Losing someone you love is, without a doubt, one of the most profoundly difficult experiences life can throw our way. In the raw, aching aftermath of grief, the last thing anyone wants to think about is a mountain of paperwork, phone calls, and logistical nightmares. Yet, sadly, these practicalities become an unavoidable part of the journey. It's a cruel irony that when your heart is heaviest, your mind is asked to be its sharpest.

I've been there. I remember vividly the haze after my own grandparent passed away. Amidst the sorrow, there was this overwhelming sense of "what do I do now?" The phone calls, the documents, the decisions – it all felt like a tidal wave threatening to drown us. We were adrift, wishing desperately for a clear path, a beacon in the fog. That experience taught me an invaluable lesson: while grief is a personal and unique process, the practical steps that follow a death don't have to be navigated alone or in total confusion. This is precisely why I poured my heart and expertise into creating this comprehensive, printable checklist for when someone dies. My hope is that it can be that beacon for you, offering a gentle hand to guide you through what might feel like an impossible task.

This isn't just a list; it's a compassionate companion designed to lighten your burden, to break down the overwhelming into manageable steps, and to provide clarity when everything feels blurry. Whether you're facing an immediate loss, supporting a grieving loved one, or proactively preparing for the future, this guide is here to offer practical advice, emotional understanding, and the reassurance that you don't have to figure it all out on your own. We'll cover everything from the very first moments to long-term considerations, ensuring you have a complete printable checklist for when someone dies at your fingertips.

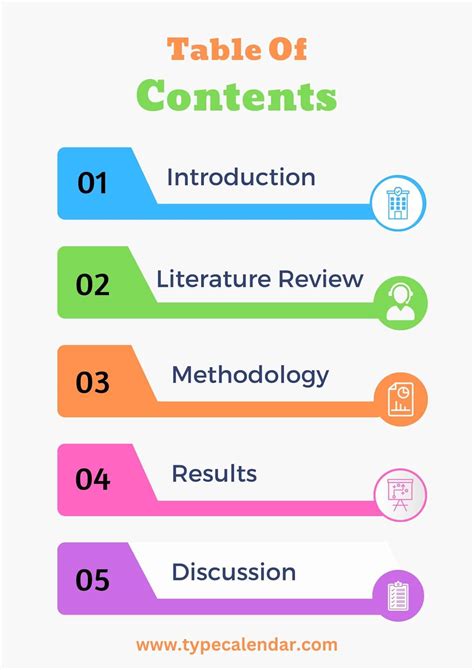

Table of Contents

- [The Immediate Aftermath: First Steps When Someone Dies](#the-immediate-aftermath-first-steps-when-someone-dies)

- [Navigating Funeral & Memorial Planning](#navigating-funeral-memorial-planning)

- [Notifying Loved Ones & Official Channels](#notifying-loved-ones--official-channels)

- [Handling the Digital Legacy: Accounts & Online Presence](#handling-the-digital-legacy-accounts--online-presence)

- [Understanding Estate & Financial Matters](#understanding-estate--financial-matters)

- [Legal & Administrative Requirements: Paperwork & Red Tape](#legal--administrative-requirements-paperwork--red-tape)

- [Managing Property & Possessions](#managing-property--possessions)

- [Prioritizing Self-Care & Support During Grief](#prioritizing-self-care--support-during-grief)

- [Long-Term Considerations & Legacy Planning](#long-term-considerations--legacy-planning)

- [Proactive Planning: Preparing for the Inevitable](#proactive-planning-preparing-for-the-inevitable)

- [How to Customize Your Printable Checklist for When Someone Dies](#how-to-customize-your-printable-checklist-for-when-someone-dies)

- [Common Pitfalls to Avoid When Someone Dies](#common-pitfalls-to-avoid-when-someone-dies)

- [Advanced Tips for Executors & Complex Estates](#advanced-tips-for-executors--complex-estates)

- [Conclusion: A Path Forward, Step by Gentle Step](#conclusion-a-path-forward-step-by-gentle-step)

---

The Immediate Aftermath: First Steps When Someone Dies

This initial phase, often the most disorienting, requires a few crucial actions. It's about ensuring immediate care and starting the official process. Take a deep breath; you don't have to do it all at once. This part of your printable checklist for when someone dies focuses on the first 24-48 hours.

- Confirm the Death and Contact Emergency Services (If Applicable):

- If the death occurs at home and was unexpected, call 911 (or your local emergency number). Paramedics will verify the death, and law enforcement may need to be involved to determine if there are any suspicious circumstances. They will then typically contact the coroner or medical examiner.

- If the death occurs in a hospital, hospice, or nursing home, medical staff will handle the pronouncement and guide you on the next steps, including contacting a funeral home.

- *Hypothetical Scenario:* "I remember my neighbor calling me in a panic after her husband passed away unexpectedly at home. Her first thought was to call an ambulance, even though it was clear he was gone. It's a natural reaction in shock, but knowing to call 911 for official pronouncement and guidance in an unexpected home death is crucial for proper documentation."

- Locate Important Documents:

- Begin the gentle search for the deceased's will, funeral pre-arrangement plans, life insurance policies, and any critical contact information (e.g., attorney, financial advisor, executor). These documents will guide many of your subsequent decisions.

- *Hypothetical Scenario:* "When my uncle passed, we spent hours sifting through old boxes looking for his will. It was tucked away in a dusty attic. Having a designated 'important documents' folder, even a simple one, would have saved us immense stress during an already painful time."

- Notify Close Family & Friends:

- This is a deeply personal step. Decide who needs to be informed immediately and how. You might designate one or two people to help make calls or send messages to a wider circle to ease your burden.

- Consider different communication methods: personal calls for immediate family, group texts or emails for close friends, and perhaps social media for a broader network (once closer circles are informed).

- Choose a Funeral Home:

- If one hasn't been pre-selected, you'll need to choose a funeral home. They are your primary point of contact for transporting the body, preparing it for burial or cremation, and helping with arrangements. Don't feel pressured to make a quick decision; you can call a few to understand their services and pricing.

- *My Subjective Insight:* "I personally found that looking for funeral homes that were highly recommended by trusted friends or family, rather than just picking one from a list, provided a much-needed sense of reassurance during such a vulnerable time."

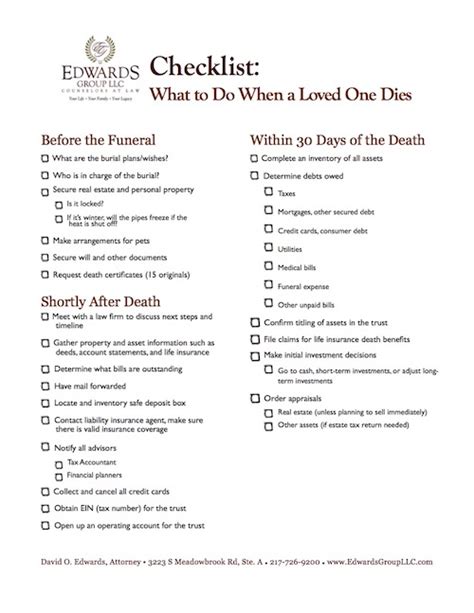

- Request Death Certificates:

- The funeral home will usually assist you with ordering official death certificates. You will need multiple certified copies for various purposes (banks, insurance companies, government agencies, etc.). It's always better to order more than you think you'll need. Around 10-15 copies is a good starting point, but it varies by complexity of estate.

- Arrange for Care of Dependents/Pets:

- If the deceased had minor children, elderly dependents, or pets, ensure immediate arrangements are made for their care and well-being. This might involve family members, friends, or professional services.

- Secure the Deceased's Home:

- If the home will be unoccupied, take steps to secure it. Lock doors and windows, stop mail and newspaper delivery, and consider informing trusted neighbors. This is especially important if the deceased lived alone.

- Begin a Log of Expenses:

- Start a simple spreadsheet or notebook to track all expenses related to the death (funeral costs, travel, legal fees, etc.). This will be vital for estate purposes and potential reimbursement.

- Gather Initial Information:

- Begin compiling basic information about the deceased: full legal name, date of birth, social security number, address, occupation, marital status, and parents' names. This information is needed for the death certificate and other official forms.

- Take Time to Breathe:

- Amidst all the practicalities, remember to give yourself permission to grieve. This printable checklist for when someone dies is a guide, not a race. Lean on your support system, take breaks, and acknowledge your feelings. You're doing the best you can.

---

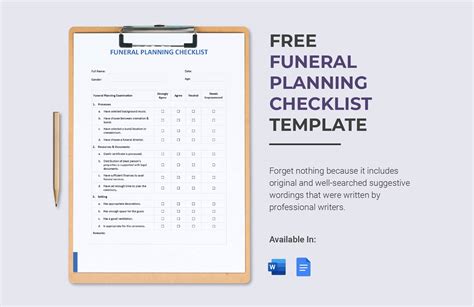

Navigating Funeral & Memorial Planning

Once the initial shock begins to subside, the focus often shifts to honoring the life that was lived. This section of your printable checklist for when someone dies delves into the significant decisions surrounding funeral, memorial, and burial arrangements.

- Determine Wishes (Burial, Cremation, Green Burial, etc.):

- The first step is to ascertain if the deceased had any pre-existing wishes regarding their final disposition. Check their will, pre-need funeral arrangements, or discuss with close family members. Honoring their wishes can bring comfort.

- *Hypothetical Scenario:* "My grandmother had very specific wishes for a simple cremation and a scattering of ashes in her beloved garden. Because she’d written it down, we didn’t have to guess or argue. It brought us peace knowing we were fulfilling her last request."

- Choose a Service Type:

- Decide on the type of service: a traditional funeral, a memorial service, a celebration of life, a graveside service, or a combination. This decision often depends on cultural, religious, and personal preferences, as well as the deceased's wishes.

- Select a Date, Time, and Location:

- Coordinate with the funeral home, family, and any officiants or venues. Consider travel for out-of-town guests and the availability of key individuals.

- Draft an Obituary or Death Notice:

- Write an obituary that announces the death, shares biographical details, lists surviving family members, and provides details about the service. The funeral home can assist with this and placement in newspapers or online.

- Arrange for Casket, Urn, or Other Receptacle:

- Work with the funeral home to select a suitable casket for burial or an urn for cremation. Understand the options available and choose what feels right for your family and budget.

- Plan the Service Details:

- This includes selecting an officiant, choosing readings, music, eulogies, and any special rituals or traditions. Personalizing the service can be a powerful way to remember and celebrate the deceased.

- *Hypothetical Scenario:* "When my best friend's mother passed, they wanted to make her service truly reflective of her vibrant personality. We worked together to pick out all her favorite upbeat jazz songs and asked friends to share funny anecdotes. It transformed a somber occasion into a beautiful celebration of her life, and everyone left feeling uplifted."

- Select Clothing and Personal Items (If Applicable):

- If there will be a viewing or open casket, choose clothing for the deceased. You may also include small personal items in the casket or urn.

- Organize Transportation:

- Arrange for transportation of the deceased (if not handled by the funeral home), and for family members, especially those who may need assistance.

- Consider Flowers, Donations, and Tributes:

- Decide whether to request flowers, suggest donations to a charity in lieu of flowers, or encourage other forms of tribute (e.g., planting a tree, creating a memory book).

- Plan for a Repast or Gathering:

- Many families choose to host a gathering after the service, offering a chance for continued fellowship, sharing memories, and support. This can be a simple reception or a full meal.

- Prepare for Visitors & Condolences:

- Understand that friends and family will want to express their condolences. Decide how you want to manage this – whether through visitations, calls, or specific times. It's okay to set boundaries if you feel overwhelmed.

---

Notifying Loved Ones & Official Channels

This phase of the printable checklist for when someone dies is about ensuring everyone who needs to know is informed, both personally and officially. It's a significant administrative hurdle, but taking it step by step makes it manageable.

- Inform Employer/Business Partners:

- Notify the deceased's employer or business partners as soon as appropriate. They will need to process final paychecks, benefits, and any outstanding work-related matters.

- Contact Life Insurance Companies:

- Locate any life insurance policies and contact the companies to begin the claims process. You'll need a certified copy of the death certificate.

- *Hypothetical Scenario:* "My cousin's husband had a small life insurance policy through his work that we almost overlooked. It wasn't a huge sum, but it significantly helped with immediate expenses. It really highlighted how important it is to dig into *all* potential sources of support and not assume anything."

- Notify Social Security Administration (SSA):

- The funeral home often notifies the SSA, but it's crucial to confirm. If not, you must contact them to stop benefits and inquire about survivor benefits for eligible family members.

- Inform Veterans Affairs (VA) (If Applicable):

- If the deceased was a veteran, contact the VA to inquire about burial benefits, survivor benefits, and any other entitlements. They can be a valuable resource.

- Notify Banks and Financial Institutions:

- Inform all banks, credit unions, and investment firms where the deceased held accounts. They will freeze accounts and provide instructions on how to access funds as the executor or legal representative.

- Contact Credit Card Companies:

- Notify credit card companies to close accounts. Be cautious about assuming responsibility for debts that aren't legally yours.

- Update Utilities & Services:

- Transfer or cancel utilities (electricity, water, gas, internet, phone, cable) and other services (subscriptions, memberships) in the deceased's name.

- Notify Post Office:

- Arrange for mail to be forwarded or held, or cancel mail delivery to the deceased's address.

- Inform Department of Motor Vehicles (DMV):

- Notify the DMV to cancel the deceased's driver's license and transfer vehicle titles if necessary.

- Cancel Passport:

- Send the deceased's passport to the appropriate government agency for cancellation to prevent identity theft.

- Inform Doctors & Healthcare Providers:

- Notify the deceased's primary care physician, specialists, and any other healthcare providers to close medical records and settle any outstanding bills.

- Update Professional Organizations/Associations:

- If the deceased was part of any professional bodies, unions, or associations, notify them to cancel membership and inquire about any death benefits or pensions.

---

Handling the Digital Legacy: Accounts & Online Presence

In our modern world, a significant part of a person's life exists online. This often-overlooked section of your printable checklist for when someone dies addresses the complex, yet crucial, task of managing a digital legacy.

- Access Email Accounts:

- Email accounts are often the gateway to other online services. Try to gain access (if legally permissible and ethically comfortable) to identify other accounts that need to be closed or managed. Look for password managers or lists.

- *My Subjective Insight:* "For me, the most daunting part was trying to figure out all the online subscriptions and accounts. It's like finding digital breadcrumbs. I found that starting with their primary email account was the best way to uncover everything."

- Manage Social Media Profiles:

- Decide whether to memorialize, close, or leave active social media accounts (Facebook, Instagram, Twitter, LinkedIn, etc.). Each platform has its own policies and procedures for handling deceased users.

- *Hypothetical Scenario:* "My friend's sister passed away suddenly, and her Facebook page became a beautiful virtual memorial for everyone to share photos and memories. However, it also meant dealing with the occasional spam message. They decided to memorialize it, which allowed people to remember her but prevented new logins or changes."

- Address Online Banking & Shopping Accounts:

- Access and close online banking portals and shopping accounts (Amazon, eBay, etc.) to prevent unauthorized use and manage any remaining funds or orders.

- Cancel Streaming Services & Subscriptions:

- Identify and cancel paid streaming services (Netflix, Spotify, Hulu), software subscriptions, online news subscriptions, and any other recurring digital payments.

- Secure Cloud Storage Accounts:

- Access and secure cloud storage (Google Drive, Dropbox, iCloud) to preserve important photos, documents, or other digital assets. Decide what to download, delete, or transfer.

- Manage Websites & Blogs:

- If the deceased maintained a personal website or blog, decide whether to keep it active, archive it, or shut it down. This involves managing domain registrations and hosting services.

- Handle Photo & Video Accounts:

- Access and secure online photo and video albums (Google Photos, Flickr, YouTube). These often contain invaluable memories that family members will want to preserve.

- Close Gaming Accounts:

- If the deceased was an avid gamer, close or memorialize their gaming accounts (Steam, Xbox Live, PlayStation Network) to prevent unauthorized access and potential charges.

- Check for Digital Wallets & Cryptocurrencies:

- Investigate if the deceased had any digital wallets (PayPal, Venmo) or cryptocurrency holdings. These can be complex to access and transfer, often requiring specific passphrases or keys.

- Review Digital Wills or Legacy Plans:

- Some individuals create digital wills or use services that allow them to designate digital beneficiaries. Check for these documents or services.

- Consider a Digital Inventory:

- If no inventory exists, start creating one as you discover accounts. Note down the service, username, and any relevant notes. This will be invaluable for future management.

---

Understanding Estate & Financial Matters

This is often the most complex and intimidating part of the printable checklist for when someone dies, requiring careful attention to detail. Don't hesitate to seek professional help from an attorney or financial advisor.

- Locate the Will or Trust Documents:

- The will dictates how the deceased's assets will be distributed. If there's no will, the estate will be distributed according to state laws of intestacy, which can be a more prolonged process.

- *Hypothetical Scenario:* "My aunt had a very old will that didn't account for some of her newer assets, which caused a bit of a headache for the executor. It really emphasized how important it is to have an updated will and to know where it's stored."

- Identify the Executor/Administrator:

- The will names an executor (or personal representative) who is responsible for carrying out the will's instructions. If there's no will, the court will appoint an administrator. This person takes on significant legal responsibilities.

- Initiate Probate (If Necessary):

- Probate is the legal process of proving the validity of a will and administering the estate. Not all estates require probate; it depends on the value and type of assets and whether there's a trust. Seek legal advice to determine if probate is necessary.

- Inventory All Assets:

- Compile a comprehensive list of all assets: real estate, bank accounts, investment portfolios, retirement accounts (401k, IRA), life insurance policies, vehicles, valuable personal property, and any business interests.

- Inventory All Debts & Liabilities:

- List all debts: mortgages, credit card balances, personal loans, medical bills, utility bills, and any outstanding taxes. Debts must typically be paid from the estate before assets are distributed to beneficiaries.

- Notify All Beneficiaries:

- Inform all beneficiaries named in the will or trust of their inheritance and the steps involved in the distribution process. Maintain open and transparent communication.

- Manage Bank Accounts:

- Understand how joint accounts, "payable on death" (POD) accounts, and individual accounts are handled. Joint accounts often pass directly to the surviving owner. Freeze individual accounts until an executor is appointed.

- Address Investment & Retirement Accounts:

- Contact financial institutions holding investment accounts (stocks, bonds, mutual funds) and retirement accounts. These often have named beneficiaries who receive funds directly, outside of probate.

- File Final Income Tax Returns:

- The estate will need to file a final income tax return for the deceased, covering the period from the beginning of the tax year up to the date of death. An estate tax return might also be necessary.

- Understand Estate Taxes:

- Determine if the estate is subject to federal or state estate taxes. This typically applies to very large estates, but it's important to be aware.

- Seek Professional Advice:

- It is highly recommended to consult with an estate attorney and a financial advisor or accountant. They can provide invaluable guidance, ensure compliance with laws, and help navigate complex financial situations.

- *My subjective opinion:* "After seeing families get bogged down in complex legal and financial details, I truly believe that investing in a good estate attorney and a financial advisor upfront can save enormous stress, time, and even money in the long run."

---

Legal & Administrative Requirements: Paperwork & Red Tape

This segment of your printable checklist for when someone dies covers the necessary official documentation and bureaucratic steps. It's often tedious but essential for legally concluding the deceased's affairs.

- Obtain Certified Copies of the Death Certificate:

- As mentioned, this is paramount. You'll need original certified copies for almost every official notification and claim (banks, insurance, government agencies, etc.). Order at least 10-15, possibly more depending on the complexity of the estate.

- *Hypothetical Scenario:* "I remember one instance where a family only ordered two death certificates, thinking that would be enough. They quickly ran out and had to wait weeks for more, delaying everything from closing bank accounts to claiming insurance. Always, *always* order more than you think you need."

- File the Will with the Probate Court:

- Even if probate isn't required for asset distribution, the original will generally needs to be filed with the probate court in the county where the deceased resided. This makes it a public record.

- Apply for Letters Testamentary/Letters of Administration:

- Once the will is probated (or an administrator is appointed), the court issues "Letters Testamentary" (if there's a will) or "Letters of Administration" (if there isn't). These legal documents empower the executor/administrator to act on behalf of the estate.

- Publish Notice to Creditors (If Required):

- In many jurisdictions, the executor must publish a notice in a local newspaper, informing potential creditors of the death and providing a deadline for them to submit claims against the estate. This protects the executor from future claims.

- Manage Outstanding Contracts & Leases:

- Review any contracts, leases (e.g., rental agreements, car leases), or other legal agreements the deceased was a party to. Determine how they are affected by the death and what actions need to be taken.

- Cancel or Transfer Licenses & Permits:

- If the deceased held any professional licenses, business permits, or special registrations, contact the issuing authorities to cancel or transfer them as appropriate.

- Address Lawsuits or Legal Actions:

- If the deceased was involved in any ongoing lawsuits or legal disputes, inform their attorney and the opposing counsel of the death. The estate may need to take over the legal proceedings.

- Manage Business Interests:

- If the deceased owned a business, consult with a business attorney to understand the legal implications, succession plans, and what needs to be done to continue, sell, or dissolve the business.

- Handle Foreign Assets/Accounts (If Applicable):

- If the deceased had assets or accounts in other countries, this adds a layer of complexity. You will likely need legal counsel specializing in international estate law.

- Maintain Detailed Records:

- Keep meticulous records of all communications, expenses, documents received, and actions taken. This includes dates, names of people spoken to, and summaries of conversations. This diligence will be invaluable if questions arise later.

- Seek Legal Counsel:

- Even for seemingly straightforward estates, consulting an attorney specializing in probate and estate law is highly recommended. They can ensure all legal requirements are met and protect the executor from liability.

---

Managing Property & Possessions

Beyond financial assets, the deceased often leaves behind a home, vehicles, and personal belongings. This part of your printable checklist for when someone dies helps you navigate these tangible assets with sensitivity and practicality.

- Secure the Deceased's Residence:

- Ensure the home is locked, valuables are secure, and utilities are managed. If the home will be vacant for an extended period, consider adjusting heating/cooling and informing local police.

- *Hypothetical Scenario:* "When my elderly aunt passed, her house sat empty for a few weeks before we could get to it. Unfortunately, a pipe burst. It really drove home the point that immediate property checks and securing the premises are not just about theft, but also about preventing damage."

- Address Vehicles:

- Locate car titles, registration, and keys. Contact the DMV to transfer ownership or cancel registration. Notify the auto insurance company. If the vehicle will be sold, ensure it's properly maintained.

- Sort Personal Belongings:

- This can be an emotionally charged task. Take your time. Sort items into categories: keep (for family/beneficiaries), donate, sell, or discard. Involve family members in this process if possible.

- Arrange for Property Maintenance:

- If the deceased owned a home, ensure ongoing maintenance (lawn care, snow removal, repairs) until it's sold or transferred.

- Cancel Home Services:

- Discontinue services like cleaning, landscaping, home security, and deliveries to the property.

- Manage Real Estate:

- If real estate is part of the estate, work with the executor and potentially a real estate agent. Understand if it needs to be sold, transferred to beneficiaries, or rented out.

- Handle Valuables & Collectibles:

- For items like jewelry, art, antiques, or valuable collections, consider obtaining professional appraisals for estate valuation and insurance purposes. Decide on their distribution or sale.

- Dispose of Unwanted Items:

- Arrange for the disposal of items that are not being kept, donated, or sold. This might involve hiring a junk removal service or coordinating with local waste management.