As a small business owner, I intimately understand the whirlwind of daily operations. From greeting customers with a smile to managing inventory and marketing, there's always a new hat to wear. But amidst the chaos, one task often quietly hums in the background, a silent sentinel guarding your hard-earned revenue: the daily cash drawer count. It’s not the glamorous part of running a business, certainly, but it's arguably one of the most critical. Trust me, I remember my first few months running a small artisanal bakery; the sheer dread of the end-of-day count, the nervous fumbling, and the heart-stopping moment when the numbers just wouldn't reconcile. If only I'd had a clear, comprehensive guide to a printable daily cash drawer count sheet then, it would have saved me countless hours of frustration and a few grey hairs!

That initial struggle taught me a profound lesson: accurate cash management isn't just about balancing books; it's about building trust, preventing loss, and gaining invaluable peace of mind. It’s about knowing, with certainty, that every penny is accounted for, allowing you to focus on what you do best – serving your customers and growing your dream. This isn't just a guide; it's a lifeline designed to empower you, whether you’re a seasoned entrepreneur or just starting your journey. We'll delve into everything you need to know about "printable daily cash drawer count sheets," from their fundamental importance to advanced customization, troubleshooting, and even integrating them into modern workflows. Prepare to transform your daily cash reconciliation from a daunting chore into a streamlined, stress-free process.

---

Table of Contents

- [The Unsung Hero: Why a Daily Cash Count Sheet is Your Business's Best Friend](#the-unsung-hero-why-a-daily-cash-count-sheet-is-your-businesss-best-friend)

- [Anatomy of Accuracy: What Makes a Great Cash Drawer Count Sheet?](#anatomy-of-accuracy-what-makes-a-great-cash-drawer-count-sheet)

- [From Zero to Hero: A Step-by-Step Guide to Daily Cash Reconciliation](#from-zero-to-hero-a-step-by-step-guide-to-daily-cash-reconciliation)

- [Beyond the Basics: Customizing Your Cash Count for Unique Business Needs](#beyond-the-basics-customizing-your-cash-count-for-unique-business-needs)

- [The Digital Shift: Integrating Printable Sheets with Modern POS Systems](#the-digital-shift-integrating-printable-sheets-with-modern-pos-systems)

- [Troubleshooting Tales: Common Cash Count Discrepancies and How to Fix Them](#troubleshooting-tales-common-cash-count-discrepancies-and-how-to-fix-them)

- [E-E-A-T in Action: Building Trust and Accountability with Every Count](#e-e-a-t-in-action-building-trust-and-accountability-with-every-count)

- [The Future of Funds: Innovations and What's Next for Cash Management](#the-future-of-funds-innovations-and-whats-next-for-cash-management)

- [The "Printable" Power: Where to Find, Download, and Create Your Own Sheets](#the-printable-power-where-to-find-download-and-create-your-own-sheets)

- [Training Your Team: Empowering Employees for Flawless Cash Handling](#training-your-team-empowering-employees-for-flawless-cash-handling)

- [How to Choose the Best Printable Daily Cash Drawer Count Sheet for Your Needs](#how-to-choose-the-best-printable-daily-cash-drawer-count-sheet-for-your-needs)

- [Common Pitfalls to Avoid in Cash Drawer Counting](#common-pitfalls-to-avoid-in-cash-drawer-counting)

- [Advanced Tips for Experts: Optimizing Your Cash Handling Workflow](#advanced-tips-for-experts-optimizing-your-cash-handling-workflow)

- [Conclusion: Reclaim Your Peace of Mind, One Count at a Time](#conclusion-reclaim-your-peace-of-mind-one-count-at-a-time)

---

The Unsung Hero: Why a Daily Cash Count Sheet is Your Business's Best Friend

Let's be honest, the idea of a "printable daily cash drawer count sheet" might not spark immediate excitement. It's not a flashy marketing campaign or a groundbreaking new product. Yet, for any business that handles cash, it is an absolutely foundational tool, a silent guardian protecting your revenue and reputation. Think of it as the bedrock upon which sound financial management is built. Without it, you're essentially sailing a ship without a compass, hoping to hit your destination.

Here's why this seemingly simple sheet is an indispensable asset for your business:

1. Ensuring Accuracy and Preventing Loss: This is the most obvious, but often underestimated, benefit. A structured sheet ensures that every denomination is counted, recorded, and reconciled. This drastically reduces the chances of human error (like miscounting a stack of twenties) and makes it much harder for internal theft or external skimming to go unnoticed. I once had a new employee who, in their haste, consistently miscounted the hundreds. It wasn't until we implemented a mandatory, signed daily count sheet that we pinpointed the recurring error and corrected it with proper training.

2. Streamlining End-of-Day Procedures: The closing shift can be hectic. Customers are winding down, staff are tired, and everyone wants to go home. A clear, printable daily cash drawer count sheet provides a step-by-step framework, turning a potentially chaotic task into an orderly routine. This saves time, reduces stress, and ensures consistency regardless of who is closing.

3. Facilitating Audits and Financial Reporting: When tax season rolls around or if you ever need to conduct an internal audit, these sheets are gold. They provide a clear, chronological record of your cash movements, making it easy to track daily sales, bank deposits, and cash-on-hand. This level of documentation is crucial for compliance and financial transparency.

4. Identifying Trends and Discrepancies: Over time, these sheets can reveal patterns. Are discrepancies more common on certain days, with particular staff members, or during specific shifts? The data collected on your printable daily cash drawer count sheet can highlight areas needing further investigation or additional training, helping you proactively address issues before they escalate.

5. Building Trust and Accountability: When every employee knows that the cash drawer will be counted and reconciled against a standard sheet, it fosters a culture of accountability. It’s not about mistrust; it’s about creating a fair, transparent system where everyone is empowered to manage cash responsibly. My team actually *prefers* using the count sheet now because it gives them confidence in their work and protects them from blame if an issue arises outside their shift.

6. Simplifying Training for New Staff: Onboarding new employees can be daunting, especially when it comes to cash handling. A well-designed cash count sheet acts as a visual guide and a checklist, making the training process smoother and ensuring new hires learn the correct procedures from day one.

7. Providing a Paper Trail for Investigations: In the unfortunate event of significant theft or an unexplained shortage, these sheets become vital evidence. They document who counted the drawer, when, and what the totals were, providing a critical paper trail for internal investigations or law enforcement.

8. Enhancing Overall Business Security: Beyond just counting, the act of using a printable daily cash drawer count sheet reinforces good security practices. It encourages vigilance and attentiveness to cash handling, contributing to a more secure environment for your business and its assets.

9. Reducing Stress and Anxiety: Knowing that your cash is accurately accounted for brings incredible peace of mind. For me, overcoming that initial bakery reconciliation nightmare was a huge weight lifted. This proactive measure significantly reduces the anxiety associated with financial management.

10. Customizable to Your Specific Needs: Unlike rigid software, a printable sheet can be easily adapted. Whether you're a small cafe, a retail store, or a service provider, you can design or choose a sheet that perfectly fits your unique operational flow and the denominations you typically handle.

11. Cost-Effective Solution: Compared to expensive cash management software or automated counting machines, a printable sheet is incredibly economical. You just need paper and a printer – a small investment for such significant returns in accuracy and security.

12. Promoting Best Practices: The very act of incorporating a "printable daily cash drawer count sheet" into your routine instills a commitment to best practices in financial operations. It sets a professional standard for your business, regardless of its size.

Anatomy of Accuracy: What Makes a Great Cash Drawer Count Sheet?

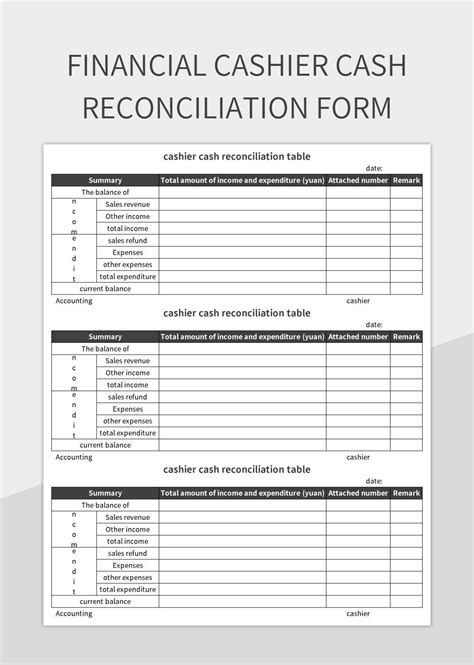

Just like a perfectly baked croissant has layers of flaky pastry, a truly effective "printable daily cash drawer count sheet" has several key components that work together to ensure accuracy and efficiency. It’s not just a blank piece of paper; it’s a thoughtfully designed tool. Understanding these elements will help you either choose the best template or create one that perfectly suits your business.

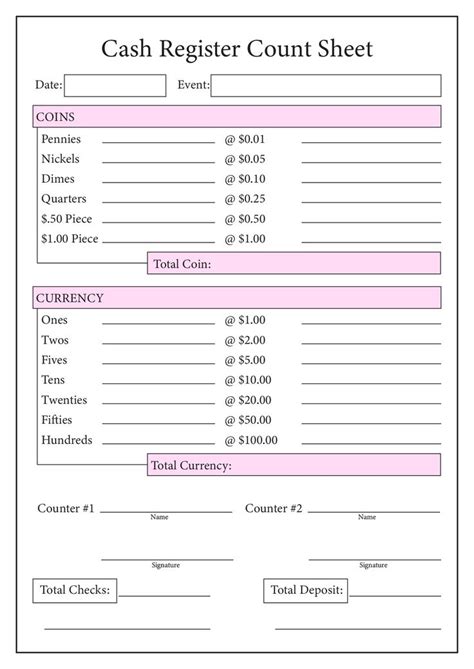

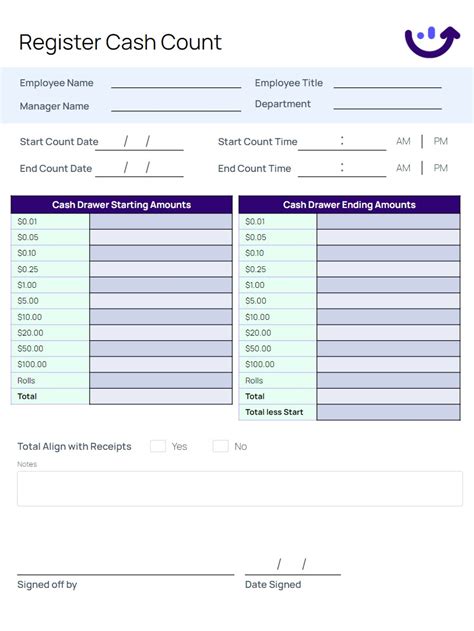

Here are the essential ingredients for an exemplary cash drawer count sheet:

1. Clear Identification Fields:

- Date: Crucial for chronological record-keeping.

- Shift/Drawer Number: Especially important for businesses with multiple shifts or cash registers.

- Employee Name/ID: For accountability, to track who performed the count. I always make sure this field is prominent, as it immediately assigns responsibility and boosts carefulness.

- Manager/Supervisor Signature: Adds an extra layer of verification and authorization.

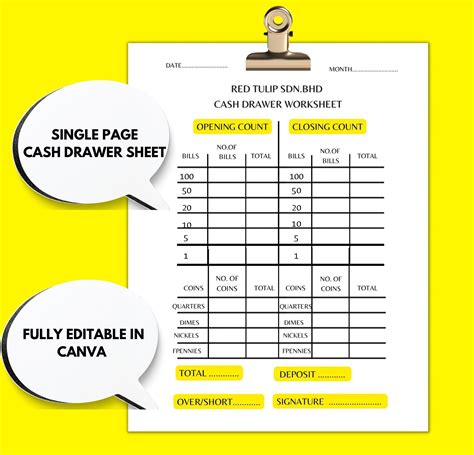

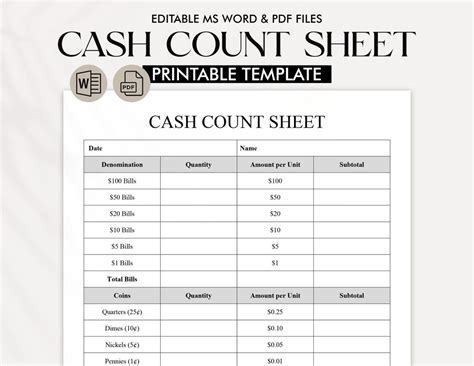

2. Denomination Breakdown:

- Individual Lines for Each Currency Denomination: Pennies, nickels, dimes, quarters, $1, $5, $10, $20, $50, $100 bills. Some businesses might also include half-dollars or $2 bills if they deal with them frequently.

- Column for "Quantity": Where the employee writes the number of each coin/bill.

- Column for "Value": Where the calculated value (Quantity x Denomination) is entered. This minimizes mental math errors.

3. Starting Bank/Petty Cash Section:

- A designated space to record the "start bank" or "float" – the amount of cash placed in the drawer at the beginning of the shift. This is absolutely critical for calculating the day's actual sales. Without it, you're just counting cash, not reconciling sales.

4. Non-Cash Sales/Tender Section:

- Credit Card Sales: Total from POS system.

- Debit Card Sales: Total from POS system.

- Gift Card Sales/Redemptions: Important for tracking non-cash revenue.

- Checks Received: Individual listing or total.

- Other (e.g., House Accounts, Vouchers): A flexible field for unique payment types.

5. Declared Cash Sales Calculation:

- A clear formula or section that calculates the expected cash sales for the day. This typically involves: (Total Cash in Drawer at Close) - (Start Bank) = Declared Cash Sales.

6. POS/System Sales Comparison:

- POS Cash Sales Total: The amount of cash sales reported by your Point-of-Sale (POS) system for that specific shift or day.

- Over/Short Calculation: This is the moment of truth! (Declared Cash Sales) - (POS Cash Sales Total) = Over or Short Amount. A well-designed sheet makes this calculation explicit and easy to see.

7. Deposit Information:

- Amount to be Deposited: The total cash that will be taken to the bank.

- Deposit Bag Number: For security and tracking.

- Date of Deposit:

8. Notes/Comments Section:

- This is often overlooked but incredibly valuable. It provides a space for employees to explain any discrepancies, unusual transactions, or observations. For example, "Short $5 – customer paid with a counterfeit $50 bill, unable to recover." Or "Over $2 – found loose change near register." This section can be a lifesaver for clarifying issues later. I recall one particularly busy Saturday where a note like "Large bill broken for another register, not recorded as sale" immediately cleared up a $50 discrepancy that would have otherwise caused a panic.

9. Clear Headings and Layout:

- Easy-to-read fonts, logical flow, and sufficient space for writing. A cluttered sheet is a recipe for errors.

10. Disclaimer/Policy Reminder (Optional but Recommended):

- A small section at the bottom reminding staff of company policy regarding cash handling, discrepancies, or reporting suspicious activity. This reinforces best practices.

11. Sequential Numbering (Optional):

- Pre-printed sequential numbers on each sheet can help ensure all sheets are used and accounted for, preventing missing records.

12. Double-Check/Verification Line:

- A line for a second person (manager/supervisor) to initial or sign after verifying the count, adding another layer of security and accuracy. This can be especially useful for high-volume businesses or those with high cash flow.

From Zero to Hero: A Step-by-Step Guide to Daily Cash Reconciliation

If you're new to the world of daily cash reconciliation, the process might seem intimidating. But fear not! With a good "printable daily cash drawer count sheet" and a systematic approach, you'll become a cash-counting hero in no time. This step-by-step guide is designed to be beginner-friendly, breaking down each action into manageable parts.

Here’s your roadmap to flawless daily cash reconciliation:

1. Gather Your Tools:

- Your chosen printable daily cash drawer count sheet.

- A pen that writes clearly.

- Your cash drawer (till).

- Your Point-of-Sale (POS) system's end-of-day report.

- A calculator (or a reliable mental math ability!).

- A secure place to store counted cash and your sheet.

- *Personal Scenario:* When I first started, I used to grab any old scrap paper. Now, I have a dedicated "cash count station" with everything neatly organized. It makes a huge difference in efficiency and accuracy.

2. Prepare the Cash Drawer for Counting:

- Remove all cash from the drawer. This means bills and coins.

- Separate non-cash items. Put aside credit card slips (if you still use paper), checks, gift cards, and vouchers. These will be reconciled separately but are not part of the physical cash count.

- Ensure a clean counting surface. A clear, uncluttered desk or counter helps prevent items from getting lost or mixed up.

3. Count the Bills (Largest to Smallest):

- Start with the largest denomination ($100s, then $50s, etc.).

- Count each stack carefully. Group them in fives or tens to make counting easier and less prone to error.

- On your printable daily cash drawer count sheet, record the quantity of each denomination in the designated "Quantity" column.

- *Example:* If you have three $100 bills, write "3" in the $100 quantity row.

4. Count the Coins (Largest to Smallest):

- Repeat the process for coins (quarters, dimes, nickels, pennies).

- Many businesses use coin wrappers or a coin counter for efficiency here. If not, count them carefully, grouping them.

- Record the quantity of each coin denomination on your sheet.

5. Calculate the Value of Each Denomination:

- For each denomination, multiply the "Quantity" by the denomination's value.

- Write this value in the "Value" column on your sheet.

- *Example:* For three $100 bills, the value is $300 (3 x $100). For 20 quarters, the value is $5.00 (20 x $0.25).

- This step is crucial for beginners; it breaks down the math and reduces errors.

6. Calculate the Total Cash in Drawer:

- Add up all the "Value" amounts for bills and coins.

- This sum is your Total Cash in Drawer at the end of the shift. Write this in the designated spot on your sheet.

7. Identify and Separate the Starting Bank (Float):

- Most businesses start the day with a predetermined "start bank" or "float" (e.g., $150 or $200) to make change.

- Carefully count out this exact amount from your "Total Cash in Drawer."

- Record the "Start Bank" amount on your sheet.

- *Crucial Tip:* This portion of the cash should be set aside and verified for the next day's opening.

8. Calculate Declared Cash Sales:

- Subtract the "Start Bank" from the "Total Cash in Drawer."

- Total Cash in Drawer - Start Bank = Declared Cash Sales. This is the amount of cash your register *actually* received from sales.

9. Run Your POS System's End-of-Day Report:

- Access your POS system and generate the "End of Day," "Z-Report," or "Shift Report."

- Locate the "Cash Sales" total on this report. This is the amount of cash sales your system *expected* to receive.

- *Personal Scenario:* I once forgot this step and spent an hour trying to figure out why my physical count didn't match anything. Always get that POS report!

10. Reconcile (The Moment of Truth!):

- Compare your Declared Cash Sales (from your physical count) with the POS Cash Sales Total (from your system report).

- Declared Cash Sales - POS Cash Sales Total = Over or Short Amount.

- Record this on your printable daily cash drawer count sheet.

- Ideally, this number should be zero.

11. Document Non-Cash Tenders:

- Record the totals for credit card sales, debit card sales, gift cards, checks, etc., from your POS report onto your cash count sheet. This completes the full financial picture for the day.

12. Complete and Sign the Sheet:

- Fill in your name/ID, the date, and any other identifying information.

- Sign the sheet. If a manager verifies, they should sign too.

- If there's an over/short, use the "Notes" section to explain if you have any insights.

13. Prepare for Deposit:

- The remaining cash (Declared Cash Sales) plus any other non-cash tenders (checks) should be prepared for deposit according to your business's procedures.

- Securely store the cash and the completed sheet.

Beyond the Basics: Customizing Your Cash Count for Unique Business Needs

While a standard "printable daily cash drawer count sheet" provides a solid foundation, truly optimizing your cash management means tailoring it to your specific business model. No two businesses are exactly alike, and your cash count sheet should reflect that. This is where you move from merely counting cash to creating a powerful, bespoke financial tool.

Here are 12 ways to customize and enhance your cash count sheet:

1. Add Product/Category-Specific Sales Tracking: If you want to monitor cash sales by product category (e.g., coffee vs. pastries, apparel vs. accessories), add rows to your sheet. This gives you deeper insights into what's selling via cash. *Scenario:* A client running a boutique discovered through this customization that their high-margin accessories were rarely purchased with cash, leading them to adjust their display strategies.

2. Incorporate Payouts/Paid-Outs Section: Many businesses have small cash payouts for things like cleaning supplies, petty cash advances, or vendor payments. Create a dedicated section to itemize these, including date, recipient, reason, and amount. This ensures these outflows are properly documented and not mistaken for shortages.

3. Include Daily Deposit Information: Beyond just the amount, add fields for the bank name, deposit slip number, and even a space to attach a copy of the deposit slip. This creates a fully self-contained record.

4. Integrate Tip Tracking: For businesses where staff receive cash tips (restaurants, salons), add a section to record declared cash tips separately. This helps with payroll reconciliation and ensures compliance. My salon found this invaluable for ensuring transparency and fairness among stylists.

5. Reflect Multiple Payment Gateways: If you use different credit card processors (e.g., Square for in-store, Stripe for online order pickup), add separate lines for each to match your POS reports accurately.

6. Create Shift-Specific Variations: If your morning shift has different responsibilities or cash flow patterns than your evening shift, consider slightly different sheets. For example, the morning sheet might have an "initial bank setup" section, while the evening sheet focuses more on final deposit prep.

7. Add an "Unusual Transactions" Log: This goes beyond a simple "notes" section. It's a structured area for detailing transactions that deviate from the norm, such as a large refund, a manual discount, or a customer dispute. It helps explain potential discrepancies more clearly.

8. Incorporate "Change Order" Requests: If you regularly need to order specific denominations from the bank, add a small section to note daily change order needs. This streamlines communication with your bank or vault service.

9. Include Promotional/Discount Tracking: If you run cash-only promotions or specific discounts, a section to record the total value of these can help reconcile against expected sales and understand their impact.

10. Design for Specific Hardware: If you use a particular type of cash drawer with an unusual coin tray layout, design your sheet to mirror that layout, making the counting process more intuitive and less error-prone.

11. Add Barcodes/QR Codes for Digital Integration: For advanced users, a pre-printed barcode or QR code on each sheet could link to a digital record-keeping system, allowing for faster data entry or audit trails.

12. Language Customization: If you operate in a multicultural area, consider offering your "printable daily cash drawer count sheet" in multiple languages. This promotes inclusivity and reduces errors for non-native speakers.

The Digital Shift: Integrating Printable Sheets with Modern POS Systems

In an increasingly digital world, some might wonder if a "printable daily cash drawer count sheet" is still relevant. The answer is a resounding *yes*! While modern POS systems offer robust digital tracking, the physical act of counting cash and recording it manually on a sheet provides a crucial layer of verification, accountability, and security that digital systems alone cannot replicate. The key is integration, not replacement.

Here’s how to seamlessly blend your tried-and-true printable sheets with the power of your modern POS system:

1. Use the POS as the "Expected" Baseline: Your POS system is the source of truth for your *expected* cash sales. The primary function of your printable daily cash drawer count sheet becomes verifying that the *physical cash* matches this expectation. The POS provides the target; your sheet confirms the reality.

2. Streamline Data Transfer (Manual Entry with Purpose): Instead of manually entering every sale, you'll primarily be transferring the "POS Cash Sales Total," "Credit Card Totals," and "Gift Card Totals" from your POS end-of-day report directly onto your printable sheet. This minimizes manual data entry points, reducing errors.

3. Leverage POS for Detailed Reporting, Sheet for Quick Verification: Use your POS for granular reports (sales by item, hourly sales, etc.). The printable sheet serves as a quick, physical snapshot of the day's cash activity and reconciliation, which is often faster to review than navigating multiple digital reports. My team uses the printable sheet for the immediate check, then I review the deeper POS reports later.

4. Barcode Integration for Faster Lookups: If your printable sheets have unique serial numbers, consider a system where a manager scans this number into a digital log when they verify the count. This links the physical sheet to a digital record without re-typing.

5. Hybrid Training Approach: When training new staff, start with the printable sheet. It provides a tangible, step-by-step process that builds confidence in cash handling. Once they master the physical count, introduce how it aligns with the POS system's reports.

6. Digital Archiving of Scanned Sheets: After completion, physical sheets can be scanned and uploaded to a cloud storage system (like Google Drive, Dropbox, or your accounting software). This creates a digital archive that's searchable, accessible, and reduces physical clutter while maintaining the paper trail.

7. Identify Discrepancies Instantly: The "over/short" calculation on your printable sheet immediately flags issues. This allows for real-time investigation while the details are fresh, rather than discovering a discrepancy days later when reviewing digital reports. I once caught a recurring $10 short within minutes of a shift change thanks to this direct comparison.

8. Reinforce Security Protocols: The act of physically counting and signing off on a printable sheet reinforces that cash handling is a serious responsibility, even with advanced POS systems. It's a tangible deterrent against carelessness or theft.

9. Backup in Case of POS Outage: What happens if your POS system goes down? A printable daily cash drawer count sheet is your analog backup. You can continue tracking sales manually and reconcile the physical cash until your system is back online. This saved a friend's restaurant during a power outage; they just switched to paper and kept going!

10. Audit Trail Enhancement: For external auditors, having both the digital POS reports and the signed, physical printable daily cash drawer count sheets provides an incredibly robust and transparent audit trail, demonstrating due diligence in cash management.

11. Cross-Referencing for Error Detection: Sometimes, a POS system might have a glitch, or an item might be rung in incorrectly. By comparing the physical cash count with the POS report on your printable sheet, you have two independent data points, increasing the likelihood of catching errors from either source.

12. Empowering Staff with Tangible Responsibility: While POS systems are powerful, they can sometimes feel abstract. A physical "printable daily cash drawer count sheet" places tangible responsibility directly in the hands of the employee, fostering a deeper sense of ownership over the cash they handle.

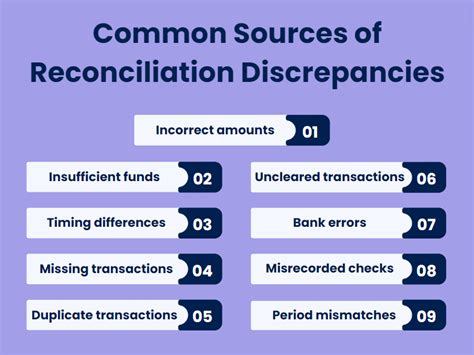

Troubleshooting Tales: Common Cash Count Discrepancies and How to Fix Them

The dreaded "over" or "short" moment. It's enough to send a shiver down any business owner's spine. But don't panic! Discrepancies are a part of cash handling, and with a good "printable daily cash drawer count sheet" and a systematic approach, you can almost always identify the root cause. My own bakery had its share of "missing" twenties that turned out to be operator error, not theft!

Here are common pitfalls that lead to cash count discrepancies and how to troubleshoot them:

1. Incorrect Starting Bank (Float):

- Problem: The initial amount of cash placed in the drawer was miscounted or not recorded correctly.

- Troubleshooting: Always have a standard, fixed start bank. Count the start bank *twice* before placing it in the drawer and record it immediately on the printable daily cash drawer count sheet. A manager should ideally verify the start bank.

2. Miscounting During Reconciliation:

- Problem: Simple human error during the physical count – a stack of twenties counted as tens, or a coin roll mislabeled.

- Troubleshooting:

- Recount, Recount, Recount: If there's a discrepancy, recount the entire drawer, focusing on the denominations where you often make mistakes.

- Count in Groups: Group bills in fives or tens. Use coin counters or wrappers.

- Second Pair of Eyes: Have another staff member or manager perform a second count.

- Use a Calculator: Don't rely solely on mental math for totals.

- *Light-hearted Warning:* Don't be like me on a particularly long shift, trying to count hundreds after staring at spreadsheets all day. Your brain needs a break sometimes!

3. Incorrectly Ringing Up Sales/Returns on POS:

- Problem: A sale was entered as cash but paid with card, or vice-versa. A return was processed incorrectly.

- Troubleshooting:

- Review POS Reports: Check transaction logs around the time of the discrepancy. Look for unusual tender types or voided transactions.

- Match Tender Types: Ensure staff are consistently selecting the correct tender type (cash, credit, gift card) in the POS system.

- Training: Provide ongoing training on correct POS procedures for all staff, especially for returns and exchanges.

4. Unrecorded Payouts or Petty Cash:

- Problem: Cash was taken from the drawer for a purchase or a payout without being recorded on the sheet or in the POS.

- Troubleshooting:

- Strict Payout Policy: Implement a strict policy that *all* cash payouts require a signed receipt or a dedicated entry on the "printable daily cash drawer count sheet."

- Manager Approval: Require manager approval for all payouts.

- *Personal Scenario:* We once found a significant shortage only to discover an employee had bought coffee for the team out of the drawer without noting it. A dedicated "payouts" section solved this immediately.

5. Change Made from the Wrong Denomination:

- Problem: A customer pays with a large bill, and change is accidentally made from a smaller denomination.

- Troubleshooting: Encourage staff to always state the amount received and the change given. Proper training on making change is paramount.

6. Skipped Steps on the Count Sheet:

- Problem: An employee rushes and misses a section on the printable daily cash drawer count sheet, leading to an incomplete tally.

- Troubleshooting: