essential Supplies: All you need are 100 envelopes, a pen, and your chosen 100 envelope challenge printable (or a DIY numbering system).

- Designate a Savings Goal: Before you start, decide what you're saving for. A vacation? An emergency fund? A down payment? This keeps your motivation high.

Strategic Savers: Maximizing Your 100 Envelope Challenge

Once you've got the hang of the basics, you can start to implement strategies that optimize your savings and help you navigate the challenge more effectively. Veterans can use this strategy to maximize results and avoid common roadblocks.

- Reverse the Challenge (for Faster Starts): Instead of picking randomly, start with the higher numbers (e.g., 100, 99) if you have extra cash at the beginning of the month. This gets the "hard parts" out of the way early when motivation is typically highest.

- Pairing Strategy: Some people like to pair envelopes that add up to 101 (e.g., 1 and 100, 2 and 99). This ensures you're always putting away $101 per "round," which can make budgeting more predictable. I've personally found this approach works best for small teams (read: my partner and I, splitting the load).

- Seasonal Saving Spikes: Plan to tackle higher numbers during times you anticipate having extra income, like tax refunds, bonuses, or holiday tips.

- Digital Alternatives: If you're uncomfortable with cash, you can adapt this. Use a digital spreadsheet to track which envelopes you've "filled" and transfer the money directly into a separate savings account. While it lacks the physical touch, it still works.

- Goal-Oriented Allocation: If you have multiple mini-goals (e.g., $1000 for a new laptop, $500 for a weekend trip), mentally assign certain envelope ranges to each goal.

- Reward Milestones: Plan small, non-monetary rewards for hitting specific milestones (e.g., after 25 envelopes, 50 envelopes). This keeps the motivation flowing.

- Family/Household Challenge: Get your family involved! Assign different envelopes to different members or work together as a team towards a shared family goal.

Motivation & Mindset: Staying Consistent (Even When It's Hard!)

The 100 envelope challenge, like any saving journey, isn't always smooth sailing. There will be weeks where money feels tight. Here's how to keep your spirits up and stay consistent.

- Celebrate Every Envelope: Seriously, even putting $1 in envelope #1 is a win. Acknowledge every step you take.

- Keep Your Goal Visible: If you're saving for a trip, have a picture of your dream destination near your envelopes. If it's debt repayment, picture yourself debt-free.

- Find Your "Why": Remind yourself constantly why you started this. Is it financial freedom? A new car? An emergency cushion? Your "why" is your fuel.

- Accountability Partner: Share your progress with a friend or family member. Knowing someone else is cheering you on (or doing the challenge with you) can be a huge motivator.

- Track Your Progress: Use your 100 envelope challenge printable to mark off each envelope as you fill it. Seeing the visual progression is incredibly satisfying.

- Focus on Progress, Not Perfection: Don't beat yourself up if you miss a week or can only do one envelope instead of two. Just pick up where you left off. Consistency over perfection, always.

- Remember the "Snowball Effect": The beginning can feel slow, but as you get into higher numbers, the amounts add up quickly. That feeling of hitting $100 in an envelope is pure joy!

Troubleshooting & Tweaks: What If Life Happens?

Life is unpredictable, and sometimes, sticking rigidly to a plan just isn't feasible. Here’s how to adapt the challenge without giving up entirely.

- The "Rainy Day" Envelope: Consider having one "emergency" envelope that you can pull from if you absolutely need cash for an unexpected expense. The goal is to avoid it, but it's a safety net.

- Borrowing from Future Envelopes: If you're really stuck, you can "borrow" from a future, higher-numbered envelope (e.g., take $10 from envelope #50 to cover #10 now). Just remember to replace it later!

- Pause and Reset: If finances get really tight, don't abandon the challenge. Just pause it for a week or two, or reduce the number of envelopes you're filling. Resume when you can.

- Mini-Challenges Within: If you finish the 100 envelopes, try a "reverse 100 envelope challenge" where you save smaller amounts for specific small goals.

- Dealing with Missing Envelopes: It happens! If you can't find a specific envelope number, just grab another one from your stack. The goal is to fill 100 unique values.

- Digital Backup: Always have a digital record of your progress if you're using a physical printable. A quick photo or a simple spreadsheet can save you a headache if your envelopes get misplaced.

- Review Your Budget: If you're consistently struggling, it might be a sign to re-evaluate your overall budget. The challenge highlights spending patterns.

Creative Customizations: Making Your Printable Uniquely Yours

The beauty of the 100 envelope challenge printable is its flexibility. Don't be afraid to make it your own!

- Theme Your Challenge: Saving for a Disney trip? Decorate your envelopes with Disney characters! Saving for a car? Use car-themed stickers. This personalizes the experience.

- Alternate Values: If $5,050 is too much (or not enough!), you can adjust the values. For example, half the values (0.50, $1, $1.50... up to $50) to save $2,525, or double them ($2, $4, $6... up to $200) to save $10,100!

- Color-Coding: Assign different colors to envelopes based on their value range (e.g., green for $1-25, yellow for $26-50, red for $51-100). This adds a visual cue and makes selection fun.

- Add Personal Reminders: Write small notes on the back of the envelopes or directly on your printable with motivational quotes, your specific mini-goal for that amount, or a positive affirmation.

- Digital Design: If you're tech-savvy, design your own unique 100 envelope challenge printable with custom fonts, colors, and graphics that truly reflect your personality.

- Reverse Order Completion: Some people prefer to start with 100 and work their way down. This gets the "hardest" parts out of the way first.

- Combine with Other Challenges: Integrate it with a "no-spend challenge" week, or a "round-up savings" app to boost your envelope contributions.

Beyond the 100 Envelopes: What Comes Next?

So you've conquered the 100 envelope challenge printable and have a hefty sum in your hands. What now? This is where the real fun begins!

- Invest Wisely: Don't let that money sit idle! Consider putting it into a high-yield savings account, a CD, or even exploring low-risk investments if you've done your research.

- Tackle Debt: This challenge is an excellent way to build a lump sum to pay down high-interest debt, accelerating your journey to financial freedom.

- Start a New Challenge: Perhaps the "52-week savings challenge" or a "no-spend month." There are countless ways to keep the momentum going.

- Re-Evaluate Your Goals: With $5,050 under your belt, you might feel empowered to set even bigger financial goals.

- Teach Others: Share your success story! Your journey can inspire friends, family, or even strangers to take control of their finances.

- Splurge (Responsibly!): It's okay to use a small portion of your hard-earned savings to celebrate. Just ensure it aligns with your overall financial plan.

- Build an Emergency Fund: If you haven't already, this $5,050 is a fantastic foundation for a robust emergency fund, providing peace of mind.

---

Tips for Personalizing Your 100 Envelope Challenge Printable

Making the 100 envelope challenge printable truly *yours* is key to its success. It transforms from a generic task into a personal mission.

- Define Your "Why": Beyond just "saving," specify what this money will *do* for you. Is it for a dream vacation? A down payment? That clarity will fuel your commitment.

- Add Your Own Rules: Maybe you decide to only pick envelopes on Tuesdays, or only after you've hit a certain step count. These personal quirks make it more engaging.

- Decorate Your Envelopes: Simple as it sounds, decorating each envelope with doodles, stickers, or even a mini-goal written on it can make it feel more exciting.

- Create a Vision Board: Pair your physical envelopes with a digital or physical vision board depicting what you're saving for. This is my favorite strategy because it saved me countless times from wavering!

- Use Unique Markers: Instead of just crossing off numbers, use different colored pens, stamps, or stickers to mark completed envelopes on your printable.

- Incorporate a "Skip" Rule: If you're genuinely stuck, allow yourself one or two "skip" weeks throughout the entire challenge, with the understanding you'll make it up later.

- Integrate Affirmations: Write positive money affirmations on your printable or inside your envelopes. "I am a powerful saver," or "Money flows easily to me."

Common Pitfalls: What to AVOID When Starting the 100 Envelope Challenge

Even the best intentions can go awry. Here’s what I learned the hard way (and what to avoid!) to ensure your 100 envelope challenge printable journey is smooth.

- Don't Raid Your Envelopes Prematurely: This is the biggest temptation! Avoid treating your envelopes like an emergency piggy bank for non-emergencies. Don’t be like me and raid your envelopes for a spontaneous pizza order!

- Avoid Over-Committing: Don't try to fill too many envelopes at once, especially in the beginning. It's better to go slower and consistently than to burn out quickly.

- Don't Keep It a Secret (Unless You Prefer To): While personal, sharing your goal with a trusted friend or family member can provide accountability. Hiding it often means less motivation.

- Don't Forget Your "Why": Losing sight of your ultimate goal is a surefire way to lose motivation. Keep it front and center.

- Ignoring Your Budget: The challenge isn't a replacement for a budget; it's a *tool* to work within one. Make sure you can actually afford the amounts you're putting away without sacrificing essentials.

- Leaving Envelopes Unsecured: If you're using cash, ensure your envelopes are stored in a safe, private place where they won't be easily found or tampered with.

- Getting Discouraged by High Numbers: Those $80s and $90s can feel daunting. Remember that the lower numbers balance them out, and the total is always $5,050. It all averages out!

---

Congratulations, future financial rockstar! You now have a comprehensive roadmap to conquer the 100 envelope challenge printable. It’s more than just a savings strategy; it’s a journey of self-discipline, visualization, and celebrating small victories that add up to something truly significant. Remember, consistency is your best friend, and every single envelope filled is a step closer to your financial goals. So, grab that printable, get those envelopes ready, and prepare to watch your savings grow in the most satisfying way possible. Now go make that money magic happen!