Donating to Goodwill feels good, doesn't it? You're decluttering your home, giving usable items a second life, and supporting valuable community programs all at once. It’s a win-win-win! But let’s be honest, for many of us, there’s also that little voice in the back of our heads whispering, "Don't forget the tax deduction!" And that, my friend, is where the humble printable Goodwill donation receipt becomes your unsung hero. Trust me, I’ve been there – scrambling at tax time, wishing I'd paid more attention to documenting my charitable giving. I once spent an entire afternoon trying to reconstruct a year's worth of donations from memory, vowing never again to miss out on the peace of mind (and potential savings!) a proper receipt provides.

This isn’t just about the IRS; it’s about recognizing the true value of your generosity and making sure every bit of your effort counts. Whether you're a seasoned donor or just starting your decluttering journey, understanding how to effectively use this essential document can save you time, stress, and even a little money. Let’s dive in and make sure your goodwill efforts are fully documented and ready for tax season.

---

1. Why You Absolutely Need That Receipt: Beyond Just Tax Time

Think of your printable Goodwill donation receipt not just as a tax form, but as proof of your positive impact. It's more than a piece of paper; it’s a record of your contribution to a healthier planet and a stronger community.

- The Obvious: Tax Deductions: This is usually the primary driver. Qualified donations to organizations like Goodwill are tax-deductible. A proper receipt is your key to claiming these deductions, which can lower your taxable income. For instance, if you donate a significant amount of household goods, that receipt could translate into meaningful savings.

- Proof of Generosity: Sometimes it's just about having a record. If there's ever a question about what you've given, your receipt stands as clear evidence.

- Personal Financial Tracking: Beyond taxes, this receipt helps you keep a clear record of your charitable giving, allowing you to see your philanthropic footprint throughout the year. I personally use my receipts to track how much I’m giving annually, which helps me stay within my budget and donation goals.

- Estate Planning: For larger or more valuable donations, a well-documented history can be useful for estate purposes.

- Peace of Mind: Honestly, the biggest benefit for me is the sheer peace of mind knowing I’m organized. No more last-minute panic searching for elusive records!

2. Finding Your Perfect Printable Goodwill Receipt: Options & How-To

Good news! Getting your printable Goodwill donation receipt is usually quite straightforward, and you have a few options depending on your preference.

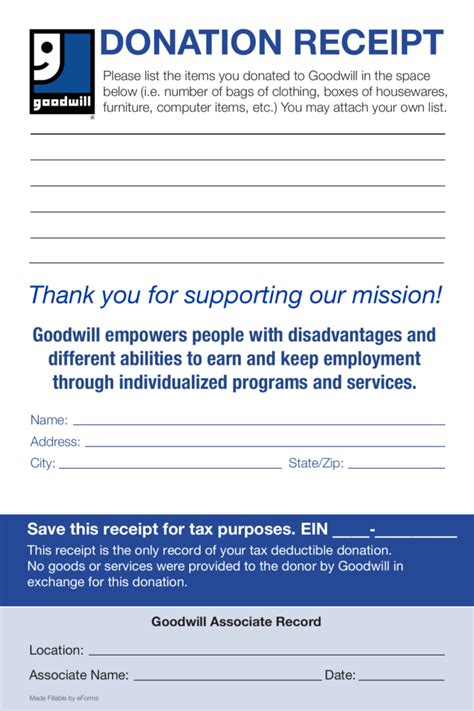

- On-Site Drop-Off Receipt: When you drop off items at a Goodwill donation center, they typically have pre-printed receipts readily available.

- Pro-Tip: Ask the attendant for one before you even start unloading, so you can fill it out as you go. I used to wait until the end, and then felt rushed.

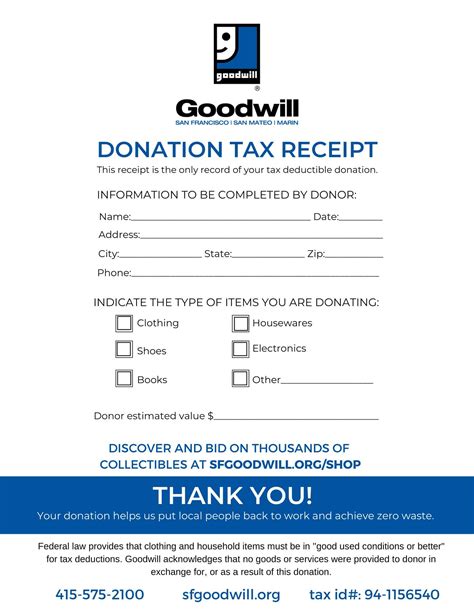

- Goodwill's Website: Many local Goodwill organizations offer a printable donation receipt directly on their website. Just search for "[Your Local Goodwill Name] donation receipt" or "Goodwill tax form."

- How I Use This: I’ve often used this option when I forgot to grab a receipt at the center or if I’m donating multiple times and want a consistent format. It’s super convenient to print it at home before I leave.

- Third-Party Receipt Templates: While not official Goodwill forms, many tax preparation software or financial planning sites offer generic donation receipt templates that are IRS-compliant. You’d fill this out yourself.

- Caution: Ensure any third-party template meets IRS requirements for charitable contributions.

- Goodwill's Valuation Guide: While not a receipt itself, Goodwill often provides a donation value guide (either online or in print) to help you estimate the fair market value of your donated items. This is crucial for filling out your receipt accurately!

- Digital Options: Some Goodwills are piloting digital receipts or online donation tracking systems. Check with your local center to see if this is an option.

3. Filling It Out Like a Pro: Tips for Accuracy & Maximizing Your Deduction

This is where the rubber meets the road! Accurately filling out your printable Goodwill donation receipt is crucial. Here's how to do it right.

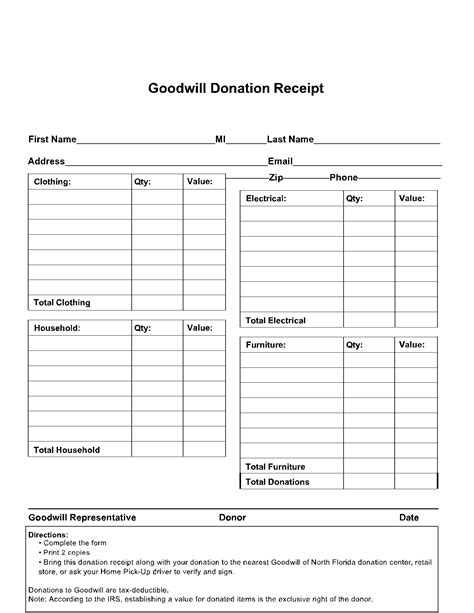

- List Items Clearly: Don't just write "clothing." Be specific: "5 pairs of jeans," "3 blouses," "1 winter coat." The more detail, the better.

- Estimate Fair Market Value (FMV): This is the value an item would sell for in its current condition on the open market (e.g., at a consignment shop or online marketplace).

- Personal Preference: I find it helpful to group similar items and then estimate their combined value. For example, "Misc. Kitchenware (pots, pans, utensils) - $45."

- Use Goodwill's Valuation Guide: Seriously, leverage this! It takes the guesswork out of assigning values to common items. Don't overvalue items; the IRS is looking for reasonable estimates.

- Date Your Donation: This is critical. Make sure the date on your receipt matches the date of your donation.

- Donor Information: Always include your full name and address. The organization’s name and address should already be on the receipt.

- Signature Confirmation: Ensure the Goodwill attendant signs and dates the receipt as well. This legitimizes the transaction from their end.

- Donations Over $500: For non-cash contributions exceeding $500, you’ll typically need to fill out IRS Form 8283 (Noncash Charitable Contributions) and attach it to your tax return.

- Donations Over $5,000: For single items or groups of similar items valued over $5,000, you’ll need a qualified appraisal, which is a whole different ball game.

4. Digital vs. Physical: Keeping Your Records Safe & Sound

Once you have your filled-out printable Goodwill donation receipt, safeguarding it is the next step. Don't let your hard work go to waste!

- Physical Filing System: Create a dedicated folder for charitable contributions. This can be a simple manila folder labeled "2024 Tax Deductions" or similar.

- My System: I keep a physical folder, and as soon as I get a receipt, it goes straight in. No exceptions!

- Scan and Digitize: Take a photo or scan a digital copy of every receipt. This is a lifesaver if the physical copy gets lost or damaged.

- Digital Storage: Store these digital copies in a cloud service (Google Drive, Dropbox, OneDrive) or on an external hard drive. Create a clear folder structure like "Taxes > 2024 > Donations."

- Email Yourself: As a quick backup, email a copy of the scanned receipt to yourself. This acts as an immediate timestamped record.

- Retention Period: The IRS generally recommends keeping tax records for at least three years from the date you filed your original return, or two years from the date you paid the tax, whichever is later. For donations, it's wise to keep them for at least this long, if not longer.

- Review Annually: Before tax season, gather all your receipts and review them. This helps you catch any missing information and ensures everything is organized for your tax preparer or software.

5. Common Mistakes When Using Your Goodwill Donation Receipt: Don't Get Caught Out!

We all make mistakes, but some can cost you money or a headache come tax time. Avoid these common pitfalls related to your printable Goodwill donation receipt.

- Not Getting a Receipt At All: The biggest mistake! No receipt, no deduction. Period.

- Generic Descriptions: Writing "stuff" or "misc. items" is a red flag. Be specific to avoid issues.

- Overvaluing Items: While you want to maximize your deduction, grossly overstating an item's fair market value can lead to an audit. Remember, it's what a *willing buyer* would pay, not what you *paid for it originally*. Don't be like me and try to guess the value of an antique lamp you found in grandma's attic – when in doubt, consult Goodwill's guide or err on the side of caution.

- Forgetting Attendant's Signature: This makes the receipt less valid. Always ensure a Goodwill representative signs it.

- Lost Receipts: This is why digitizing is so important! Losing the only copy can mean losing your deduction.

- Donating Too Much Without Proper Forms: If your non-cash donations exceed $500, simply handing over a basic receipt isn't enough; you'll need Form 8283. Ignoring this can lead to disallowed deductions.

- Not Knowing What's Deductible: Not all donations are deductible. Cash, used clothing, and household items generally are, but certain items (like your time or services) are not. Understand the rules.

---

Tips for Maximizing Your Goodwill Donation Receipt

Ready to take your donation game to the next level? Here are some insider tips to make your printable Goodwill donation receipt work even harder for you.

- Batch Your Donations (Strategically): If you make multiple small donations throughout the year, you can list them all on one detailed receipt if you prefer, or keep individual receipts. I personally find it easier to do one comprehensive donation every few months to minimize the number of receipts.

- Photographic Evidence (Optional, But Smart): For larger or more valuable donations, consider taking photos of the items before you donate them. This can serve as additional proof of the condition and quantity of items, especially if you ever face questions about their value.

- Utilize Online Valuation Tools: Beyond Goodwill's own guide, sites like eBay (for "sold" listings) can give you a realistic idea of what similar items are actually selling for.

- Keep Your Own Detailed List: Even if Goodwill provides a pre-printed form, it's a good habit to keep your own running list of items and their estimated values in a spreadsheet. Then transfer these values to the official receipt. This gives you a backup and helps you stay organized.

- Consult a Tax Professional: When in doubt about complex donations or high-value items, always consult with a qualified tax advisor. They can provide personalized guidance and ensure you're maximizing your deductions legally and accurately.

---

Donating to Goodwill is an incredibly impactful way to give back and declutter simultaneously. By taking a few extra moments to understand and correctly use your printable Goodwill donation receipt, you're not just getting a tax break – you're affirming the value of your contribution and ensuring your generosity truly counts, both for your community and for your financial well-being. Now go make those donations, get those receipts, and enjoy the peace of mind that comes with being wonderfully organized!