Losing a spouse is an experience that defies adequate description. It’s an earthquake in the landscape of your life, leaving behind not just sorrow, but often a bewildering array of practical tasks that feel impossible to navigate through the fog of grief. The world keeps moving, but for you, time might feel like it’s standing still, or conversely, racing ahead with demands you’re ill-equipped to meet. In these moments, the simplest things can feel monumental, and the thought of managing complex administrative and legal duties can be utterly overwhelming.

You're not alone in feeling this way. Millions have walked this path before you, and millions more will. The journey is intensely personal, yet many of the challenges are universal. When the initial shock begins to recede, a new kind of struggle often emerges: the practicalities. From notifying institutions to managing finances, from legal paperwork to digital accounts, the sheer volume of "what to do next" can be paralyzing. I've witnessed firsthand how this period can compound an already unbearable emotional burden. I recall a dear friend, reeling from her husband's sudden passing, staring blankly at a pile of mail, utterly unsure where to even begin. She desperately wished for a clear, step-by-step guide, something tangible to hold onto when her mind felt scattered.

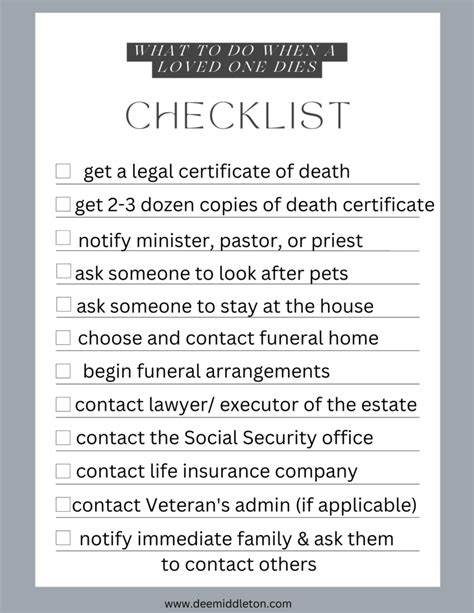

That's precisely why this guide exists. It's designed to be that steady hand, that clear roadmap, transforming the daunting mountain of tasks into a series of manageable steps. This printable checklist after death of spouse isn't just a list; it’s a compassionate companion for a difficult journey. We'll break down the immediate, short-term, and long-term actions you might need to take, offering practical advice, empathetic insights, and a structure to help you regain a sense of control, one step at a time. My hope is that by the end of this comprehensive article, you'll feel better equipped, less overwhelmed, and more confident in handling the necessary practicalities, allowing you more space to grieve and heal. Trust me, navigating this period with a clear plan can make an immeasurable difference.

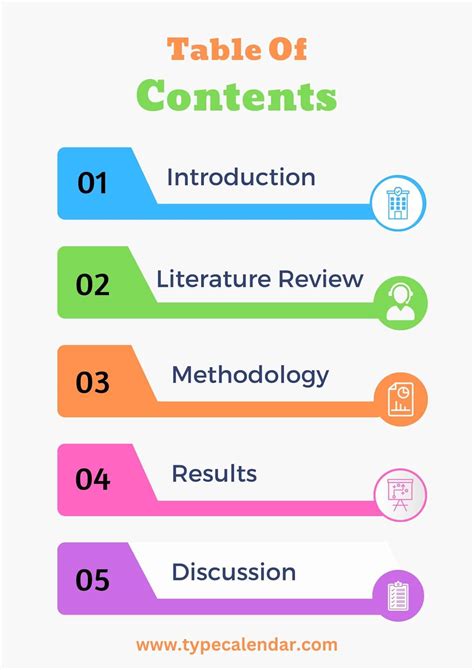

Table of Contents

- [The Immediate Aftermath: Prioritizing Self-Care and First Steps](#the-immediate-aftermath-prioritizing-self-care-and-first-steps)

- [Navigating Funeral Arrangements and Memorialization](#navigating-funeral-arrangements-and-memorialization)

- [Securing Vital Documents and Information](#securing-vital-documents-and-information)

- [Managing Immediate Financial Realities](#managing-immediate-financial-realities)

- [Initiating the Estate and Probate Process](#initiating-the-estate-and-probate-process)

- [Adjusting Household and Property Matters](#adjusting-household-and-property-matters)

- [Addressing Digital Legacy and Online Accounts](#addressing-digital-legacy-and-online-accounts)

- [Understanding and Claiming Benefits & Pensions](#understanding-and-claiming-benefits--pensions)

- [Prioritizing Ongoing Emotional and Social Support](#prioritizing-ongoing-emotional-and-social-support)

- [Long-Term Planning and Rebuilding Your Life](#long-term-planning-and-rebuilding-your-life)

- [How to Choose the Best Approach for Your Needs](#how-to-choose-the-best-approach-for-your-needs)

- [Common Pitfalls to Avoid During This Difficult Time](#common-pitfalls-to-avoid-during-this-difficult-time)

- [Advanced Tips for Navigating Grief and Logistics](#advanced-tips-for-navigating-grief-and-logistics)

- [Conclusion: Taking One Step at a Time](#conclusion-taking-one-step-at-a-time)

---

The Immediate Aftermath: Prioritizing Self-Care and First Steps

In the immediate hours and days following the death of a spouse, your primary focus should be on your emotional and physical well-being. It’s a time of profound shock and immense sorrow, and expecting yourself to be fully functional or make perfect decisions is unrealistic. This initial phase of our printable checklist after death of spouse emphasizes grace, self-compassion, and the very first practical steps that simply cannot wait.

- Allow Yourself to Grieve: This is not a task, but a vital part of your healing. Don't suppress your emotions, whatever they may be – sadness, anger, confusion, even numbness. Give yourself permission to feel them fully. I've seen countless individuals try to "be strong" for others, only to find their grief delayed and intensified later. It’s okay to cry, to withdraw, or to simply exist.

- Lean on Your Support System: This is the time to reach out to trusted family members, close friends, or a spiritual advisor. You don't have to carry this burden alone. Let them help with practicalities like phone calls, childcare, or simply being present. One friend confided in me that the simple act of letting her sister answer the doorbell gave her immense relief in those first few days.

- Prioritize Basic Needs: Eating, sleeping (even if fitfully), and hydration are crucial. Grief is physically exhausting. Try to maintain some semblance of routine, even if it feels impossible. If cooking is too much, accept meal deliveries or let friends bring food. Your body needs nourishment to support your grieving mind.

- Notify Immediate Family and Close Friends: While difficult, this is a necessary first step. Consider asking a trusted family member or friend to help make these calls or send messages on your behalf. This can prevent you from having to repeat the difficult news multiple times.

- Contact Your Spouse's Physician or Hospice (if applicable): They will confirm the death and can guide you on obtaining a pronouncement of death and, eventually, a death certificate. This is a foundational step for all subsequent legal and administrative processes.

- Understand Funeral Home Services: If your spouse did not have pre-arranged plans, you'll need to contact a funeral home. They can often provide immediate guidance on transporting the body, obtaining the death certificate, and starting the funeral planning process. Don't feel pressured to make all decisions at once.

- Gather Essential Information for Funeral Arrangements: Before meeting with a funeral director, try to locate any preferences your spouse might have expressed regarding burial, cremation, or memorial services. This could be in a will, a letter, or simply conversations you had. My own family found immense comfort in knowing we were honoring my uncle's wishes because he'd casually mentioned them years prior.

- Delegate When Possible: This is perhaps the most important tip for the immediate aftermath. You are in no state to handle everything. If someone offers to help with a specific task (e.g., picking up groceries, coordinating visitors, making phone calls), accept gracefully. People genuinely want to help, and letting them do so allows you to conserve your precious energy.

- Be Wary of Immediate Financial Decisions: Avoid making any significant financial or legal decisions under duress. Grief can impair judgment. If anyone pressures you into quick decisions, put them off. There's almost nothing that needs to be decided in the first 24-48 hours that can't wait a day or two.

- Consider Professional Support: Even in the very early stages, if you feel completely overwhelmed or unable to cope, don't hesitate to reach out to a grief counselor, therapist, or support group. Many hospices and community centers offer immediate bereavement support.

- Keep a Journal or Notebook: Even if it’s just scribbling down names of people who called or questions that pop into your head, a notebook can be invaluable. Your memory might be hazy, and having a physical record can reduce anxiety. I always advise people to write things down, even small details, when they're under stress; it lightens the mental load.

- Limit External Stimuli: Give yourself permission to turn off your phone, avoid social media, or decline visitors if you need quiet time. Protect your space and your peace as much as possible.

---

Navigating Funeral Arrangements and Memorialization

Once the initial shock begins to settle, one of the most immediate and significant tasks is planning the funeral or memorial service. This section of our printable checklist after death of spouse guides you through the process, emphasizing options and personal touches that can bring comfort during this difficult time.

- Choose a Funeral Home: If your spouse didn't pre-arrange anything, selecting a funeral home is paramount. Research local options, ask for recommendations, and don't hesitate to call and ask questions about their services and pricing before committing.

- Understand Service Options: Funeral homes offer a range of services: traditional funerals, cremation with a memorial service, direct cremation, green burials, etc. Discuss all options with the funeral director to find what best honors your spouse's wishes and your family's needs.

- Review Pre-Arrangements (if any): Check if your spouse had pre-paid for or pre-planned their funeral. This information might be in their will, a separate binder, or with a specific funeral home. This can significantly ease the burden and ensure their wishes are met.

- Determine Burial or Cremation: This is a fundamental decision. If your spouse had strong preferences, honor them. If not, consider what feels right for your family and what aligns with their values.

- Select a Location for the Service: This could be a funeral home chapel, a place of worship, a community center, or even a private residence. Think about what would be most meaningful and accessible for attendees.

- Choose Casket, Urn, or Other Receptacle: This is a very personal choice. Funeral homes will present many options, but don't feel pressured. Focus on what feels appropriate and within your budget.

- Plan the Ceremony Details: This includes selecting readings, music, eulogists, and any special rituals or traditions. Personalizing the service can be incredibly healing. One family I know played their loved one's favorite silly song at the end of the service, bringing a much-needed moment of shared joy amidst the tears.

- Prepare an Obituary: This is a public announcement of your spouse's passing, usually published in local newspapers and online. It typically includes biographical details, survivors, and service information. Many funeral homes can assist with writing and submitting the obituary.

- Arrange for Pallbearers/Honorary Pallbearers: If appropriate for the service type, select individuals who were close to your spouse to serve in this role. It's an honor for them and a source of support for you.

- Consider Flowers, Donations, or Other Tributes: Decide if you prefer flowers, or if you'd like to suggest donations to a specific charity in lieu of flowers. This is often mentioned in the obituary.

- Coordinate with Clergy or Celebrant: If you're having a religious service, work closely with your spiritual leader. If not, a celebrant can help create a personalized, non-religious ceremony.

- Plan a Reception or Gathering (Optional): Many families choose to have a gathering after the service to allow people to connect, share memories, and offer support. This can be informal or more structured, depending on your preferences.

---

Securing Vital Documents and Information

The bureaucratic aftermath of a death requires a surprising number of documents. Gathering these key pieces of information early on is a critical step in our printable checklist after death of spouse, as they will be required for almost every subsequent task.

- Obtain Multiple Certified Copies of the Death Certificate: This is the single most important document you will need. You'll require certified copies for banks, insurance companies, government agencies, and more. Order at least 10-15 copies, possibly more depending on the complexity of your spouse's estate. You can typically get these through the funeral home or the vital statistics office in the county where the death occurred.

- Locate Your Spouse's Will or Trust Documents: This is paramount for understanding their final wishes and initiating the probate process. Check safe deposit boxes, home safes, personal files, or contact their attorney. My friend was so relieved she'd organized a "important documents" binder years ago; it saved her immense searching time.

- Gather Insurance Policies: This includes life insurance, health insurance, auto insurance, home insurance, and any other policies your spouse held. You'll need these to file claims and potentially update coverage.

- Find Bank Account Information: Collect details for all checking, savings, and investment accounts. You'll need account numbers, bank names, and contact information.

- Locate Retirement Account Information: This includes 401(k)s, IRAs, pensions, and any other retirement savings plans. These often have specific beneficiary designations that supersede a will.

- Identify Debts and Creditors: Gather statements or bills for credit cards, mortgages, loans, utility bills, and any other outstanding debts. This helps you understand the estate's liabilities.

- Find Investment Account Information: If your spouse had brokerage accounts, stocks, bonds, or other investments, gather statements and contact details for the financial institutions.

- Collect Property Deeds and Titles: Locate deeds for real estate (home, land) and titles for vehicles (cars, boats, RVs). These are essential for transferring ownership.

- Gather Income Tax Returns: Copies of recent tax returns (federal and state) can provide a snapshot of financial assets and liabilities, and will be needed for final tax filings.

- Locate Social Security Number: Your spouse's Social Security number will be needed for many notifications and applications. It's usually on their Social Security card, tax returns, or other official documents.

- Find Marriage Certificate: This may be required by certain agencies or for claiming spousal benefits.

- Create a Centralized File System: As you gather documents, create a dedicated binder or digital folder. Organize everything logically. This simple act can reduce stress immeasurably as you move through the process. I can't stress enough how much a good organizational system helps when you're overwhelmed.

- Compile a List of Key Contacts: Include names, phone numbers, and email addresses for your spouse's attorney, financial advisor, insurance agent, employer, and any other important professional contacts.

---

Managing Immediate Financial Realities

The financial aspects after a spouse's death can be daunting. This part of our printable checklist after death of spouse focuses on immediate financial steps to ensure stability and prevent issues, while always advising caution and seeking professional help when needed.

- Assess Immediate Cash Needs: Ensure you have access to funds for immediate expenses like funeral costs, household bills, and daily living. Check if your spouse had joint accounts or if you are a designated beneficiary on any accessible accounts.

- Notify Banks and Financial Institutions: Inform your spouse's banks, credit unions, and investment firms of their passing. They will likely freeze individual accounts and provide guidance on how to access funds or transfer ownership based on the death certificate and account type.

- Cancel Unnecessary Subscriptions and Services: Review bank statements and credit card bills to identify recurring charges for services your spouse used but you no longer need (e.g., gym memberships, streaming services, magazine subscriptions). Canceling these can prevent unnecessary expenses.

- Forward Mail: Contact the post office to set up mail forwarding for your spouse's mail to your address, or a designated address, if necessary. This ensures you don't miss important correspondence.

- Gather Recent Bills and Statements: Collect all recent utility bills, credit card statements, loan statements, and mortgage statements. This helps you understand current financial obligations and avoid missed payments.

- Inform Your Spouse's Employer (if applicable): If your spouse was employed, notify their HR department. They will provide information on final paychecks, accrued vacation time, retirement benefits, and any life insurance policies provided through the employer.

- Understand Joint vs. Individual Accounts: It's crucial to distinguish between accounts held jointly (which often pass directly to the surviving spouse) and accounts held solely in your spouse's name (which may need to go through probate).

- Be Mindful of Credit Cards: If your spouse had individual credit cards, notify the companies. Do not use their credit cards after their death. Joint credit cards will typically become your sole responsibility.

- Identify and Secure Assets: If there are physical assets like cash, jewelry, or valuable collectibles, ensure they are secured and inventoried.

- Create a Budget for Your New Financial Reality: Even if it's a rough estimate, start thinking about your income and expenses as a single individual. This can help you plan for the future.

- Consult a Financial Advisor (Early On): While not an immediate action *you* must take, scheduling a meeting with a financial advisor who specializes in bereavement can be invaluable. They can help you understand the long-term financial implications and guide investment decisions. My own financial advisor was a godsend after my aunt passed; he helped her husband navigate complex pension choices.

- Do Not Rush to Pay Debts: While you need to be aware of debts, do not immediately pay off all your spouse's individual debts from your own funds. The estate is responsible for debts, and you need professional advice on how to handle creditors.

---

Initiating the Estate and Probate Process

The legal process of settling an estate can be complex and intimidating. This section of our printable checklist after death of spouse demystifies the steps involved in probate and estate administration, stressing the importance of legal counsel.

- Determine if Probate is Necessary: Probate is the legal process of validating a will (if one exists), inventorying assets, paying debts, and distributing property to heirs. Not all estates require probate, especially if assets are held jointly or in a trust. Consult with an attorney to determine the best path.

- Locate the Original Will: If a will exists, the original document is crucial. It dictates how assets are to be distributed and names the executor.

- Identify the Executor/Personal Representative: The will names an executor (or personal representative) who is responsible for managing the estate. If there is no will, the court will appoint an administrator. This could be you.

- File the Will with the Probate Court: The executor must file the original will with the probate court in the county where the deceased resided. This typically starts the formal probate process.

- Obtain Letters Testamentary/Letters of Administration: Once the court officially appoints the executor or administrator, they will issue "Letters Testamentary" (with a will) or "Letters of Administration" (without a will). These legal documents prove your authority to act on behalf of the estate. You will need multiple certified copies.

- Inventory All Assets and Debts: The executor is responsible for creating a comprehensive inventory of all the deceased's assets (real estate, bank accounts, investments, personal property) and all outstanding debts. This is a meticulous process.

- Notify Creditors: The estate is legally obligated to notify creditors of the death so they can submit claims against the estate. This is often done through a public notice in a newspaper, as required by state law.

- Pay Valid Debts and Taxes: The executor must pay all legitimate debts and final taxes from the estate's assets before distributing any inheritances. This includes final income taxes, estate taxes (if applicable), and property taxes.

- Distribute Assets According to the Will (or State Law): Once debts and taxes are paid, the remaining assets are distributed to beneficiaries as outlined in the will. If there is no will, state intestacy laws will dictate how assets are divided among heirs.

- Close the Estate: Once all assets are distributed and all obligations met, the executor can petition the court to formally close the estate.

- Consult an Estate Attorney: This is perhaps the most vital step in this section. Navigating probate and estate law is complex. An experienced estate attorney can guide you through every step, ensure compliance with laws, and help minimize stress. I cannot overstate the peace of mind that comes from having an expert handle these legal intricacies.

- Understand State-Specific Laws: Probate laws vary significantly from state to state. Your attorney will be able to advise you on the specific requirements and timelines in your jurisdiction.

---

Adjusting Household and Property Matters

Your home, once a shared space, now reflects a profound absence. This part of the printable checklist after death of spouse helps you address practical household and property adjustments, blending sensitivity with necessity.

- Secure the Residence: If your spouse lived alone or you will be away, ensure the home is secure. Lock doors and windows, and consider informing trusted neighbors of the situation.

- Address Utilities and Services: Contact utility companies (electricity, gas, water, internet, phone) to transfer accounts into your name, if they were solely in your spouse's name, or to cancel services no longer needed. My friend found it surprisingly cathartic to cancel her husband's old newspaper subscription – a small step towards accepting the new reality.

- Change Locks (if necessary): If you are concerned about security, or if others had keys, consider changing the locks on your home.

- Update Homeowner's/Renter's Insurance: Notify your insurance provider of your spouse's passing. You may need to update the policy to reflect single ownership or adjust coverage.

- Address Vehicle Ownership: If your spouse owned vehicles, you'll need to transfer titles. This often involves the Department of Motor Vehicles (DMV) and requires a death certificate and potentially probate documents. Update auto insurance policies as well.

- Manage Household Belongings: This is a deeply personal and often emotionally taxing task. There's no right or wrong way or timeline.

- Phase 1: Immediate Sorting: Remove highly personal items that might cause immediate distress from common areas if you wish.

- Phase 2: Gradual Decluttering: Over time, you'll need to decide what to keep, donate, sell, or discard. Don't rush this process. Take it in small chunks. I observed one widow who found comfort in sorting through her husband's books, remembering stories associated with each.

- Phase 3: Sentimental Items: Designate a special box or area for sentimental items you want to keep.

- Consider Downsizing or Selling Property: This is a long-term decision, not an immediate one. If the current home is too large, too expensive, or holds too many painful memories, you might eventually consider selling or moving. This decision should only be made when you feel emotionally ready and have a clear financial picture.

- Review Home Security Systems: If you have a home security system, ensure it's updated with your contact information and that you know how to operate it.

- Maintain the Property: Even if you plan to move, the property needs to be maintained. Arrange for lawn care, snow removal, or other necessary upkeep. If you can't do it, delegate or hire help.

- Address Pets (if any): If your spouse was the primary caregiver for a pet, ensure their needs are met. This can also be a source of comfort for you.

- Update Mail Subscriptions: Beyond forwarding mail, consider directly contacting organizations for subscriptions (magazines, newsletters) to update the recipient name or cancel them.

---

Addressing Digital Legacy and Online Accounts

In today's interconnected world, a significant part of a person's life exists online. This section of our printable checklist after death of spouse guides you through the often-overlooked but crucial steps of managing your spouse's digital footprint.

- Compile a List of All Online Accounts: This is a significant task and often requires detective work. Think about email accounts, social media profiles (Facebook, Instagram, Twitter, LinkedIn), online banking portals, shopping sites (Amazon, eBay), streaming services (Netflix, Spotify), utility accounts, cloud storage (Google Drive, Dropbox), and any other online presence.

- Locate Passwords or Access Information: This is the biggest hurdle. Check for password managers, physical notebooks, or shared digital documents where your spouse might have stored this information. If you don't have access, you'll need to follow the account provider's specific procedures for deceased users.

- Secure Email Accounts First: Email accounts are often the gateway to other online services (password resets, notifications). Gaining access or closing them is a priority.

- Address Social Media Profiles:

- Memorialization: Most platforms (Facebook, Instagram) offer options to memorialize an account, which preserves the profile as a tribute while preventing further logins.

- Deletion: Alternatively, you can request account deletion, which permanently removes the profile.

- Check Platform Policies: Each platform has its own process, often requiring a death certificate and proof of your relationship.

- Cancel Streaming Services and Subscriptions: Identify all paid online subscriptions (Netflix, Hulu, Spotify, gaming services, software licenses) and cancel them to prevent ongoing charges.

- Manage Online Banking and Investment Portals: While you've likely notified the financial institutions offline, ensure you address any online access your spouse had. You may need to close these digital portals or transfer access to yourself.

- Check Cloud Storage Accounts: Services like Google Drive, Dropbox, iCloud, or OneDrive might contain important documents, photos, or digital memories. Access these to download or preserve content before closing accounts.

- Address Online Shopping Accounts: Close accounts like Amazon, eBay, or other e-commerce sites your spouse used frequently to prevent fraudulent activity or accidental orders.

- Handle Digital Assets and Intellectual Property: If your spouse was a content creator, artist, or had digital intellectual property (e.g., e-books, music, software), you'll need to understand how to manage or transfer these assets. This might require legal advice.

- Consider a Digital Executor Service: Some companies specialize in managing digital legacies, offering services to identify, access (where legally possible), and close online accounts. This can be a worthwhile investment if the digital footprint is extensive.

- Be Patient and Methodical: This process can be tedious and frustrating, especially without passwords. Take it one account at a time. It's perfectly okay to tackle this in phases, as you discover more accounts. I once spent weeks helping a friend untangle her father's digital life; it's a marathon, not a sprint.

- Preserve Digital Memories: Before deleting anything, download photos, videos, or meaningful messages from social media or cloud storage. These digital memories can be incredibly precious later on.

---

Understanding and Claiming Benefits & Pensions

Navigating government agencies and private benefit providers to claim what your spouse was entitled to can be complex. This section of our printable checklist after death of spouse outlines the key steps to ensure you receive available survivor benefits and pensions.

- Notify Social Security Administration (SSA): This is one of the most critical notifications. The funeral home often handles this, but confirm it has been done. If not, contact the SSA directly. You may be eligible for survivor benefits as a widow/widower, and a one-time death payment.

- Understand Social Security Survivor Benefits Eligibility: Eligibility depends on your age, whether you have dependent children, and your spouse's work record. The SSA website (SSA.gov) has detailed information. Be prepared with your spouse's SSN, your SSN, their death certificate, and your marriage certificate.

- Contact Your Spouse's Former Employers Regarding Pensions/Retirement Plans: If your spouse had a pension, 401(k), 403(b), or other retirement plans, contact their current or former employers' HR or benefits departments. Ask about survivor benefits or beneficiary designations.

- Claim Life Insurance Benefits: Contact all life insurance companies where your spouse had policies. You'll need the policy number and a certified copy of the death certificate. Be prepared to fill out claim forms.

- Check for Veteran's Benefits (if applicable): If your spouse was a veteran, contact the Department of Veterans Affairs (VA). Surviving spouses may be eligible for burial benefits, dependency and indemnity compensation (DIC), or other survivor benefits.

- Investigate Union Benefits: If your spouse was a member of a union, contact the union office to inquire about any death benefits, pension plans, or life insurance policies they may have provided.

- Review Annuities and Other Investment Products: Check if your spouse had any annuities, trusts, or other investment products that may have beneficiary designations or survivor clauses.

- Understand Medicare/Medicaid Implications: If your spouse was on Medicare or Medicaid, their enrollment will cease. Your own health coverage may need to be adjusted. Contact Medicare or your state's Medicaid office for guidance.

- Address Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs): These accounts have specific rules regarding what happens to funds upon death. Contact the plan administrator for guidance.

- Seek Advice on Tax Implications of Benefits: Survivor benefits, life insurance payouts, and inherited retirement accounts can have complex tax implications. Consult with a tax advisor or financial planner to understand your obligations and options.

- Keep Meticulous Records: Keep copies of all applications, correspondence, and payment confirmations related to benefits. This will be invaluable if questions arise later.

- Be Patient with Bureaucracy: Dealing with large government agencies or insurance companies can be slow and require persistence. Don't get discouraged by long wait times or multiple forms. This is a common experience, and your patience will pay off. I've heard countless stories of people needing to follow up multiple times to get what they were entitled to.

---

Prioritizing Ongoing Emotional and Social Support

While the practical tasks are crucial, your emotional well-being remains paramount. This section of our printable checklist after death of spouse focuses on nurturing your grief journey and finding healthy ways to cope and connect.

- Acknowledge Your Grief is Unique: There is no "right" way to grieve. Your experience will be different from anyone else's, even those who have lost a