Let's be honest, managing your money can feel like trying to herd cats – especially when you're dealing with tiny lines and even tinier numbers on a standard check register. It’s frustrating, it’s prone to errors, and frankly, it can be downright stressful. I remember once, after a particularly busy month, I misplaced a single digit on my old, cramped register. It took me hours to reconcile my account, feeling that familiar knot of anxiety tightening in my stomach. Trust me, you don’t want to mess this up! That’s why discovering the power of a large printable check register was a game-changer for me, and I’m here to share why it might just be the financial clarity you've been craving too.

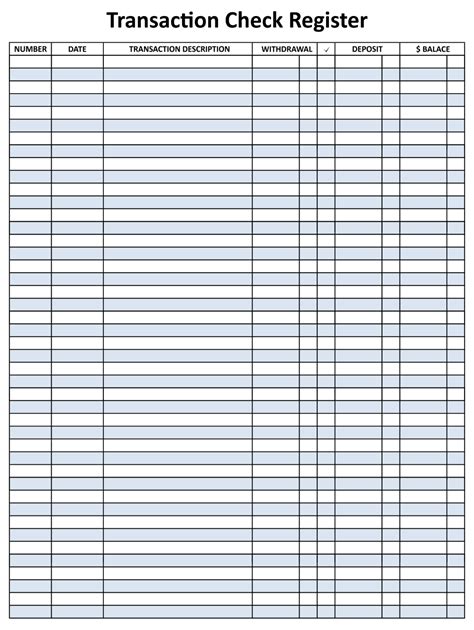

Whether you're a seasoned budgeter or just starting your financial journey, a clear, well-organized check register is your best friend. It’s not just about checks anymore; it’s about tracking *all* your transactions – debit card purchases, online payments, deposits – everything. And for those of us who appreciate the tangible, the act of writing things down, and the ease of reading bigger print, a printable version is a true blessing.

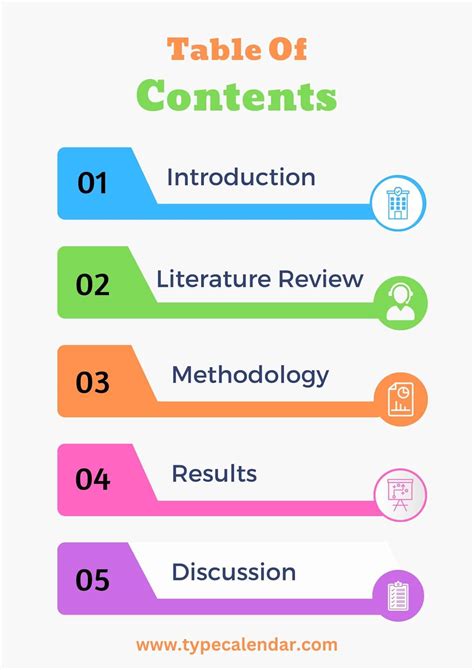

Table of Contents

- [The "Large Print" Advantage: Seeing Your Money Clearly](#the-large-print-advantage-seeing-your-money-clearly)

- [Beyond the Basics: Daily Transaction Tracking for Peace of Mind](#beyond-the-basics-daily-transaction-tracking-for-peace-of-mind)

- [Budgeting Brilliance: Integrating Your Register with Financial Goals](#budgeting-brilliance-integrating-your-register-with-financial-goals)

- [Customization & Flexibility: Making Your Register Truly Yours](#customization-flexibility-making-your-register-truly-yours)

- [For Small Businesses & Side Hustles: Streamlined Expense Management](#for-small-businesses-side-hustles-streamlined-expense-management)

- [Digital Harmony: Bridging the Gap Between Paper and Apps](#digital-harmony-bridging-the-gap-between-paper-and-apps)

- [Tips for Personalizing Your Large Printable Check Register](#tips-for-personalizing-your-large-printable-check-register)

- [Common Pitfalls: What to AVOID When Using Your Check Register](#common-pitfalls-what-to-avoid-when-using-your-check-register)

- [Ready for Financial Clarity?](#ready-for-financial-clarity)

---

The "Large Print" Advantage: Seeing Your Money Clearly

One of the biggest struggles with traditional check registers is their minuscule size. If you've ever squinted, grabbed reading glasses, or even used a magnifying glass just to jot down a transaction, you know the pain. A large printable check register solves this instantly.

- Enhanced Readability: The most obvious benefit. Larger font and wider columns mean less strain on your eyes and fewer errors.

- Reduced Stress: When you can clearly see what you're writing, the process becomes less intimidating and more manageable.

- Ideal for All Ages: Perfect for seniors or anyone with vision challenges who still prefer physical tracking.

- More Space for Details: No more abbreviating "Target run" to "TRGT" – you can actually write clear descriptions!

- Less Smudging: With more room between lines, your hand is less likely to smudge freshly written entries. I remember using a template that gave me plenty of room for notes, making my monthly reconciliation a breeze instead of a headache.

Beyond the Basics: Daily Transaction Tracking for Peace of Mind

While "check register" is in the name, modern financial life means tracking much more than just checks. This is where a robust, large printable check register truly shines as your comprehensive transaction log.

- Debit Card Dominance: Easily log every debit card purchase, ensuring you know exactly where your money is going.

- Online Payment Records: Keep a physical record of all your bill pays and online transfers.

- ATM Withdrawals: Note down cash withdrawals to prevent discrepancies with your bank statement.

- Deposits & Credits: Log incoming funds clearly, whether it’s your paycheck or a refund.

- Category Tags (Optional Column): Add a column for simple categories (e.g., "Groceries," "Utilities") to get a quick sense of spending habits. I used this method for a month and was shocked (and enlightened!) by how much I spent on impulse buys.

- Running Balance Check: The core function – consistently update your balance after each transaction to always know your true available funds.

- Reconciliation Made Easy: When your bank statement arrives, matching it to your clear, large-print entries is a snap, preventing "where did that go?" moments.

Budgeting Brilliance: Integrating Your Register with Financial Goals

A well-maintained check register isn't just a record-keeping tool; it's a powerful asset for budgeting and achieving your financial aspirations.

- Expense Awareness: Truly understand where your money is flowing by seeing every transaction logged.

- Spending Habit Insights: Patterns emerge when you regularly track; you might notice you're spending too much on coffee or subscriptions.

- Goal Tracking: Dedicate a section to specific savings goals, marking progress as you allocate funds.

- Debt Repayment Strategy: Log every debt payment and watch your balances decrease, which is incredibly motivating.

- "No-Spend" Challenges: Use your register to track success during periods you've committed to not spending money on non-essentials.

- Income vs. Outflow Visual: A quick glance can tell you if you're living within your means or heading for trouble. For instance, after a few weeks, I could easily see how much I had left for discretionary spending, helping me avoid overspending on fun outings.

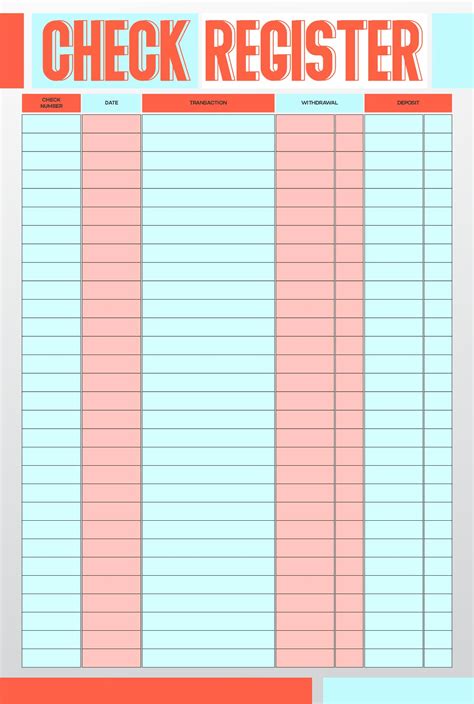

Customization & Flexibility: Making Your Register Truly Yours

The beauty of a large printable check register is its adaptability. Unlike pre-printed booklets, you can tailor it precisely to your needs.

- Choose Your Layout: Opt for simple date/description/amount/balance columns or add more fields for categories, notes, or even initial confirmations.

- Print as Needed: No need to buy bulky books; print pages only when you run out, saving paper and clutter.

- Bind It Your Way: Keep pages loose, punch holes for a binder, staple them, or use a clip. I personally love a spiral-bound version because it lays flat.

- Color-Code Entries: Use different colored pens for deposits, withdrawals, or specific categories to make scanning easier.

- Design Your Own Columns: If you need a column for "Budget Category" or "Receipt Attached Y/N," you can add it!

- Different Sizes: While we're talking "large," you can print it on letter, legal, or even ledger-sized paper for ultimate spaciousness. This flexibility is what helped me experiment and find the perfect flow for my unique financial life.

For Small Businesses & Side Hustles: Streamlined Expense Management

If you're running a small business, a freelance gig, or even just a robust side hustle, a dedicated large printable check register can be an invaluable, low-tech accounting tool.

- Separating Personal & Business: Essential for clarity and tax purposes. Use a separate register for business transactions.

- Tracking Business Expenses: Accurately log every business-related purchase, from supplies to software subscriptions.

- Income Tracking: Record all incoming payments from clients or sales.

- Mileage & Travel (Add-on Column): Some registers allow for extra columns to track business mileage or travel expenses.

- Proof of Purchase: Note reference numbers or link to physical receipts, crucial for audits.

- Tax Prep Simplified: With all your business income and expenses clearly logged, tax season becomes significantly less daunting. I used a specific printable for my freelance work, and come tax time, my accountant was thrilled with how organized everything was!

Digital Harmony: Bridging the Gap Between Paper and Apps

While the focus is on a printable register, it doesn't mean you have to be completely analog. A large printable check register can complement your digital financial tools beautifully.

- Offline Backup: Your physical register serves as a crucial backup in case of tech glitches or power outages.

- First Entry Point: Many find it easier to quickly jot down transactions on paper before entering them into an app later.

- Visual Confirmation: Double-check entries in your app against your physical ledger for accuracy.

- Learning Tool: For those new to budgeting apps, starting with a physical register can help them understand the flow of money.

- Reduced Screen Time: Sometimes, it’s nice to step away from the screen and engage with your finances in a tactile way. I find this approach works best for small teams managing shared expenses, as it provides a clear, undeniable paper trail that everyone can see and verify.

---

Tips for Personalizing Your Large Printable Check Register

Making your check register truly your own will increase your likelihood of sticking with it.

- Choose a Template That Sparks Joy: There are many free printable templates online. Find one whose layout and design appeal to you.

- Use Your Favorite Pens: Seriously, small things like a smooth-flowing pen can make the task more pleasant.

- Add Decorative Elements (if you like): A little color or a few stickers can turn a chore into a mini-project.

- Keep it Accessible: Store your register somewhere convenient – next to your computer, in your kitchen drawer, or in your purse – so you can update it immediately.

- Review Regularly: Set a specific time each week to review your entries and reconcile with your bank account. This is my favorite strategy because it saved me countless times from overdraft fees and financial surprises.

- Consider a "Notes" Section: A small section for thoughts, reminders, or future financial goals can be incredibly useful.

Common Pitfalls: What to AVOID When Using Your Check Register

Even with the best intentions, it's easy to fall into traps. Here's what to watch out for:

- Forgetting to Log Immediately: This is the #1 mistake! Transactions pile up, and suddenly you're guessing, leading to errors. Don’t be like me and try to recall five days' worth of transactions from memory; it’s a recipe for a headache!

- Not Calculating Running Balance: The whole point of a register is to know your *current* balance. Skipping this step defeats its purpose.

- Ignoring Small Transactions: Those seemingly insignificant coffee purchases or app subscriptions add up fast. Log everything!

- Misplacing Your Register: Treat it like cash. Know where it is at all times.

- Not Reconciling with Bank Statements: Your bank can make errors, and so can you. Regular reconciliation catches discrepancies early.

- Giving Up After a Mistake: Everyone makes mistakes. Just find it, correct it, and keep going. Don't let one error derail your entire financial tracking system.

---

Ready for Financial Clarity?

A large printable check register isn't just a piece of paper; it's a tool for empowerment. It puts you in the driver's seat of your finances, giving you a clear, tangible picture of where your money is going and where it needs to be. Stop squinting, start tracking, and reclaim your financial peace of mind. Now go make your money work for you!