Are you staring at your financial future, dreaming of a significant milestone – perhaps a down payment on a home, a life-changing trip, or finally shedding that nagging debt? The idea of saving $10,000 can feel monumental, even overwhelming. Trust me, I’ve been there. I remember looking at my bank account feeling like I was running a marathon without a map, until I found the simple, empowering tool that changed everything: a savings challenge printable. It's not just a piece of paper; it’s a visual commitment, a daily reminder, and your personal cheerleader all rolled into one.

This isn't just about stashing away cash; it's about building consistent habits, celebrating small wins, and transforming your financial mindset. A well-designed $10,000 savings challenge printable provides the structure and motivation many of us desperately need. It turns a daunting goal into a series of achievable steps, making the journey feel less like a sprint and more like a satisfying climb. Let’s dive into how these magical printables work and how you can use one to conquer your $10,000 goal.

The Foundation: Why a $10,000 Savings Challenge Printable Works

At its heart, a $10,000 savings challenge printable leverages the power of visual tracking and gamification. For anyone looking to boost their financial planning or even start their budgeting journey, this is a game-changer. It’s a powerful tool for visual learners and those who thrive on seeing progress. Here's why it's so effective for reaching significant financial goals:

- Clarity and Structure: It breaks down a large sum like $10,000 into smaller, manageable increments, making the goal less intimidating. For beginners, this roadmap is invaluable.

- Visual Progress: Each time you color in a box, check off a number, or mark a milestone, you get an immediate visual representation of your progress. This boosts motivation and reinforces positive behavior.

- Accountability: Having a physical tracker serves as a constant reminder of your commitment, keeping your financial habits in check. I’ve found that even on tough days, seeing my partially filled printable gave me the push to stay on track.

- Psychological Boost: The act of physically marking off a saved amount creates a powerful sense of accomplishment, fostering a positive relationship with your money.

- Flexibility: While the goal is fixed, many printables offer flexibility in how and when you save, adapting to different income flows.

Classic Approaches: Weekly & Bi-Weekly Savings Challenges

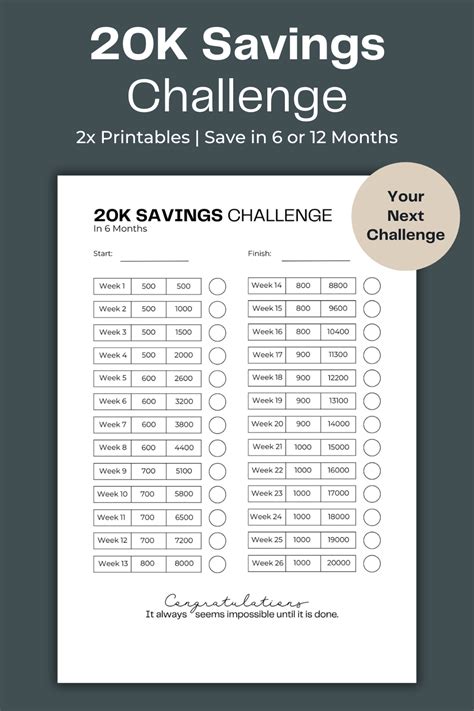

These are the bread and butter of the $10,000 savings challenge printable world. They provide a predictable, consistent path to your goal, perfect for those with regular income. This method emphasizes consistent effort over sporadic large sums, a cornerstone of effective money management and reaching your financial freedom.

- The 52-Week Challenge: This classic strategy starts with saving small amounts ($1 the first week, $2 the second, etc.) and gradually increases. To reach $10,000, you’d need a modified version, perhaps saving an average of $192.30 per week. (I once used a version of this to save for a new appliance, and the steady progression made it feel surprisingly easy!)

- The Reverse 52-Week Challenge: Start with the largest amounts first and work your way down. This can be great if you're highly motivated at the beginning or expect your income to decrease later in the year.

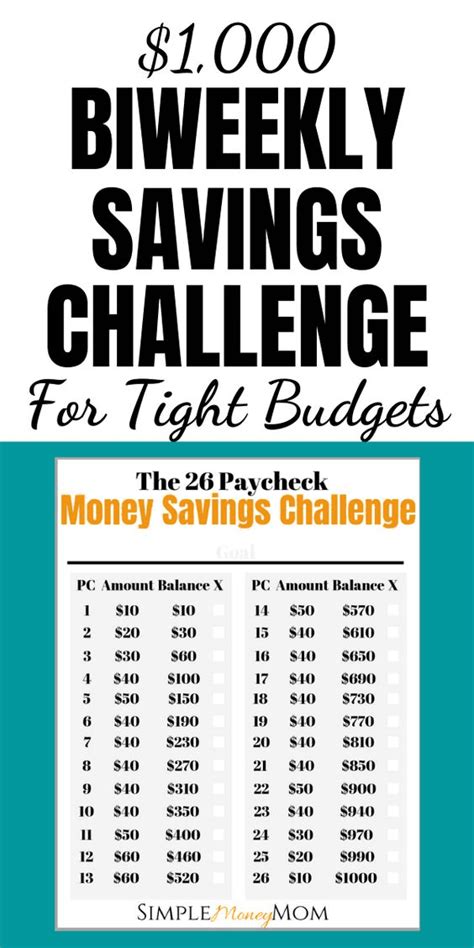

- Fixed Weekly/Bi-Weekly Amounts: Simply divide $10,000 by 52 weeks ($192.31/week) or 26 bi-weekly periods ($384.62/bi-weekly). Many printables will have these amounts clearly laid out. This direct approach makes financial planning straightforward.

- Income-Based Weekly Challenge: Some printables allow you to adjust amounts based on your weekly income, saving a fixed percentage. This caters to fluctuating earnings.

- "Pay Yourself First" Printable: Integrate the challenge into your payday routine by having a specific amount automatically transferred to savings, then mark it off on your printable. This is my favorite strategy because it saved me countless times from accidentally spending my savings!

- The "Round Up" Bi-Weekly Challenge: Use an app to round up purchases to the nearest dollar, then transfer that "change" to your savings every two weeks and mark off amounts on your printable.

- Bi-Weekly Bonus Challenge: Besides your regular bi-weekly savings, look for extra ways to earn or save (e.g., selling unused items) and add those bonus amounts to your printable.

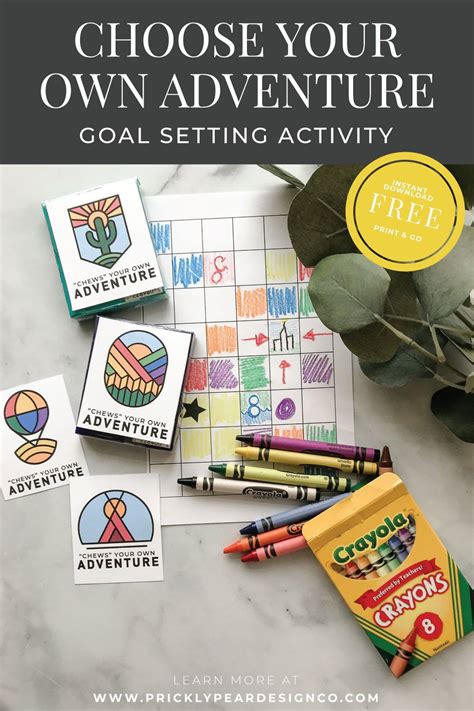

Flexible & Adaptable: Choose Your Own Adventure Printables

Not everyone's income is steady, and life throws curveballs. These printables are designed for maximum flexibility, allowing you to save at your own pace while still working towards the $10,000 goal. They are excellent for those navigating variable income or unexpected expenses.

- The "$10,000 in 100 Envelopes" Challenge: Label 100 envelopes with varying amounts that sum up to $10,000 (e.g., $50, $100, $150). Whenever you have extra cash, pick an envelope, fill it, and mark it off your printable. (I used a scaled-down version for a small emergency fund, and the element of surprise was surprisingly motivating!)

- "Random Amount" Printable: This challenge has squares with different amounts (e.g., $25, $75, $120) scattered throughout. You choose which amount to save and mark it off, giving you control over when you save larger or smaller sums.

- "No Spend" Day Tracker: Link savings to "no-spend" days. Each day you successfully avoid spending, you mark off a square that represents a predetermined savings amount (e.g., $10 or $20 saved by not buying coffee).

- "Found Money" Tracker: Every time you receive unexpected money (cash gifts, refunds, side hustle earnings), you dedicate a portion or all of it to your $10,000 goal and mark it on a dedicated section of your printable.

- "Debt Snowball/Avalanche Crossover": If you're also paying off debt, your printable can include spaces for both debt payments and savings. Once a debt is cleared, you can "roll" that payment into your $10,000 savings goal.

- The "Bonus Income" Challenge: Whenever you receive a bonus, commission, or extra pay, a portion goes directly onto your printable, filling in a larger segment towards your $10,000.

- "Budget Surplus" Tracker: At the end of each month, if you have a budget surplus, you transfer it to your savings and mark off a corresponding amount on your printable.

Level Up: Gamified & Visual $10,000 Savings Challenge Printable Designs

For those who love a bit of fun and a strong visual element, gamified printables turn saving into an enjoyable pursuit. These often incorporate creative designs that make tracking progress even more satisfying, boosting consistency in your money management.

- The "Savings Jar" Printable: A large outline of a jar that you color in as you add money. It might have lines or sections representing specific amounts ($100, $500, $1,000) that fill up the jar.

- The "Path to $10k" Board Game: A printable designed like a board game, where each step represents a savings milestone. You "move your piece" (or color a square) as you hit each amount. (I once used a "mountain climbing" theme for a tough goal, and it truly felt like an ascent!)

- Seasonal/Holiday Themed Printables: Integrate the challenge with seasons or holidays. For example, a "Spring Bloom" printable where each saved amount colors in a flower petal.

- "Goal Destination" Map: A map leading to your $10,000 goal (e.g., a tropical island, a new home). Each saved amount fills in a portion of the map.

- The "Puzzle Piece" Challenge: Your printable is a blank puzzle, and each time you save a specific amount, you color in or draw a puzzle piece. Once the puzzle is complete, you've hit $10,000.

- "Pixel Art" Savings: A grid of tiny squares. Each square represents a small amount (e.g., $10), and as you save, you color in the pixels to reveal a larger image or design.

- "Bingo Board" Savings: Create a bingo card with different savings amounts in each square. The goal is to get "Bingo" (a row, column, or diagonal) by saving those amounts, eventually filling the whole card for $10,000.

Beyond the Printable: Maximizing Your Savings Challenge

While the $10,000 savings challenge printable is a fantastic tool, its true power comes from how you integrate it into your overall financial life. These tips are for both beginners and veterans, ensuring you get the most out of your commitment to financial freedom.

- Automate, Automate, Automate: Set up automatic transfers from your checking to your savings account to align with your chosen challenge schedule. This removes willpower from the equation.

- Find "Found Money": Look for easy wins: cancel unused subscriptions, sell old clothes/electronics, pack lunches instead of buying out. Every little bit adds up quickly. This is where those LSI keywords like 'budgeting' and 'money management' truly shine.

- Set Mini-Goals and Rewards: Break down the $10,000 into smaller chunks (e.g., save $1,000, then $2,500). Reward yourself modestly when you hit these milestones (e.g., a nice coffee, a new book, a guilt-free movie night). I find celebrating mini-milestones keeps me from burning out.

- Track Your Spending: Knowing where your money goes is crucial. Use a budgeting app or spreadsheet in conjunction with your printable to identify areas for more savings.

- Boost Your Income: Consider a side hustle, freelance work, or asking for a raise. More income means you can fill those printable squares faster. This is key for accelerating your financial planning.

- Review and Adjust: Life happens. If you fall behind, don't give up! Adjust your plan, perhaps by extending the timeline or finding areas to cut back.

- Involve Your Household: If you share finances, make it a family challenge. Everyone contributing (even small amounts from kids' chores) can make the journey more fun and collaborative.

The Emotional Fuel: Staying Motivated Through Your $10,000 Challenge

Saving money isn't always a walk in the park. There will be weeks where it feels tough, or unexpected expenses pop up. This is where your mental game becomes as important as your tracking. Remember, financial stability is a journey, not a destination.

- Connect to Your "Why": Why do you want to save $10,000? Is it for a dream vacation, an emergency fund, a down payment? Write this "why" on your printable. Look at it daily. I once put a picture of my dream travel destination right next to my printable, and it worked wonders!

- Celebrate Every Mark: Don't just tick off a box; acknowledge the act of saving. A quick mental pat on the back, or a small cheer, reinforces the positive behavior.

- Share Your Journey (Wisely): Tell a trusted friend or family member about your challenge. Their encouragement can be a huge motivator. However, avoid sharing too widely if you fear judgment.

- Visualize the End Goal: Spend time imagining what it will feel like to have that $10,000 in your account. How will it change your life? This future vision can pull you through tough times.

- Don't Beat Yourself Up Over Setbacks: Missed a week? Had an unexpected expense? It's okay. Acknowledge it, learn from it, and get back on track. The goal is progress, not perfection.

- Focus on the Journey, Not Just the Destination: Enjoy the process of learning about your spending habits, discovering new ways to save, and building financial discipline.

- Find a Savings Buddy: Team up with a friend or family member who also has a savings goal. Check in with each other regularly, share tips, and celebrate successes.

Tips for Personalizing Your $10,000 Savings Journey

Your printable is a tool, but how you wield it makes all the difference. Tailoring your approach will ensure you stick with it. This is where your unique financial planning and money management style comes into play.

- Customize Your Printable: If you download a template, don't be afraid to add your own flair. Draw doodles, use colorful pens, or paste inspiring images. Make it visually appealing to *you*.

- Set Micro-Rewards: Beyond the major rewards, think of tiny acknowledgements for consistent effort. Maybe after five consecutive weeks of saving, you allow yourself to buy that book you've been eyeing.

- Integrate with Your Budget: Don't let your savings challenge be an isolated task. Weave it into your monthly budget meetings or tracking sessions to see how it fits into the bigger picture.

- Consider a "Buffer" Fund: Before starting, ensure you have a small emergency fund (e.g., $500). This prevents you from dipping into your challenge savings for minor emergencies.

- Review Your Progress Regularly: Don't just mark off squares; sit down weekly or monthly to review how close you are to your goal and if any adjustments are needed.

- Listen to Your Instincts: If a certain saving strategy feels too restrictive or unrealistic for your lifestyle, it's okay to pivot. The goal is sustainable saving, not misery.

Common Pitfalls: What to AVOID on Your Savings Challenge

While the $10,000 savings challenge printable is incredibly helpful, there are common traps that can derail your progress. Learn from others' mistakes (and my own!) to stay on track.

- Setting Unrealistic Goals (Initially): Don't commit to saving $500 a week if your budget clearly shows you can only manage $100. Start small and build momentum. You don’t want to mess this up by burning out too fast!

- Not Tracking Consistently: The "printable" part is key. If you don't update it regularly, you lose the visual motivation and accountability. Don't be like me and forget to update your printable for weeks – it felt like starting from scratch!

- Giving Up After a Slip-Up: One missed week or an unexpected expense isn't failure; it's life. Dust yourself off, adjust, and get back to it. Don't let perfection be the enemy of good.

- Ignoring Your Budget: The printable is a tracking tool, not a budget. You still need to understand your income and expenses to make room for the savings.

- Not Automating Transfers: Relying solely on willpower to move money is a recipe for inconsistency. Set it and forget it!

- Focusing Only on the "Sacrifice": Saving often feels like deprivation. Reframe it as investing in your future self and your financial freedom.

- Comparing Yourself to Others: Everyone's financial journey is different. Focus on your progress and your unique circumstances. Your $10,000 journey is *yours*.

Conclusion

Saving $10,000 might seem like a distant dream, but with the right tools and a resilient mindset, it's absolutely within reach. A well-chosen $10,000 savings challenge printable isn't just a gimmick; it's a powerful psychological and practical aid that breaks down a colossal goal into digestible, actionable steps. It provides the clarity, motivation, and visual proof of progress that keeps you going, even when the journey feels long.

Remember, consistency trumps intensity. Every small amount you save, every box you tick, brings you closer to that significant financial milestone. Embrace the process, celebrate your wins, and learn from your setbacks. Now, go find that perfect printable, commit to the challenge, and start building the financial future you deserve. You've got this!