Let's be honest, staring down a mountain of debt can feel overwhelming, isolating, and downright terrifying. That knot in your stomach? I've felt it. I remember the paralyzing fear when I first truly tabulated all my student loan and credit card debt – it felt like an impossible climb. But here's the secret: every journey, no matter how daunting, starts with a single step and a clear map. And that's exactly what a free printable debt payoff worksheet PDF can be for you: your personalized map to financial freedom.

This isn't just about numbers; it's about reclaiming your peace of mind. Over the years, I've seen countless people, myself included, transform their financial lives by simply visualizing their debt and tracking their progress. It's a game-changer, providing clarity, motivation, and a tangible sense of accomplishment with every payment. Ready to turn those overwhelming figures into actionable steps? Let’s dive in.

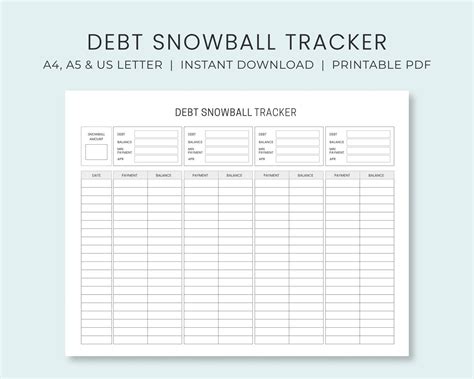

The First Step: Getting Your Bearings with Your Worksheet

Before you can conquer anything, you need to understand your enemy – or in this case, your debt. This initial phase is about gathering information and setting up your free printable debt payoff worksheet PDF for success. Think of it as your financial reconnaissance mission!

- Gather All Your Debt Info: List every single debt: credit cards, student loans, car loans, personal loans, medical bills. Don't leave anything out.

- Know Your Numbers: For each debt, record the creditor, current balance, interest rate, and minimum monthly payment. This is crucial for planning.

- Pick Your Worksheet Style: Some PDFs are simple balance trackers, others include spaces for payment dates and strategies. Choose one that resonates with you.

- Set a Start Date: Mark it on your calendar, on your worksheet, everywhere! This is your official "Day One" of becoming debt-free.

- Understand the "Why": Take a moment to write down *why* you want to be debt-free. Is it for a new home, travel, peace of mind? This personal motivation is powerful.

- Review Regularly: I personally found that setting a weekly "debt check-in" with my worksheet kept me accountable and prevented me from losing momentum.

- Consider Consolidation Info: If you're exploring debt consolidation, make a note of potential new loan terms to compare against your current debts on the worksheet.

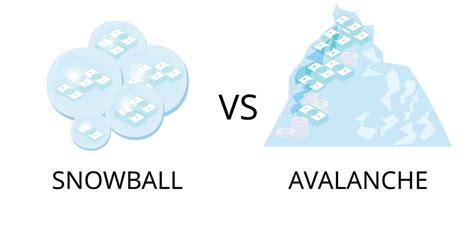

Igniting the Fire: Snowball vs. Avalanche Strategies

Once you have all your debts laid out on your free printable debt payoff worksheet PDF, it's time to choose your battle strategy. These two methods are popular for a reason: they work! Your worksheet will be invaluable for tracking either one.

- The Debt Snowball: List your debts from smallest balance to largest. Pay the minimum on all but the smallest, then throw every extra dollar you have at that smallest debt. Once it's gone, take the money you were paying on it (minimum + extra) and apply it to the *next* smallest debt.

- *My take:* This strategy is a psychological powerhouse. Those quick wins on smaller debts provide incredible motivation, especially when you're just starting out and need to feel like you're actually *doing* something.

- The Debt Avalanche: List your debts from highest interest rate to lowest. Pay the minimum on all but the debt with the highest interest rate, then focus all your extra money there. Once it's paid off, move to the next highest interest rate.

- *Expert insight:* This method saves you the most money on interest over time. If you’re a numbers person and highly disciplined, this is often the financially optimal choice.

- Mark Your Strategy: Clearly indicate on your worksheet which strategy you're using. This helps maintain focus.

- Highlight Your Target Debt: Use a highlighter or a big star on your free printable debt payoff worksheet PDF next to the debt you're currently attacking.

- Track Minimum Payments: Ensure your worksheet helps you keep track of all minimum payments to avoid late fees, no matter your strategy.

- Calculate Potential Savings: Use your worksheet to estimate how much interest you'll save using one method over the other.

Staying the Course: Tracking Your Wins and Celebrating Progress

The journey to becoming debt-free isn't always linear. There will be good months and tough months. This is where your free printable debt payoff worksheet PDF shines as a tool for motivation and accountability.

- Color-Code Progress: As you pay down debt, use different colors to fill in progress bars or shade out balances. Visual progress is incredibly motivating!

- Note Down Payments: Every time you make a payment, no matter how small, mark it on your worksheet. It reinforces positive habits.

- Calculate Your "Freedom Number": Your total debt remaining. Seeing this number shrink is a powerful motivator.

- Acknowledge Milestones: Paid off your first credit card? Slashed $1,000 off a loan? Shout it from the rooftops (or just write it proudly on your worksheet!). I once celebrated paying off a small medical bill with a fancy coffee—it's those small wins that keep you going.

- Use Your Worksheet as a Journal: Jot down how you felt after a big payment, or a challenge you overcame. This adds a personal touch to your financial story.

- Track Your "Snowball/Avalanche Roll-Over": Make sure your worksheet clearly shows how money from paid-off debts is being applied to the next one.

- Update Balances Monthly: Dedicate a specific day each month to update your worksheet with current balances. Consistency is key.

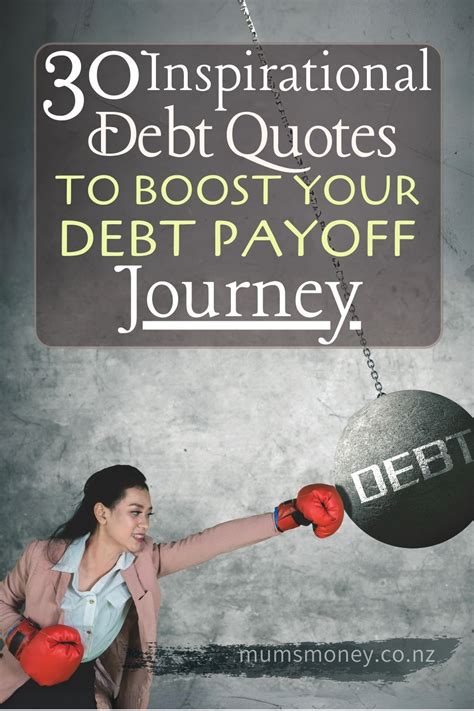

Beyond the Numbers: Mindset Mastery on Your Debt Payoff Journey

While the numbers on your free printable debt payoff worksheet PDF are crucial, your mindset is arguably even more so. This journey is as much mental as it is financial.

- Embrace Imperfection: You might miss a payment goal or have an unexpected expense. It's okay. Don't ditch the worksheet; just adjust and keep going.

- Visualize Success: Imagine life without debt. What will you do with that extra money? This vision helps you push through tough times.

- Find Your "Why": Revisit that reason you wrote down earlier. Let it fuel your determination.

- Practice Gratitude: Be grateful for the progress you've made, and for the tools like your worksheet that are helping you.

- Set Realistic Expectations: Debt payoff isn't a sprint; it's a marathon. Your worksheet helps manage those expectations by showing gradual progress.

- Stay Positive: It’s easy to get discouraged. Remind yourself that you're taking control and building a better future. I’ve found that framing it as "my financial adventure" helped me maintain a positive outlook even during lean times.

- Don't Compare: Your journey is unique. Don't get bogged down comparing your progress to others. Your worksheet is your story, not theirs.

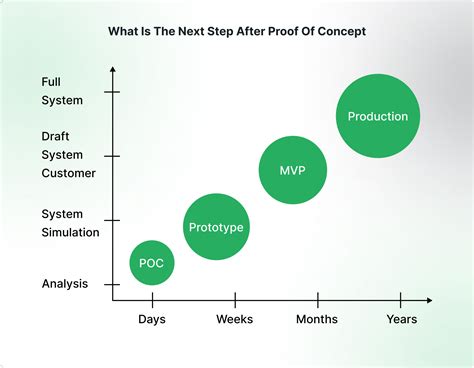

Future-Proofing: What Comes Next After Debt Payoff?

Congratulations! You've paid off your debts, and your free printable debt payoff worksheet PDF is a testament to your hard work. But the journey doesn't end here. Now, you pivot to building wealth and securing your future.

- Build an Emergency Fund: Now that you have "extra" money, direct it to building a robust emergency fund (3-6 months of living expenses). Your worksheet can be repurposed to track savings goals!

- Invest for the Future: Learn about investing. This is where your money starts working for you.

- Set New Financial Goals: What's next? A down payment on a house? Retirement savings? Your worksheet (or a similar financial planner) can help you track these new ambitions.

- Review Your Spending Habits: With no debt payments, it’s tempting to spend more. Keep an eye on your budget to ensure you’re still living within your means and saving.

- Maintain Your Money Mindset: The discipline you learned while paying off debt is an invaluable asset for your future financial success.

- Consider Your Net Worth: Shift your focus from "debt owed" to "assets owned." It's a powerful and positive change.

- Help Others: Once you've achieved financial freedom, consider sharing your story and insights. Your experience with your free printable debt payoff worksheet PDF could inspire someone else.

Tips for Personalizing Your Debt Payoff Journey

Your journey out of debt is uniquely yours, and your free printable debt payoff worksheet PDF should reflect that. Generic advice only gets you so far; personalization makes it powerful.

- Make it Visually Appealing: Print your PDF on nice paper, use colorful pens, add stickers, or doodle. If you enjoy looking at it, you'll be more likely to use it.

- Integrate with Your Budget: Don't let your worksheet live in isolation. Connect it directly to your monthly budget, so you see how extra payments impact other spending categories. This is my favorite strategy because it really highlights how every dollar contributes to your freedom.

- Set Mini-Goals: Instead of just "pay off debt," set smaller, achievable goals like "pay off Credit Card A by [Date]" or "reduce Loan B by $500 this month."

- Reward Yourself (Responsibly): When you hit a milestone, plan a small, non-debt-inducing reward. A nice meal out (paid for in cash!), a new book, a relaxing evening.

- Find an Accountability Partner: Share your progress (or lack thereof) with a trusted friend, family member, or even an online community.

- Review and Adjust: Life happens. Your income might change, or unexpected expenses arise. Review your progress and adjust your plan on your worksheet as needed. It's a living document.

Common Pitfalls: What to AVOID on Your Debt Payoff Journey

Navigating debt payoff can feel like walking a tightrope. A misstep can set you back. Here are some common traps to watch out for as you utilize your free printable debt payoff worksheet PDF.

- Ignoring Your Budget: A worksheet helps track debt, but if you don't have a budget to *fund* those payments, you're setting yourself up for failure. Don't be like me and only focus on the debt number without understanding where my money was actually going!

- Taking on New Debt: This is the cardinal sin. If you're using your worksheet to pay off old debt, don't accumulate new debt. It’s like trying to bail out a boat with a hole in the bottom.

- Getting Discouraged by Slow Progress: Debt payoff can be a marathon. Some months, you might only make minimum payments. Don't let that derail your overall plan.

- Comparing Yourself to Others: Everyone's journey is different. Focus on your own progress shown on your free printable debt payoff worksheet PDF, not someone else's highlight reel.

- Not Celebrating Small Wins: Skipping these moments of acknowledgment can lead to burnout and a feeling of endless struggle.

- Giving Up Too Soon: There will be moments you want to throw in the towel. Remember why you started and how far you've come.

- Trying to Do It All Alone: If you're truly struggling, don't hesitate to seek professional financial advice. Sometimes a fresh perspective is all you need.

Take Control: Your Future Starts Now!

You've got the map, you know the strategies, and you understand the pitfalls. The only thing left is to take that first courageous step. Your free printable debt payoff worksheet PDF isn't just a piece of paper; it's a powerful symbol of your commitment to financial freedom.

So, download your chosen worksheet, print it out, grab your favorite pen, and start filling in those numbers. Each balance you write down, each payment you record, brings you closer to shedding the burden of debt. Trust me, the feeling of crossing off that final debt on your worksheet is one of the most liberating experiences imaginable. Now go make it happen—your debt-free future awaits!