Let's face it: money talk can feel heavy. Whether you're dreaming of a big vacation, saving for a down payment, or just trying to build an emergency fund, the goal often feels distant, and the journey a bit daunting. I’ve been there, staring at my bank balance, wondering if I'd ever get ahead. But then I discovered the magic of a money saving challenge printable – and trust me, it changed everything. I once thought saving was all about deprivation, but a good printable transformed it into a fun, visual game, making those big financial goals feel totally achievable.

This isn't just about stashing away a few bucks; it's about building consistent habits, celebrating small wins, and actually seeing your progress unfold right before your eyes. Forget complicated spreadsheets or endless budgeting apps that make your head spin. We're talking about a simple, powerful tool that makes saving less of a chore and more of an exciting quest. Ready to transform your financial future? Let’s dive into the types of challenges that can work for *you*.

Discover Your Perfect Money Saving Challenge Printable

Finding the right challenge is like finding the perfect pair of shoes – it needs to fit your comfort level, your lifestyle, and your financial goals. Here are a few creative categories of money saving challenge printable ideas, each designed to tackle saving from a different angle.

### 1. The Gentle Start: Beginner-Friendly & Low Pressure Challenges

If you're new to saving or have a variable income, starting small is key. These challenges build confidence without overwhelming your budget. The beauty of these printables is their flexibility and low entry barrier.

- The 100-Envelope Challenge (Mini Version): Instead of 100, try a 25-envelope challenge. Number envelopes 1-25. Each week, pick an envelope and save that amount. Cross it off your printable tracker! *I used a simplified version of this to save my first $500 – it felt like a game every week!*

- The "Round Up" Challenge: Automate your bank to round up purchases and transfer the difference to savings, or do it manually each week by rounding up your total spending. Your printable tracks the cumulative "change."

- The Penny Challenge: Start with 1 cent on Day 1, 2 cents on Day 2, and so on. By the end of a year, you'll have over $660! A simple printable calendar makes this easy to track daily.

- The $1 a Day Challenge: Commit to saving just $1 every single day. At the end of the month, you've got $30-$31. Simple, consistent, and your printable tracker helps you visualize those daily wins.

- The "No Spend" Day Tracker: Mark off days you manage to spend nothing extra (beyond essentials like rent/groceries). Each marked day on your printable is a win!

- The Coffee Break Saver: Skip one fancy coffee a week and put that $5-$7 into savings. Your printable tracks how many "skipped coffees" turn into real money.

- The Declutter & Save Challenge: Each week, sell one item you no longer need and put the proceeds into savings. Your printable lists items to sell and tracks the money earned.

### 2. The Quick Win: Short-Term & Highly Motivating Challenges

Sometimes you need a burst of motivation! These challenges are designed to be completed in a shorter timeframe, giving you a quick sense of accomplishment.

- The 30-Day Challenge: Choose a specific amount to save daily for a month (e.g., $5 a day for $150 total, or varying amounts). A dedicated printable for each day helps you tick them off.

- The "Weekend Warrior" Savings: Commit to saving a set amount every weekend. A printable tracks each weekend’s contribution, perhaps leading to a fun treat or a small goal.

- The "Found Money" Fund: Any unexpected cash – a rebate, a small gift, a forgotten fiver in a old jacket – goes straight into savings and gets marked on your printable. *This challenge helped me quickly build up a mini-emergency fund when I needed it most, just by being mindful!*

- The Paycheck Pulse Challenge: Immediately after each payday, transfer a set percentage or amount to savings. Your printable celebrates each successful transfer.

- The "One Less Thing" Challenge: For a week or two, challenge yourself to buy "one less thing" you usually would – a snack, a soda, an impulse item. Track the estimated savings on your printable.

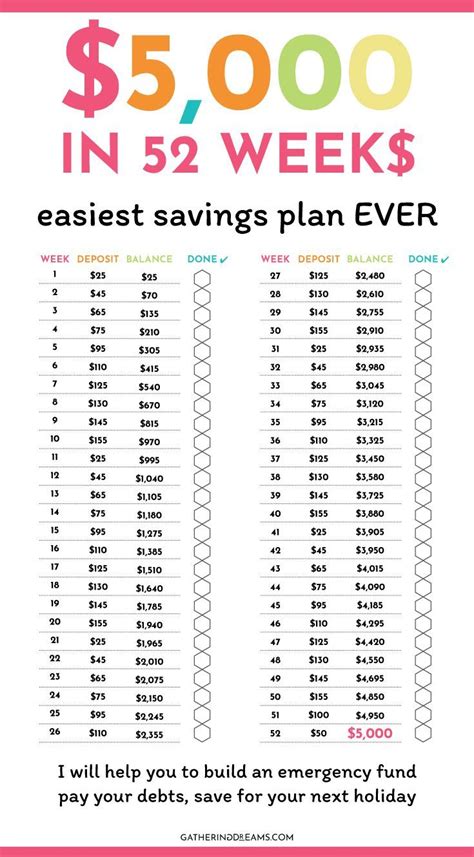

### 3. The Big Leap: Ambitious & Goal-Oriented Challenges

Ready to tackle a bigger financial goal? These challenges require a bit more commitment but yield substantial results. They often involve saving larger, fixed amounts over a longer period.

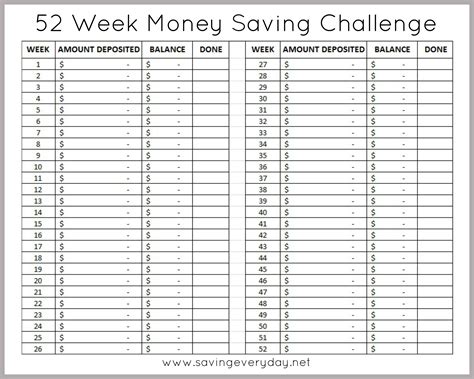

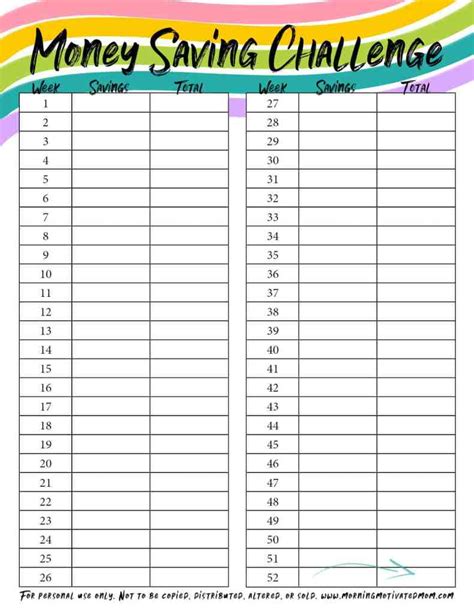

- The 52-Week Money Challenge (Classic): Save $1 in Week 1, $2 in Week 2, up to $52 in Week 52. By year-end, you'll have $1,378! This classic challenge really benefits from a dedicated printable checklist.

- The Reverse 52-Week Challenge: Start with $52 in Week 1, then $51 in Week 2, and so on, down to $1. It’s harder at the start when you might be less motivated, but easier as you go.

- The $5 or $10 Bill Challenge: Every time you receive a $5 or $10 bill (or larger, like $20) as change, commit to putting it aside. Your printable simply tallies the number of bills saved. *I actually used the $5 challenge to save up for a new camera lens I thought was out of reach!*

- The Debt Snowball/Avalanche Savings: While primarily for debt, you can adapt a printable to track "payments" to your savings goal with the same intensity. Focus on one major saving goal at a time.

- The Specific Goal Tracker: Saving for a car down payment? A new appliance? Use a printable that lets you color in sections as you hit incremental targets towards your big goal. This visual progress is incredibly motivating!

### 4. The Flexible Saver: Adaptable to Income & Lifestyle

Life happens, and income can fluctuate. These challenges are designed to be flexible, allowing you to save when you can without strict, rigid rules.

- The "No-Spend" Category Challenge: Choose one spending category (e.g., eating out, clothes, entertainment) and commit to spending $0 on it for a week or month. Your printable tracks the duration and estimated savings.

- The Income Percentage Challenge: Decide on a fixed percentage (e.g., 5%, 10%) of every paycheck to save. Your printable can have a simple table to fill in income, percentage, and amount saved. *This is my personal favorite strategy because it scales with your income and ensures you're always paying yourself first.*

- The "Unbudgeted Bonus" Challenge: Any extra money not in your usual budget – a bonus, a refund, a gift – immediately goes into savings and is tracked on your printable.

- The Variable Weekly Challenge: Instead of fixed amounts, some weeks you might save $5, others $20, depending on your budget. Your printable is just a grid to fill in whatever you *can* save each week, fostering a guilt-free approach.

- The Pay-Your-Future-Self Challenge: Each time you get paid, immediately transfer an amount you *choose* that day into savings. It could be small or large. The printable encourages this active decision-making.

### 5. The Family Fun Challenge: Engaging Everyone in Saving

Saving doesn't have to be a solo mission. Get the whole family involved with these engaging challenges that make financial literacy fun for all ages.

- The "Chores for Cash" Challenge: Assign specific chores with set "payments." Kids earn money, which goes into a shared family savings goal (e.g., a trip to the zoo, a new game console). A collaborative printable tracks chores and contributions.

- The Family "No-Buy" Weekend: As a family, commit to a weekend with no discretionary spending. Find free activities. The printable tallies up the "saved" amount that can go into a fun family fund.

- The Family Vacation Jar Challenge: Decorate a jar and use a printable to track contributions from everyone towards a dream family trip. Each time someone adds money, they get to color in a section on the printable.

- The "Eat at Home" Challenge: Track how many meals the family eats at home versus dining out. Each home-cooked meal earns a "point" or a small contribution to a family savings goal. The printable serves as a tally board.

- The "Lights Out" Challenge: Encourage everyone to turn off lights and unplug unused electronics to save on utility bills. Agree on a percentage of the saved bill to go into the family fund. A printable tracks the "energy savings" for the month.

Tips for Personalizing Your Money Saving Challenge

A generic printable is a good start, but making it *yours* is where the real magic happens.

- Define Your "Why": Before you start, write down what you're saving for on the printable itself. Is it a dream vacation? A new gadget? An emergency fund? Seeing your goal keeps you motivated.

- Set Realistic Goals: Don't try to save $1,000 in a month if your budget is already tight. Start small, build momentum, and then scale up. I find starting with an easily achievable goal prevents burnout.

- Pick a Reward System: What happens when you hit a milestone? A small, non-financial reward (like a movie night, or an hour of guilt-free reading) can keep spirits high.

- Visualize Your Progress: Printables are powerful because they're visual. Keep yours somewhere you see it daily – on the fridge, at your desk. Seeing those boxes checked or colors filled in is incredibly satisfying.

- Tell a Trusted Friend: Share your goal with someone who will cheer you on. Accountability is a powerful motivator.

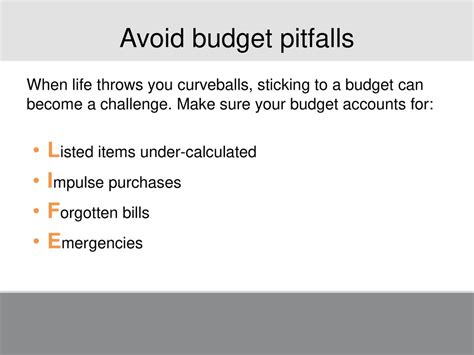

Common Pitfalls: What to AVOID When Starting a Money Saving Challenge

Even the best intentions can hit roadblocks. Here’s what I learned the hard way (so you don’t have to!):

- Don't Be Overly Ambitious (and Quit): The biggest mistake is trying to save too much too fast. This leads to frustration and giving up. Start small, finish strong. It's better to save a little consistently than to attempt a lot and fail.

- Don't Forget Your "Why": Losing sight of your goal is a motivation killer. Remind yourself *why* you started, especially on tough days.

- Don't Compare Yourself to Others: Everyone's financial situation is different. Focus on your progress, not someone else's highlight reel. Your journey is unique.

- Don't Deprive Yourself Entirely: Saving doesn't mean you can't enjoy life. Budget for small treats or fun experiences. Extreme deprivation often leads to impulsive overspending later.

- Don't Keep Your Printable Hidden: If it's out of sight, it's out of mind! Put it where you'll see it daily. Don't be like me and stash it in a drawer, only to forget about it a week later – that's how progress goes to zero, don't let it be a bust!

Ready to Print, Save, and Conquer?

There you have it – a whole universe of money saving challenge printable ideas waiting for you to dive in. From gentle starts to ambitious leaps, the perfect challenge is out there to help you reach your financial dreams. Remember, it's not just about the money; it's about building healthy habits, gaining confidence, and empowering yourself.

So, grab a challenge that speaks to you, print it out, and start coloring in those little boxes. Every checkmark, every colored section, is a step closer to your goals. Now go make that money move, and let your printable be your trusty sidekick on the journey!