Oh, the humble checkbook register. In an age of instant transactions, digital wallets, and banking apps that tell us *almost* everything, it’s easy to think of this old-school tool as a relic of a bygone era. But trust me, as someone who’s navigated the choppy waters of personal finance for years – sometimes gracefully, sometimes by the skin of my teeth – there's an undeniable power in the simplicity and tangible control a physical checkbook register offers. I remember a few years back, relying solely on my banking app, I completely miscalculated my spending for the month. A subscription I’d forgotten about, a few small online purchases that hadn’t cleared yet – it all added up, and suddenly, I was staring at an overdraft fee. That moment was my wake-up call. I realized that while digital tools are convenient, they often lack the immediate, visceral connection to my money that I truly needed.

That's when I rediscovered the magic of the checkbook register. Not just any register, but a free printable checkbook register PDF. It was a game-changer. It forced me to acknowledge every dollar moving in and out, creating a mental map of my finances that no app could quite replicate. It gave me a sense of peace, a feeling of being truly in control, rather than just reacting to numbers on a screen.

This comprehensive guide isn't just about finding a piece of paper; it's about reclaiming your financial narrative. We're going to dive deep into why these simple tools are more relevant than ever, how to pick the perfect one for your unique style, and how to use it not just for tracking checks, but for truly understanding and mastering your money. Whether you're a beginner just starting your financial journey, a seasoned budgeter looking for a reliable backup, or someone simply craving a bit more clarity, you're in the right place. Get ready to turn that financial uncertainty into confident control, one entry at a time!

---

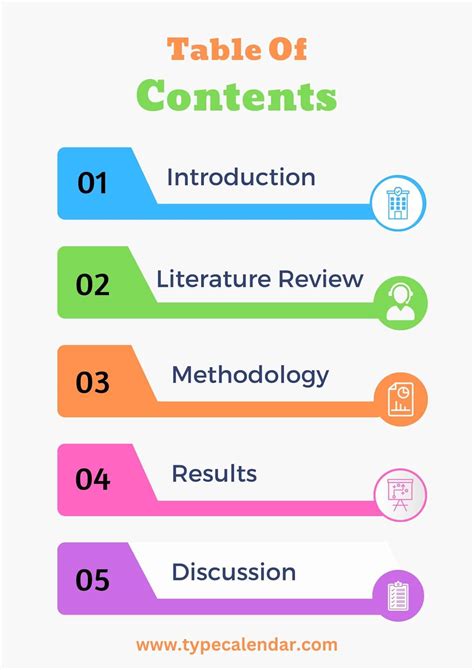

Table of Contents

- [1. The "Why": Back to Basics – Why a Physical Register Still Rules](#1-the-why-back-to-basics-why-a-physical-register-still-rules)

- [2. Finding Your Perfect Match: Types of Free Printable Checkbook Register PDFs](#2-finding-your-perfect-match-types-of-free-printable-checkbook-register-pdfs)

- [3. Mastering the Art: Step-by-Step Usage of Your Printable Register](#3-mastering-the-art-step-by-step-usage-of-your-printable-register)

- [4. Beyond Transactions: Using Your Register for Budgeting & Forecasting](#4-beyond-transactions-using-your-register-for-budgeting--forecasting)

- [5. Digital Meets Analog: Syncing Your Register with Online Banking](#5-digital-meets-analog-syncing-your-register-with-online-banking)

- [6. Customization & Creativity: Making Your Printable Register Your Own](#6-customization--creativity-making-your-printable-register-your-own)

- [7. Troubleshooting & Common Questions: Navigating Register Roadblocks](#7-troubleshooting--common-questions-navigating-register-roadblocks)

- [8. The Long-Term Game: Building Lasting Financial Habits with Your Register](#8-the-long-term-game-building-lasting-financial-habits-with-your-register)

- [9. Security & Privacy: Keeping Your Financial Data Safe (Even on Paper)](#9-security--privacy-keeping-your-financial-data-safe-even-on-paper)

- [10. Community & Support: Sharing Your Financial Journey](#10-community--support-sharing-your-financial-journey)

- [How to Choose the Best Free Printable Checkbook Register PDF for Your Needs](#how-to-choose-the-best-free-printable-checkbook-register-pdf-for-your-needs)

- [Common Pitfalls to Avoid When Using a Checkbook Register](#common-pitfalls-to-avoid-when-using-a-checkbook-register)

- [Advanced Tips for Checkbook Register Masters & Beyond](#advanced-tips-for-checkbook-register-masters--beyond)

- [Conclusion: Your Journey to Financial Empowerment Begins Here](#conclusion-your-journey-to-financial-empowerment-begins-here)

---

1. The "Why": Back to Basics – Why a Physical Register Still Rules

In our increasingly digital world, it’s easy to dismiss the humble checkbook register as an outdated relic. But for many, including myself, it remains an indispensable tool for financial management. Why? Because sometimes, the simplest solutions are the most effective. A free printable checkbook register PDF offers a unique blend of tangibility, clarity, and control that digital tools often struggle to replicate.

Here's why going back to basics with a physical register is a powerful move for your finances:

- Tangible Connection to Your Money: There's something profoundly different about physically writing down each transaction. It forces you to acknowledge the money leaving your account in a way that swiping a card or tapping a button doesn't. This tactile experience creates a stronger psychological connection to your spending. I've found that when I physically write down a purchase, I think twice before making impulse buys. It's a subtle but powerful deterrent.

- Reduced Digital Fatigue & Screen Time: We spend so much time glued to screens – phones, computers, tablets. Taking a few minutes each day or week to interact with your finances offline can be a refreshing break. It's a deliberate act of mindfulness, a moment to step away from the digital noise and focus solely on your financial reality.

- Independent Verification (Your "Second Set of Eyes"): Relying solely on your bank's app or website means you're trusting their numbers implicitly. While banks are generally accurate, errors *do* happen. A checkbook register acts as your personal ledger, a parallel record you can use to cross-reference with your bank statement. This independent verification is crucial for catching discrepancies, unauthorized transactions, or even bank errors. It's your financial safety net.

- Clarity in Case of Technical Glitches or Outages: What happens if your bank's app is down, or their website is experiencing technical difficulties? If you rely solely on digital, you're flying blind. Having a physical register ensures you always know your current balance and recent transactions, regardless of internet connectivity or system outages. Imagine being at the checkout and your card declines, but you know *for sure* you have the money because your physical register confirms it.

- Visual Snapshot of Your Cash Flow: A physical register provides an immediate, visual overview of your incoming and outgoing funds. You can quickly scan through entries, identify spending patterns, and see where your money is truly going. Unlike an app that might require several taps and swipes to get the same information, a well-maintained register lays it all out in front of you. This visual clarity is incredibly empowering.

- Aids in Developing Financial Discipline: The act of consistently logging every transaction builds discipline. It’s a small, consistent habit that reinforces responsible money management. It teaches you to be proactive rather than reactive with your finances. For beginners, this is an invaluable first step towards a healthier financial mindset.

- No Learning Curve for Tech-Averse Individuals: For those who aren't comfortable with technology, or simply prefer traditional methods, a printable checkbook register is perfectly straightforward. There are no passwords to remember, no updates to download, and no complex interfaces to navigate. It's accessible to everyone.

- Excellent for Teaching Financial Literacy: If you have children or teenagers, using a physical register is a fantastic way to teach them about money management, the importance of tracking, and balancing an account. They can physically see the numbers change, making abstract financial concepts much more concrete. My niece started using a simplified version for her allowance, and it transformed her understanding of saving and spending.

- A Backup for Digital Records: Even if you primarily use digital budgeting tools, a physical register serves as a robust backup. In the unlikely event of data loss, a hack, or a system crash, your paper trail remains intact. It’s a low-tech, high-reliability redundancy.

- Privacy and Security (No Data Breaches): A paper register cannot be hacked, its data cannot be compromised in a server breach, and it doesn't collect information on your spending habits for advertisers. It offers a level of privacy that digital tools simply cannot match. Your financial data stays securely with you.

- Historical Record Keeping: A physical register provides a clear, chronological record of your financial life. This can be invaluable for tax purposes, resolving disputes, or simply looking back to understand your financial journey over time.

- Personal Preference and Comfort: For many, myself included, there's a simple comfort and satisfaction in using a physical tool. It's a personal preference that aligns with a desire for simplicity and direct engagement with one's finances. It's about choosing the method that makes *you* feel most in control and at ease.

2. Finding Your Perfect Match: Types of Free Printable Checkbook Register PDFs

Just like there's no one-size-fits-all budget, there's a surprising variety of free printable checkbook register PDF templates available. The "best" one for you depends entirely on your personal needs, your banking habits, and how detailed you want your financial tracking to be. Let's explore some common types and what they offer.

Here are the different types of registers you might encounter, helping you find your perfect fit:

- The Basic, No-Frills Register:

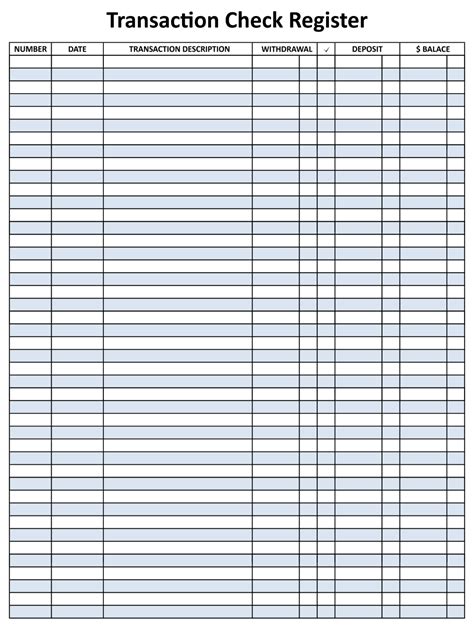

- What it is: This is your classic, straightforward register. It typically includes columns for Date, Transaction/Description, Check Number (or Ref #), Debit/Withdrawal, Credit/Deposit, and Balance.

- Who it's for: Perfect for beginners, those who primarily use checks, or anyone who wants a simple, uncluttered way to track their bank account. It's easy to understand and use right away.

- Example Scenario: My friend, who was just starting her first "real" job, found this type of register invaluable. She wanted something super easy to grasp without being overwhelmed by too many categories. It helped her track her paychecks and rent payments without any fuss.

- The Expanded Transaction Register:

- What it is: These registers add a few extra columns beyond the basic. Common additions might include a "Category" column (e.g., Groceries, Utilities, Entertainment), a "Cleared" checkbox, or a "Memo" section for more detailed notes.

- Who it's for: Ideal for users who want to not just track *what* they spent, but *where* their money is going, aiding in basic budgeting. The "Cleared" column is fantastic for reconciliation.

- Example Scenario: I personally gravitate towards this type. The "Category" column allows me to quickly see if I'm overspending in a particular area without needing a separate budgeting app. It's my quick expense tracker.

- The Multi-Account Register:

- What it is: Designed for individuals or families managing multiple bank accounts (e.g., checking, savings, separate business account). It might have dedicated sections or duplicate layouts for each account.

- Who it's for: Those with complex financial setups, small business owners, or families who pool some funds but keep others separate.

- Example Scenario: A client of mine runs a freelance business alongside his day job. He uses a multi-account register to keep his business expenses separate from personal ones, making tax time a breeze. He prints one for each quarter and stores them together.

- The Bill Pay Planner & Register Combo:

- What it is: These registers combine transaction tracking with a dedicated section for upcoming bills. They might have columns for bill due dates, amounts, and a checkbox for "Paid."

- Who it's for: Anyone who struggles to keep track of bill due dates and wants a unified system for both tracking spending and managing recurring payments.

- The Budgeting-Focused Register:

- What it is: Goes beyond simple transaction logging by incorporating budgeting elements directly into the template. This could include sections for monthly income, allocated budget categories, and a running total of remaining budget for each category.

- Who it's for: Users who want their register to double as their primary budgeting tool, providing a holistic view of their financial health in one place.

- The Minimalist/Ink-Saver Register:

- What it is: Designed with simplicity and economy in mind. Fewer lines, less shading, and minimal graphics to save on printer ink. Focus is purely on functionality.

- Who it's for: Environmentally conscious users, those with limited printing budgets, or anyone who prefers a very clean, no-distraction layout.

- The Large Print/Accessibility Register:

- What it is: Features larger fonts, wider spacing between lines, and sometimes fewer columns to make it easier to read and write for individuals with visual impairments or dexterity challenges.

- Who it's for: Older adults, individuals with vision issues, or anyone who simply prefers a more spacious layout.

- The Themed or Decorative Register:

- What it is: While still functional, these registers incorporate aesthetic elements – perhaps a subtle pattern, a specific color scheme, or cute icons.

- Who it's for: People who enjoy personalizing their stationery and want their financial tools to reflect their personality, making the task of money management a little more enjoyable.

- The Travel/Vacation Register:

- What it is: A compact version designed for short-term use, specifically for tracking expenses during a trip. Might have specific columns for currency exchange or travel categories.

- Who it's for: Frequent travelers or anyone planning a vacation who wants to keep a tight rein on their spending while away from their main financial records.

- The Debt Payoff Tracker Register:

- What it is: Combines basic transaction tracking with a dedicated section for monitoring debt reduction. It might include columns for original debt amount, payment made, and remaining balance.

- Who it's for: Individuals actively working on paying down debt who want a visual and tangible way to track their progress and stay motivated.

- The Hybrid Digital-Friendly Register:

- What it is: Designed to be easily scannable or transferable to a digital spreadsheet. Columns might be clearly defined for easy data entry into software later.

- Who it's for: Users who like the act of writing but also want the option to digitize their records for long-term analysis or cloud backup.

- The Family/Shared Expenses Register:

- What it is: Features extra columns or sections for tracking shared expenses between partners, roommates, or family members. Could include "Paid By" columns.

- Who it's for: Households managing joint finances or roommates splitting bills, offering clear accountability for who paid what.

3. Mastering the Art: Step-by-Step Usage of Your Printable Register

So you’ve found your perfect free printable checkbook register PDF. Fantastic! Now comes the truly empowering part: using it effectively to gain unparalleled clarity over your finances. Don't worry if you're a complete beginner; we'll walk through this together, step by step. It's simpler than you might think, and the payoff in financial peace of mind is enormous.

Here’s a detailed, step-by-step guide to mastering your checkbook register:

1. Gather Your Supplies:

- Your printed free printable checkbook register PDF.

- A reliable pen (I prefer one that doesn't bleed through the paper).

- Your checkbook (if you still use checks).

- Your debit/credit cards (for reference, not for actual entry).

- Any receipts you've collected.

- A small calculator (optional, but handy for quick calculations).

- Personal Scenario: I always keep my register, a pen, and a small stack of receipts in a designated spot by my desk. This way, there’s no excuse to delay entries, which is crucial for accuracy.

2. Understand Each Column:

- Date: The date the transaction occurred. Always fill this out first.

- Check No./Ref No.: If it's a check, write the check number. For debit card purchases, online payments, or ATM withdrawals, you can use "ATM," "DC" (Debit Card), "Online," "POS" (Point of Sale), or the last few digits of your card. For deposits, you might write "DEP." Consistency is key here.

- Description/Transaction: Briefly describe what the transaction was for. Be specific enough to remember later (e.g., "Groceries - Safeway," "Electric Bill - PGE," "Paycheck - Employer Name").

- Debit/Withdrawal (-): The amount of money leaving your account (purchases, bill payments, cash withdrawals).

- Credit/Deposit (+): The amount of money coming into your account (paychecks, refunds, transfers in).

- Balance: This is your running total. After each transaction, calculate your new balance.

- Optional Columns (Category, Cleared, Memo): If your chosen PDF has these, use them! "Category" is great for budgeting, "Cleared" for reconciliation, and "Memo" for extra notes (e.g., "Refund for shirt," "Birthday gift").

3. Start with Your Current Balance:

- The very first entry in your register should be your starting balance. This is the amount of money you currently have in your checking account. Get this from your online banking or your last bank statement.

- Write "Starting Balance" or "Balance Forward" in the description column, and enter the amount in the "Balance" column.

4. Logging Deposits (Money In):

- When you receive money (paycheck, refund, gift), immediately log it.

- Date: The date the money was deposited.

- Ref No.: You can write "DEP" or "Direct Deposit."

- Description: "Paycheck," "Refund from Amazon," "Transfer from Savings."

- Credit/Deposit (+): Enter the amount received.

- Balance: Add the deposit amount to your previous balance.

5. Logging Withdrawals/Debits (Money Out):

- This is where vigilance pays off! Log every single time money leaves your account:

- Check Written: Fill out the register *before* you write the check. Date, check number, payee, and amount.

- Debit Card Purchase: As soon as you make the purchase, jot down the date, "DC" or "POS," where you spent the money, and the amount.

- Online Bill Pay/Transfer: Date, "Online" or a unique reference number from your bank, description of the bill, and amount.

- ATM Withdrawal: Date, "ATM," location (optional), and amount.

- Balance: Subtract the withdrawal amount from your previous balance.

- Personal Scenario: I once used my register to spot a duplicate charge from a restaurant. Because I logged it immediately, I noticed the same amount appeared twice the next day. A quick call to the bank and it was resolved! Without my register, I might have missed it for weeks.

6. Reconcile Regularly (Crucial for Accuracy!):

- This is the most important step for ensuring your register matches your bank account.

- How often: At least once a week, or whenever your bank statement becomes available.

- Process:

1. Get your bank statement (online or paper).

2. Go through each transaction on your bank statement and compare it to your register.

3. As you find a match, put a small checkmark or a "C" (for "Cleared") in the "Cleared" column of your register.

4. Identify any transactions in your register that *haven't* cleared yet (no checkmark) – these are your outstanding transactions.

5. Identify any transactions on your bank statement that are *not* in your register (these are errors or forgotten entries – log them immediately!).

6. Calculate: Take your bank statement's ending balance. Add any outstanding deposits (those you recorded but haven't shown up on the statement yet). Subtract any outstanding withdrawals (checks written but not cashed, debit purchases not yet posted).

7. Match: This calculated balance *should* match the final balance in your register. If it doesn't, you have an error to find (a skipped entry, a calculation mistake, or a bank error).

7. Correcting Errors:

- Mistakes happen! If you make a mathematical error or miss an entry, don't erase it. Draw a single line through the incorrect entry, write the correct information next to it, and make a note in the margin. This maintains a clear audit trail.

- If you find a discrepancy during reconciliation, systematically go back through your entries and calculations until you find it. Most common errors are simple addition/subtraction mistakes or forgetting to log a small purchase.

8. Carry Forward Your Balance:

- When you reach the end of a page or fill up your register, take your final balance from the previous page and carry it forward as the starting balance on the new page. This ensures a continuous record.

By consistently following these steps, your free printable checkbook register PDF won't just be a record-keeping tool; it will be your financial compass, guiding you towards better money habits and a clearer understanding of your financial reality.

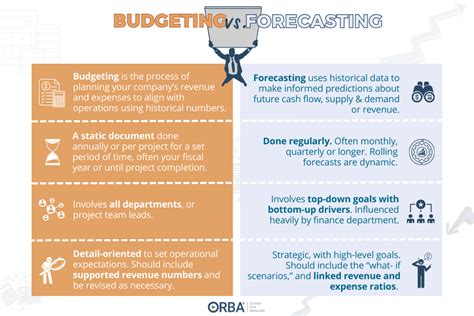

4. Beyond Transactions: Using Your Register for Budgeting & Forecasting

The power of a free printable checkbook register PDF extends far beyond simply tracking checks and debit card transactions. With a little creativity and consistent effort, it can transform into a robust tool for budgeting, forecasting, and gaining a deep understanding of your financial flow. This is where your register truly becomes a strategic asset, helping you move from simply recording what happened to actively planning what *will* happen.

Here’s how to elevate your checkbook register into a comprehensive financial planning tool:

- Implement a Simple Envelope System (Digitally/Mentally):

- Even without physical envelopes, you can use your register to manage "virtual" envelopes. Dedicate specific amounts for categories like "Groceries," "Dining Out," or "Entertainment." As you spend, subtract from that mental allocation in your register's "Description" or "Memo" column.

- Example: You allocate $400 for groceries. After a $75 grocery trip, you might write "Groceries - Safeway ($325 left)" in the description.

- Track Your Income Streams:

- Don't just record your main paycheck. Use your register to track all sources of income, no matter how small. This includes side hustle payments, refunds, cash gifts, or interest earned. Seeing all your income in one place gives you a clearer picture of your earning potential.

- Personal Scenario: I use my register to track small freelance payments. Even though they're irregular, seeing them logged alongside my main income helps me understand my overall cash flow for the month and plan for variable income.

- Identify Spending Categories and Patterns:

- If your register has a "Category" column, use it! If not, create a simple code system in your description (e.g., G=Groceries, UT=Utilities, ENT=Entertainment). After a month, review your entries to see where your money is *actually* going. You might be surprised!

- Tip: Highlight or use different colored pens for different categories to make patterns jump out visually.

- Forecast Upcoming Expenses (The "Future You" Method):

- Before the money leaves your account, "pre-log" your known upcoming bills. Write down the date they're due, a description, and the estimated amount, but leave the Debit/Credit column blank or put a small placeholder like "P" for pending.

- When the bill is actually paid, fill in the final amount and adjust your balance. This helps you see your "true" available balance, accounting for money already committed.

- Example Scenario: My partner struggled with overdrafts because he'd forget about a large utility bill due mid-month. By "pre-logging" it in his register, he always knew that money was "spoken for," preventing accidental overspending.

- Monitor Irregular Expenses:

- Beyond regular bills, use your register to keep an eye on less frequent but significant expenses like annual subscriptions, car maintenance, or holiday spending. This helps you anticipate and save for them rather than being caught off guard.

- Calculate Your "True" Available Balance:

- Your bank balance might show X amount, but if you've written checks that haven't cleared or have upcoming pre-logged bills, your *actual* available balance is often lower. Your register helps you calculate this "true" balance, preventing accidental overspending.

- Set and Track Financial Goals:

- Want to save for a down payment, a vacation, or pay off a specific debt? Dedicate a section of your register (or a separate page) to track contributions towards these goals. Each time you transfer money to savings for a goal, log it in your main register as a withdrawal, and then add it to your goal tracker.

- "No-Spend" Challenges:

- If you're doing a no-spend day or week, your register becomes your accountability partner. The absence of debit entries is a visual win, motivating you to stick to your challenge.

- Analyze Your Spending Habits Over Time:

- After a few months, flip back through your completed register pages. You'll see trends emerge – peak spending periods, categories where you consistently overspend, or areas where you've successfully cut back. This historical data is invaluable for refining your budget.

- Identify "Money Leaks":

- Those small, seemingly insignificant purchases that add up? Your register will highlight them. Daily coffees, vending machine snacks, impulse buys – when written down one after another, their cumulative impact becomes glaringly obvious.

- Emergency Fund Tracking:

- While your emergency fund should ideally be in a separate savings account, your register can still track contributions to it. Seeing those regular transfers out of checking and into savings reinforces your commitment to financial security.

- Prepare for Tax Time:

- Categorized expenses in your register can be a lifesaver for tax preparation, especially if you're self-employed or have deductible expenses. All the information is neatly organized in one place, saving you hours of sifting through bank statements.

By consistently applying these strategies, your free printable checkbook register PDF transforms from a mere record-keeper into a powerful, proactive financial management system. It puts you firmly in the driver's seat, empowering you to make informed decisions about your money and work towards your financial goals with confidence.

5. Digital Meets Analog: Syncing Your Register with Online Banking

In a world increasingly dominated by digital finance, it might seem counterintuitive to advocate for a paper-based free printable checkbook register PDF. However, the beauty isn't in choosing one over the other, but in integrating them. Your physical register and your online banking aren't rivals; they're complementary tools that, when used together, provide an unparalleled level of financial clarity and security. Think of your register as the immediate, hands-on control panel, and online banking as the comprehensive dashboard.

Here's how to seamlessly sync your analog register with your digital banking world:

- The Golden Rule: Enter Transactions in Your Register First:

- Whenever you make a purchase (debit card, online, check), the very first thing you should do is record it in your physical register. Don't wait for it to appear in your online banking. This proactive approach ensures your register always reflects your *actual* current balance, including pending transactions that haven't hit your bank's system yet