Let's be honest: money can be a source of stress, a constant worry, or just a nebulous concept that seems to slip through our fingers. We all dream of a little more financial breathing room, whether it's for a dream vacation, a down payment on a home, or simply the peace of mind that comes with a robust emergency fund. But turning those dreams into reality often feels like an uphill battle, especially when you're staring at a blank budget spreadsheet or a bank account that just doesn't seem to grow.

I've been there. For years, my saving efforts were sporadic at best. I'd start with grand intentions, manually tracking expenses for a week or two, only to lose steam and revert to old habits. It felt like I was constantly running on a financial treadmill, never quite getting anywhere. Then, almost by accident, I stumbled upon the concept of a money saving chart printable. It sounded almost too simple, too low-tech for our digital age. Could a piece of paper, a pen, and a little bit of color truly make a difference? Trust me, the answer is a resounding yes. It transformed my relationship with money, turning a daunting chore into a visual, satisfying game. This guide is born from that personal transformation, aiming to equip you with every tool, every insight, and every bit of motivation you need to make saving not just possible, but enjoyable. We’re going to dive deep into the world of money saving chart printables, exploring their power, variety, and how you can harness them to build the financial future you deserve.

---

Table of Contents

- [The Foundation: Understanding Money Saving Charts & Why They Work](#the-foundation-understanding-money-saving-charts--why-they-work)

- [Diverse Printable Chart Designs for Every Saving Goal](#diverse-printable-chart-designs-for-every-saving-goal)

- [Strategic Saving Challenges: Beyond the Basic Chart](#strategic-saving-challenges-beyond-the-basic-chart)

- [Customizing Your Chart: Making It Uniquely Yours](#customizing-your-chart-making-it-uniquely-yours)

- [Integrating Charts with Your Broader Financial Plan](#integrating-charts-with-your-broader-financial-plan)

- [Troubleshooting & Overcoming Saving Hurdles with Your Chart](#troubleshooting--overcoming-saving-hurdles-with-your-chart)

- [Printable Charts for Specific Life Stages & Goals](#printable-charts-for-specific-life-stages--goals)

- [Leveraging Digital Tools & Apps Alongside Your Printable](#leveraging-digital-tools--apps-alongside-your-printable)

- [The Psychology of Saving: How Charts Boost Motivation](#the-psychology-of-saving-how-charts-boost-motivation)

- [The Future of Financial Tracking: What's Next for Printable Charts?](#the-future-of-financial-tracking-whats-next-for-printable-charts)

- [How to Choose the Best Money Saving Chart Printable for Your Needs](#how-to-choose-the-best-money-saving-chart-printable-for-your-needs)

- [Common Pitfalls to Avoid When Using Money Saving Charts](#common-pitfalls-to-avoid-when-using-money-saving-charts)

- [Advanced Tips for Experts: Optimizing Your Printable Saving Journey](#advanced-tips-for-experts-optimizing-your-printable-saving-journey)

- [Conclusion](#conclusion)

---

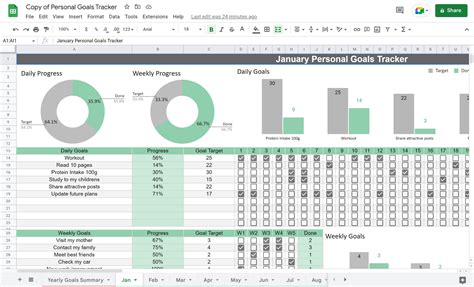

The Foundation: Understanding Money Saving Charts & Why They Work

If you're new to the world of intentional saving, the very idea of a "money saving chart printable" might seem a bit quaint. In an age of sophisticated budgeting apps and AI-driven financial advisors, why would we turn to something as simple as paper and pen? The answer lies in the profound psychological impact of visualization, gamification, and tangible progress. This section lays the groundwork, explaining what these charts are and why they are incredibly effective tools for anyone looking to boost their savings.

What Exactly Is a Money Saving Chart Printable?

At its core, a money saving chart printable is a visual tool designed to help you track your progress towards a specific savings goal. Instead of just seeing numbers in a spreadsheet, you see a picture – a thermometer, a grid, a series of shapes – that you fill in as you save. Each time you put money aside, you color in a section, check a box, or add a sticker, creating a clear, immediate representation of your progress.

Why They Work: The Psychology of Visual Savings

1. Visual Reinforcement: Our brains are wired for visual input. Seeing a physical representation of your savings grow provides a powerful psychological boost. It's not just a number on a screen; it's a tangible, growing commitment.

2. Gamification: Money saving charts turn saving into a game. Each colored square or completed challenge feels like achieving a new level or winning a mini-victory. This makes the process fun and engaging, rather than a dreary task. I remember feeling a genuine thrill every time I colored in a square on my first "emergency fund" chart – it felt like I was leveling up my financial stability!

3. Motivation and Momentum: When you see how far you've come, it naturally motivates you to keep going. The momentum builds with each small success, making it easier to stay consistent and resist impulse spending.

4. Clarity of Goal: A good money saving chart printable clearly outlines your target amount and the steps to get there. This breaks down a large, daunting goal into smaller, manageable chunks, making it feel achievable.

5. Accountability: Whether you stick it on your fridge or keep it in your planner, the chart serves as a constant reminder of your commitment. For many, this visible reminder acts as a personal accountability partner.

6. Accessibility: They require no special software, no internet connection. Just print, grab a pen, and start. This low barrier to entry makes them perfect for everyone, from tech-savvy millennials to those who prefer a more traditional approach.

7. Positive Feedback Loop: Each time you save and mark it on your chart, your brain releases dopamine, a "feel-good" chemical. This positive feedback loop reinforces the behavior, making you more likely to save again.

8. Mindfulness in Spending: When you're actively tracking your savings with a chart, you become more aware of your spending habits. You might think twice before an unnecessary purchase, knowing it could mean coloring in another square on your chart.

9. Adaptability: These charts are incredibly versatile. They can be used for any saving goal, big or small, and can be easily adapted to fit different income levels and saving styles.

10. Stress Reduction: By making your financial goals concrete and trackable, these charts can significantly reduce the anxiety often associated with money. You move from abstract worry to concrete action.

11. Family Engagement: For families, a money saving chart printable can be a fantastic way to involve everyone in financial goals, teaching kids about saving and delayed gratification in a fun, visual way.

12. Proof of Progress: There’s something incredibly satisfying about looking back at a fully colored-in chart and seeing the tangible proof of your hard work. It builds confidence and reinforces your ability to achieve financial goals.

My Personal Aha! Moment with Charts:

I vividly recall the first time I fully funded an emergency savings goal using a simple "thermometer" money saving chart printable. Every time I transferred money, I'd color in another segment. It took me longer than I expected, but seeing that red line creep higher and higher, day by day, month by month, was incredibly motivating. When I finally colored in the very top, I felt a surge of accomplishment that no digital notification had ever given me. It wasn't just about the money; it was about the discipline I’d built and the proof that I *could* do it. This experience completely changed my perspective on saving.

---

Diverse Printable Chart Designs for Every Saving Goal

The beauty of the money saving chart printable lies in its incredible versatility. There isn't a one-size-fits-all solution, and that's a good thing! Different designs cater to different preferences, different goals, and different psychological triggers. Here, we'll explore a variety of popular and effective chart designs, highlighting their unique strengths and suggesting scenarios where they shine.

1. The Classic Savings Thermometer Chart

- Description: This iconic design features a large thermometer, usually with increments marked up the side. As you save, you color in the thermometer from the bottom up.

- Strengths: Incredibly intuitive and visually satisfying. Provides a clear, linear representation of progress. Great for large, long-term goals.

- Best For: Emergency funds, down payments (house, car), large vacation funds, debt repayment.

- Hypothetical Scenario: My friend, Sarah, used a massive thermometer chart to save for her dream wedding. She stuck it on her kitchen wall, and every time she made a deposit into her wedding fund, she'd color in a section. Her fiancé even joined in, making it a joint effort that kept them both motivated!

- Why it works: The upward movement directly mirrors your increasing savings, creating a powerful sense of ascent.

- Example: A chart with increments of $100 up to $10,000, each colored section representing a milestone.

- Customization Idea: Add small images or text alongside each increment representing what that amount could buy (e.g., "$1000 - plane tickets!").

- Tip: Print it large! The bigger the chart, the more impactful the visual progress.

- Relatability: We all understand a thermometer – it’s a universal symbol of increasing levels.

2. The Grid/Checkbox Chart

- Description: A simple grid of squares or checkboxes. Each square represents a fixed amount of money you need to save. You check or color a square each time you hit that amount.

- Strengths: Highly flexible. You decide the value of each square. Great for breaking down goals into many small, achievable steps.

- Best For: Accumulating smaller amounts, daily or weekly savings, "no-spend" challenges.

- Hypothetical Scenario: For my "no-spend meal kit" challenge, I used a grid where each square represented $20 saved by cooking at home instead of ordering in. It was amazing how quickly the grid filled up!

- Why it works: Provides frequent, satisfying "wins" as you check off squares.

- Example: A 10x10 grid where each square is $5, totaling $500.

- Customization Idea: Turn each square into a mini-icon related to your goal (e.g., tiny house for a down payment).

- Tip: Mix up the values of the squares for a surprise element and to accommodate fluctuating income.

3. The Coloring Page / Doodle Chart

- Description: A picture (e.g., a piggy bank, a house, a car, a stack of coins) divided into many smaller sections. Each section represents a specific amount, and you color it in as you save.

- Strengths: Highly engaging and artistic. Offers a sense of creative expression alongside financial progress. Can be very motivating for visual learners.

- Best For: Fun, personal goals, or for getting kids involved in saving.

- Hypothetical Scenario: My niece started saving for a new bike using a "bike" coloring chart. Every $5 she saved, she got to color in a wheel spoke or a part of the frame. She was so excited about it!

- Why it works: Combines the joy of coloring with the satisfaction of saving.

- Example: A detailed drawing of a tropical beach, with each shell or palm leaf representing $25 saved for a vacation.

- Customization Idea: Design your own picture that perfectly represents your goal.

- Tip: Use different colored pens or markers to make the chart vibrant and personal.

4. The Ladder / Staircase Chart

- Description: Features a series of steps or rungs on a ladder, each representing an increasing amount of savings. You climb the ladder as you reach each new tier.

- Strengths: Creates a strong sense of ascent and progression. Good for milestones within a larger goal.

- Best For: Debt snowball/avalanche tracking, building an emergency fund in phases, or any goal with tiered progress.

- Hypothetical Scenario: My colleague, Tom, used a "debt ladder" to track his credit card payoff. Each step was a $500 reduction in his balance, and he felt a huge sense of relief climbing each rung.

- Why it works: Symbolizes moving up, away from debt or towards a higher level of financial security.

- Example: A ladder where the first rung is $100, the next is $250, then $500, etc., leading up to a final goal.

- Customization Idea: Add motivational quotes or small rewards at each "step."

5. The Habit Tracker / "No-Spend Day" Chart

- Description: Often a monthly calendar grid where you mark off days you successfully avoid spending money (or avoid specific spending categories).

- Strengths: Focuses on behavior change rather than just accumulating money. Excellent for reducing discretionary spending.

- Best For: Breaking bad spending habits, short-term challenges, identifying spending triggers.

- Hypothetical Scenario: After realizing how much I spent on impulse coffee, I used a "no-coffee-shop" habit tracker. Each day I brewed at home, I marked it. It made me incredibly mindful and saved me a surprising amount!

- Why it works: Shifts focus from deprivation to achievement, building positive habits.

- Example: A calendar grid where you put a star on "no-spend days" and an "X" on spending days.

- Customization Idea: Include different colored markers for "no-spend," "essentials-only," and "treat" days.

6. The "Savings Jars" Chart

- Description: A printable featuring several empty "jars" or containers, each labeled with a specific mini-goal or savings category (e.g., "Vacation," "Emergency," "New Laptop"). You fill them in as you save for each.

- Strengths: Great for managing multiple concurrent savings goals. Keeps your focus clear on diverse targets.

- Best For: People with several smaller goals, or those who like to allocate savings to different "pots."

- Hypothetical Scenario: My sister uses a "multi-jar" chart to manage her savings for a new car, a weekend getaway, and a new wardrobe. It helps her visualize her progress on each specific goal.

- Why it works: Allows for diversified saving and prevents "robbing Peter to pay Paul."

- Example: Three jars: one for $500 "Birthday Fund," one for $1000 "Emergency," one for $200 "Pet Fund."

- Customization Idea: Draw items related to each jar's goal inside it as you fill it up.

7. The Debt Snowball/Avalanche Chart

- Description: Similar to a ladder or thermometer, but specifically designed to track the payoff of multiple debts. Each section might represent a certain amount paid off on a specific debt, or the total amount reduced across all debts.

- Strengths: Highly motivating for debt repayment. Provides a clear visual of shrinking balances.

- Best For: Individuals or families tackling multiple loans (credit cards, student loans, car loans).

- Hypothetical Scenario: A couple I know used a debt snowball chart to pay off nearly $30,000 in student loans. They listed each loan, and as one was paid off, they'd color it in and then redirect that payment to the next loan, seeing their chart fill up rapidly.

- Why it works: Visual proof of freedom from financial burdens.

- Example: A chart with separate bars for each debt, reducing in length as payments are made.

- Customization Idea: Add a celebratory note next to each debt as it's fully paid off.

8. The "Fill-the-Jar" Challenge Chart

- Description: A chart featuring a large empty jar or container, divided into many small sections. Each section represents a small, fixed amount (e.g., $1, $5). You fill the jar by adding small sums whenever you can.

- Strengths: Perfect for accumulating money without strict budgeting. Great for loose change, unexpected windfalls, or "found money."

- Best For: Anyone who wants to save without feeling restricted, or for teaching kids about saving small amounts.

- Hypothetical Scenario: I keep a physical jar for loose change, and a corresponding "fill-the-jar" printable. Every time I empty the change into the physical jar, I color in a section on the printable. It’s a surprisingly effective way to build up a small fund for treats!

- Why it works: Low pressure, high satisfaction from seeing the jar fill.

- Example: A jar divided into 100 sections, each worth $1, for a total of $100.

- Customization Idea: Label each section with a different idea for where the money could come from (e.g., "Found a dollar," "Skipped coffee," "Returned item credit").

9. The "Target Date" Countdown Chart

- Description: Combines a savings chart with a calendar. Each day or week, you aim to save a specific amount and then mark it off on the calendar, often with a visual element that builds towards a goal.

- Strengths: Excellent for time-bound goals. Keeps you on track with a deadline in mind.

- Best For: Saving for specific events (wedding, holiday, concert tickets) with a fixed date.

- Hypothetical Scenario: My sister used a "Paris Trip Countdown" money saving chart printable. Each week had a saving target, and she'd color in a little Eiffel Tower when she hit it. It kept her focused on her travel dates!

- Why it works: Creates a sense of urgency and direct connection between saving and the desired outcome.

- Example: A calendar for 6 months, with each week having a target saving amount and a small icon to color.

10. The "Progress Bar" Chart

- Description: A horizontal or vertical bar divided into percentage increments (e.g., 10%, 25%, 50%, 75%, 100%). You color in the bar as you reach each percentage of your goal.

- Strengths: Simple, clean, and highly effective for visualizing overall progress.

- Best For: Any goal where you want a quick, at-a-glance view of how far along you are.

- Hypothetical Scenario: I use a simple progress bar for my annual investment goals. It's a quick visual check that helps me stay on track without getting bogged down in daily numbers.

- Why it works: Directly communicates how much of the total goal is complete.

- Example: A bar with "0%," "25%," "50%," "75%," "100%" milestones.

- Customization Idea: Add small images or text at each percentage point to represent the feeling of getting closer to the goal.

Remember, the best money saving chart printable is the one you'll actually use. Don't be afraid to experiment with different designs until you find what truly motivates you!

---

Strategic Saving Challenges: Beyond the Basic Chart

While a basic money saving chart printable is powerful, combining it with a structured saving challenge can supercharge your progress. These challenges provide a clear framework, often with escalating amounts or specific rules, turning saving into an engaging, goal-oriented game. Here, we'll explore some of the most popular and effective saving challenges you can pair with a printable chart.

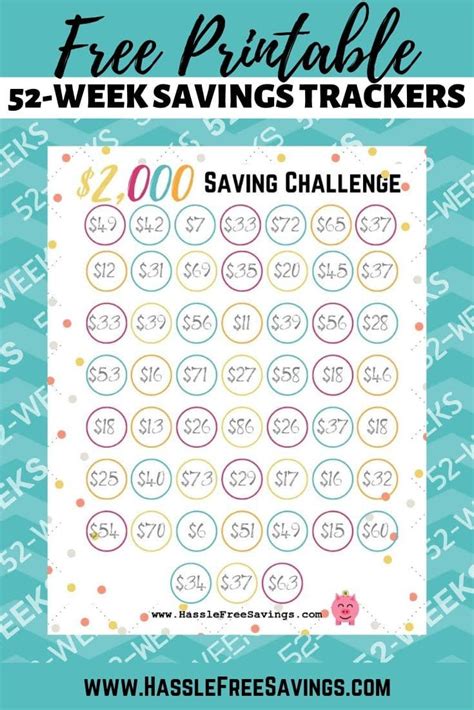

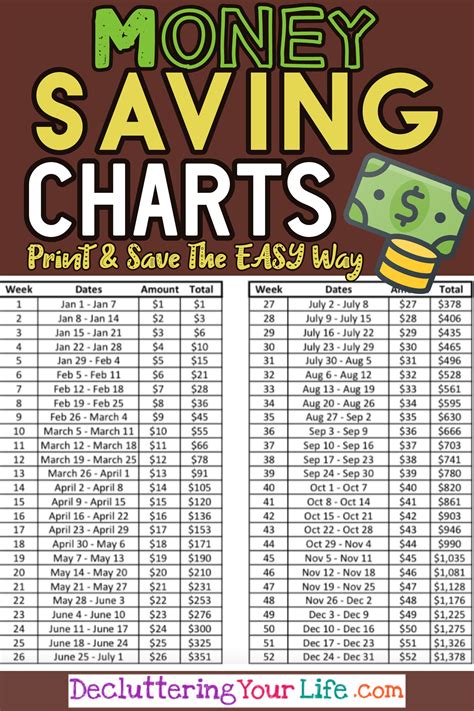

1. The 52-Week Money Challenge

- Description: This challenge involves saving money for 52 consecutive weeks, with the amount increasing or decreasing each week.

- Traditional: Save $1 in week 1, $2 in week 2, up to $52 in week 52. Total: $1,378.

- Reverse: Save $52 in week 1, $51 in week 2, down to $1 in week 52. Total: $1,378 (easier start in the holiday season).

- Flexible: Mix and match the weekly amounts to suit your income flow.

- Printable Chart Integration: A 52-square grid where each square represents a week and its corresponding saving amount. You check off or color in each week as you save.

- Strengths: Builds saving habit gradually, achievable for most income levels, clear end goal.

- Best For: Beginners, building an emergency fund, holiday savings, or a general "boost" to your savings.

- Hypothetical Scenario: My cousin, Mark, used the reverse 52-week challenge to save for Christmas gifts. Starting with larger amounts in January meant he had less pressure on his wallet as the holidays approached, and his money saving chart printable was almost full by November!

- Why it works: The consistent, small actions add up to a significant sum, proving that anyone can save.

- Example: A chart with 52 numbered boxes, each with a dollar amount next to it.

- Tip: If you can afford it, save ahead! If you have extra one week, tackle a higher-value week from later in the year.

2. The 100 Envelope Challenge

- Description: A physical challenge where you label 100 envelopes with amounts from $1 to $100. Each day (or whenever you can), you pick an envelope, put that amount of cash into it, and then store it.

- Printable Chart Integration: A chart with 100 numbered squares, representing each envelope. As you fill an envelope, you cross off or color in the corresponding number on your money saving chart printable.

- Strengths: Highly visual, uses physical cash (which feels more "real" to some), results in a significant sum ($5,050).

- Best For: Visual and tactile learners, those who prefer cash budgeting, saving for a large specific goal.

- Hypothetical Scenario: A couple I know used the 100 envelope challenge to save for their honeymoon. They made it a daily ritual to pick an envelope, and seeing their money saving chart printable fill up with colored squares was a huge motivator.

- Why it works: The tangible act of stuffing cash reinforces the saving habit.

- Example: A grid of 100 numbered boxes, or 100 small envelope icons to color.

- Tip: Keep a master list of the envelopes you've already filled to avoid duplicates if you're not using a printable.

3. The No-Spend Challenge (Daily/Weekly/Monthly)

- Description: Committing to a period (a day, a week, a month) where you only spend money on absolute necessities (rent, groceries, utilities) and avoid all discretionary spending (dining out, entertainment, shopping).

- Printable Chart Integration: A monthly calendar money saving chart printable where you mark each successful "no-spend" day. You can also track the amount saved by avoiding certain purchases.

- Strengths: Excellent for identifying spending leaks, resetting habits, and quickly boosting savings.

- Best For: Breaking impulse spending habits, quickly accumulating a small emergency fund, or for a financial "detox."

- Hypothetical Scenario: I once did a "no-new-clothes" month. Every time I avoided an impulse purchase, I calculated the savings and marked it on my chart. It made me realize how much unconscious spending I was doing!

- Why it works: Forces you to confront and change spending habits directly.

- Example: A monthly calendar grid where you color a square green for a "no-spend" day and red for a "spend" day.

- Tip: Be very clear on what constitutes "necessary" spending beforehand to avoid cheating yourself.

4. The Round-Up Challenge

- Description: Every time you make a purchase, you "round up" the amount to the nearest dollar (or five, or ten) and transfer that rounded-up difference to your savings.

- Printable Chart Integration: A money saving chart printable where each increment represents a rounded-up transfer. You color in a section each time you make a transfer.

- Strengths: Effortless saving, as it leverages small, often unnoticed amounts.

- Best For: People who want to save without actively thinking about it, or those who make frequent small purchases.

- Hypothetical Scenario: My friend Sarah used an app that automatically rounded up her purchases and transferred the change to savings. She then used a "round-up" money saving chart printable to track the accumulating total, which helped her visualize the power of small amounts.

- Why it works: "Hidden" savings that don't feel like a sacrifice.

- Example: A chart where each colored section represents $5 or $10 accumulated from round-ups.

- Tip: Some banking apps offer automatic round-up features, making this even easier.

5. The "Found Money" / Windfall Challenge

- Description: Committing to save every unexpected bit of money that comes your way – tax refunds, birthday cash, work bonuses, rebates, even forgotten money in old pockets.

- Printable Chart Integration: A money saving chart printable (e.g., a thermometer or a grid) where you color in amounts as you discover or receive "found money."

- Strengths: Turns unexpected income into tangible savings, builds a sense of financial opportunity.

- Best For: Anyone looking for a fun, low-pressure way to boost savings, or to build a "fun money" fund.

- Hypothetical Scenario: I once committed to saving every bit of "found money." A $5 bill in an old jacket, a small refund check, a cash-back reward – each time, I happily colored in a section on my "found money" chart. It added up surprisingly fast for a new gadget!

- Why it works: Celebrates "bonus" money and prevents it from being mindlessly spent.

- Example: A "treasure chest" chart where each coin or jewel represents a specific "found money" amount.

- Tip: Make a rule: 100% of found money goes to savings. No exceptions!

6. The Bi-Weekly Paycheck Challenge

- Description: For those paid bi-weekly, there are often two months a year where you receive three paychecks instead of the usual two. The challenge is to save the *entire* third paycheck.

- Printable Chart Integration: A special money saving chart printable specifically for the "extra" paychecks, clearly marking the target amount for these months.

- Strengths: Provides a significant boost to savings twice a year without feeling like a major sacrifice.

- Best For: Salaried employees paid bi-weekly, quickly building a large sum for a specific goal.

- Hypothetical Scenario: My friend Mark (a master of challenges!) uses this. When those "bonus" paychecks hit, he immediately transfers them to savings, then colors in a large segment on his "house down payment" chart. It’s accelerated his goal significantly.

- Why it works: Leverages existing income patterns for large, impactful savings.

- Example: A chart with two large sections, each representing one of the "extra" paychecks.

- Tip: Plan for these months in advance to ensure you don't accidentally budget for the third paycheck as regular income.

These challenges, when combined with a visually engaging money saving chart printable, transform the often-dreaded act of saving into an exciting journey. Pick one, print your chart, and watch your financial future take shape!

---

Customizing Your Chart: Making It Uniquely Yours

The true power of a money saving chart printable isn't just in its existence, but in how well it resonates with *you*. A generic chart might get you started, but a personalized one will keep you motivated and engaged long-term. This section delves into how to customize your money saving chart printable, making it a reflection of your goals, your personality, and your unique saving journey.

1. Personalize Your Goal (Beyond Just the Number)

- Description: Don't just write "$5,000." Write "Dream Vacation to Bali!" or "My First Home Down Payment!" or "Financial Freedom Fund."

- Why it matters: Connecting the numbers to a vivid, emotional goal makes saving far more compelling.

- Example: Instead of "Emergency Fund," label it "Peace of Mind Pot" or "Rainy Day Rescuer."

- Hypothetical Scenario: For my "new camera lens" fund, I printed a small picture of the lens I wanted and stuck it right at the top of my money saving chart printable. Every time I looked at it, I remembered *why