Let's be honest: the idea of saving money can feel… daunting. You look at your bank account, then at your bills, and suddenly, that dream vacation or emergency fund seems like a distant galaxy. I remember staring at my bank account, feeling utterly lost about how to start saving for that dream trip. Then I stumbled upon the magic of a simple printable – it literally changed my financial game!

That’s where the incredible power of a free printable savings challenge printable comes in. These aren't just pretty sheets of paper; they're your personal cheerleaders, visual motivators, and accountability partners all rolled into one. They transform the abstract goal of saving into a fun, achievable game. If you’re new to this, trust me, this simple tool can be the catalyst you need. For veterans who’ve tried and perhaps stumbled, these refreshers and new ideas can reignite your motivation. Ready to turn your financial dreams into a vibrant, colorful reality? Let's dive in!

Starting Small: Incremental Weekly & Bi-Weekly Challenges

These challenges are perfect for beginners or anyone who prefers a gradual approach. The beauty lies in their simplicity and the steady build-up of small wins. You barely notice the incremental increases, but your savings account certainly does! These leverage the power of consistency, proving that even tiny steps lead to significant progress.

- The Classic $1 a Week Challenge: Start with $1 in week one, $2 in week two, and so on. By week 52, you’ll have saved $1,378! This is incredibly popular and for good reason – it’s almost painless.

- The Reverse $1 a Week Challenge: For those who want to start strong, save $52 in week one, $51 in week two, down to $1 in the last week. The biggest contributions are at the beginning.

- Bi-Weekly $5 Incremental Challenge: If weekly is too frequent, save $5 one pay period, $10 the next, and so on. A great way to align with paychecks.

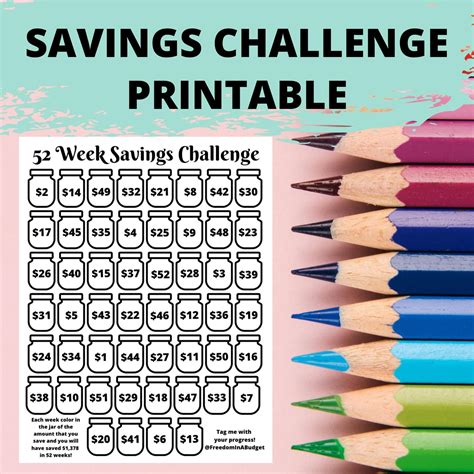

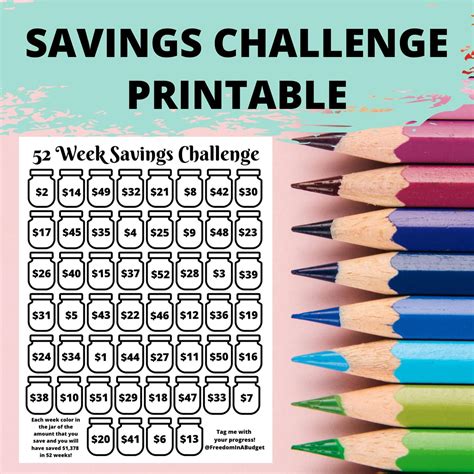

- The "Fill-in-the-Jar" Challenge: Print a jar outline with small circles. Each circle represents a small, random amount (e.g., $1, $3, $5). When you have spare cash, pick a circle, save that amount, and color it in. I used this when I was trying to build my first emergency fund, and it made the process so much more engaging.

- The "$5 or $10 Every Time" Challenge: Each time you get a $5 or $10 bill (or any specific denomination), put it aside. Design a printable with blocks for each bill. This is a simple yet effective way to accumulate money from everyday transactions.

Goal-Oriented: Targeting Your Big Dreams

Sometimes, you need a specific finish line to sprint towards. These printable savings challenge templates are designed to help you visualize and achieve larger, specific financial goals, whether it’s a down payment, a new gadget, or that dream vacation. They turn abstract desires into concrete targets.

- Emergency Fund Builder (e.g., $1,000 in 3 Months): A printable with 100 squares, each representing $10. As you save $10, color a square. This makes a crucial goal feel incredibly manageable.

- Vacation Fund Tracker: Design a printable with icons related to your destination (e.g., Eiffel Tower, beach palm trees). Each icon represents a certain amount (e.g., $50, $100). Color them in as you save.

- Down Payment Dynamo: For larger goals, break it down. If you need $5,000, create a printable with 50 blocks, each representing $100. It transforms an intimidating sum into bite-sized chunks. I used a similar method for my car down payment, and seeing the progress visually was a huge motivator.

- Debt Snowball Savings (Offsetting Debt): While not direct savings, you can use a challenge to save money specifically to make extra payments on debt. For example, a "Debt Attack" challenge where you color in a square for every $25 extra you put towards a specific debt.

No-Spend & Fun Challenges: Making Saving a Game

Who says saving can't be fun? These challenges add a playful element to your financial journey, turning everyday habits into saving opportunities. They're great for shaking up your routine and finding hidden money.

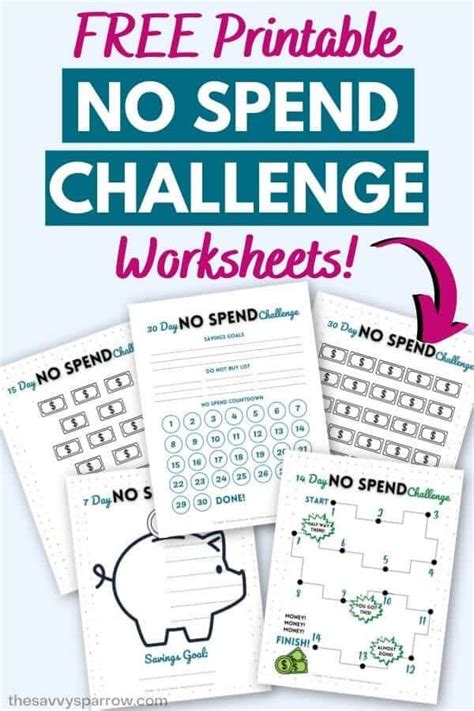

- The No-Spend Day Challenge: A calendar printable where you mark off days you don't spend any money (beyond essentials like rent/mortgage). See how many consecutive days you can go!

- The Coffee Shop Boycott: If you spend too much on daily lattes, this printable helps you track how much you save by making coffee at home. Each "saved" coffee cup represents $X.

- Found Money Jar Challenge: A whimsical free printable savings challenge printable where you actively look for coins/small bills around the house, in old pockets, or even on the street. Design a jar, color in a segment for every $1 found. My kids love this one, and it's amazing how fast pennies add up!

- The "Buy Nothing New" Month: Challenge yourself to buy only essentials, no new clothes, gadgets, or entertainment. A simple checklist printable can help you track your progress.

Holiday & Seasonal Savings: Prepping for Special Times

The holidays can be a huge financial drain if you're not prepared. These challenges help you spread out the cost and avoid debt, making your festive seasons joyful and stress-free.

- Christmas/Holiday Gift Fund: A tree printable with gift boxes as squares. Each box represents a portion of your gift budget. Start early and watch your fund grow.

- Vacation Spending Money Challenge: Different from the "Vacation Fund Builder," this focuses on saving specifically for on-trip expenses like dining out, activities, or souvenirs. A printable with suitcase icons works well.

- Back-to-School Savings: A backpack or school supply themed printable where each item you color in signifies a certain amount saved for uniforms, books, or supplies.

Tackling Debt: Challenges with a Purpose

While technically paying *off* money rather than *saving* it, many people use a printable savings challenge mindset to tackle debt. These challenges help you visualize progress and stay motivated on your debt-free journey.

- Debt Payoff Avalanche/Snowball Tracker: A printable designed like a mountain or a snowball where each segment represents a chunk of debt paid off. It visually celebrates your reduction in debt, which is a powerful motivator.

- "$1,000 Extra Payment" Challenge: If you're aiming to make an extra $1,000 payment to a specific debt, divide this into smaller chunks on a printable (e.g., 20 squares of $50). As you set aside or pay off each $50, color in a square.

- Credit Card Payoff Grid: Create a grid with squares, each representing a percentage of your credit card balance. As you pay it down, fill in the squares, watching your debt disappear. This is my favorite strategy because it saved me countless times from feeling overwhelmed by high-interest debt.

Tips for Personalizing Your Free Printable Savings Challenge

A generic challenge is good, but a personalized one is powerful. Tailoring your free printable savings challenge printable to your life makes it stick!

- Know Your "Why": Before you even print, sit down and identify *why* you're saving. Is it for a trip, an emergency, a new gadget? Write it boldly at the top of your printable. This keeps your motivation front and center.

- Break Down Big Goals: If your goal is large, break it into smaller, more digestible chunks. Instead of "Save $10,000," think "Save $100 five times, then $500 five times."

- Visual Appeal is Key: Choose a printable design that genuinely appeals to you. If it's for a vacation, find one with palm trees or famous landmarks. If it’s for debt, maybe a mountain peak to conquer.

- Track Consistently: Don't just save; track it! Color in your squares immediately after you transfer the money. This visual feedback loop is incredibly rewarding.

- Set Mini-Rewards: For longer challenges, set up small, non-financial rewards for reaching milestones (e.g., after saving $100, treat yourself to a movie night at home). I find that linking a specific reward to each completed challenge, even a small one like a favorite coffee, keeps me incredibly motivated.

- Share (or Don't): Some people thrive on accountability, so sharing your challenge with a trusted friend or partner can help. Others prefer to keep it private. Do what works for *you*.

Common Pitfalls: What to AVOID When Using Savings Challenges

While free printable savings challenge printables are fantastic tools, there are a few traps to watch out for.

- Being Overly Ambitious: Don't start a $10,000 challenge if you're just scraping by. Begin with something manageable like the $1 a week challenge or a $500 emergency fund. Overwhelm leads to giving up.

- Forgetting to *Actually* Save the Money: The printable is a tracker, not a bank. Make sure you're actually moving the money into a separate savings account (or physical jar). Don't be like me and forget to actually *transfer* the money you saved. I once had a perfectly tracked challenge but forgot the final step – talk about a facepalm moment!

- Getting Discouraged by Missed Days: Life happens. If you miss a week or can't contribute as much as planned, don't throw in the towel. Just pick up where you left off. Every dollar saved is a win.

- Not Adjusting to Your Income: Your income fluctuates. If a challenge becomes too difficult, it’s okay to pause, adjust the amounts, or switch to a different challenge that better suits your current financial situation.

- No Clear "Why": If you don't have a clear purpose for saving, it's easy to lose motivation. Revisit your "why" regularly.

Conclusion

So, ready to ditch the financial stress and embrace the fun of saving? A free printable savings challenge printable is more than just a piece of paper; it's a commitment to yourself, a visual testament to your progress, and a powerful tool for financial empowerment. No matter your current financial situation, there's a challenge out there for you.

Grab a printable that speaks to you, print it out, and start coloring in those boxes! Every colored square, every dollar saved, is a step closer to your goals. You've got this!